Do money talks with your partner turn tense way too fast? That was Sarah and Mike, especially when a surprise $3,000 credit card bill nearly ended their engagement. Like many couples, they managed money separately until that wake-up call forced them to build a shared plan. That’s where marriage and finance software comes in—simple tools that help you see your whole budget together without constant arguments. If you’re still working on the big-picture habits, our how to live frugally and save money guide walks you through the basics first.

Whether you fully combine finances, keep everything separate, or use a “yours, mine, and ours” setup, the right app can turn financial stress into progress. These platforms go beyond basic budgeting to support couples budget planning with shared expense tracking, synchronized goals, and communication tools that keep both partners on the same page.

Your Best-Fit Couples Money App Tool

Answer three quick questions and we’ll suggest the app that best matches your relationship, privacy preferences, and money goals.

See your best-fit couples app

Choose answers that feel most like you two to get a tailored recommendation from the list of apps reviewed below.

💡 You can tap different choices anytime to compare results.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- What Makes Great Marriage and Finance Software

- The 5 Best Apps for Marriage and Finance Management

- How to Choose the Right Marriage and Finance Software

- Making the Transition Successful

- Frequently Asked Questions

- Conclusion

Tip: Bookmark this guide and the app you choose so you can check in together during quick weekly money conversations.

Key Takeaways

- YNAB (You Need A Budget) leads for couples who want hands-on envelope budgeting with excellent goal tracking and debt payoff tools.

- Honeydue specializes in relationship-focused features with built-in messaging, bill reminders, and flexible privacy controls for mixed financial approaches.

- PocketGuard offers the simplest setup for couples wanting automated spending limits and basic shared expense tracking.

- Goodbudget provides envelope budgeting with optional bank connections, perfect for couples prioritizing privacy and manual control.

- Monarch Money is a popular paid replacement for Mint, offering an all-in-one overview for couples who liked Mint’s dashboards but want an actively maintained app.

Mint itself was shut down in March 2024, so if you used it in the past you’ll need to choose a replacement from the apps below.

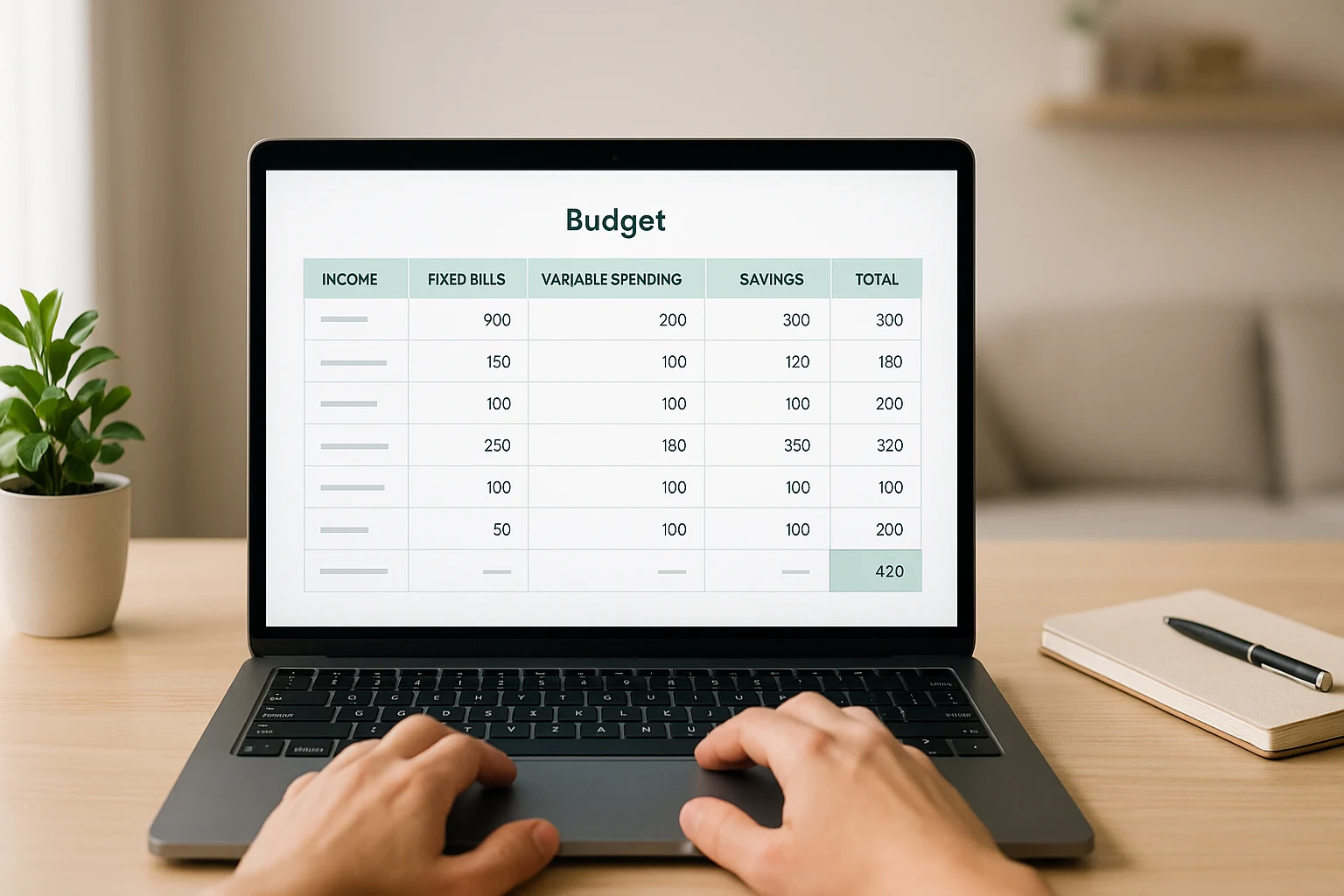

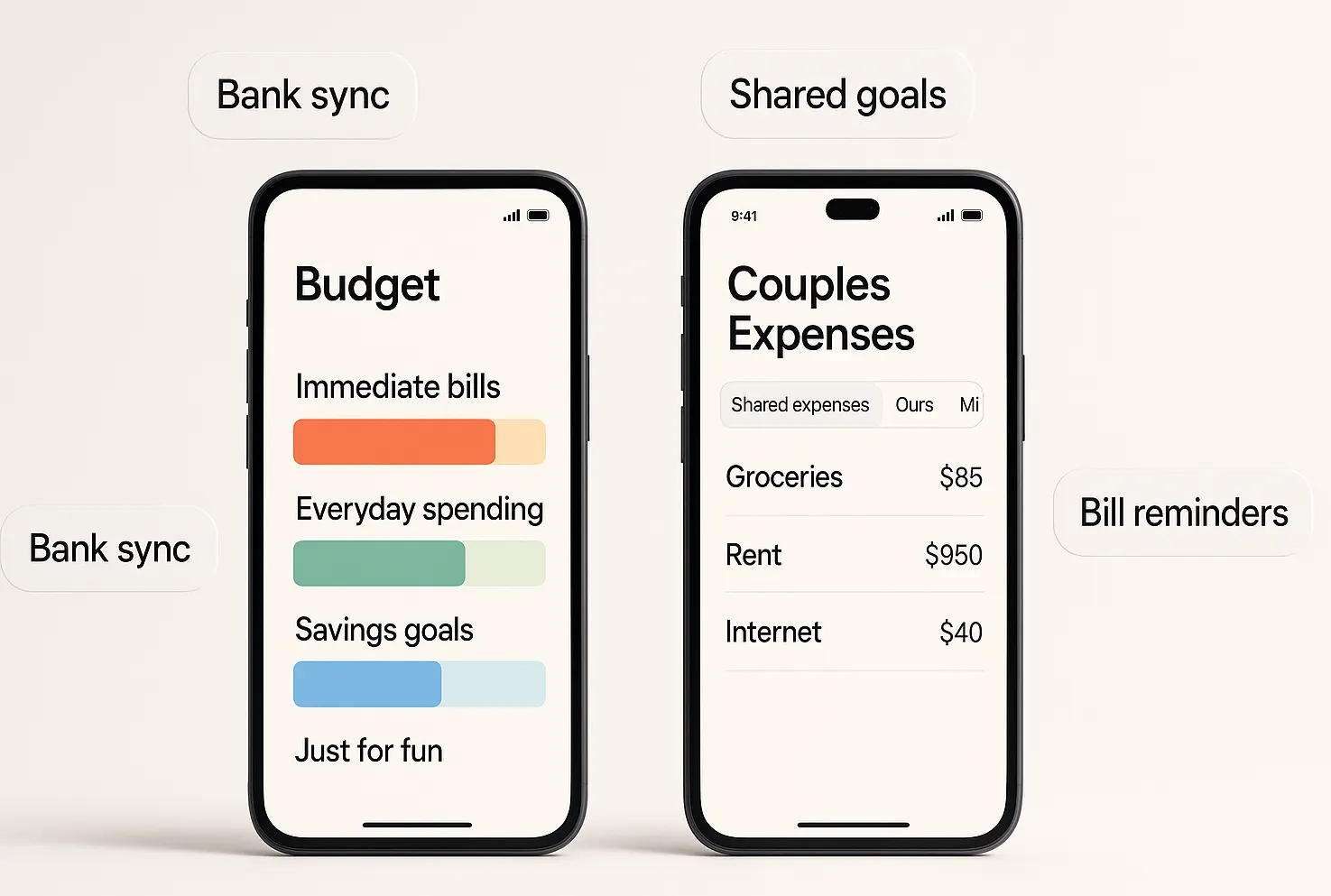

Want to see how dedicated apps can support the way you already talk about money? This quick visual shows a budget app alongside a couples expenses app that highlights shared bills, goals, and reminders.

If you enjoy exploring different money apps and calculators, our top free financial tools roundup highlights other helpful budgeting and tracking tools beyond couples-focused apps.

| App | Best for | Pricing | Standout couple feature |

|---|---|---|---|

| YNAB | Hands-on envelope budgeters | Paid, free trial | Deep goal tracking and debt payoff tools |

| Honeydue | Relationship-focused communicators | Free with optional monthly tip | In-app chat and flexible privacy settings |

| PocketGuard | Busy couples who want quick limits | Free and Plus tiers | “In My Pocket” safe-to-spend snapshot |

| Goodbudget | Privacy-first manual trackers | Free and Premium tiers | Shared envelopes with optional bank sync |

| Monarch Money | All-in-one money overview (Mint replacement) | Paid, 7-day free trial | Household-level budgets, goals, and investment view |

App pricing and availability can change quickly, so double-check details on each provider’s site before you sign up.

What Makes Great Marriage and Finance Software

The best marriage and finance software goes beyond individual budgeting apps by addressing the unique challenges couples face when managing money together. These tools must balance transparency with privacy, automation with control, and simplicity with comprehensive features.

Essential Features for Couples

Bank Synchronization and Security 🏦

Top-tier apps connect securely to multiple banks, credit cards, and investment accounts using bank-level encryption. This allows both partners to see real-time balances and transactions across all shared and individual accounts.

Flexible Expense Categorization

Whether couples prefer envelope budgeting, percentage-based allocation, or simple category tracking, the best apps accommodate different money management philosophies. Look for customizable categories that reflect real spending patterns.

Shared Goals and Sinking Funds 🎯

Successful couples need tools for planning major purchases, building emergency funds, and saving for shared dreams. The most effective apps show progress visually and allow both partners to contribute toward common objectives.

Communication Features

Built-in messaging, transaction notes, and spending alerts help couples stay connected about financial decisions without awkward money conversations over dinner.

Privacy Controls

Many couples maintain some financial independence. The best apps offer granular permission settings, allowing partners to share what they choose while keeping certain accounts private.

Setup and User Experience Considerations

You can tell a lot about an app from how it walks you through setup. Premium options guide couples through important conversations about financial goals, spending priorities, and account sharing preferences. They also offer smooth bank connection processes and intuitive interfaces that don’t require a finance degree to understand.

Mobile vs. Desktop Experience

Since couples often check finances on-the-go, mobile app quality is crucial. The best platforms offer full functionality across devices with seamless synchronization.

The 5 Best Apps for Marriage and Finance Management

1. YNAB (You Need A Budget) – Best for Hands-On Budgeters

Who It’s For: Couples who want to actively manage every dollar and appreciate the envelope budgeting methodology.

YNAB transforms the traditional envelope budgeting system into a digital powerhouse. Every dollar gets assigned a job before spending occurs, making it difficult to accidentally overspend shared money.

Key Strengths:

- Zero-based budgeting forces intentional money decisions.

- Excellent goal tracking with automatic calculations for timeline and monthly contributions.

- Robust debt payoff tools with avalanche and snowball method support (you can pair them with our debt snowball vs. avalanche guide).

- Outstanding educational resources including free workshops and comprehensive guides.

- Real-time synchronization across all devices and users.

Couple-Specific Features:

- Multiple user access with full permission sharing.

- Category-level notes for communication about spending decisions.

- Flexible income allocation for varying paychecks.

- Age of money metric shows financial health improvement over time.

Pricing: $14.99/month or $109/year (includes 34-day free trial)

Platforms: iOS, Android, Web

Bank Connections: Connects to many major banks and credit unions via secure sync.

Limitations:

YNAB requires a significant time investment upfront and ongoing monthly reconciliation. Couples preferring automated budgeting may find the hands-on approach overwhelming. The learning curve is steep, though the educational support helps offset this challenge.

2. Honeydue – Best for Relationship-Focused Money Management

Who It’s For: Couples wanting specialized relationship features with flexible privacy controls.

Honeydue was built specifically for couples, and it shows. The app understands that successful financial partnerships require communication, transparency, and respect for individual preferences.

Key Strengths:

- In-app messaging lets partners discuss transactions in real-time.

- Customizable privacy settings for each account and category.

- Bill reminder system with assignment to specific partners.

- Spending limit alerts prevent awkward overspending situations.

- Transaction categorization with emoji reactions for fun communication.

Couple-Specific Features:

- His/hers/ours expense categorization.

- Partner spending notifications with customizable thresholds.

- Shared and individual account views.

- Photo attachments for receipts and transaction notes.

- Monthly spending summaries designed for couple review.

Pricing: Free to download and use; you can optionally tip a few dollars each month if you love the app.

Platforms: iOS, Android

Bank Connections: Supports a wide range of financial institutions across several countries.

Limitations:

Honeydue lacks advanced investment tracking and comprehensive debt payoff tools. Goal setting features are basic compared to dedicated budgeting apps. You’ll do more planning outside the app if you want detailed long-term projections.

3. PocketGuard – Best for Automated Simplicity

Who It’s For: Couples who want straightforward spending limits without complex budgeting workflows.

PocketGuard answers one crucial question: “How much can we safely spend right now?” Its “In My Pocket” feature automatically calculates available spending money after accounting for bills, goals, and necessities.

Key Strengths:

- Automatic spending calculations eliminate mental math.

- Bill tracking with due date reminders and amount predictions.

- Subscription monitoring catches forgotten recurring charges.

- Simple goal setting with automatic savings recommendations.

- Spending limit alerts prevent overspending in real-time.

Couple-Specific Features:

- Shared account visibility with individual app access.

- Joint spending limit calculations.

- Bill assignment between partners.

- Combined financial snapshot view.

Pricing: Free version available; PocketGuard Plus offers additional features at a monthly or annual fee.

Platforms: iOS, Android, Web

Bank Connections: Connects to many major banks, credit cards, and loan providers.

Limitations:

PocketGuard’s simplicity comes at the cost of advanced features. Investment tracking is minimal, debt payoff tools are basic, and budgeting categories are limited. Couples wanting detailed financial analysis will need additional tools.

4. Goodbudget – Best for Privacy-Conscious Couples

Who It’s For: Couples preferring manual transaction entry and maximum privacy control.

Goodbudget brings envelope budgeting to the digital age without requiring bank connections if you don’t want them. This approach appeals to couples concerned about data security or those who prefer hands-on money management.

Key Strengths:

- Manual control or bank sync depending on the plan you choose.

- True envelope budgeting with visual envelope management.

- Debt tracking with payoff planning tools.

- Household sharing allows multiple users per account.

- Detailed reporting shows spending patterns and trends.

Couple-Specific Features:

- Shared envelope access across devices.

- Transaction entry from either partner.

- Spending notifications and envelope status updates.

- Historical data for financial pattern analysis.

Pricing: Free plan with a limited number of envelopes; Goodbudget Premium at about $10/month or $80/year offers unlimited envelopes, more accounts, and longer history (some legacy Plus plans may still exist for older subscribers).

Platforms: iOS, Android, Web

Bank Connections: Optional automatic bank sync on Premium; manual entry still works on all plans if you prefer to stay offline.

Limitations:

Manual transaction entry requires discipline and time commitment from both partners, especially on the free plan. While Premium offers bank sync for many U.S. banks, investment tracking is limited and you may still want an additional tool for long-term investing.

5. Mint Is Gone – Monarch Money as the Closest Replacement

Who It’s For: Couples who loved Mint’s all-in-one dashboard and want a modern, actively maintained replacement.

Mint was one of the most popular budgeting apps for more than a decade, but Intuit shut it down in March 2024 and encouraged users to move to Credit Karma instead. That means you can’t sign up for Mint anymore, and former users had a limited window to export data or migrate before the shutdown.

Key Takeaways for Former Mint Users:

- You’ll need a replacement app if you relied on Mint for shared budgets or bill tracking.

- Credit Karma focuses more on credit monitoring and does not fully replace Mint’s detailed budgeting tools.

- Monarch Money, YNAB, PocketGuard, and Honeydue are common Mint alternatives depending on how hands-on you want to be and whether you prefer free or paid options.

Why Monarch Money Feels Most Like Mint for Couples: Monarch Money pulls together budgets, goals, cash flow, and investments in one place with a modern interface. You can invite a partner to share a household view, which makes it easy to see joint progress without losing track of individual accounts.

Key Strengths:

- Household views so both partners can see the same big-picture dashboard.

- Goal tracking for things like travel, debt payoff, and home down payments.

- Flexible budgeting by category or groups instead of rigid envelopes.

- Ad-free experience, which many former Mint users appreciate.

Pricing: Free trial (typically 7 days), then about $14.99/month or $99.99/year depending on billing period.

Platforms: iOS, Android, Web

Bank Connections: Connects to many major banks, credit cards, and investment accounts via secure sync.

Limitations:

Monarch is fully paid after the trial, so budget-conscious couples who need a completely free tool may prefer Honeydue or a spreadsheet-based system. Like any sync-based app, occasional connection hiccups can happen and may require relinking accounts.

Tip: If you’re migrating from Mint, expect any replacement app to feel different at first. Give yourselves at least a month or two to get used to the new workflows before you decide whether it’s a good fit.

How to Choose the Right Marriage and Finance Software

Selecting the perfect marriage and finance software for your couples budget planning depends on your unique financial situation, technology comfort level, and relationship dynamics. Consider these key factors when making the decision.

Assess Your Financial Complexity

Simple Finances: Couples with straightforward income, minimal debt, and basic saving goals can thrive with streamlined apps like PocketGuard or Honeydue.

Complex Finances: Partnerships involving multiple income streams, investment portfolios, business ownership, or significant debt benefit from comprehensive solutions like YNAB or Monarch Money.

If that sounds like you two, you’re not behind—you just need tools that can keep up with the moving pieces.

If that “significant debt” has also dented your credit scores or left confusing errors on your reports, an extra layer of support can help:

Once your reports are cleaned up, your couples app can focus on future progress instead of constantly patching past mistakes.

Determine Your Budgeting Philosophy

Envelope Budgeters who want to assign every dollar a specific purpose should consider YNAB or Goodbudget. These apps force intentional spending decisions and provide excellent goal tracking.

Automated Budgeters preferring hands-off money management work better with PocketGuard or Monarch Money, which handle categorization and limit-setting automatically.

Percentage-Based Budgeters following the 50/30/20 rule or similar frameworks can customize any of these apps to match their preferred allocation system.

Privacy and Control Preferences

Consider how much financial information each partner wants to share:

- Full Transparency: YNAB and Monarch Money work well for couples combining all finances.

- Selective Sharing: Honeydue offers the most granular privacy controls.

- Maximum Privacy: Goodbudget’s manual tools keep sensitive information out of automatic bank feeds if you prefer.

Migration from Existing Systems

Spreadsheet Users will appreciate YNAB’s detailed categorization and reporting capabilities, which mirror advanced Excel workflows, and can pair them with our couples budgeting spreadsheets if you like tracking some of your plan in Excel or Google Sheets.

Bank App Users might prefer PocketGuard or Monarch Money for familiar automatic categorization and simple interfaces.

Cash-Based Couples should consider Goodbudget’s manual entry system as a natural digital transition.

Making the Transition Successful

Implementing new marriage and finance software requires patience, communication, and realistic expectations. Many couples find it takes 2–3 months to fully adapt to digital money management.

Getting Started Together

Schedule Setup Time: Block 2–3 hours for initial app configuration, bank connections, and goal setting. Treat this as an important financial planning session, not a quick task.

Start Simple: Begin with basic features before exploring advanced tools. Focus on accurate expense tracking for the first month before diving into complex goal setting.

Establish Check-in Routines: Weekly 15-minute money meetings help couples stay aligned and address issues before they become problems.

Common Implementation Challenges

Different Technology Comfort Levels & Resistance to Change: If one partner feels overwhelmed by apps or prefers the old way, start with the most user-friendly tool and keep expectations low at first. Focus conversations on shared goals and small wins instead of blaming old habits.

It’s completely normal for one of you to feel “behind” or anxious about money apps at first.

Over-Categorization: Many couples create too many budget categories initially. Start with broad categories such as housing, food, debt, and fun, then refine over time based on actual spending patterns.

Frequently Asked Questions

Conclusion

The right marriage and finance software is the one you and your partner will actually use together, whether that’s YNAB for hands-on planning, Honeydue for communication, PocketGuard or Goodbudget for simple structure, or Monarch Money for an all-in-one view. Choose the app that fits your money habits and privacy comfort, then commit to using it side by side for a few months. With regular check-ins, even small steps like tracking spending, naming shared goals, and reviewing progress can turn money stress into clearer conversations and more wins you celebrate together.

References

- [1] Federal Reserve Bank of St. Louis. “Household Debt Service Payments as a Percent of Disposable Personal Income.” 2025. Official data series.

- [2] American Psychological Association. “Stress in America: Money and Relationships.” 2024 Survey Results.

- [3] National Endowment for Financial Education. “Couples and Money Survey.” 2024 Annual Report.

This marriage and finance software guide is for general education only and isn’t financial, legal, or tax advice. App features and pricing can change, so always check the provider’s website and consider speaking with a qualified financial professional before making major money decisions.