Picture this: you’re excited to buy a car, get approved for an apartment, or finally apply for a rewards card—then a low three-digit number suddenly gets in the way. That number is your credit score. For most lenders, what is a good credit score usually starts around 670, while excellent scores begin at 740 and above. The higher your score, the more money you save on interest and fees over time. If you’ve ever felt like that number has more power than it should, you’re not alone. In this guide, you’ll see where your score likely falls, what lenders really care about, and the practical steps you can take to improve it.

Once you know your starting point, the next step is managing your debt wisely. For deeper strategies to tackle balances and stay on track, see our debt management plan guide.

Your Best-Fit Credit Score Action Plan

Answer a few quick questions to see which part of your credit score to focus on first.

Question 1/3

What best describes your current credit score range?

What’s your main goal for the next 6–12 months?

Which statement sounds most like your current habits?

Your suggested focus will appear here

Answer the questions to get a tailored suggestion based on your credit score situation.

Try different choices to see how your recommended focus changes.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Understanding Credit Score Ranges: What is a Good Credit Score?

- The Five Factors That Determine Your Credit Score

- How to Check Your Credit Score Safely

- Proven Strategies to Improve Your Credit Score

- What Lenders Really Look For: Beyond the Score

- Common Credit Score Myths Debunked

- Timeline: When to Expect Credit Score Improvements

- Red Flags That Hurt Your Credit Score

- Special Situations: Building Credit from Scratch

- Frequently Asked Questions

- Conclusion

Key Takeaways

Here are the key points to keep in mind before you dive into the details.

- Good credit scores typically range from 670-739, while excellent scores are 740 and above.

- Payment history accounts for 35% of your score—making on-time payments the most crucial factor.

- Credit utilization should stay below 30%, with under 10% being ideal for the best scores.

- Checking your credit score doesn’t hurt it when using official sources or soft inquiries.

- Score improvements can happen quickly—some changes show results within 30-60 days.

Understanding Credit Score Ranges: What is a Good Credit Score?

When asking "what is a good credit score," the answer depends on which scoring model lenders use. The two most common systems are FICO and VantageScore, and while they’re similar, there are important differences to understand. For an official overview, you can also review this CFPB credit score guide.

FICO Score Ranges

FICO scores, used by 90% of top lenders, range from 300 to 850:

| Score Range | Rating | Population % | Typical Outcomes |

|---|---|---|---|

| 800-850 | Excellent | 21% | Best rates, easy approval ✅ |

| 740-799 | Very Good | 25% | Great rates, high approval 🎯 |

| 670-739 | Good | 21% | Competitive rates, good approval 👍 |

| 580-669 | Fair | 17% | Higher rates, limited options ⚠️ |

| 300-579 | Poor | 16% | Difficult approval, high rates ❌ |

VantageScore Ranges

VantageScore 3.0 and 4.0 use the same 300-850 range but with slightly different categories:

- 781-850: Excellent

- 661-780: Good

- 601-660: Fair

- 500-600: Poor

- 300-499: Very Poor

The bottom line: Most lenders consider a score of 670 or higher to be "good," with 740+ opening doors to the best available terms.

The Five Factors That Determine Your Credit Score

To change your credit score, you first need to understand what actually moves it. You can think of your credit score like a recipe: every ingredient matters, but a few have a much bigger impact than the rest.

1. Payment History (35% of Your Score) 💳

This is the single biggest factor. Even one missed payment can knock your score down by 60–110 points, depending on where you started and how long you’ve had credit.

What lenders look at here:

- Credit card payments

- Loan payments (auto, mortgage, personal)

- Some utility and phone bills (if reported)

Real example: Marcus had a 720 credit score but forgot about a small medical bill that went to collections. That one $85 slip-up dropped his score to 650 and cost him a better mortgage rate.

2. Credit Utilization (30% of Your Score) 📊

This measures how much credit you’re using compared to your available limits. Keep utilization below 30% overall, with under 10% being ideal.

Pro tip: Utilization is calculated both per card and across all cards. Having one card maxed out can hurt your score even if your overall utilization is low.

3. Length of Credit History (15% of Your Score) ⏰

Longer credit history generally means higher scores. This includes:

- Age of oldest account

- Average age of all accounts

- How long since accounts were last used

Important note: This is why financial experts often advise against closing old credit cards, even if you don’t use them.

4. Credit Mix (10% of Your Score) 🔄

Having different types of credit shows lenders you can manage various financial responsibilities:

- Revolving credit: Credit cards, lines of credit

- Installment loans: Auto loans, mortgages, personal loans

You don’t need every type of credit, but having a mix can help your score.

5. New Credit Inquiries (10% of Your Score) 🔍

Hard inquiries (when you apply for credit) can temporarily lower your score by 5-10 points. However, multiple inquiries for the same type of loan within 14-45 days typically count as one inquiry.

How to Check Your Credit Score Safely

A lot of people avoid checking their credit score, fearing it will hurt their credit. This is a myth that costs people opportunities to improve their financial health.

Free and Safe Options

1. Annual Credit Report (annualcreditreport.com)

- Get free, government-mandated reports from all three bureaus

- Shows detailed credit reports (but not your scores)

- Checking them this way has no impact on your credit

2. Credit Card Companies

- Most major cards now include a free FICO score

- Usually updates monthly without hurting your score

- Often comes with basic score tracking and alerts

3. Credit Monitoring Services

- Many banks bundle in free credit monitoring

- Apps like Credit Karma show VantageScores

- Real-time alerts let you spot changes quickly

Understanding Score Variations

Don’t panic if you see different scores from different sources. You actually have dozens of credit scores because:

- Different scoring models (FICO vs. VantageScore)

- Different versions of each model

- Scores calculated on different dates

- Different credit bureaus may have different information

Focus on trends rather than exact numbers. If all your scores are moving in the same direction over time, that’s the signal to watch.

Proven Strategies to Improve Your Credit Score

Improving your credit score requires a strategic approach. Here are the most effective methods, ranked by potential impact and speed of results.

Quick Wins (30-60 Days) ⚡

If you’re impatient to see progress, focus first on the moves that change your score the fastest. These quick wins don’t require fancy tricks—just a few targeted actions with your existing accounts that can move your score within 30–60 days. If you also want a framework for which debts to attack first, you can compare the debt snowball vs avalanche methods and choose the one that fits your style.

1. Pay Down Credit Card Balances

This is often the fastest way to see improvement.

Action plan:

- List all credit cards with balances and limits

- Calculate current utilization for each card

- Focus extra payments on cards over 30% utilization

- Consider making multiple payments per month

Case study: Jennifer had three credit cards with a combined $8,000 limit and $4,000 in balances (50% utilization). By paying down $2,400 to reach 20% utilization, her score climbed from 640 to 680 in just two months.

2. Request Credit Limit Increases

When your limits go up but your balances stay the same, your utilization drops without changing how much you owe.

Strategy:

- Call or request increases with existing card companies every 6–12 months

- Mention any income increases or strong payment history

- Treat the higher limit as breathing room, not extra spending money

3. Dispute Credit Report Errors

Studies show roughly 1 in 4 credit reports contain errors that could drag down scores.

Common errors to look for:

- Accounts that aren’t yours

- Incorrect payment histories

- Wrong account statuses or balances

- Duplicate accounts

Want a simple way to start adding fresh positive history every month?

Then keep working through the strategies below to strengthen every part of your credit profile.

Medium-Term Improvements (3-6 Months) 📈

4. Become an Authorized User

Ask a trusted family member with excellent credit to add you as an authorized user on their account.

Requirements for maximum benefit:

- The primary cardholder has excellent payment history

- Low utilization on the account

- The card company reports authorized user activity

5. Pay Bills Before Due Dates

Many card companies report your balance on the statement date, not the day the bill is due.

Strategy: Aim to pay down your balance before the statement closes so the reported utilization looks lower.

Long-Term Building (6+ Months) 🏗️

6. Consider a Secured Credit Card

A secured card can be a gentle way to build credit from scratch or restart after money troubles.

How it works:

- You provide a security deposit (usually $200-$500)

- This becomes your credit limit

- Use it like a regular credit card

- Graduate to unsecured cards after 6-12 months

Top secured card features to look for:

- Reports to all three credit bureaus

- No annual fee

- Graduation path to unsecured card

- Rewards program (bonus feature)

7. Credit-Builder Loans

These small loans are designed to build credit while you gradually save.

Process:

- Borrow a small amount ($300-$1,000)

- The money sits in a savings account instead of going to you upfront

- Make monthly payments for 6–24 months

- Receive the money plus any interest earned at the end

- Each on-time payment adds positive history to your reports

Advanced Strategies for Optimization 🎯

8. Strategic Credit Applications

Once your score improves, applying for new credit carefully can give you a further boost.

- Increased available credit (lower utilization)

- Better credit mix

- Access to better financial products

Timing rules:

- Wait 6+ months between applications

- Apply only for credit you genuinely need

- Research which cards or loans you’re likely to be approved for

9. Negotiate with Creditors

If you have past-due accounts or collections, negotiating can sometimes soften the damage.

Options:

- Pay for delete: Offer to pay in exchange for removal from your credit report

- Payment plans: Set up affordable payment schedules

- Goodwill letters: Ask for removal of late payments due to one-time or extenuating circumstances

If you’re thinking about rolling multiple balances into one simpler payment, it helps to understand what credit score you need for a debt consolidation loan before you apply.

What Lenders Really Look For: Beyond the Score

Knowing your credit score is only part of the story. Even with a strong number, lenders still zoom in on the details: how steady your income is, how much debt you’re already carrying, and how reliably you’ve been paying it back. In plain language, they’re asking whether you can comfortably handle one more payment. When you understand these extra checks, you can shape your whole financial picture instead of chasing a single score on a screen.

Income and Employment Stability

- Debt-to-income ratio: Many lenders like to see this below about 36%

- Employment history: A steady job record of 2+ years looks best

- Income verification: Expect to share recent pay stubs, tax returns, or bank statements

Down Payment and Assets

- Larger down payments can help offset a lower credit score

- Savings and assets signal financial stability

- Co-signers with strong credit can help you qualify or improve terms

Loan-Specific Factors

Mortgages:

- Minimum scores vary by loan type (for example, FHA around 580, many conventional loans 620+)

- The very best rates typically go to borrowers with 740+ scores

- Your down payment size also affects both your rate and approval odds

If you want a deeper walkthrough of home loans from payoff to refinancing, our homeowner’s guide to mortgages breaks the process down step by step.

Auto Loans:

- Some lenders approve scores as low as 500, but usually at higher rates

- Scores of 700+ tend to unlock the most favorable auto rates

- The car’s age and value also play a role in your terms

Credit Cards:

- Many top-tier rewards cards look for scores around 700+ or higher

- Solid starter and mid-tier cards are often available with 650+ scores

- Secured cards are an option at nearly any score if you can provide a deposit

Common Credit Score Myths Debunked

Myth 1: "Checking my credit hurts my score"

Truth: Soft inquiries (checking your own credit) don’t affect your score. Only hard inquiries from credit applications have an impact.

Myth 2: "I need to carry a balance to build credit"

Truth: Paying your full balance every month is better for your score and saves money on interest.

Myth 3: "Closing old cards helps my score"

Truth: Closing cards can hurt your score by reducing available credit and shortening credit history.

Myth 4: "Credit repair companies can remove accurate information"

Truth: Accurate negative information can only be removed by time (7-10 years for most items).

Myth 5: "All credit scores are the same"

Truth: You have dozens of different credit scores. Focus on trends rather than exact numbers.

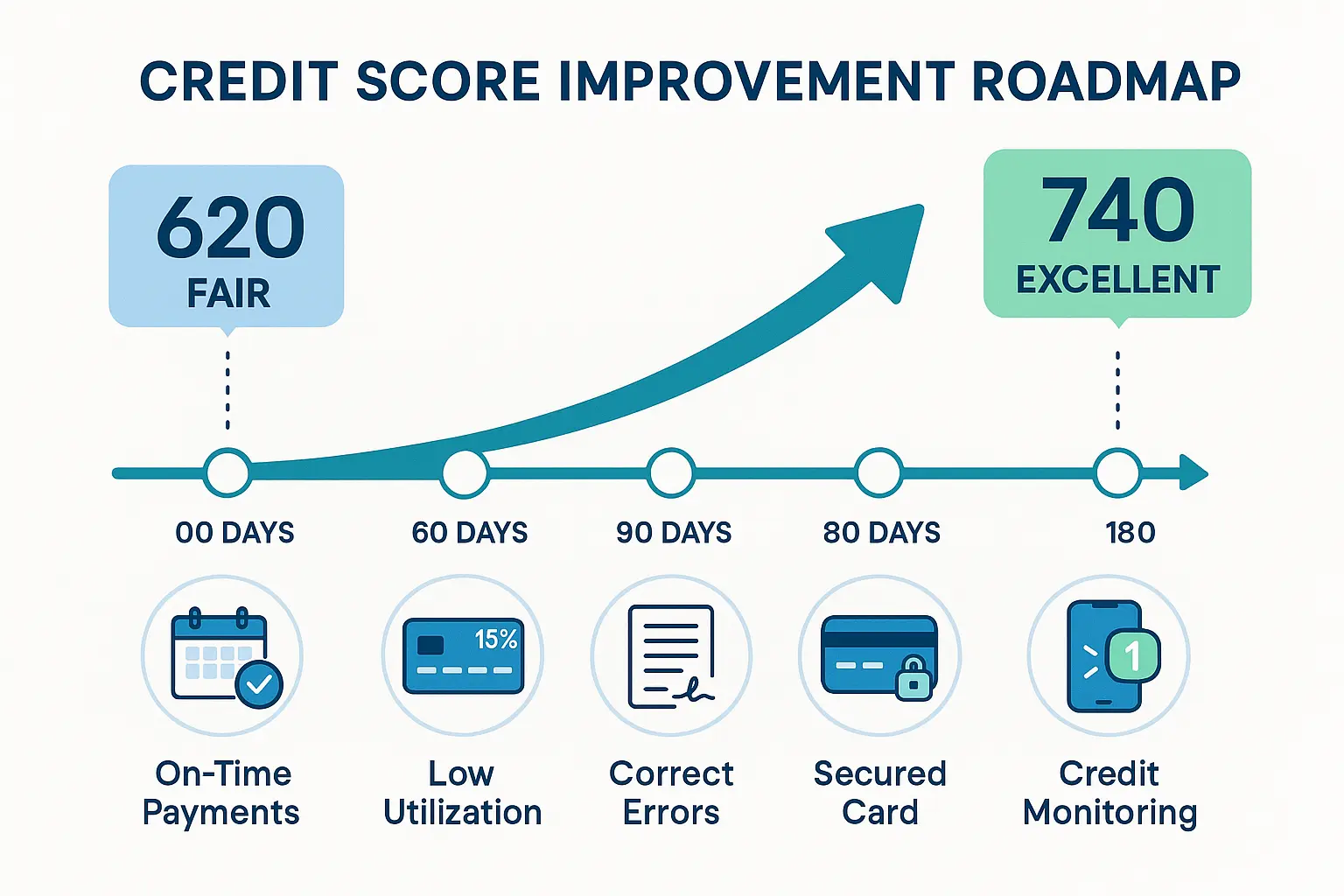

Timeline: When to Expect Credit Score Improvements

Knowing roughly how long changes take also helps you set expectations and stay motivated.

30 Days 📅

- Credit utilization changes show up quickly

- Paying down balances can show immediate impact

- Dispute resolutions may update scores

60-90 Days 📅

- New positive payment history begins to help

- Authorized user accounts typically appear

- Credit limit increases show full impact

6 Months 📅

- Consistent payment history shows significant improvement

- New accounts begin to help rather than hurt

- Credit-builder loans start showing positive impact

1-2 Years 📅

- Major score improvements possible with consistent effort

- Negative items begin to have less impact

- Credit mix improvements show full benefit

7+ Years 📅

- Most negative items fall off credit reports

- Bankruptcies (Chapter 13) are removed

- Maximum score recovery possible

Red Flags That Hurt Your Credit Score

Avoiding these common mistakes is just as important as implementing improvement strategies. If high-interest debt is a big part of the problem, a free debt payoff tracker can help you map out payments and stay accountable.

Payment-Related Issues ❌

- Late payments (even one day late can be reported)

- Missed payments (30+ days late have major impact)

- Defaulted accounts (severe long-term damage)

Credit Utilization Problems ❌

- Maxing out credit cards (even temporarily)

- High utilization across multiple cards

- Closing cards with available credit

Application Mistakes ❌

- Too many applications in short periods

- Applying for credit you’re unlikely to get approved for

- Not understanding hard vs. soft inquiries

Account Management Issues ❌

- Closing old accounts without considering impact

- Ignoring credit reports and missing errors

- Not monitoring for identity theft

Special Situations: Building Credit from Scratch

Young Adults and Students 🎓

Starting with no credit history:

- Student credit cards: Designed for people with little or no history

- Secured credit cards: Let you build credit with a refundable deposit

- Authorized user status: Lets you piggyback on a parent’s or mentor’s good credit

- Student loans: Can help build your credit mix if you pay on time

Timeline for students:

- Month 1–6: Apply for your first card and use it lightly

- Month 6–12: Focus on building a spotless payment history

- Year 2: Consider adding another well-chosen credit product

- By graduation: Aim to leave school with a solid credit foundation

New Immigrants 🌍

Challenges:

- No U.S. credit history showing up in the system

- Limited documentation or short work history

- Unfamiliarity with how U.S. credit scores work

Solutions:

- Secured credit cards: Often the easiest type of card to get approved for

- Credit-builder loans: Help you establish payment history from scratch

- Bank relationships: Start with a checking or savings account and build from there

- ITIN applications: Let you begin building credit even without a Social Security number

Special programs:

- Some banks offer immigrant-friendly cards and loans

- Credit cards specifically designed for newcomers

- In some cases, limited consideration of international credit history

Rebuilding After Financial Difficulties 🔄

Post-bankruptcy strategy:

- Wait periods: Some lenders want to see time pass first (often about 2 years after Chapter 7; less for Chapter 13)

- Secured credit cards: Use a small deposit-backed card to start rebuilding immediately

- Credit monitoring: Keep an eye on your reports so you can see progress

- Patient approach: Commit to steady, positive habits rather than quick fixes

After foreclosure:

- Waiting periods vary by loan type and lender

- Alternative credit documentation like utilities or phone bills can help

- Rent payments reported through certain services can also support rebuilding

Frequently Asked Questions

Conclusion

Understanding what lenders see as a good credit score is just the beginning of your financial journey. A good credit score—typically 670 or higher—opens doors to better interest rates, easier approvals, and significant long-term savings. But more importantly, the habits that build good credit create a foundation for overall financial health.

Remember Sarah from our opening story? After learning about credit improvement strategies, she focused on paying down her credit card balances and disputing an error on her credit report. Within six months, her score improved from 580 to 680, qualifying her for that 4% auto loan rate she originally wanted.

Your next steps:

- Check your credit score and reports from all three bureaus

- Identify your biggest improvement opportunities (usually payment history or utilization)

- Create a specific action plan with timeline goals

- Set up monitoring to track your progress

- Stay consistent with positive credit habits

The journey to excellent credit isn’t always quick, but it’s always worthwhile. Every point of improvement brings you closer to your financial goals, whether that’s buying a home, starting a business, or simply having the peace of mind that comes with strong credit.

Your credit score is more than just a number—it’s a tool that can help you build the financial future you deserve. Start today, stay consistent, and watch your opportunities grow along with your score.

This guide about what lenders consider a good credit score is for general education. For persistent issues or safety concerns, consult a professional.