Car payments can drag on and eat into your budget. The good news: a few extra dollars can move your payoff date up and cut interest. Use our auto loan payoff calculator to see how much time and interest you can save, then pick a simple strategy to get there. For many households, the car loan is the second-biggest monthly bill after a mortgage; paying it off sooner frees cash for goals like travel, savings, or a stronger emergency fund. If you’re juggling other debts, our debt management plan guide can help you prioritize.

Auto Payoff Early Calculator

Slide or type values. Extras apply toward principal.

Tip: try a small monthly extra—$20 can still pull your payoff date closer.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Early Loan Payoff

- Why Pay Off Your Car Loan Early?

- How the Calculator Works

- How to Use the Calculator

- Smart Strategies to Pay Off Your Car Loan Early

- Try the Calculator

- Benefits Beyond Savings

- Frequently Asked Questions

- Common Mistakes to Avoid

- Drive Toward Financial Freedom

Key Takeaways for Early Loan Payoff

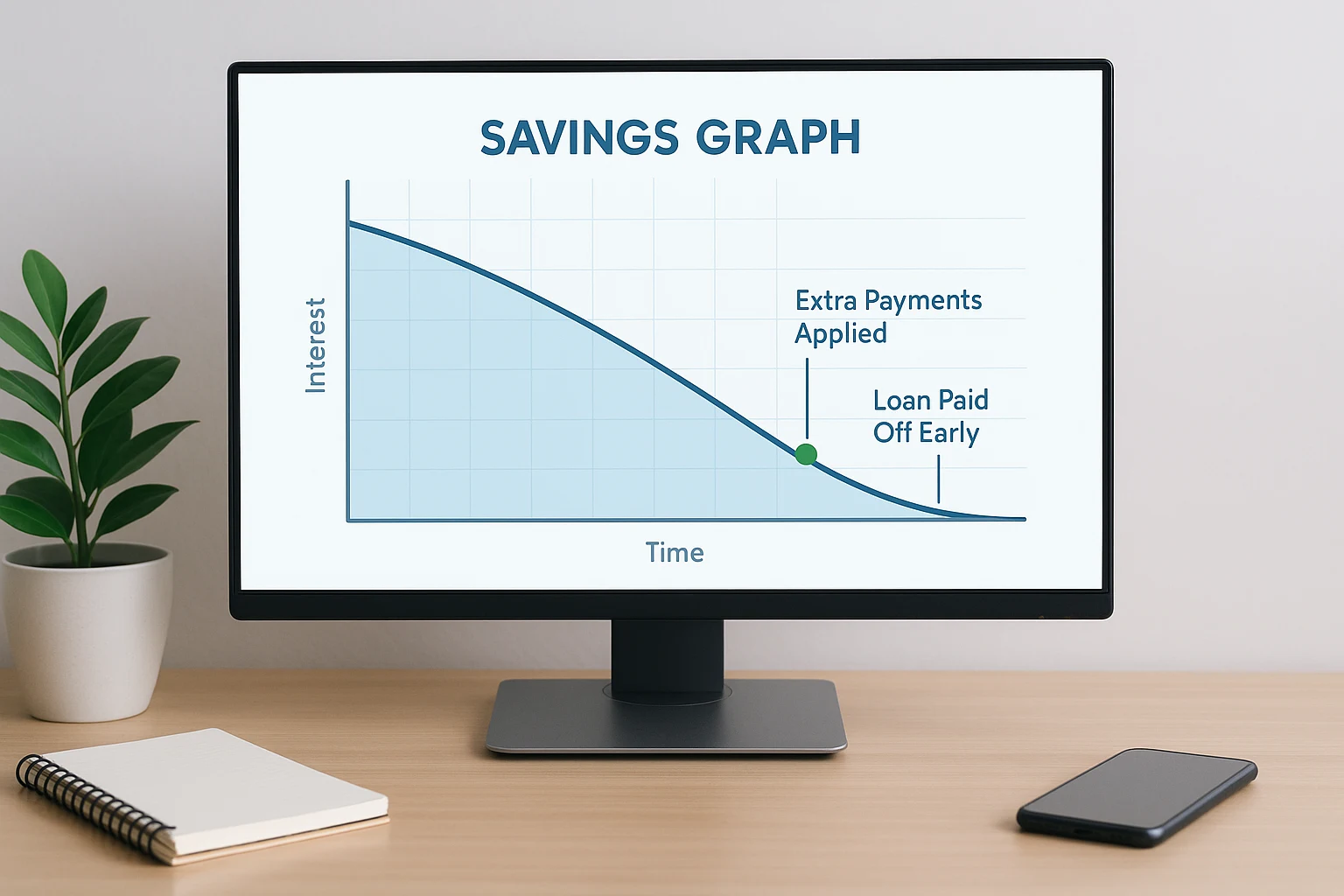

- Save on interest: A small extra payment can save hundreds or thousands over the loan.

- See your timeline: The tool shows how extra payments pull your payoff date closer.

- Simple moves: Rounding up or adding a lump sum makes a real dent.

- Better borrowing power: Lower monthly debt improves your debt-to-income ratio.

- More cash each month: Kill the payment, free up your budget.

Why Pay Off Your Car Loan Early?

Early payoff can cut interest and bring peace of mind. Here’s why it’s worth it.

Save Big on Interest

You pay interest on the principal—the longer the term, the more you pay. For a $20,000 loan at 5% over 60 months, interest adds up fast. Extra payments reduce principal sooner, so future interest shrinks. Every extra dollar works against the balance, not for the bank.

Every dollar you put toward principal may reduce future interest—ask your servicer to apply extras to principal.

Boost Cash Flow

No car payment means more room in your budget. Once it’s gone, redirect that money to a down payment, retirement, or savings.

Lower Debt-to-Income Ratio (DTI)

Dropping a monthly payment improves DTI, which can help with future approvals, like mortgages.

Own Your Car Free and Clear

Owning the car outright feels great. If you sell later, you keep the full value.

Protect Against Negative Equity

Cars depreciate quickly. Paying faster builds equity and reduces the risk of owing more than the car is worth.

How the Calculator Works

This auto payoff early calculator uses standard amortization math to show how extra payments change your payoff date and total interest. If you’d like a month-by-month schedule, try our simple loan amortization calculator.

- Calculates your original payment schedule.

- Applies extra payments to principal.

- Reduces future interest as the balance falls.

- Shortens the overall loan term.

Think snowball: small extras today speed up every payment that follows. Ask your servicer to credit extras to principal so you reduce future interest.

How to Use the Calculator

Grab details from your statement or lender portal. Then plug in the numbers below. Working on student debt too? Use the student loan payoff calculator for those balances.

Inputs Needed

- Current Loan Balance: What you owe now (e.g., $21,000 after 12 months).

- Interest Rate (APR): Your annual rate (e.g., 4.5%).

- Loan Term: Months remaining (e.g., 48 months).

- Extra Payment Amount: What you can add (e.g., $50).

- Payment Frequency: Monthly, bi-weekly, or one-time.

Outputs Provided

- Original Payoff Date and New Payoff Date.

- Months Saved.

- Original Interest vs. New Interest.

- Interest Saved.

Smart Strategies for Car Loan Payoff

Test these in the calculator and pick what fits your budget.

Round-Up Method

If your payment is $387, pay $400. That extra $13 a month adds $624 to principal over 48 months and trims interest.

Car Loan Payoff with Bi-Weekly Payments

Pay half your monthly amount every two weeks. With 26 half-payments, you make the equivalent of 13 full payments a year—one extra payment without much pain. For a deeper breakdown of the concept, see biweekly payments explained.

Not sure how your lender handles early-payoff rules or fees? Try this:

Back to bi-weekly vs. round-up—use the calculator to see your dates shift.

One-Time Lump Sum Payments

Use a bonus or refund to hit principal. A $1,000 lump sum on a $15,000 balance can shave months off—check the tool for your exact savings.

Debt Snowball or Avalanche

If you have multiple debts, use snowball (smallest balance first) or avalanche (highest APR). For the car, be consistent with extra amounts. Not sure which fits you? Compare methods in debt snowball vs. avalanche.

Refinancing with Caution

Refinancing may lower your APR, but avoid stretching the term—smaller payments can mean more total interest. Learn the basics of early payoff and prepayment rules from the Consumer Financial Protection Bureau.

| Strategy | How It Works | Impact |

|---|---|---|

| Round-Up | Pay slightly more than your monthly payment. | Low effort, steady savings. |

| Bi-Weekly | Pay half your payment every two weeks. | Extra payment yearly, faster payoff. |

| Lump Sum | Apply a large payment to principal. | Biggest immediate impact. |

Try the Calculator

Enter your numbers and see how even $20 more can pull your payoff date closer—motivating and actionable. If car loan payoff is your goal, this makes progress tangible. Then track your wins with our free debt payoff tracker.

Frequently Asked Questions

Common Mistakes to Avoid

Avoid these pitfalls to maximize your results:

- Not confirming principal payments: Make sure extras go to principal, not future due dates.

- Draining savings: Keep an emergency fund.

- Ignoring high-interest debt: Kill 18%+ credit cards before focusing on the car.

- Missing penalties: Check for any prepayment clause.

- Not using the calculator: Don’t guess—run the numbers.

Drive Toward Financial Freedom

Paying off your car early is about control. Use the calculator, start small, and watch your balance fall. Less interest, less stress, more cash—you’ve got this.

This content is educational and not financial advice. Your loan terms and state law may allow or limit prepayment and how extra payments are credited. Always review your contract and consult a professional before making financial decisions.