Ever buy a finance book, read 20 pages, and then… life happens? If you’re hunting for a money mindset book that actually changes how you think (and what you do), you’re in the right place. The goal isn’t “positive vibes.” It’s fewer money spirals, clearer choices, and habits you can repeat on your worst week. If you want the bigger foundation behind all of this, start with our money mindset guide.

Below are five standout reads with a quick “who it’s for,” a couple of concrete reasons they work, and one tiny action you can try today.

Find Your Best-Fit Money Mindset Book (60 seconds)

Pick what you’re dealing with + the style you’ll actually finish. You’ll get a top match and a solid backup.

This page contains paid/affiliate links. As an Amazon Associate we earn from qualifying purchases, and we may earn commissions from other partners—at no extra cost to you. Links marked with ‘#ad’ are affiliate links, meaning we may earn a commission at no extra cost to you. Learn more.

Top 3 money mindset books to start with

Top 3If you want the simplest starting point, these three are the most beginner-friendly ways to build calmer, more consistent money habits.

The Psychology of Money

A clear, story-driven read that helps you understand your money habits—without shame or overwhelm.

- Best for: Quick “why do I do this?” clarity that actually sticks

Your Money or Your Life

Great when you want a structure to follow and a clearer definition of what “enough” looks like for you.

- Best for: Purpose + a practical plan (especially if FIRE appeals to you)

Happy Money

A softer starting point when money stress is loud—you’ll build steadier habits from a calmer place.

- Best for: Anxiety and guilt spirals around spending or saving

Table of Contents

- Key Takeaways

- What Makes a Great Money Mindset Book?

- The 5 Best Money Mindset Books

- How to Read Money Mindset Books for Maximum Impact

- Recommended Reading Order for Beginners

- Beyond Books: Building Your Money Mindset Ecosystem

- Common Pitfalls and How to Avoid Them

- Measuring Your Money Mindset Progress

- Frequently Asked Questions

- Conclusion

Key Takeaways

If you want real change, read for behavior—not inspiration. You’re looking for a book that gives you one idea you can test this week, then repeat. (If you also want practical systems to pair with mindset, bookmark our roundup of great budgeting tools.)

- Mindset trumps tactics: even good budgets fail when your beliefs keep sabotaging you.

- Action beats theory: one tiny weekly experiment creates momentum.

- Match the book to your stage: calm first, then habits, then bigger goals.

- Track feelings, not just dollars: money stress is data, not a personality flaw.

What Makes a Great Money Mindset Book?

Some books hype you up for a day. The good ones change the decisions you make when you’re tired, stressed, or tempted.

- Psychology-based: explains why you react the way you do (shame, fear, “treat yourself” spirals).

- Actionable frameworks: prompts, checklists, or experiments you can run this week.

- Balanced tone: motivating without pretending real life (and real bills) don’t exist.

- Measurable progress: you can track calmer check-ins, fewer impulse buys, or consistent saving.

Quick start: Pick one book, one exercise, and do it for 7 days before adding anything else.

The 5 Best Money Mindset Books

1. Your Money or Your Life by Vicki Robin and Joe Dominguez

Who it’s for: Anyone who wants spending to feel intentional again (especially if you’re drawn to FIRE). Also great if you keep asking, “Why am I working this hard?” Pair it with our financial independence early guide if you want the bigger strategy.

Check editions & reviews on Amazon.

About the authors: Vicki Robin is a longtime personal finance writer; Joe Dominguez was known for teaching financial independence through mindful spending and saving.

Two reasons it works: (1) It reframes money as “life energy,” which makes purchases feel real again. (2) It gives a structured nine-step program, so you’re not guessing what to do next.

Why it still matters today: Burnout is real—this book helps you trade busy spending for values-based freedom.

Length: ~368–384 pages depending on edition.

Try this today: Pick one recent purchase and ask, “Was it worth the hours of my life?”

2. The Psychology of Money by Morgan Housel

Who it’s for: If you’re smart, you know what you “should” do… and you still don’t do it. Perfect when emotions drive your money choices more than math.

Browse paperback, Kindle, or audiobook options.

About the author: Morgan Housel is a widely read finance writer known for explaining risk, behavior, and decision-making in plain language.

Two reasons it works: (1) Short, sticky chapters you can read in bursts. (2) It normalizes messy behavior—so you can change without self-hate.

Why it still matters today: With constant noise online, this book keeps you anchored to simple, repeatable behavior that builds wealth.

Length: ~256 pages.

Try this today: Write your “money story” in 5 lines—what did you learn about money growing up?

3. Mind Over Money by Claudia Hammond

Who it’s for: If you want the science of why you spend, avoid, or freeze—plus experiments you can run in real life.

See current formats and reader feedback.

About the author: Claudia Hammond is a psychology author and broadcaster known for translating research into practical, readable ideas.

Two reasons it works: (1) It explains biases (like mental accounting) without making you feel broken. (2) It pushes you toward small environmental changes that beat willpower.

Why it still matters today: Most money advice assumes you’ll “just be disciplined.” This book shows how to design your environment so discipline isn’t the bottleneck.

Length: ~384 pages.

Try this today: Track one purchase + the feeling that came right before it (bored, stressed, lonely).

4. You Are a Badass at Making Money by Jen Sincero

Who it’s for: If you’re stuck in “I know what to do, but I’m scared” mode—and you want a bold, funny push that still includes practical reflection.

Check editions & reviews on Amazon.

About the author: Jen Sincero is a bestselling self-help author known for a direct, humorous style and mindset-based exercises.

Two reasons it works: (1) It calls out money blocks fast (without letting you hide behind “someday”). (2) It’s built for momentum—short sections that make action feel less intimidating.

Why it still matters today: If you’re overwhelmed by perfectionism, this book helps you move first and refine later.

Length: ~288 pages.

Try this today: Write one “I can’t earn more because…” sentence, then rewrite it as “What if I could…?”

5. Happy Money by Ken Honda

Who it’s for: If money makes your chest tighten—and you want calm, gratitude, and a healthier emotional relationship with spending and saving.

Browse paperback, Kindle, or audiobook options.

About the author: Ken Honda is a Japanese author who writes about the emotional side of money and well-being.

Two reasons it works: (1) It softens fear-based money habits so you can think clearly. (2) It gives simple gratitude practices that make financial routines feel less punishing.

Why it still matters today: When costs feel unpredictable, learning to stay calm around money is a real skill—not a “nice to have.”

Length: ~240 pages.

Try this today: The next time you pay for something essential, pause and say a quick “thank you.”

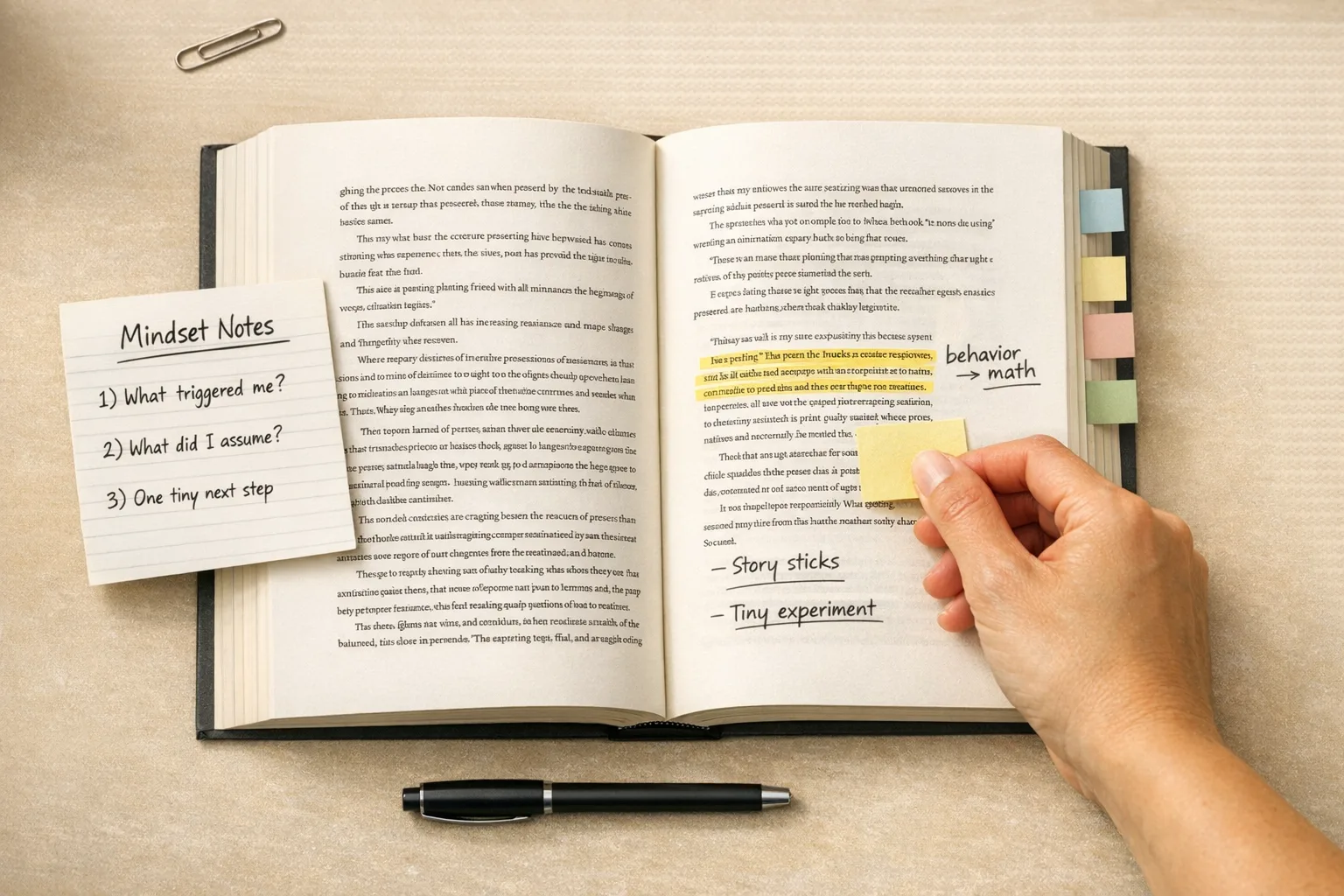

How to Read Money Mindset Books for Maximum Impact

Reading isn’t the hard part. The hard part is doing one small thing when your brain wants to scroll instead.

- Week 1–2: One chapter per week. Take notes on the one idea that stings a little (that’s usually the one).

- Week 3–4: Pick one tiny experiment per chapter and do it within 48 hours.

- Week 5–6: Track emotions (stress, guilt, confidence) on a 1–10 scale after money decisions.

- Week 7–8: Talk it out—teach one insight to a friend to lock it in.

| Tool | Purpose | Example |

|---|---|---|

| Habit tracker | Make the new behavior visible | Gratitude, no-spend day, weekly check-in |

| Emotion log | Spot triggers | Rate anxiety before/after purchases |

| Belief inventory | Catch sabotaging thoughts | “I don’t deserve wealth” → rewrite |

| Win journal | Build proof you can change | Automated savings, skipped impulse buy |

Recommended Reading Order for Beginners

If you’re new to mindset work, this order keeps it simple:

If you’re specifically looking for abundance books for beginners, start with You Are a Badass at Making Money for confidence + momentum, then follow with The Psychology of Money to make the behavior stick.

- Start with The Psychology of Money for easy, non-judgy insights.

- Then Your Money or Your Life for a framework you can follow.

- Choose next: Mind Over Money (science) or Happy Money (calm).

- Finish with You Are a Badass at Making Money if you want a confidence push.

Beyond Books: Building Your Money Mindset Ecosystem

Sometimes you’re not “bad at money.” You’re overwhelmed. Build support that makes the good choice easier.

- Daily practice: Short meditations or breathwork before checking your accounts.

- Community: A friend who won’t shame you—just asks, “What’s the next tiny step?”

- Professional help: If money stress is intense, exploring financial therapy can help you untangle emotions from decisions.

If stress is the main issue, you’ll likely want this too: how to overcome money stress.

Common Pitfalls and How to Avoid Them

- Information overload: One book, one change. That’s enough.

- All theory, no practice: For every chapter, do one exercise within 48 hours.

- Expecting instant results: Track calmer check-ins and fewer spirals as real progress.

- Ignoring basics: Pair mindset with simple rules (like the 50/30/20 budget rule) so your actions have a container.

Measuring Your Money Mindset Progress

It’s 2 a.m., you check your bank app, and your stomach drops. That moment is exactly what you’re retraining. Track the shift.

- Emotional: Less anxiety checking balances; calmer money talks; fewer guilt spirals.

- Behavioral: More consistent saving; fewer impulse buys; clearer boundaries.

- Practical: Emergency fund growing; debt shrinking; investing becoming less scary.

Micro-action: Pick one metric above and track it for 7 days—no judgment, just data. If you want a gentle next step on the practical side, start here: Investing 101 for beginners.

Frequently Asked Questions

Conclusion

You don’t need a dozen books—you need one that matches your brain and your season of life. Pick a book, do one exercise this week, and let momentum do the heavy lifting. If you’re still unsure, use the tool above to get a top match and a backup you’ll actually finish.

This money mindset book guide is for general education, not personal financial advice. Your situation is unique, and results vary. If you want help tailored to your circumstances, consider talking with a qualified financial professional.