Dreaming of tax-free cash in early retirement—but not sure how to get from here to there? A Roth conversion ladder spreadsheet helps you plan small annual conversions and shows exactly when each rung becomes penalty-free. We’ll lay out the 5-year rules in plain English and share simple, low-stress ways to cut your tax bill. I’ve wrestled with retirement accounts myself, so I know how confusing (and intimidating) they can be. This guide breaks down the Roth conversion ladder, explains the two 5-year rules, and gives you a free spreadsheet plus an interactive visualizer to make planning easy, so your plan feels real instead of abstract. As you read, keep a scratchpad nearby and jot down your current account balances and yearly spending so the examples land in your real life, not just on the screen. If you’d like a big-picture overview first, start with this guide to retirement accounts and taxes.

Plan Your Tax-Free LadderThis post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Your Roth Ladder Plan

- Roth Ladder Spreadsheet Basics

- Why You Need a Roth Conversion Ladder

- Roth IRA 5-Year Rule Explained

- Your Free Roth Conversion Ladder Spreadsheet & Calculator

- How to Build Your Roth Conversion Ladder

- Timing Your Roth Conversion Ladder for Savings

- Tips for a Successful Roth Conversion Ladder

- Frequently Asked Questions About Roth Conversion Ladder

- Conclusion: Your Path to Tax-Free Retirement

Key Takeaways for Your Roth Ladder Plan

- Tax-Free Income: This strategy lets you tap traditional retirement funds (like 401(k)s or IRAs) tax-free and penalty-free before age 59½.

- 5-Year Rule: Each Roth IRA conversion must “season” for five years before you can withdraw the principal penalty-free, forming the “ladder.”

- Strategic Tax Planning: Convert during low-income years to stay in lower tax brackets and possibly score Affordable Care Act (ACA) subsidies.

- No RMDs: Roth IRAs skip Required Minimum Distributions (RMDs) for the original owner, so you keep the reins on your money longer.

- Free Tools: Grab our free planner and interactive visualizer to plan and track your conversions easily.

Tax rules change over time and everyone’s situation is different. Treat this Roth ladder spreadsheet as education only and run your own numbers with a qualified tax pro before you make big conversion decisions.

Roth Conversion Ladder Spreadsheet: Basics

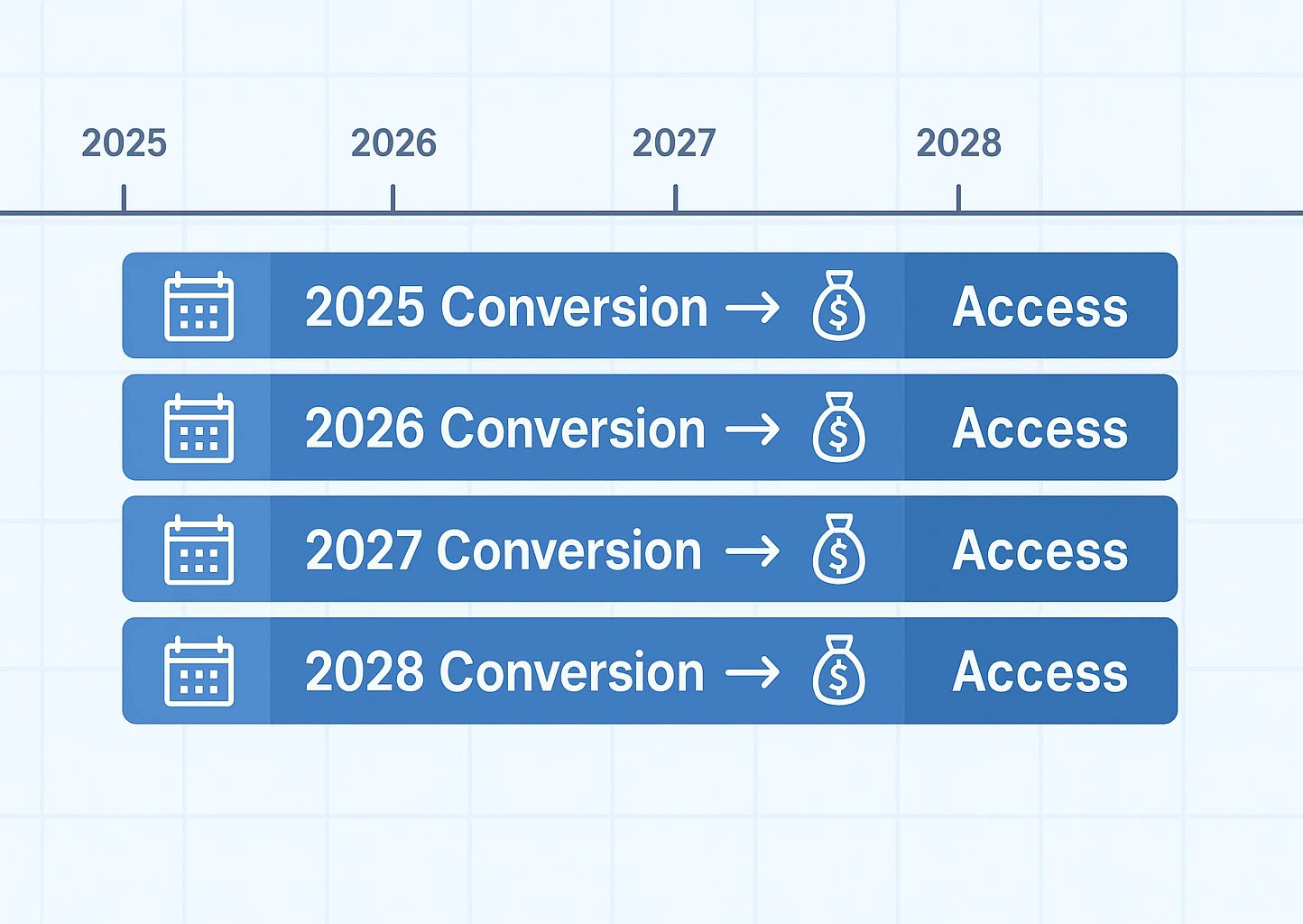

Your spreadsheet mirrors the real process: each annual conversion becomes a rung you can track to its penalty-free date.

Think of a traditional IRA or 401(k) as a locked savings box. Your money grows tax-deferred, but withdrawals get hit with income taxes. A Roth IRA, though, is like a tax-free piggy bank. If you’re brand-new to Roths, it’s worth skimming this beginner’s guide to Roth IRAs before you build your ladder. The ladder strategy shifts money from traditional accounts into a Roth account in small, manageable chunks, or “rungs.”

Why It Matters for Early Retirees

Traditional accounts sting you with a 10% penalty for withdrawals before 59½. For FIRE (Financial Independence, Retire Early) folks like me, that’s a dealbreaker—and it’s a big reason people chasing financial independence and early retirement look closely at Roth ladders. This approach dodges the penalty, letting you tap funds early. For example, my $20,000 conversion in 2025 will be ready penalty-free in 2030, powering my retirement plans. You can do the same exercise: pick a rough conversion amount and add five years to see which calendar year that “rung” would unlock.

Why You Need a Roth Conversion Ladder

Got early retirement on your mind? This strategy is your key to tax-smart income. Here’s why it’s a must for FIRE enthusiasts:

Access Funds Before 59½

Without a ladder, you’re stuck with taxable accounts or eating penalties. This method frees up your pre-tax savings early, no penalty attached.

Tax Control with a Roth Account

When you retire early, your income usually drops, putting you in lower tax brackets like 10% or 12%. Converting then cuts your tax bill. Plus, you can time conversions to grab ACA health insurance subsidies, saving a bundle. Want to dive deeper into early retirement strategies? Check out our guide on health insurance options for early retirees.

No RMDs and Tax-Free Growth

Roth IRAs don’t require RMDs during the original owner’s lifetime, unlike traditional accounts that generally require withdrawals starting around age 73 under current U.S. rules. Your Roth can grow tax-free for longer, and heirs may receive tax-free distributions if the account meets the qualified distribution rules and current IRS guidelines.

Inflation and Simplicity

Paying taxes now at lower rates shields you from future tax spikes. Once your ladder’s built, pulling out cash is straightforward and tax-free.

Who a Roth Conversion Ladder Works (and Doesn’t Work) For

In my own early-retirement plan, I built a Roth conversion ladder in my 40s, and I’ve found it works best for people who:

- want to retire before 59½ and need a bridge strategy for those “in-between” years,

- expect to be in a similar or lower tax bracket in early retirement than right now, and

- don’t mind tracking a simple spreadsheet to keep their conversions and 5-year windows straight.

It may be less helpful if you expect much lower taxes later in life, or if you’d rather keep things ultra-simple and just withdraw from traditional accounts when the penalties go away. There’s no one-size-fits-all answer—your ladder should fit your goals.

Want more details? Check out the IRS guide to Roth IRAs.

Roth IRA 5-Year Rule Explained

The 5-year rule is the backbone of your ladder strategy. It’s like letting dough rise before baking bread. There are two rules to know:

Account 5-Year Rule (Earnings)

Your Roth account needs to be open for five years before earnings come out tax-free and penalty-free. The clock starts January 1 of your first contribution year. For instance, my own Roth account opened in 2025 lets me pull tax-free earnings if I’m 59½ and the account has been open for five tax years.

So if you first contributed in 2022, for example, you generally can’t treat your earnings as tax- and penalty-free until at least the 2027 tax year, even if you stopped working earlier.

Conversion 5-Year Rule (Principal)

Every Roth IRA conversion has its own 5-year timer, starting January 1 of the conversion year. Pull out principal early, and you’re hit with a 10% penalty unless an exception applies. Here’s a quick look:

| Conversion Year | Amount | Accessible Penalty-Free |

|---|---|---|

| 2025 | $25,000 | January 1, 2030 |

| 2026 | $30,000 | January 1, 2031 |

By converting a portion of your funds each year, you create a new step on your ladder, ensuring a steady stream of cash when you’re ready to use it.

These 5-year rules are simplified for planning your own ladder. If you have multiple Roth IRAs, inherited accounts, or more complex situations, double-check current IRS guidance (for example, the latest Roth IRA sections of IRS Publication 590-B on IRS.gov) or ask a tax pro so you don’t run into surprise penalties.

Your Free Roth Conversion Ladder Spreadsheet & Calculator

Planning Roth conversions can feel like a puzzle. I originally built this spreadsheet for my own early-retirement plan after juggling too many sticky notes and IRS tables. Now this free tool helps you:

- See when each conversion’s ready to withdraw.

- Track conversion amounts and dates.

- Map out future conversions based on your budget.

Download Your Free Roth Ladder Spreadsheet!

Interactive Visualizer: Play with the tool below to get a sneak peek at your ladder. It’s like a rough draft for your full plan.

Roth Conversion Ladder Calculator

Slide to plan your conversions and see when funds are penalty-free! 🪜

Using the Tool

Here’s how to use the Roth Conversion Ladder Calculator:

- Annual Conversion Amount: Slide or type an amount (e.g., $15,000).

- Start Year: Pick when you’ll begin conversions.

- Number of Years: Choose how many years you’ll convert funds.

- Your Age: See when you’ll be 59½ relative to your first available rung.

Adjust the controls and the table updates instantly! Green (✅) means funds are ready, yellow (⚠️) means they’re available next year, and gray means they’re still pending.

How to Build Your Roth Conversion Ladder

Building a Roth Conversion Ladder is like paving the way to your ideal retirement. Here’s a simple, step-by-step plan to make it happen:

Under current U.S. rules, there’s no income limit for doing Roth conversions—the main constraint is how much extra taxable income you’re comfortable creating in a given year.

Step 1: Open a Roth IRA

No Roth IRA yet? No problem! Open one with a trusted brokerage like Vanguard or Fidelity to kick things off. This starts the 5-year timer for your account.

Step 2: Load Up Your Traditional Accounts

Ensure you’ve got funds in a Traditional IRA, an old 401(k), or a SEP IRA. Have a 401(k) from a past job? Roll it into a Traditional IRA to make life easier.

Step 3: Plan Your Conversions

Decide how much you’ll convert each year. Aim to stay in a low tax bracket, like 12%, to keep taxes manageable. Think about:

- Your Yearly Expenses: How much money will you need to cover your costs?

- ACA Savings: Keep conversions low enough to qualify for health insurance subsidies.

- Extra Income: Include any money from side hustles or investments.

Step 4: Make the Conversion Happen

Contact your brokerage or hop online to transfer funds from your Traditional IRA to the Roth. Don’t let them withhold taxes during the transfer—it maximizes what you convert!

Step 5: Keep Track of Everything

Record each conversion’s date, amount, and when it’s ready to pull out. My free Roth conversion ladder tool makes this super easy, just like our free financial tools for savvy savers.

Step 6: Keep It Going

Convert a chunk of money every year to add new rungs to your ladder. This ensures you’ve got funds ready every five years.

Step 7: Tap Into Your Funds

After five years, you can withdraw the principal without penalties. For example, my 2025 conversion will be ready to cover my 2030 expenses.

Get Expert Eyes on Your Ladder

You can bring your spreadsheet, tax bracket estimates, and ACA questions to a JustAnswer finance expert and talk through your “what if” scenarios before you lock in conversions.

Timing Your Roth Conversion Ladder for Savings

Timing is everything to save on taxes. Here’s when to make your moves:

Low-Income Years

Early retirement usually means lower income, perfect for converting in the 10% or 12% brackets. Do it before Social Security or RMDs push up your taxable income.

ACA Subsidies

Keep your Modified Adjusted Gross Income (MAGI) within ACA subsidy limits to protect those premium savings—our deep dive on health insurance for early retirees walks through how coverage and income interact.

Market Downturns

Convert when the market dips to pay taxes on cheaper assets, which then grow tax-free in the Roth.

Avoiding the Pro-Rata Rule

Mixing pre-tax and after-tax IRA funds triggers the pro-rata rule, taxing conversions proportionally. Roll pre-tax funds into a 401(k) to avoid it.

For some people, other early-access tools like 72(t) SEPP withdrawals or simply drawing from a taxable brokerage account may work better, or even using strategies like 401(k) withdrawals without penalty. A fee-only planner or tax pro can help you weigh a ladder against those options and avoid surprises like higher Medicare premiums from IRMAA surcharges later on. A simple starting point is to sketch out two or three “what if” paths on paper—ladder, 72(t), and taxable—and bring that to a pro so you’re not starting the conversation from zero.

Tips for a Successful Roth Conversion Ladder

Want to make your ladder strategy shine? These tips, straight from my own trial and error, will save you taxes and stress:

- Convert Wisely: I stick to the 12% bracket to avoid overpaying taxes, saving thousands yearly.

- Check State Taxes: My state’s tax rate surprised me once—always factor it in.

- Backdoor Roth: I’ve used Backdoor Roth IRAs for high-income years, but cleared pre-tax IRAs to dodge the pro-rata rule.

- Record Meticulously: My tracker keeps me IRS-compliant—track every conversion!

- Re-evaluate Yearly: Tweaking conversions as my income shifted kept my plan rock-solid.

- Consult Experts: A tax pro streamlined my ACA subsidies, making my ladder airtight and helped me see the full tax picture more clearly.

I’m not a tax professional—just a money nerd sharing what’s worked for me. Use this as a practical starting point. Then run your own numbers with a qualified advisor who understands your whole situation.

Frequently Asked Questions About Roth Conversion Ladder

Conclusion: Your Path to Tax-Free Retirement

The Roth Conversion Ladder, teamed up with a Roth account, can be a powerful strategy for a more tax-efficient early retirement. Nail the 5-year rule and plan your conversions thoughtfully to help you avoid unnecessary penalties until you hit 59½. Don’t let taxes scare you off. With this guide and my free ladder spreadsheet, you’re in a great spot to carve out your financial freedom without constantly worrying about surprise tax bills.

Hi, I’m the writer behind Frugal Harpy, a longtime DIY investor and early-retirement planner who’s been managing Roth conversions and spreadsheets like this for my own family for years. This article shares what’s worked for us so you can stress less about the tax side of your plan.

This content is for general educational purposes only and is not tax, investment, or financial advice. Tax laws and health-insurance rules change over time, and what works for one household may not fit another. Before making Roth conversions or other major money moves, talk with a qualified tax or financial professional who understands your full situation.