Want work to be optional sooner rather than later? That’s the promise of financial independence early. This pillar guide gives you a live calculator, a simple plan, and realistic scenarios so you can see where you stand—and exactly what to do next.

FIRE Calculator: Check Your Timeline

Your Best-Fit Financial Independence Tool

Your FIRE Snapshot On track

Nudge savings up, lower spending, or test a 3.5% rate for longer retirements to see immediate impact.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What Is FIRE?

- FIRE Calculator

- How to Start Financial Independence Early (Step-by-Step)

- The 4% Rule (Plus Guardrails)

- Inflation & Volatility Adjustments

- Investment Strategies for FIRE

- Lean vs. Fat FIRE Lifestyle: Choosing a Path

- Coast FIRE: Are You Already on Track?

- Case Study: From 20% Saving to Work-Optional

- Common FIRE Mistakes (and Fixes)

- Books, Communities & Resources

- FIRE with a Partner or Kids

- Health Insurance Before Medicare

- Location & Taxes: Stretching Every Dollar

- Frequently Asked Questions

- Conclusion

Pro tip: Skim the steps below, then re-run the calculator after any change to savings, returns, or spending—tiny tweaks compound over time.

What Is FIRE?

FIRE means saving aggressively, investing simply, and letting compounding make work optional. “Retire” is flexible—you might fully stop, downshift, or build passion projects. The FIRE lifestyle is flexible—design it around the life you want, not someone else’s checklist. To compare styles, see Fat FIRE vs. Lean FIRE. Prefer a hybrid with part-time income? Our guide to Barista FIRE shows how low-stress work can cover extras.

How to Start Financial Independence Early (Step-by-Step)

Wondering how to retire early without burning out? Start with a simple plan you can actually stick to.

- Audit cash flow: Track three months of spending and list debts. Use a starter 50/30/20-style budget tailored for FIRE.

| Category | Starter % | Example Notes |

|---|---|---|

| Needs | 45–55% | Housing, food, utilities, insurance |

| Wants | 10–20% | Dining, travel, subscriptions |

| Savings/Investing | 25–40% | Automate on payday; raise quarterly |

- Build the buffer: 3–6 months emergency fund in high-yield savings.

- Automate investing: Max tax-advantaged accounts first; keep fees low.

- Increase the gap: Add a side hustle or negotiate raises; trim top 3 expenses.

- Quarterly review: Re-run the calculator, rebalance, and raise savings by 1–2% if possible.

If your plan includes a pension, this primer on retiring at 55 with a pension shows how to blend guaranteed income with portfolio withdrawals.

The 4% Rule (Plus Guardrails)

The 4% rule says you can withdraw ~4% in year one (then adjust for inflation), which has historically shown reasonable success rates over ~30-year periods, though outcomes vary. For very long retirements, many choose 3–3.8%. Treat it as a starting point, not a promise. For background, see our simple guide to the 4% rule.

Heads up: Historical rules of thumb are starting points, not guarantees. Stress-test different rates and consider getting advice from a fiduciary planner.

Inflation & Volatility Adjustments

For 2025 planning, stress-test two paths: a 2.5% baseline inflation vs. a 4% “hot” scenario. With rate cuts easing yields, consider a small allocation to short/intermediate bonds or TIPS as a buffer. Keep 1–3 years of withdrawals in safer assets and pause lifestyle upgrades after large drawdowns. Tax-loss harvest when markets dip to improve after-tax outcomes.

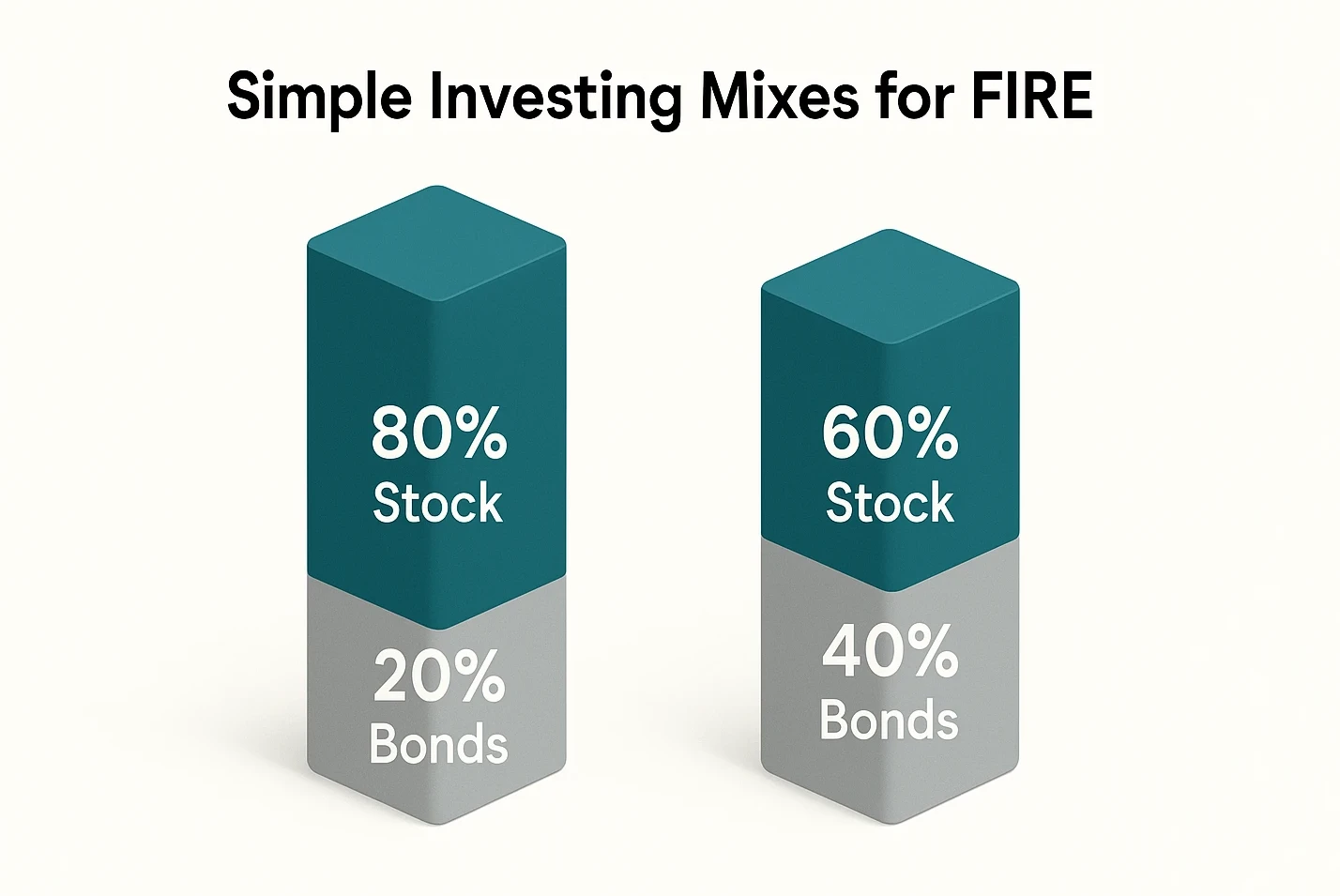

Investment Strategies for FIRE

Keep it simple and repeatable. Many use low-cost index funds for broad diversification, then tune risk by adjusting stock/bond mix. Rebalance annually or when bands drift. Planning to stop at 60? Compare allocation and withdrawal examples in how to retire at 60 with $2 million and retire at 60 with $1 million to calibrate your target.

| Portfolio | Why it works | Watch-outs |

|---|---|---|

| 80/20 Stock/Bond | Higher growth potential; may suit long horizons. | Larger drawdowns—consider a cushion. |

| 60/40 Stock/Bond | Balanced growth with a typically smoother ride. | May be too conservative decades out. |

| Dividend Tilt | Psychologically helpful income stream. | Don’t chase yield—focus on total return. |

| Target-Date Fund | Hands-off rebalancing and glidepath. | Expense ratios vary; verify allocation. |

Glidepath idea: As you near work-optional, shift a slice into bonds/cash to cover 1–3 years of withdrawals. After the early-retirement risk zone, drift back to your long-term mix.

Lean vs. Fat FIRE Lifestyle: Choosing a Path

Lean FIRE favors minimal spending and a smaller target; it’s the quickest route but requires discipline. Fat FIRE supports a higher lifestyle and travel, needing a larger nest egg and more time. If most income will be Social Security later, practice frugality now with these rich life on Social Security tips. Closing in on 60? Tighten expenses with retirement savings hacks after 60.

Coast FIRE: Are You Already on Track?

If your current investments can grow to your target by traditional retirement age without new contributions, you’ve hit Coast FIRE. That lets you “coast” by scaling back savings or hours now. Use the calculator: set annual savings to $0 and see when you’d arrive—or try the dedicated Coast FIRE calculator for a focused projection.

Case Study: From 20% Saving to Work-Optional

Jamie earns $95k, spends $50k, and saves ~$25k/yr with a $60k portfolio. Using a 7% return and a 4% withdrawal, the target is about $1.25M and ~17 years to work-optional. Jamie bumps savings by $400/month, trims subscriptions, and keeps a 6-month cash buffer. Re-running the calculator drops the timeline by ~2 years—small, boring changes compound into big leaps. Wondering about more aggressive targets? See whether retiring at 50 with $2 million holds up over a 40+ year horizon.

Common FIRE Mistakes (and Fixes)

- Lifestyle creep: Auto-raise savings with every raise.

- Underestimating healthcare: Price ACA plans and HSAs ahead of time.

- All-in on one asset: Diversify; total return beats headlines.

- Ignoring taxes: Plan Roth conversions and harvest losses/gains deliberately.

- Burnout from extreme frugality: Budget small “joy” money to stay consistent.

- Over-relying on side hustles: If you’re exhausted, consider Barista FIRE to cover extras without burnout.

- Sequence-of-returns blindness: Early market drops hurt more—keep a 1–3 year buffer and consider guardrail rules.

Books, Communities & Resources

Start with Your Money or Your Life for mindset and simple math. Explore r/financialindependence for accountability. Want the basics of how to retire early in one place? For a neutral overview, see a FIRE movement summary. Prefer expert help on strategy or taxes? You can ask a finance expert online for tailored answers. For an authoritative overview of compounding and investing basics, review the SEC’s Investor.gov guide to compounding.

FIRE with a Partner or Kids

Align on the end state (work-optional vs. full stop), savings targets, and timelines. Fund 529s if college is a goal, and consider a term-life policy to protect plans. Coordinate Roth conversions across spouses and keep a shared money calendar for quarterly check-ins. For starting small accounts and automating gifts, review Acorns Early to see if it fits your family.

Health Insurance Before Medicare

Early retirees usually compare COBRA, marketplace plans (ACA), spousal coverage, or direct-from-insurer options. Many plan around ACA subsidies by managing taxable income; HSAs can pre-fund future costs. Re-price plans annually and keep a dedicated healthcare sinking fund. For details, see health insurance options for early retirees and our 2025-focused ACA early retirement guide.

Location & Taxes: Stretching Every Dollar

Lower living costs and tax-friendly states can shrink your target. Weigh income tax, property tax, insurance, and healthcare access—not just headline rates. “Geographic arbitrage” works domestically and abroad if you’re flexible. For ideas, browse the best cities to reach FI by 50 and compare the most tax-friendly states for early retirement. If you plan to access 401(k) funds early, understand the Rule of 55 before you roll accounts.

Frequently Asked Questions

Conclusion

Early independence isn’t magic—it’s math you control and habits you can live with. Use the calculator, pick a simple investing mix, and review quarterly. Keep the lifestyle you love, trim the rest, and let compounding turn today’s small choices into tomorrow’s freedom.

This guide is for general education only and is not investment, tax, or legal advice. No recommendations here guarantee results or performance. Consider consulting a licensed, fiduciary professional for advice specific to your situation.