Most of the stories I hear about day-to-day money stress sound the same: someone is doing their best, but one badly timed bill or surprise fee knocks everything out of balance. Sarah, a freelance graphic designer, was in that exact spot. She dreaded opening her banking app because overdraft fees kept eating the tiny buffer she managed to save. After switching to Go2Bank for its early direct deposit and clearer fee setup, she finally started building a small emergency fund instead of watching every extra dollar disappear. If you’re also trying to rebuild your whole money system, our how to live frugally and save money guide walks you through the bigger frugal-living strategy behind choices like this. But is Go2Bank really the right everyday bank if you’re juggling a tight budget?

This comprehensive Go2Bank review examines whether this fintech solution lives up to its promises for people rebuilding their finances or seeking a low-cost mobile banking alternative. From account setup to advanced features, we’ll explore key parts of Go2Bank’s offerings so you can decide if it fits how you actually use money.

If you just want the quick version: Go2Bank is a strong fit if you live on a tight budget, rely on regular paychecks, and like managing everything from your phone. Early access to paychecks, simple savings tools, and a built-in path to rebuild credit are big wins. It’s a weaker fit if you handle a lot of cash, want in-person service, or need business and investment accounts. If you’re okay doing everything in the app and watching a few fees, Go2Bank can be a solid everyday checking hub.

Go2Bank is usually best if you:

- Rely on regular paychecks or benefits and want them available a bit earlier.

- Mostly get paid by direct deposit instead of large amounts of cash.

- Are comfortable managing money in a mobile app instead of visiting branches.

- Need everyday checking plus simple savings tools, not full-service investing or business accounts.

- Want a built-in way to rebuild credit with a secured card tied to your bank account.

- Rarely need to deposit cash or send lots of domestic wire transfers.

Your Best-Fit Go2Bank Review Tool

Answer a few quick questions to see how well Go2Bank fits your banking style.

Your result will appear here

Answer the questions to see how well Go2Bank matches your banking style.

💡 You can tap different answers to update your result anytime.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Explore Go2Bank for Your Budget

See how Go2Bank’s early direct deposit, savings vaults, and credit-building tools could fit into your everyday budget routine.

See if Go2Bank fits your budget

Table of Contents

- Key Takeaways

- What Is Go2Bank? Understanding the Mobile Banking Platform

- Go2Bank Review: Account Setup and Eligibility Requirements

- Key Features Deep Dive: What Makes Go2Bank Different

- Fee Structure Breakdown: Understanding the Costs

- Go2Bank Review: Pros and Cons Analysis

- Security, FDIC Insurance, and Customer Protection

- Comparing Go2Bank to Alternatives

- Customer Support and Service Channels

- Frequently Asked Questions

- Making the Decision: Is Go2Bank Right for You?

- Conclusion

Key Takeaways

- Early Direct Deposit: Go2Bank can release paychecks up to 2 days early with eligible direct deposits.

- Transparent Fee Structure: The $5 monthly fee is easy to waive with qualifying direct deposits, but some service fees can stack up if you rely on cash or out-of-network ATMs.

- Built-in Financial Tools: High-yield savings “vaults” and simple budgeting tools help you separate bills, goals, and everyday spending.

- Limited Physical Access: Go2Bank is mobile-first with no branches and relies on the Allpoint ATM network plus digital support.

- Credit Building Options: A secured credit card and credit monitoring tools make it useful for people rebuilding their credit profile.

What Is Go2Bank? Understanding the Mobile Banking Platform

Go2Bank is a mobile-first banking platform built for people who want simple, app-based money management instead of traditional branches. You open and manage the account almost entirely from your phone, with a focus on early direct deposit, savings tools, and basic credit building.

In practice, Go2Bank tends to appeal to:

- Budget-conscious consumers who are tired of surprise fees.

- Credit rebuilders who need a second-chance bank that still reports to the bureaus.

- Mobile-native users who already do most money tasks on their phone.

- Gig workers who want paychecks and app income in one place.

Core Banking Services

At its core, Go2Bank offers the usual checking-and-savings setup with a few twists:

Checking account features:

- No minimum balance requirement.

- Early direct deposit for eligible payroll and benefits.

- Mobile check deposit and online bill pay.

- A debit card with EMV chip for in-store and online purchases.

Savings options:

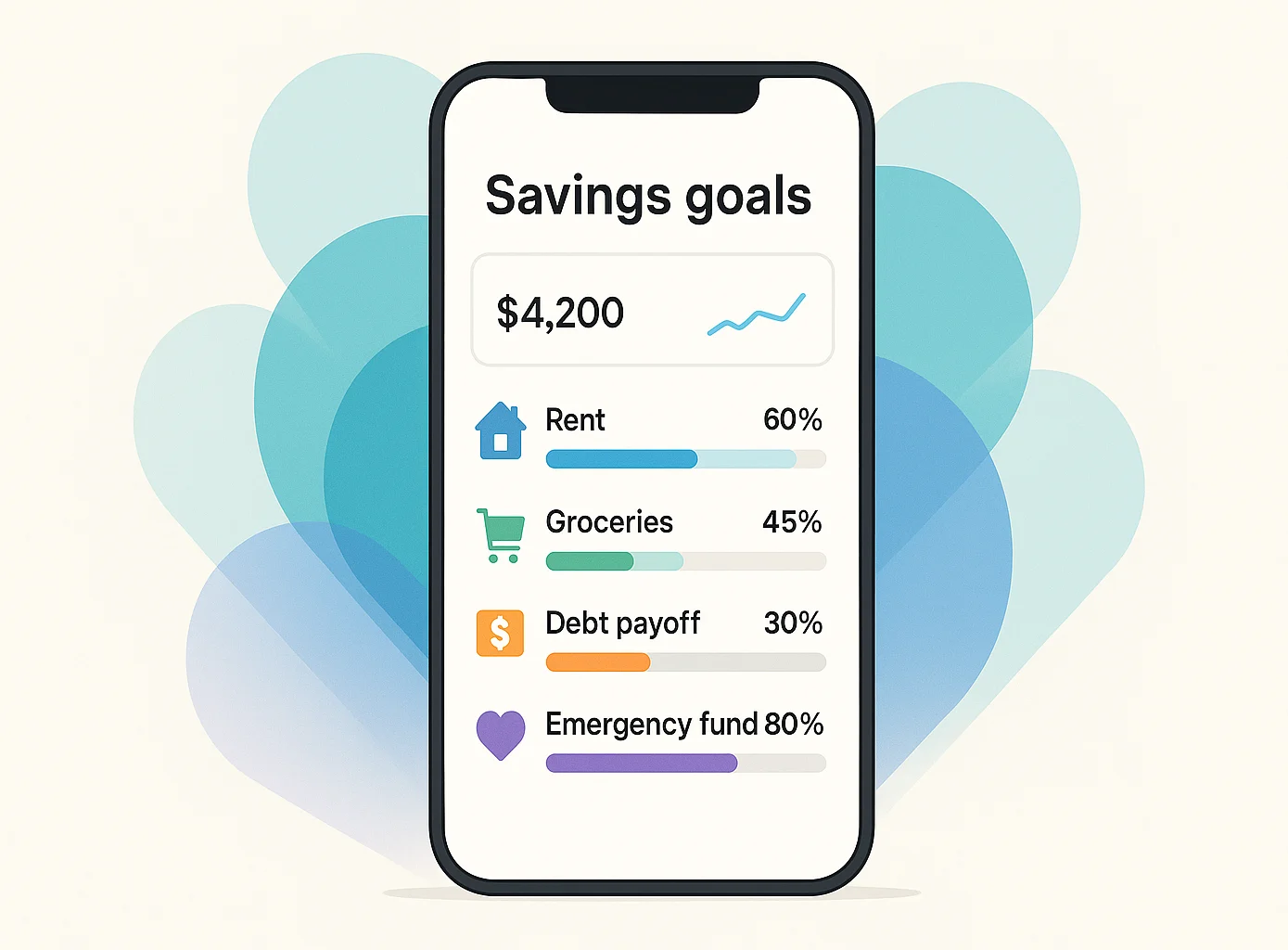

- High-yield savings “vaults” you can earmark for different goals.

- Automatic transfers from checking into those vaults.

- Visual progress tracking for each savings goal in the app.

- Competitive APY on the first chunk of savings, then a lower rate above that cap.

Additional services:

- A secured credit card designed to help rebuild credit.

- Basic credit monitoring tools.

- Cash reload options at partner retailers.

- Fee-free ATM access through the Allpoint network.

Go2Bank Review: Account Setup and Eligibility Requirements

Setting up a Go2Bank account involves a streamlined digital process designed for quick approval and activation. The bank has positioned itself as accessible to consumers who might face challenges with traditional banking institutions.

Eligibility Criteria

Basic Requirements:

- Must be 18 years or older

- Valid Social Security number

- U.S. residential address

- Government-issued photo ID

- Email address and phone number

Credit and Banking History:

Unlike many traditional banks, Go2Bank doesn't require:

- Minimum credit scores

- Extensive banking history

- Large opening deposits

- Employment verification for basic accounts

Account Opening Process

The digital account opening typically takes 5–10 minutes and follows these steps:

- Personal Information: Name, address, Social Security number, date of birth

- Identity Verification: Photo ID upload and selfie verification

- Funding Options: Initial deposit methods (optional for some account types)

- Agreement Review: Terms and conditions, fee schedules, privacy policies

- Account Activation: Immediate access to mobile banking features

Timeline Expectations:

- Many applicants receive instant approval and can start using the mobile app or wallet right away.

- The physical debit card usually arrives in roughly 7–10 business days.

Potential Approval Challenges

While Go2Bank accepts many applicants traditional banks might decline, certain factors can still result in denial:

- ChexSystems Reports: Severe banking violations or fraud history

- Identity Verification Issues: Inability to confirm personal information

- Regulatory Restrictions: Certain geographic or legal limitations

Key Features Deep Dive: What Makes Go2Bank Different

Early Direct Deposit: Getting Paid Faster 💰

One of Go2Bank's most attractive features is early access to direct deposits, providing paychecks up to 2 days earlier than many traditional banks and some government benefits up to 4 days earlier with eligible direct deposit.

How It Works:

- Employers or agencies submit payroll files to their bank.

- Go2Bank makes funds available as soon as it receives the payment file.

- Funds become available in customer accounts, often before the “official” pay date.

- Traditional banks may hold deposits until the posted date.

Real-World Impact:

Consider Marcus, a restaurant server whose rent is due on the 1st but didn't get paid until the 2nd with his old bank. With Go2Bank's early direct deposit, he receives his paycheck on the 30th or 31st instead, avoiding late fees and overdrafts.

Qualifying Requirements:

- Eligible payroll or government benefits direct deposits

- Consistent deposit schedule

- Employer or benefits provider participation in the ACH network

- Account in good standing

High-Yield Savings Vaults: Organized Saving Made Simple

Go2Bank's “vault” system transforms traditional savings by allowing users to create multiple savings goals within a single account structure.

Vault Features:

- Goal-Based Saving: Create vaults for specific purposes (emergency fund, vacation, car repair).

- Automatic Transfers: Set up recurring transfers from checking to vaults.

- Visual Progress Tracking: See savings goals progress through the app interface.

- High-Yield Potential: Strong APY on savings vault balances up to a certain cap.

If you like nerding out on your numbers, you can also pair Go2Bank’s vaults with some of the best free financial tools so you see this account alongside your other savings and investments.

| Balance Tier | Typical APY Structure | Key Requirements |

|---|---|---|

| Up to $5,000 across all vaults | High-yield rate (recently advertised around 4.50% APY) | Active Go2Bank checking account in good standing; interest paid quarterly |

| Balances over $5,000 | Little or no interest on the extra balance | Consider moving extra savings to another high-yield account if you consistently exceed the cap |

Example structure based on Go2Bank’s published terms as of late 2025. Always confirm current APYs before you apply, because rates can change quickly.

Overdraft Protection: Understanding the Requirements

Go2Bank offers optional overdraft protection that can cover small shortfalls on debit card purchases, but you have to qualify first and the rules are stricter than at many traditional banks.

Eligibility basics:

- Receive eligible direct deposits into your Go2Bank account (typically at least $100 total in the prior month).

- Keep your account in good standing with an activated, chip-enabled debit card.

- Explicitly opt in to overdraft protection in the app or through customer support.

Coverage and fees:

- Overdraft coverage can reach up to a few hundred dollars for some customers (Go2Bank has recently advertised limits in the $200–$300 range for people who qualify).

- A fee of up to $15 may apply to each covered debit card purchase that leaves your balance negative.

- If you bring your balance back to at least $0 within about 24 hours of the first overdrafting purchase, you can usually avoid the fee.

Important limitations:

Unlike some traditional overdraft programs, Go2Bank’s protection:

- Only applies to eligible debit card purchase transactions, not ATM withdrawals or most transfers.

- Is paid at the bank’s discretion — they can decline transactions even if you’re under your limit.

- Requires ongoing eligible direct deposits; if those stop, your coverage can be reduced or removed.

Credit Building Tools: Secured Card and Monitoring

For consumers rebuilding credit, Go2Bank offers integrated credit-building solutions through its secured credit card program.

Go2Bank Secured Credit Card:

- Security Deposit: Typically starts at $100 minimum.

- Credit Limit: Equal to your security deposit amount.

- Reporting: Reports to all three major credit bureaus.

- Graduation Path: Potential upgrade options over time if your account remains in good standing.

Credit Monitoring Features:

- Credit score updates inside the app

- Credit report alerts for major changes

- Educational resources for credit improvement

- Integration with banking app for a unified financial view

If you’re not sure what score to aim for, our plain-English guide on what is a good credit score breaks down the ranges and shows how banks tend to view them.

You can also compare Go2Bank’s built-in tools with outside apps in our Brigit app review, which covers a different way to build credit and smooth your cash flow.

Fee Structure Breakdown: Understanding the Costs

Fees are where Go2Bank can either feel like a quiet win or a slow leak in your budget. The $5 monthly fee looks annoying on paper, but it’s easy to avoid if you set up eligible direct deposits—and most everyday app actions are low cost. Where people get tripped up is cash reloads, out-of-network ATMs, and using overdraft protection without a plan. In plain English: if you mostly use direct deposit and tap your card instead of handling a lot of cash, your ongoing Go2Bank fees will probably stay close to zero. And if you’re already juggling balances, pairing a new bank account with a simple debt management plan can keep payments and due dates from spiraling.

If these fees sound workable for your budget, here’s where you can take a closer look at the account itself:

Turn Go2Bank into Your Everyday Checking

Use Go2Bank as your main checking hub if you like early paychecks, simple savings vaults, and a clear list of fees up front.

Review Go2Bank fees & features

Monthly Maintenance Fees

Standard monthly fee: $5.00

How to avoid it:

- Have at least one qualifying payroll or government benefits direct deposit posted in the prior monthly statement period.

- Use your Go2Bank account as an active, everyday checking hub rather than letting it sit idle.

If you truly want an online bank with no fees at all, you may want to compare Go2Bank with completely fee-free competitors before committing.

Transaction and Service Fees

| Fee Type | Typical Cost | What to Know |

|---|---|---|

| Cash reload at retailers | Up to about $4.95 per load | Retail partners set the exact fee; check the register before you confirm a reload. |

| Out-of-network ATM withdrawal | $3.00 + any ATM owner fee | Withdrawals are free only at in-network Allpoint ATMs. |

| Expedited replacement debit card | About $24.95 | Standard replacement by mail is usually free but slower. |

| Overdraft fee (optional protection) | Up to $15 per covered purchase | Fee applies only if your balance stays negative beyond the grace window. |

These figures are simplified snapshots based on Go2Bank’s disclosures as of late 2025. The official, current fee schedule is always the final word.

ATM Access and Cash Withdrawals

In-network ATMs:

- Allpoint network: thousands of fee-free ATMs nationwide.

- Access via app: use the Go2Bank app to find nearby in-network machines.

Out-of-network usage:

- $3 Go2Bank fee for each withdrawal at non-Allpoint ATMs, plus any fee the ATM owner charges.

- Balance inquiries at out-of-network ATMs can also trigger a small fee even if you don’t withdraw cash.

Bottom line: if you rely on direct deposit and stick to in-network ATMs, Go2Bank’s everyday costs stay low; frequent cash reloads and out-of-network withdrawals are where fees pile up.

Go2Bank Review: Pros and Cons Analysis

Advantages for Budget-Focused Users ✅

Strong Points:

- Early Direct Deposit: Significant cash flow advantage for paycheck-to-paycheck budgeters who need money a bit before payday.

- No Minimum Balance: Eliminates stress about maintaining account balances.

- Transparent Fees: Clear monthly fee and straightforward waiver rules.

- Built-in Budgeting: Savings vaults and spending categorization tools.

- Credit Building: Integrated secured card helps rebuild credit profiles.

- Mobile-First Design: Intuitive app interface designed for smartphone banking.

Real User Experience:

Jennifer, a single mother working two part-time jobs, found Go2Bank's early direct deposit feature crucial for managing her tight budget. “Getting my paycheck two days early means I can pay my daycare bill on time and avoid late fees. That $25 late fee was killing my budget every month.”

Limitations and Drawbacks ❌

Areas for Improvement:

- Limited Physical Locations: No branches for in-person service needs.

- Customer Service Hours: Phone support not available 24/7 for all issues.

- Cash Deposit Limitations: Requires third-party retailers, often with separate fees.

- Overdraft Restrictions: Stricter eligibility requirements than some competitors.

- International Features: Limited options for international transfers or travel.

Potential Deal-Breakers:

- Cash-Heavy Users: Frequent cash deposits become expensive with reload fees.

- Business Banking: No business account options available.

- Joint Accounts: Limited joint account functionality.

- Investment Services: No integrated investment or retirement account options.

Who Should Consider Go2Bank?

Ideal Candidates:

- Digital-Native Consumers: Comfortable with mobile-first banking.

- Credit Rebuilders: Need accessible banking with credit-building tools.

- Gig Workers: Benefit from early direct deposit and flexible features.

- Budget-Conscious Users: Appreciate transparent fees and savings tools.

- Young Adults: Starting their financial journey without extensive banking history.

Poor Fit Scenarios:

- High-Cash Users: Frequently deposit cash or money orders.

- Complex Banking Needs: Require business accounts, loans, or investment services.

- Traditional Preferences: Prefer in-person banking relationships.

- International Users: Need robust international banking features.

Security, FDIC Insurance, and Customer Protection

Banking Safety and Regulation

Go2Bank operates through Green Dot Bank, which provides FDIC insurance coverage up to $250,000 per depositor, per ownership category. This insurance protects customer deposits with the same coverage as traditional banks; you can review the details directly on the FDIC deposit insurance site.

Security Measures:

- 256-bit SSL encryption for online activity

- Multi-factor authentication for account access

- Real-time fraud monitoring on transactions

- Card controls allowing users to freeze/unfreeze debit cards instantly

- Zero liability protection for unauthorized transactions that meet policy rules

Customer Complaint Patterns

Based on consumer protection agency data and user reviews, common complaint categories include:

Most Frequent Issues:

- Customer Service Response Times: Longer hold times during peak periods.

- ATM Network Confusion: Not realizing which ATMs are fee-free.

- Overdraft Policy: Misunderstanding eligibility requirements and fee timing.

- Account Freezes/Closures: Frustration when fraud checks temporarily lock access.

Resolution experiences are mixed: some users say issues are fixed quickly once they reach the right person, while others report needing multiple follow-ups or filing complaints when they feel stuck. As with most online-first banks, patience and clear documentation go a long way if you ever need to escalate an issue.

Comparing Go2Bank to Alternatives

Go2Bank sits in the broader group of best challenger banks 2025, especially for people who care more about early direct deposit and credit building than having every possible in-person service. But it’s not your only option.

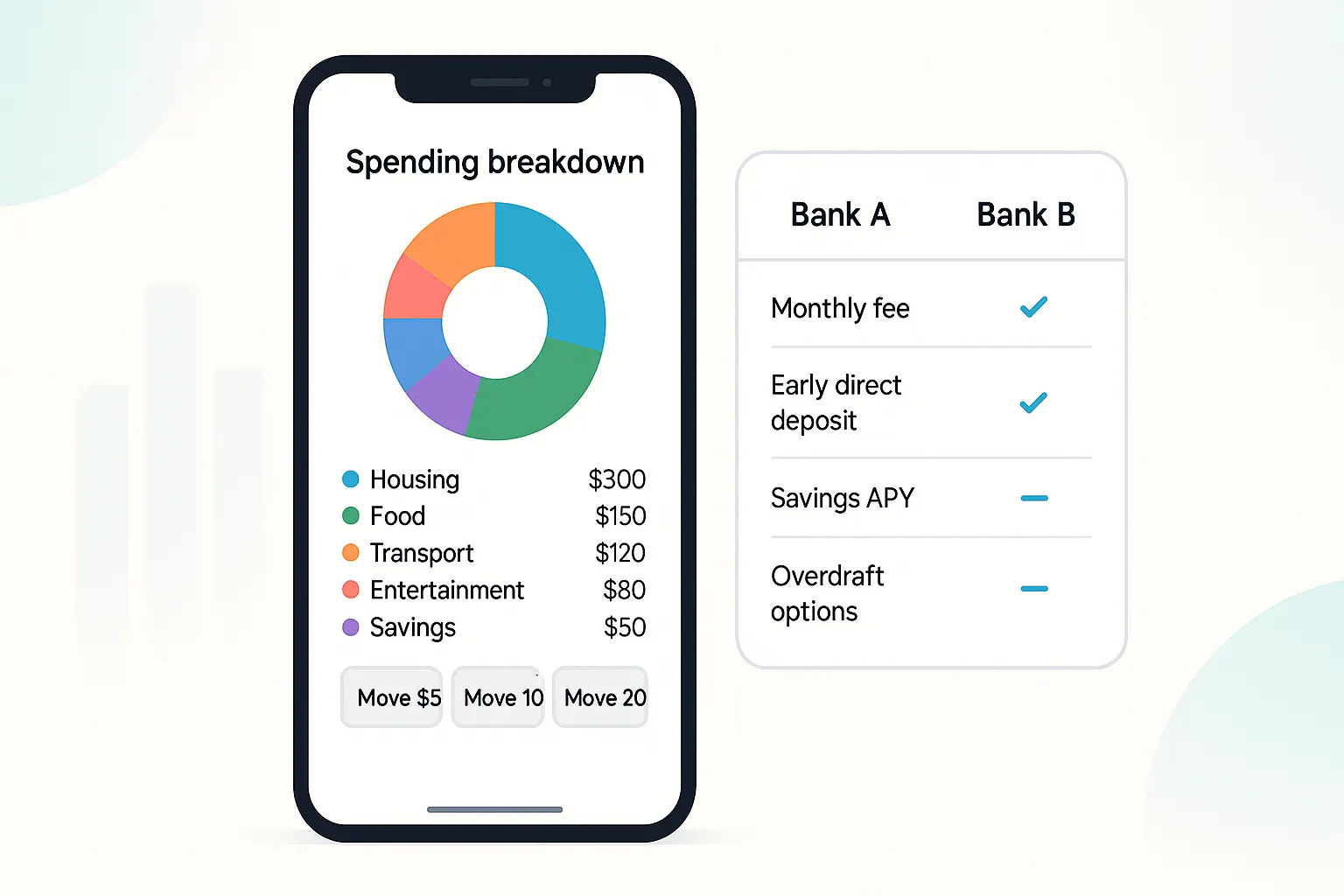

Versus Online Banks

Go2Bank vs. Ally Bank:

| Feature | Go2Bank | Ally Bank |

|---|---|---|

| Monthly maintenance fee | $5, waived with qualifying direct deposit | $0 |

| Early direct deposit | Yes, up to 2 days early for paychecks (and up to 4 days early for some benefits) with direct deposit | No widely advertised early-pay feature on standard checking/savings |

| Savings APY (as of late 2025) | High APY on savings vault balances up to $5,000; little or no interest on extra | Competitive APY on the entire savings balance with no small cap |

| ATM access | Free at in-network Allpoint ATMs; fees at others | Free at Allpoint and MoneyPass ATMs, plus limited reimbursements on some accounts |

| Credit building | Secured credit card tied to your Go2Bank account | No integrated secured card; focus on checking and savings |

Go2Bank vs. Chime:

Similarities: Both offer early direct deposit and mobile-first design.

Differences: Go2Bank charges a modest monthly fee without qualifying direct deposits but adds high-yield savings vaults and a secured credit card. Chime leans harder on fee-free accounts and simple credit monitoring instead of vaults.

Versus Credit Unions

Advantages Over Credit Unions:

- Technology: More advanced mobile app features out of the box.

- Accessibility: No membership requirements or geographic restrictions.

- Speed: Faster account opening and card delivery in many cases.

Credit Union Advantages:

- Personal Service: In-person relationship banking.

- Loan Products: Access to personal loans, auto loans, mortgages.

- Lower Fees: Often lower or no fees on many services.

- Community Focus: Local community investment and support.

Customer Support and Service Channels

Available Support Options

Digital Support:

- In-App Chat: Available 7 days a week, during extended daytime hours.

- Email Support: Responses typically arrive within a couple of business days.

- FAQ Database: Comprehensive self-service resources.

- Video Tutorials: Step-by-step feature explanations.

Phone Support:

- Customer Service: Phone support during standard business hours on weekdays and limited hours on Saturdays.

- Lost/Stolen Cards: 24/7 automated reporting system.

- Emergency Support: Limited after-hours assistance for urgent issues.

Response quality (based on recent reviews):

- Phone and chat support are generally helpful once you connect, but hold times can stretch during busy periods, and some issues (like fraud or freezes) may take multiple follow-ups to resolve.

- App-store ratings for Go2Bank’s mobile app sit in the mid-to-high 4-star range, which is solid for an online bank.

Self-Service Capabilities

The Go2Bank mobile app provides extensive self-service options:

- Card Controls: Instant freeze/unfreeze, spending limits.

- Dispute Resolution: Report unauthorized transactions.

- Account Management: Update personal information, change PINs.

- Fee Inquiries: See fee details and waiver status in-context.

Frequently Asked Questions

Making the Decision: Is Go2Bank Right for You?

At a glance: Is Go2Bank a good fit for you?

- Do you get regular payroll or government benefits by direct deposit?

- Are you okay managing money mostly in a mobile app instead of branches?

- Would early paycheck access help you avoid overdrafts or late fees?

- Do you mostly spend with a debit card rather than withdrawing a lot of cash?

- Are you rebuilding credit and open to a secured card tied to your checking?

If you found yourself nodding “yes” to most of these, Go2Bank is probably worth a closer look.

Financial Readiness Assessment

Before opening a Go2Bank account, consider these factors:

Budget Analysis:

- Can you keep at least one qualifying payroll or benefits direct deposit flowing each month?

- How often do you deposit cash or money orders?

- Do you need in-person banking services regularly?

- Are you comfortable managing finances primarily through mobile apps?

Feature Prioritization:

- High Priority: Early direct deposit, savings tools, credit building.

- Medium Priority: Extensive ATM network, transparent fees.

- Low Priority: Investment services, business banking, international features.

Implementation Strategy

Month 1: Setup and Basics

- Open an account and activate your debit card.

- Set up direct deposit with your employer or benefits provider.

- Download and familiarize yourself with the mobile app.

- Create initial savings vaults for specific goals.

If you don’t have a framework for where each dollar should go, our breakdown of the 50/30/20 budget rule can give you a simple starting point for dividing up each paycheck.

Month 2–3: Feature Exploration

- Apply for a secured credit card if credit building is a goal.

- Optimize automatic transfers into savings vaults.

- Explore budgeting and spending categorization tools.

- Test ATM locations in your area to confirm which are in-network.

Month 4+: Advanced Usage

- Evaluate whether overdraft protection fits your habits or if you’d rather avoid it.

- Consider increasing savings vault contributions as your budget stabilizes.

- Review fee waiver status and overall account performance every few months.

- Assess whether Go2Bank still meets your evolving needs or if it’s time to compare alternatives.

Ready to Test-Drive Go2Bank?

Try Go2Bank with a small, low-stress test—like routing one paycheck or a single bill—to see if early deposits and savings vaults actually make life easier.

Explore Go2Bank account options

Product terms and fees can change; always check the latest details on Go2Bank’s site before you apply.

Conclusion

After pulling everything together, this Go2Bank review points to a simple truth: Go2Bank can be a very helpful everyday account for the right kind of budgeter, and a frustrating mismatch for others. If you live on direct deposit, prefer your phone over a branch lobby, and want savings tools and credit building in one place, it lines up well with how you already handle money.

Where Go2Bank really shines is its focus on everyday financial stability for people who’ve felt overlooked by traditional banks. Early paycheck access, goal-based savings vaults, and a secured card that reports to the major credit bureaus can genuinely move the needle if you use them consistently and keep an eye on fees.

But this is not a one-size-fits-all solution. Cash-heavy users will feel the sting of reload fees, and anyone who wants business accounts, joint accounts, or a full menu of loans and investments will probably be happier elsewhere. If you know you’ll always need in-person help, a local credit union is likely a better fit.

My take: If the quiz, the checklists, and your own budget all point in the same direction, Go2Bank is worth trying with a small, low-stress test—like routing one paycheck or a single bill. Watch how it feels for a couple of months, compare it with your current bank, and keep the account that actually makes your money life calmer, not more complicated.

References

[1] Federal Deposit Insurance Corporation. “Understanding Deposit Insurance.” FDIC.gov, 2024.

[2] Consumer Financial Protection Bureau. “Banking Account Fees and Policies.” CFPB.gov, 2025.

[3] Green Dot Bank / Go2Bank. “Terms, Fee Schedule, and Product Disclosures.” Green Dot Corporation, 2024–2025.

[4] Major banking review sites and app stores. “Go2Bank and Ally Bank product reviews and ratings.” 2024–2025.

This go2bank review is for general educational purposes only and isn’t financial, legal, tax, or investment advice. Product features, fees, and APYs can change at any time, so always confirm current terms directly with Go2Bank or another qualified provider before opening, closing, or changing any account.