When Sarah found herself staring down an unexpected $800 car repair with poor credit and almost no savings, an online search led her to HonestLoans.net. Like thousands of borrowers each month, she wondered whether using this marketplace was a smart move or a costly mistake. This honestloans.net review walks you through how the site really works, what it costs, and safer options you can turn to instead if you’re feeling pressure to make quick emergency loan decisions. If you’re also juggling multiple balances, our debt management plan guide can help you build a safer long-term strategy.

Your Best-Fit HonestLoans.net Decision Helper

Answer a few quick questions to see if using HonestLoans.net—or an alternative—fits your situation.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- What Is HonestLoans.net?

- How the HonestLoans.net Application Process Works

- Interest Rates, Fees, and True Costs

- Evaluating Legitimacy: Red Flags and Concerns

- State Availability and Regulatory Compliance

- Safer Alternatives to Consider

- How to Protect Yourself When Considering Online Lenders

- Frequently Asked Questions

- Conclusion

- References

Tip: High-cost emergency loans can buy you time, but they can also deepen money stress. When in doubt, compare total costs, use trusted resources like the Consumer Financial Protection Bureau, and talk to a nonprofit credit counselor before you commit.

Key Takeaways

- HonestLoans.net is not a direct lender but a lead-generation marketplace that passes your information to third-party lenders.

- Partner lenders may offer extremely high APRs, especially on emergency cash advances, which can reach several hundred percent.

- No real “guaranteed approval” exists despite marketing language you may see around the web; approval and terms depend on each lender.

- Sharing your data with a marketplace means more exposure—multiple lenders may contact you, and hard credit pulls are possible.

- Safer alternatives include credit unions, CDFIs, and credit-builder options that focus on lower-cost borrowing and long-term stability.

What Is HonestLoans.net? Understanding the Platform

HonestLoans.net positions itself as a convenient way to request personal loans between roughly $100 and $5,000, especially for people with fair-to-poor credit. Instead of being a bank or online lender itself, it acts as a middleman that connects you with multiple companies that may be willing to lend.

The Lead Generation Model

HonestLoans.net is a lead marketplace, not a lender. When you submit your information, you’re authorizing them to share your details with a network of third-party lenders and financial service providers who may respond with offers—or additional marketing.

- You don’t get a loan directly from HonestLoans.net.

- Multiple companies may receive your personal and financial data.

- Rates, fees, and terms vary widely between lenders.

- There is never a guaranteed approval, even after filling out the full form.

Target Borrower Profile

The site is clearly aimed at people who struggle to qualify for traditional financing:

- Credit scores below about 650 or thin credit files.

- Past issues like late payments, collections, or even bankruptcies.

- Urgent needs like car repairs, medical bills, or overdue utilities.

- Borrowers who have been turned down by banks and credit unions.

Marketing around marketplaces like HonestLoans.net sometimes suggests that people looking for personal loans for a 620 credit score or below, or for debt consolidation loans for a 620 credit score, can still get approved quickly, but those offers often come with very high APRs and strict repayment schedules.

How the HonestLoans.net Application Process Works

Understanding the step-by-step flow helps you know what you’re signing up for before you share sensitive details like your bank account number.

Initial Application Screen

The online form asks for personal details (name, address, contact information), your employment and income, how often you’re paid, and your bank account information for potential funding. You’ll also choose a loan amount and general purpose, like “auto repair” or “bills.”

Although the process is often framed as a quick or “soft” check, lenders in the network may run hard inquiries on your credit once they review your information, which can temporarily impact your credit score.

The Matching Process

After you submit the form, HonestLoans.net says it will review your details, attempt to match you with suitable lenders, and display offers for you to compare. Some borrowers may see multiple offers, while others may get only one—or none.

Reality vs. Marketing Claims

In practice, experiences reported in reviews and complaints frequently don’t match the smooth, guaranteed-sounding marketing copy used in ads:

- Pre-approval language doesn’t always lead to final approval.

- Actual APRs and fees may be much higher than advertised ranges.

- You may be contacted about other financial products instead of a simple loan.

- Some borrowers report multiple calls or emails from different companies.

Interest Rates, Fees, and True Costs

The most important question for any high-risk loan marketplace is simple: “How much will this actually cost me?” The answer with HonestLoans.net’s lender network is often “a lot more than you expect.”

Typical APR Ranges

Because HonestLoans.net works with many different lenders, exact APRs vary, but offers commonly fall into these broad buckets:

| Loan Type | APR Range | Typical Terms |

|---|---|---|

| Short-term personal loans | 18% – 36% | 2–7 years |

| Bad credit installment loans | 25% – 99% | 1–5 years |

| Emergency cash advances | 200% – 400%+ | 2 weeks – 6 months |

Hidden Fees and Charges

High APRs are only part of the story. Many lenders in this space also charge extra fees that increase the real cost of borrowing:

- Origination fees, often 1%–8% of the loan amount.

- Processing or “application” charges.

- Late payment and returned payment fees.

- Potential prepayment penalties, depending on the lender’s policy.

Real-World Cost Example

Imagine a $1,000 loan with terms that may look “reasonable” at first glance:

- Principal: $1,000

- APR: 45%

- Term: 12 months

- Origination fee: 5% ($50)

Your monthly payment would be around $103.50, for total payments of about $1,242. That means roughly $242 in interest plus the $50 fee—a total cost of $292 for one year, or about a 29.2% total cost on top of what you borrowed.

Still curious about HonestLoans.net offers?

See HonestLoans.net offers carefully

If you choose to explore this marketplace, you can review potential loan offers on HonestLoans.net and compare them against the safer options in this guide.

Take your time to compare all terms and fees before you accept any loan.

Evaluating Legitimacy: Red Flags and Concerns

Is HonestLoans.net “legit”? In the strict sense, it’s a real business with disclosures that clearly say it is a lead generator, not a lender. The bigger question is whether using it is a wise move for your situation.

Marketing Red Flags

- “Guaranteed approval” style language: No legitimate lender can promise approval without reviewing your information.

- Promises of instant cash: Even fast lenders still face bank-processing times and verification checks.

- “No credit check” headlines: Most serious lenders perform some form of credit or bank data review before funding.

Customer Complaint Patterns

Reviews and complaints about marketplaces like HonestLoans.net frequently mention:

- Big gaps between advertised and actual APRs or terms.

- Unexpected hard credit pulls from multiple lenders.

- A flood of follow-up calls, emails, or texts.

- Frustration at completing forms without ever receiving usable offers.

Data Privacy Concerns

Sharing your data with a lead generator always carries extra risk. Your information may be stored, shared, and used for marketing in ways that aren’t always obvious from the initial form.

- Your personal details may go to several companies at once.

- You have limited control over how each company uses or stores your data.

- You may continue receiving marketing messages, even if you never take a loan.

State Availability and Regulatory Compliance

Lending rules are set at both the federal and state level, and those rules can dramatically change which products are available to you and at what price.

Limited State Coverage

HonestLoans.net’s own disclosures make it clear that its service and partner lenders are not available in all states, and that you shouldn’t apply if the loan you want is illegal where you live. Availability depends on your state’s laws and on the individual lenders that receive your information.

Because state rules and lender lineups change over time, it’s safer to assume that no public list is ever fully up to date. Instead of relying on a generic “approved states” list, always read the latest disclosures on the company’s website and verify licensing with your state regulator before you apply.

Regulatory Gaps

Lead generators often sit in a gray zone: they aren’t funding loans themselves, but they can still influence who gets marketed which products. Oversight tends to focus on the lenders, not the marketplace, so you may have less clarity around who is responsible when things go wrong.

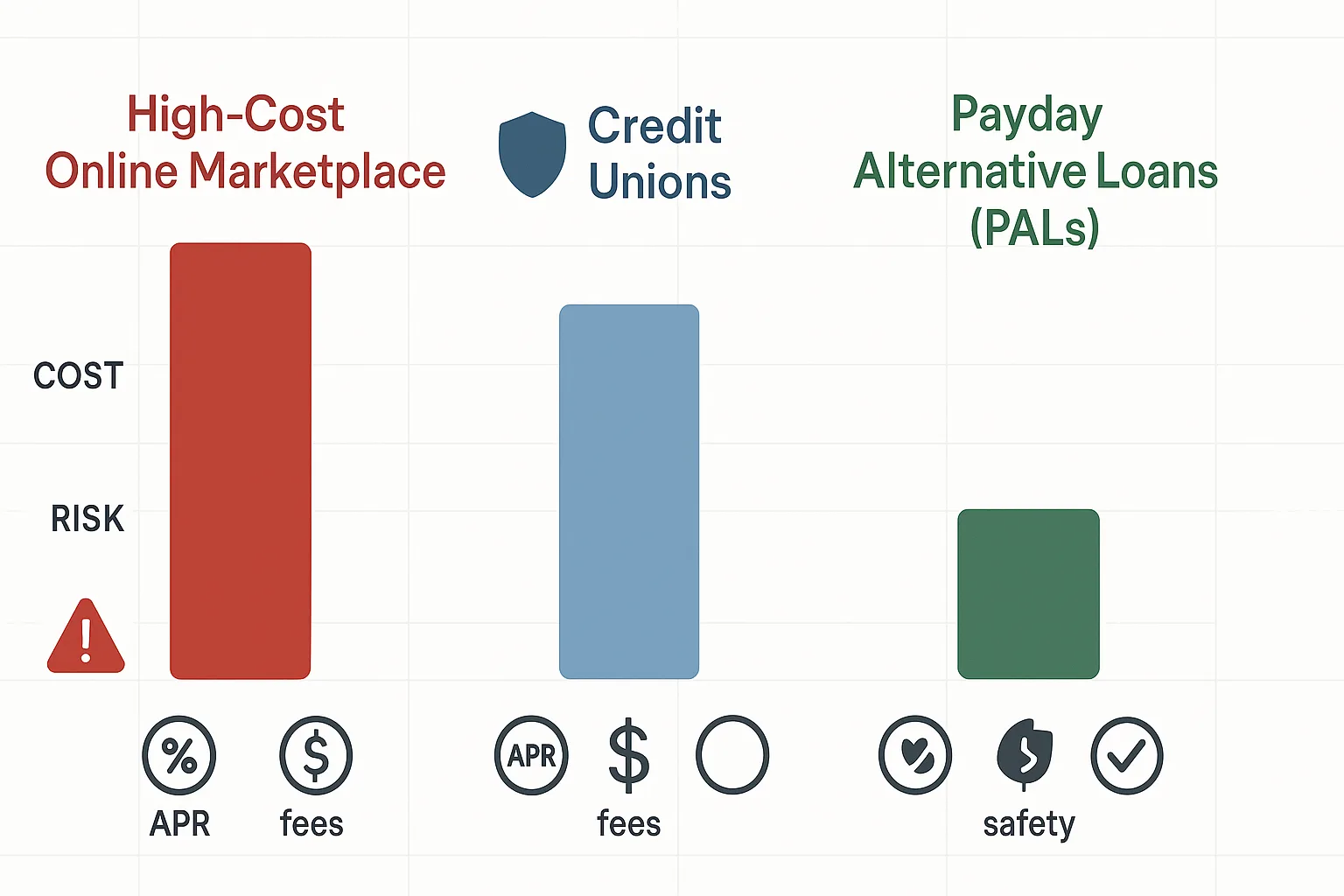

Safer Alternatives to Consider

Before you accept a high-cost offer from a lender in any online marketplace, it’s worth checking lower-cost options that focus on long-term financial health.

Credit Union Alternatives

Many credit unions offer Payday Alternative Loans (PALs) with lower costs and clearer terms. PALs typically have capped APRs, modest fees, and short, structured repayment periods. You’ll need to join the credit union, but membership requirements are often simple and flexible.

Community Development Financial Institutions (CDFIs)

CDFIs are mission-driven lenders that serve communities and borrowers who are often ignored by traditional banks. They may offer small-dollar loans, credit-building programs, and financial coaching at far lower costs than payday or high-APR installment lenders.

Credit-Builder Options

If your primary goal is to improve your credit, consider products that are designed specifically for that purpose:

- Secured credit cards: You put down a refundable deposit and build history with on-time payments.

- Credit-builder loans: Your “loan” payments are held in a savings account and released once you finish the plan.

You can also explore our debt snowball vs. avalanche guide if you’re trying to organize multiple balances and choose a payoff method.

Emergency Assistance Programs

Before you borrow, check whether community or government programs can relieve some pressure:

- Utility assistance and payment plans for power, gas, and water bills.

- Food banks, community fridges, and local nonprofits that help with essentials.

- Emergency assistance funds from religious or community organizations.

- Government benefit programs if you meet income or household requirements.

How to Protect Yourself When Considering Online Lenders

If you still decide to explore offers through HonestLoans.net or similar sites, it’s critical to slow down and protect yourself at each step.

Before Applying

- Research the companies you see using independent reviews, not just ads.

- Check Better Business Bureau profiles and your state regulator’s site for complaints.

- Confirm that any lender you consider is properly licensed in your state.

- Run the numbers with a loan calculator so you know the true total cost.

During the Application Process

- Use a secure internet connection and avoid public Wi-Fi when entering bank details.

- Never sign blank or incomplete documents.

- Read all fee disclosures, especially around late payments and renewals.

- Be cautious of any lender asking for upfront fees before providing a loan.

After Receiving Offers

- Compare at least a few options, including credit unions or CDFIs, not just marketplace offers.

- Write out a realistic repayment plan and check whether it fits your actual budget.

- Consider talking with a nonprofit credit counselor or reviewing what a good credit score looks like before accepting a high-APR loan.

“The most expensive loan is often the one that seems easiest to get. Take time to understand what you’re really agreeing to pay.”

Explore HonestLoans.net with a plan

If you still decide to use HonestLoans.net after weighing the risks, go in with a clear payoff plan and compare each offer against lower-cost options like credit unions and CDFIs.

Frequently Asked Questions

Conclusion

HonestLoans.net is a functioning online marketplace, but “real” doesn’t automatically mean “right for you.” For many borrowers—with limited savings, unstable income, or existing debt—offers from high-cost lenders can quickly turn a short-term fix into a long-term burden. Slowing down, comparing alternatives, and protecting your information can make a big difference in your long-term financial health.

The bottom line: it’s often better to exhaust lower-cost options like credit unions, CDFIs, and community support before relying on any high-APR marketplace. Taking time to ask questions and read about what credit score you need for a consolidation loan can help you avoid rushed decisions. Reading a few debt consolidation loan reviews can also give you a clearer picture of how fees and customer experiences compare across lenders. Then, use tools like our free debt payoff tracker to map out a payoff plan you can actually stick with.

References

- Consumer Financial Protection Bureau. “Payday Loans and Deposit Advance Products.” Accessed 2025.

- National Credit Union Administration. “Payday Alternative Loans (PALs).” Accessed 2025.

- Federal Trade Commission. “Advance Fee Loan Scams.” Accessed 2025.

- Better Business Bureau. “Online Lending Marketplace Complaints Analysis.” Accessed 2025.

This honestloans.net review guide is for general educational purposes only and does not provide financial, legal, or tax advice. Always review current lender disclosures and consult a qualified professional or nonprofit credit counselor before taking on new debt or changing your repayment strategy.