Buying a home is exciting, but the mortgage you choose can shape your budget for decades. This mortgage guide for homeowners follows Sarah, a first-time buyer who later refinanced and cut her payment by $300 a month—and then turns her story into clear steps you can copy with your own loan.

Whether you’re a brand-new homeowner or you’ve had your mortgage for years, the goal is the same: understand your loan, avoid expensive mistakes, and use your payments to build long-term wealth instead of stress. We’ll walk through loan types, payoff strategies, refinancing opportunities, and smart ways to tap home equity without putting your future at risk.

If you’re still shopping for a home, you’ll also find quick basics on pre-approval, affordability, and closing costs before we dive deeper into managing and refinancing an existing mortgage. That way, you can go from “What can I even afford?” to a clear, confident mortgage plan.

Mortgage Refinance Savings Calculator

Enter balance, rates, and years to estimate a new monthly mortgage payment.

Your quick savings estimate

Move the sliders or edit your balance to see how much a lower rate could save you each month.

💡 Try nudging the new rate down by 0.25% to see how even small changes can add up.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Getting Your Mortgage: Pre-Approval to Closing

- Mortgage Fundamentals & Key Concepts

- Types of Mortgages: Finding Your Perfect Match

- Fixed vs. Variable Rates: Making the Right Choice

- Smart Mortgage Payoff Strategies

- The Complete Mortgage Guide to Refinancing

- Home Equity: Your Hidden Financial Resource

- Credit Impact and Managing Your Mortgage

- Common Mortgage Mistakes to Avoid

- Advanced Mortgage Strategies for 2025

- Planning Your Mortgage Future

- Frequently Asked Questions

- Conclusion: Your Mortgage Action Plan

Key Takeaways

Before you dive into the details, here are the biggest mortgage moves that can change your long-term finances at a glance.

- Mortgage types matter: Fixed-rate loans offer stability, while adjustable-rate mortgages can provide initial savings but carry interest rate risk.

- Strategic payoffs save thousands: Extra principal payments, bi-weekly schedules, and targeted strategies can cut years off your loan term.

- Refinancing timing is crucial: Monitor interest rates, credit scores, and home values to identify optimal refinancing opportunities.

- Home equity unlocks options: HELOCs and home equity loans provide access to funds for improvements, debt consolidation, or major expenses.

- Credit impact is ongoing: Mortgage payments significantly influence credit scores, affecting future borrowing opportunities and rates.

Quick step: Pick one key takeaway that matches where you are right now and jot it down so you can focus on it as you read the rest of this guide.

Getting Your Mortgage: Pre-Approval to Closing

Before you ever sign a mortgage, lenders want to know two things: how much risk you are and how much you can realistically afford. That’s what the pre-approval and underwriting process is all about. A solid pre-approval doesn’t just give you a number on a piece of paper—it tells you the price range where your budget, income, and debt levels actually work. If you've ever seen a pre-approval number that felt way higher than what you’re comfortable spending each month, this section will help you reconcile those two views.

Most lenders look closely at your debt-to-income (DTI) ratio, credit score, and down payment. A lower DTI, stronger credit, and larger down payment usually unlock better interest rates and lower monthly payments. If your numbers are tight, you can improve your position by paying down high-interest debt, avoiding new credit lines, and building a modest cash cushion before you apply.

Closing costs are another major piece that buyers often underestimate. Plan for roughly 2%–5% of the purchase price in fees for appraisals, title work, inspections, and lender charges. You might be able to negotiate seller credits or choose slightly higher rates in exchange for lower upfront costs, but you’ll still want cash available for moving, small repairs, and your first few months of homeownership.

Once your offer is accepted and underwriting wraps up, you’ll review a final closing disclosure that shows your rate, monthly payment, and total cash to close. Take the time to compare this against earlier estimates, ask questions about any surprises, and only sign when you’re confident the terms fit your long-term plans. A few careful hours here can save you thousands over the life of the loan.

Micro-action: Set a 30-minute calendar reminder before closing to reread your loan estimate and closing disclosure side by side with a highlighter in hand.

Understanding Mortgages: Key Fundamentals

What Every Homeowner Should Know About Their Loan

Understanding mortgages starts with seeing them as more than just a monthly payment—each home loan is a complex financial instrument that shapes your wealth-building potential for decades. At its core, a mortgage is a secured loan where your home serves as collateral, allowing lenders to offer lower interest rates compared to unsecured debt.

If the terms lenders use—like principal, escrow, and PMI—have ever made you feel like you missed a class in school, you’re not alone; the goal here is to slow things down and translate those moving parts into plain language.

Key mortgage components include:

- Principal: The original loan amount

- Interest: The cost of borrowing money

- Taxes: Property taxes collected in escrow

- Insurance: Homeowners insurance and PMI (if applicable)

Understanding these elements is a big part of truly understanding mortgages and helps homeowners make strategic decisions about payments, refinancing, and long-term financial planning. For more official guidance and definitions, you can also review the Consumer Financial Protection Bureau’s mortgage resources.

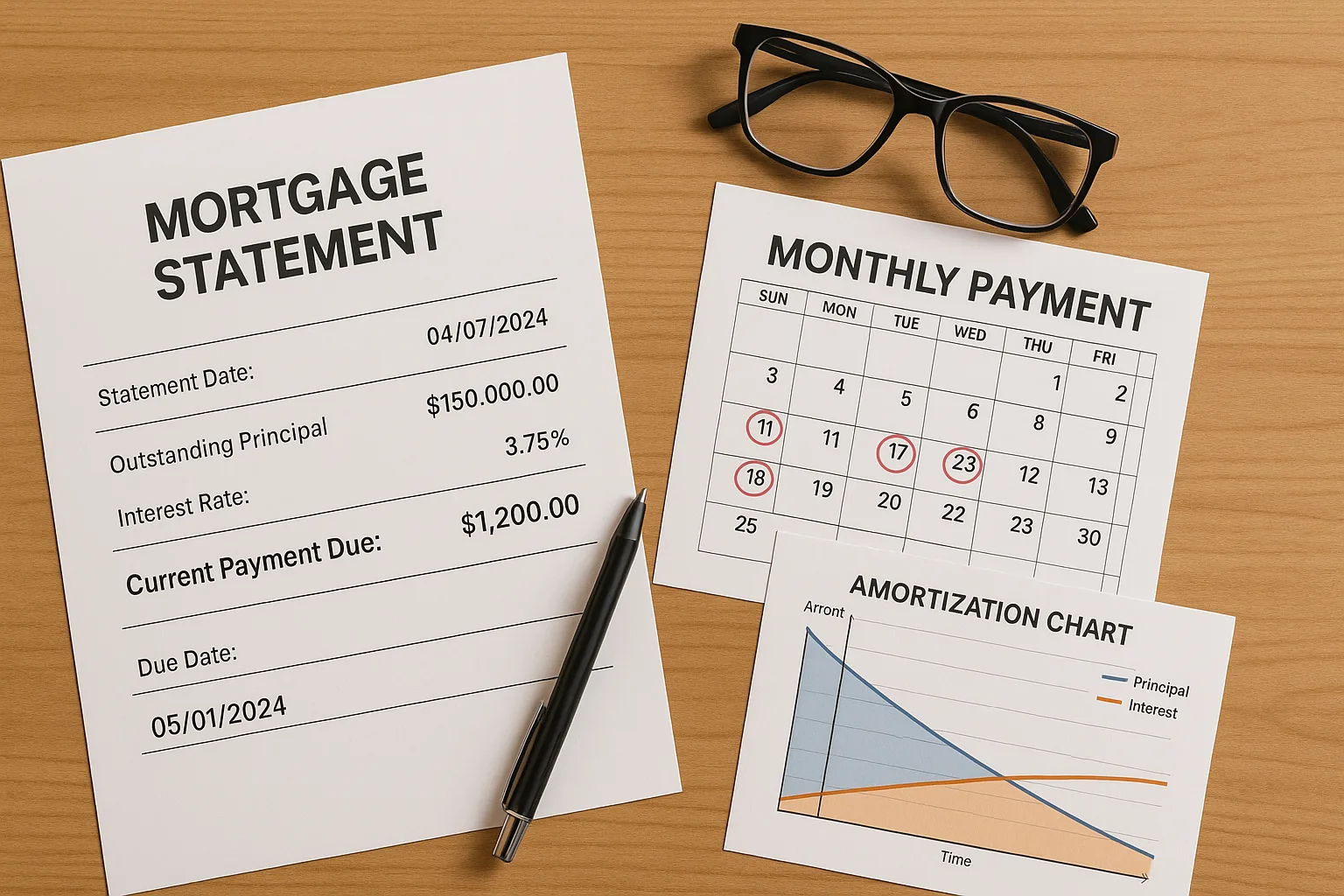

The Anatomy of Mortgage Payments

Every monthly mortgage payment gets divided between principal and interest through a process called amortization. Early in the loan term, most of your payment goes toward interest. As time progresses, more money applies to principal reduction.

For example, on a $300,000 30-year loan at 6.5% interest:

- Month 1: $1,896 payment ($625 principal, $1,271 interest)

- Month 180: $1,896 payment ($1,055 principal, $841 interest)

- Month 360: $1,896 payment ($1,884 principal, $12 interest)

This amortization schedule explains why making extra principal payments early in the loan term creates the most significant impact on total interest savings. If you’d like to see similar schedules laid out line by line, look for a mortgage amortization calculator from a major bank or government housing agency. If you want to plug in your own numbers, try our free mortgage payoff calculator with extra payments to see how different payment amounts change your payoff date.

Micro-action: Pull out your latest mortgage statement and jot down which line is principal and which is interest so the numbers on the screen actually match the bill in your hand.

Types of Mortgages: Finding Your Perfect Match

If you’ve ever had a lender throw three or four loan options at you in a single call, this part of the mortgage guide will help you slow down and see what actually fits your life.

Fixed-Rate Mortgages: The Stability Champion

Fixed-rate mortgages maintain the same interest rate throughout the entire loan term, providing predictable monthly payments regardless of market fluctuations. This stability makes budgeting easier and protects homeowners from rising interest rates. If you like knowing exactly what your housing payment will look like five or ten years from now, a fixed-rate loan often feels most comfortable.

Popular fixed-rate terms:

- 30-year mortgages: Lower monthly payments, higher total interest

- 15-year mortgages: Higher monthly payments, significant interest savings

- 20-year mortgages: Balanced approach between payment size and interest costs

Best for: First-time buyers, homeowners planning to stay long-term, those preferring payment predictability.

Adjustable-Rate Mortgages (ARMs): The Flexible Option

Adjustable-rate mortgages offer lower initial interest rates that adjust periodically based on market conditions. These loans typically feature an introductory fixed-rate period followed by regular rate adjustments.

Common ARM structures:

- 5/1 ARM: Fixed rate for 5 years, then adjusts annually

- 7/1 ARM: Fixed rate for 7 years, then adjusts annually

- 10/1 ARM: Fixed rate for 10 years, then adjusts annually

Best for: Homeowners planning to move or refinance within the fixed-rate period, or those expecting income increases.

Government-Backed Loans: Accessible Homeownership

Government programs help qualified borrowers access homeownership with favorable terms:

- FHA Loans: 3.5% down payment, flexible credit requirements

- VA Loans: No down payment for eligible veterans and service members

- USDA Loans: Zero down payment for rural and suburban properties

These programs often feature competitive rates and reduced mortgage insurance costs, making homeownership more accessible.

Next step: Write down which loan type (fixed-rate, ARM, FHA, VA, etc.) seems most realistic for you so you can ask focused questions when you talk to a lender.

Fixed vs. Variable Rates: Making the Right Choice

Maybe you’re wondering whether to lock in today’s rate or gamble that things will improve—this section walks through how to think about that trade-off without panic.

The Fixed-Rate Advantage

Fixed-rate mortgages provide several compelling benefits:

- ✅ Payment predictability for easier budgeting

- ✅ Protection against rising interest rates

- ✅ Simplified financial planning

- ✅ Peace of mind during market volatility

However, fixed-rate loans typically start with higher rates than ARMs and don't benefit from falling interest rates without refinancing.

When Variable Rates Make Sense

Adjustable-rate mortgages can be advantageous in specific situations:

- ✅ Lower initial payments free up cash for other investments

- ✅ Rate caps limit potential payment increases

- ✅ Shorter ownership timeline reduces rate adjustment risk

- ✅ Falling rate environment can decrease payments over time

Consider an ARM if you plan to move or refinance before the first rate adjustment, or if you expect significant income growth that would offset potential payment increases.

Rate Comparison Strategy

When evaluating mortgage options, compare:

| Factor | Fixed-Rate | Adjustable-Rate |

|---|---|---|

| Initial Rate | Higher | Lower |

| Payment Stability | Guaranteed | Variable |

| Rate Risk | None | Borrower assumes |

| Best Timeline | Long-term | Short to medium-term |

Quick step: Take your top two loan options and note the rate, term, and payment for each so you can see on one page how much volatility you’re actually comfortable with.

Smart Mortgage Payoff Strategies 💡

If you’ve ever dreamed about sending in that final mortgage payment years earlier, these strategies show how to chip away at your balance without starving the rest of your goals.

The Power of Extra Principal Payments

Adding extra money toward principal each month can dramatically reduce loan terms and interest costs. Even small additional payments create substantial savings over time.

Example: On a $250,000 30-year loan at 6% interest:

- Standard payment: $1,499/month, $539,595 total cost

- Extra $100/month: $1,599/month, $456,319 total cost

- Savings: $83,276 and 6 years off the loan term

Bi-Weekly Payment Strategy

Switching from monthly to bi-weekly payments (half your monthly payment every two weeks) results in 26 payments annually—equivalent to 13 monthly payments instead of 12.

Benefits of bi-weekly payments:

- Reduces a 30-year loan to approximately 26 years

- Saves thousands in interest without increasing payment burden

- Aligns with bi-weekly paychecks for easier budgeting

To see the real impact on your own loan, our biweekly mortgage payments guide walks through example savings and shows how much interest you can really save.

The Mortgage Avalanche Method

Similar to debt avalanche strategies, focus extra payments on the mortgage with the highest interest rate if you have multiple properties. This approach minimizes total interest costs across all loans.

Windfall Application Strategy

Apply unexpected money strategically:

- Tax refunds directly to principal

- Work bonuses split between savings and mortgage paydown

- Inheritance or gifts partially toward loan reduction

Remember to maintain emergency savings before aggressively paying down mortgage debt, especially given mortgages' relatively low interest rates compared to other debt types. For even more creative ideas, see our mortgage payoff hacks to save thousands that build on these core strategies.

Micro-action: Decide on a small extra amount—like $25 or $50—that you could realistically add to your next mortgage payment and note the date you’ll try it.

The Complete Mortgage Guide to Refinancing

It’s common to get a shiny postcard or email promising a lower rate and feel unsure if it’s a real opportunity or just marketing—this section gives you a framework for telling the difference.

When Refinancing Makes Financial Sense

Refinancing replaces your current mortgage with a new loan, potentially offering better terms, lower payments, or access to home equity. Consider refinancing when:

- 🔄 Interest rates drop 1–2% below your current rate

- 🔄 Credit scores improve significantly since the original loan

- 🔄 Home values increase enough to eliminate PMI

- 🔄 Income changes allow for different loan terms

- 🔄 Debt consolidation needs arise

In some cases, you might even qualify to refinance without a new appraisal; our guide on refinancing your mortgage without an appraisal explains when that’s possible and what to expect.

Types of Refinancing Options

Rate-and-Term Refinancing: Changes interest rate or loan term without accessing equity.

- Lower monthly payments

- Reduced total interest costs

- Shorter loan terms for faster payoff

Cash-Out Refinancing: Borrows against home equity for cash.

- Home improvements

- Debt consolidation

- Investment opportunities

- Education expenses

Cash-In Refinancing: Brings money to closing to reduce loan balance.

- Eliminates PMI faster

- Qualifies for better rates

- Reduces monthly payments

If you’re also weighing a lump-sum recast instead of a full refi, our comparison of mortgage recast vs. refinance breaks down which option fits different situations.

Refinancing Cost-Benefit Analysis

Calculate refinancing benefits using this framework:

Monthly Savings × Months Remaining = Total Benefit

Total Benefit − Closing Costs = Net Savings

If net savings exceed $10,000 or you'll break even within about 2–3 years, refinancing may make sense for many homeowners. You can skip the math by using our mortgage refinance break-even calculator, which runs the numbers for you automatically, and you can also compare your results with guidance from a government housing agency or consumer finance regulator to sense-check your assumptions.

Imagine you owe $320,000 at 6.25% with 25 years left and you can refinance to 5.25% for a new 25-year term with $4,000 in closing costs. Your current payment is about $2,111; the new one would be about $1,918, saving roughly $190 a month. Divide the $4,000 in costs by that savings and you break even in about 21 months. Over the full term, that lower rate could keep more than $50,000 in interest in your pocket instead of the bank’s.

The Refinancing Process Timeline

- Week 1–2: Shop lenders and compare offers

- Week 3–4: Submit application and documentation

- Week 5–6: Underwriting and appraisal

- Week 7–8: Final approval and closing preparation

- Week 9: Closing and loan funding

Start the process early, as refinancing with many lenders typically takes around 30–45 days from application to closing; check your lender’s current estimate or a government-backed mortgage program’s guidance for up-to-date timelines.

Next step: Gather your latest mortgage statement, credit score, and an estimate of your home’s value so you’re ready to compare at least two real refinance offers side by side.

Home Equity: Your Hidden Financial Resource

Maybe you’ve watched your home value climb on real estate sites and wondered whether you should tap that equity or leave it as a safety net; here’s how to think through those choices.

Understanding Home Equity Accumulation

Home equity represents the difference between your home's current market value and outstanding mortgage balance. Equity grows through:

- 📈 Principal payments reducing loan balance

- 📈 Property appreciation increasing home value

- 📈 Home improvements adding value

- 📈 Market conditions boosting neighborhood values

Home Equity Line of Credit (HELOC)

HELOCs provide flexible access to home equity through a revolving credit line, similar to a credit card secured by your home.

HELOC Features:

- Variable interest rates tied to the prime rate

- Draw period (typically 10 years) followed by a repayment period

- Interest-only payments during the draw period

- Credit limits up to 80–90% of home value minus existing mortgage

Best uses: Home improvements, emergency funds, variable expenses.

Home Equity Loans: The Fixed Alternative

Home equity loans provide lump-sum funding with fixed interest rates and predictable monthly payments.

Home Equity Loan Features:

- Fixed interest rates and payments

- Immediate full funding at closing

- Typically 5–30 year repayment terms

- Lower rates than unsecured loans

Best uses: Large one-time expenses, debt consolidation, major purchases.

Equity Access Comparison

| Feature | HELOC | Home Equity Loan | Cash-Out Refi |

|---|---|---|---|

| Rate Type | Variable | Fixed | Fixed |

| Access | As needed | Lump sum | Lump sum |

| Payments | Interest-only option | Fixed P&I | Fixed P&I |

| Closing Costs | Lower | Moderate | Highest |

Micro-action: Estimate your current home value, subtract your loan balance, and write down your rough equity so you can decide whether it’s better to tap it or leave it as a cushion.

Credit Impact and Mortgage Management

If you’ve seen your credit score bounce around after buying a home and panicked that you did something wrong, you’re not alone—this section explains what’s normal and what to watch.

How Mortgages Affect Credit Scores

Good mortgage management significantly influences your credit scores through multiple factors:

- Payment History (35%): On-time mortgage payments boost scores; late payments cause substantial damage.

- Credit Utilization (30%): Mortgages don't count toward utilization ratios.

- Credit Mix (10%): Installment loans like mortgages diversify credit types positively.

- Account Age (15%): Long-term mortgages increase average account age over time.

Protecting Your Credit During Homeownership

- Make payments on time: Set up automatic payments to avoid late fees and credit damage.

- Monitor credit reports: Check for errors that could affect future refinancing rates.

- Maintain other accounts: Keep credit cards open to preserve credit history length.

- Avoid major credit changes: Don't close accounts or take new debt before refinancing.

Credit Score Improvement Strategies

Boost your credit score for better refinancing rates:

- ✨ Pay down credit card balances below 30% utilization

- ✨ Dispute credit report errors promptly

- ✨ Avoid new credit inquiries 6 months before refinancing

- ✨ Keep old accounts open to maintain credit history

- ✨ Consider credit mix by maintaining different account types

If your score feels stuck even after good habits, guided credit repair can help you address stubborn report errors step by step.

Moving up a full credit tier (often roughly 40–100 points) can reduce mortgage rates by around 0.25–1.0% in many lender pricing sheets, potentially saving thousands over the loan term; rate charts from major lenders or government-backed mortgage programs can show the current differences between tiers.

Quick step: Pull a free copy of your credit report and highlight any late payments or errors so you know exactly what to fix before your next refi or home purchase.

Common Mortgage Mistakes to Avoid ⚠️

If you’ve ever signed something at closing and only later realized you didn’t fully understand it, this section is your second chance to slow down and spot those pitfalls in advance.

Refinancing Pitfalls

Mistake 1: Refinancing too frequently and paying excessive closing costs.

Solution: Wait until savings justify costs, typically a 1–2% rate reduction.

Mistake 2: Extending loan terms repeatedly and increasing total interest.

Solution: Consider shorter terms or maintain your current payoff timeline.

Mistake 3: Cash-out refinancing for non-appreciating purchases.

Solution: Reserve cash-out for investments, improvements, or debt consolidation.

Payment Strategy Errors

Mistake 4: Prioritizing mortgage payoff over high-interest debt.

Solution: Pay minimums on low-rate mortgages while eliminating credit card debt.

Mistake 5: Depleting emergency funds for extra mortgage payments.

Solution: Maintain 3–6 months of expenses before aggressive payoff strategies.

Mistake 6: Ignoring tax implications of mortgage interest deductions.

Solution: Consult tax professionals about deduction strategies.

Credit and Documentation Issues

Mistake 7: Making major credit changes during mortgage processes.

Solution: Avoid new credit, job changes, or large purchases until closing.

Mistake 8: Failing to shop multiple lenders for the best rates.

Solution: Compare at least 3–5 lenders within 14–45 day windows.

Next step: Pick one potential mistake from this list that feels most likely for you and write down a single safeguard you’ll use to avoid it (like “always get three quotes”).

Advanced Mortgage Strategies for 2025

Headlines about interest rates can feel like a roller coaster—one week “rates are soaring,” the next “rates are falling”—so this section focuses on the parts you can actually control. If you’ve spent a few years making payments while watching those headlines, you already know that what matters most is how any change shows up in your own monthly budget, not just in the news.

Interest Rate Environment Navigation

Mortgage strategies in 2025 have to account for an interest-rate landscape that’s very different from the ultra-low days of 2020–2021. In recent years, many markets have seen 30-year fixed rates move from the sub-3% pandemic lows up into the mid-6% range or higher, before easing back from peaks above 7% in 2023. That means many homeowners are better off protecting the low rates they already have, while others with older, higher-rate loans may still benefit from refinancing or restructuring; checking an up-to-date rate survey from a major housing data provider or central bank can help you see where today’s numbers sit.

- Rising Rate Environment: Focus on fixed-rate locks, consider points purchases, and accelerate refinancing decisions.

- Falling Rate Environment: Delay refinancing if rates are trending down, and consider ARM products where appropriate.

- Volatile Markets: Maintain flexibility and avoid overextending on payments.

Technology Integration

Modern mortgage management leverages technology:

- Mortgage Apps: Track payments, principal reduction, and equity growth.

- Automated Payments: Ensure on-time payments and consider bi-weekly options.

- Rate Monitoring: Set alerts for refinancing opportunities.

- Digital Documentation: Streamline refinancing with electronic records.

Using Discount Points Wisely

When you take out a new mortgage or refinance, your lender may offer discount points—upfront fees that lower your interest rate. Paying points can make sense if you plan to keep the loan long enough to break even on the cost, so it’s worth running the numbers with a calculator and comparing them to guidance from a trusted housing agency or financial planner before you commit.

Investment Property Considerations

For homeowners with multiple properties:

- Cross-Collateralization: Use equity from one property to acquire others.

- Strategic Refinancing: Optimize rates across portfolio properties.

- Tax Strategy: Coordinate mortgage interest deductions across properties.

- Cash Flow Management: Balance rental income with mortgage obligations.

If you’re curious about turning a duplex into a live-in investment, our guide on house hacking a duplex with tips from Reddit shows how other homeowners reduce their housing costs.

Micro-action: List one “stretch” strategy that interests you—like using discount points, refinancing an investment property, or house hacking—and note a single question you’ll ask a lender or planner about it.

Planning Your Mortgage Future

You might be picturing what life will look like when the kids are grown or you’ve stepped back from work; tying your mortgage plan to those future seasons can make today’s decisions much clearer.

Long-Term Wealth Building

Mortgages play crucial roles in wealth accumulation strategies:

- Forced Savings: Principal payments build equity automatically.

- Leverage Benefits: Control valuable assets with borrowed money.

- Tax Advantages: Mortgage interest deductions can reduce taxable income.

- Inflation Hedge: Fixed-rate payments become easier with inflation.

If your main goal is to own your home free and clear sooner, our home loan repayment calculator with extra payments shows how different payoff schedules change your timeline and interest costs.

Retirement Planning Integration

Consider mortgage payoff timing with retirement goals:

- Pre-Retirement Payoff: Reduces fixed expenses during retirement.

- Maintain Mortgage: Preserves liquidity and investment opportunities.

- Hybrid Approach: Partially pay down while maintaining some debt.

Estate Planning Considerations

Mortgages affect estate planning:

- Life Insurance: Ensure coverage for mortgage payoff if needed.

- Beneficiary Planning: Consider how mortgage debt transfers.

- Trust Strategies: Coordinate mortgage ownership with estate plans.

Next step: Choose a target year you’d like your mortgage paid off or restructured by and jot it down so you can reverse-engineer the steps from there.

Frequently Asked Questions

Conclusion: Your Mortgage Management Action Plan

Mastering mortgage management takes steady attention and a few smart habits. This comprehensive mortgage guide is here so you can make confident decisions about your home loan, from understanding the basics to trying out more advanced strategies when you’re ready.

Your next steps should include:

- Evaluate your current mortgage: Review your loan terms, payment history, and remaining balance to identify optimization opportunities.

- Monitor market conditions: Set up rate alerts and track your home's value to identify refinancing opportunities.

- Implement payoff strategies: Choose extra payment methods that align with your financial goals and cash flow.

- Maintain excellent credit: Protect and improve your credit score for future refinancing at better rates.

- Plan for the future: Integrate mortgage decisions with broader financial goals, retirement planning, and wealth-building strategies.

Remember Sarah from our opening story? By staying informed about her mortgage options and market conditions, she saved $300 monthly through strategic refinancing. Your mortgage represents more than just a monthly obligation—it's a powerful financial tool that, when managed properly, can significantly impact your long-term wealth and financial security.

The mortgage landscape keeps shifting with new products, regulations, and market conditions. Stay informed, review your options regularly, and don't hesitate to consult a mortgage professional before big decisions. Your home is likely your largest investment, so let your mortgage strategy support both your long-term wealth and your day-to-day peace of mind. Micro-action: Choose one small next step—like checking your rate, setting up auto-pay, or running your payoff numbers—and schedule 15 minutes this week to do it.

This mortgage guide is for general education only and isn’t personal financial, tax, or legal advice. Your situation and results may look very different from the examples here, so always check big decisions with a qualified financial professional or housing counselor who understands your full picture.