When Sarah and Mike got married last year, they thought love would conquer all—including their vastly different approaches to money. Sarah meticulously tracked every coffee purchase in a notebook, while Mike operated on the “wing it and hope for the best” philosophy. Three months and several heated discussions later, they discovered the secret weapon that saved their financial sanity: a well-designed couples budgeting spreadsheet. It finally gave them both clarity and control over their shared financial future.

Money talks don’t have to end in arguments. With the right budgeting system, you’re on the same team instead of opposite sides of the table. A thoughtfully designed budget spreadsheet for couples becomes neutral ground where transparency meets practicality, helping you navigate everything from monthly bills to long-term goals. If you’re also working on your overall spending habits, our guide on how to live frugally and save money pairs perfectly with this couples budgeting spreadsheet guide.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Find Your Best-Fit Setup

- What Makes a Great Budget Spreadsheet for Couples?

- Top Couples Budgeting Spreadsheet Templates for 2025

- How to Choose the Right Budget Spreadsheet for Couples

- Implementation Tips for Couples Budgeting Success

- Common Pitfalls and How to Avoid Them

- Advanced Features for Budget Spreadsheets for Couples

- Frequently Asked Questions

- Conclusion

Key Takeaways

- Platform flexibility matters: Google Sheets offers real-time collaboration, Excel provides advanced features, and Notion combines budgeting with project management capabilities.

- Template customization is crucial: The best couples budgeting spreadsheets accommodate both joint and split expense tracking while supporting individual and shared financial goals.

- Automation saves relationships: Features like automatic imports, category rollover and built-in formulas reduce manual work and minimize friction-causing errors.

- Privacy and access controls: Successful financial partnerships require the right balance of transparency and individual autonomy through customizable sharing permissions.

- Regular reconciliation prevents conflicts: Monthly review features and dashboard summaries keep both partners aligned and accountable.

Find Your Best-Fit Couples Budget Setup

Answer four quick questions to see which couples budgeting setup fits you.

What Makes a Great Budget Spreadsheet for Couples?

A strong money partnership starts with choosing tools you both actually like using, especially your shared budget spreadsheet for couples. If one of you dreads opening it, it won’t last. Unlike individual budgeting systems, couples budgeting spreadsheets must navigate the complex dynamics of shared responsibility while respecting individual preferences and spending habits.

Essential Features for Financial Harmony

Real-Time Collaboration 📱

Both partners need simultaneous access to update expenses, check balances, and review progress. Cloud-based platforms like Google Sheets excel here, allowing instant synchronization across devices.

Flexible Expense Categories

Every couple operates differently. Some split groceries 50/50, others alternate months, and many use the “whoever shops, pays” method. The best templates accommodate these variations without requiring a computer science degree to customize.

Goal Tracking and Sinking Funds

Whether saving for a vacation, emergency fund, or new car, couples need visual progress indicators that celebrate wins and maintain motivation during challenging months.

Debt Management Tools

Student loans, credit cards, and mortgages affect both partners. Effective spreadsheets provide clear debt payoff timelines and strategies, including snowball and avalanche methods. If you’re comparing those approaches, our debt snowball vs. avalanche guide can help you decide what fits your relationship.

If you’re dealing with multiple high-interest debts while building your couples budget, it can be helpful to explore options that combine them into a single structured payment you both can see clearly each month:

Debt consolidation isn’t right for every couple, so compare interest rates, fees and payoff timelines carefully before making changes to your current plan.

Platform Comparison: Finding Your Perfect Match

| Platform | Best For | Collaboration | Automation | Learning Curve |

|---|---|---|---|---|

| Google Sheets | Real-time sharing | Excellent | Moderate | Easy |

| Excel | Advanced features | Good | Excellent | Moderate |

| Notion | All-in-one planning | Good | Limited | Steep |

Top Couples Budgeting Spreadsheet Templates for 2025

Here’s a quick side-by-side look at the main budget spreadsheet options for couples in this guide. If you’re also weighing spreadsheets against marriage and finance software, this overview shows where simple shared sheets still shine for transparency and control.

| Template | Platform | Best For | Cost | Automation Level |

|---|---|---|---|---|

| Tiller Couples Budget | Google Sheets / Excel | Hands-off tracking with detailed categories | Subscription | High (bank-connected) |

| Vertex42 Couples Planner | Excel | Excel fans who want deep customization | One-time purchase | Low (manual entry) |

| Frugal Harpy Ultimate Planner | Excel / Google Sheets | Free, flexible “yours, mine, ours” setup | Free | Low–Moderate (manual entry) |

| Notion Couples Financial Workspace | Notion | Couples who plan life and money together | Free personal tier | Low (manual entry) |

Note: Pricing and features can change, so always check each provider’s site for the most current details.

1. Tiller’s Couples Budget Template (Google Sheets/Excel)

Best For: Couples who want automated transaction imports with detailed categorization.

Tiller can streamline couples budgeting by automatically importing transactions from all accounts into a shared spreadsheet. Their couples-specific template separates individual and joint expenses while maintaining a unified dashboard view.

Key Features:

- Automatic bank account syncing

- Customizable spending categories

- Monthly and yearly budget comparisons

- Debt payoff tracking with visual progress bars

Setup Process:

- Connect bank accounts through Tiller’s secure portal.

- Customize expense categories for your relationship dynamic.

- Set individual and joint spending limits.

- Configure automatic monthly rollover for unused budget amounts.

Cost: $79/year after 30-day free trial.

Limitations: Requires ongoing subscription; limited customization for complex financial arrangements.

2. Vertex42’s Couples Budget Planner (Excel)

Best For: Excel power users who prefer one-time purchases and extensive customization.

This template turns Excel into an organized shared budgeting hub for couples. Created by financial planning experts, it handles everything from paycheck allocation to retirement planning.

Standout Features:

- Separate “His/Hers/Ours” budget sections

- Built-in debt snowball calculator

- Annual financial goal tracking

- Customizable dashboard with spending alerts

Why Couples Love It:

The template includes pre-built scenarios for common arrangements: fully joint finances, proportional contribution based on income, and complete separation with shared expenses.

Cost: Usually a low-cost one-time purchase (often under $20, but check Vertex42’s site for the latest price).

Setup Considerations: Requires Excel 2016 or newer; manual transaction entry.

3. The Frugal Harpy Ultimate Couples Budget Planner (Excel/Google Sheets)

Best For: Couples who want a free, comprehensive and highly customizable solution that balances individual spending freedom with shared financial goals.

We combined the best parts of popular systems—the collaboration of Google Sheets, the power of Excel and the “yours, mine, ours” concept—to create a free template designed specifically for couples. It solves the classic transparency problem without killing autonomy and is built to be one of the most feature-rich free tools you can start with.

Template Highlights:

- Dedicated Budget Tab: Set monthly spending limits for each category and see at a glance how you’re tracking.

- Conditional Formatting: Categories automatically highlight when you go over budget so you spot issues quickly.

- Automated Contribution Split: Calculates each partner’s share of joint expenses based on your chosen ratio (50/50 or income-based).

- “Yours, Mine, Ours” Tracking: Tag every expense to Partner A, Partner B or Shared to keep things fair and transparent.

- Sinking Funds Tracker: Manage multiple savings goals—like vacations, car funds or an emergency cushion—with built-in monthly targets.

How to Get Your Free Ultimate Budget Planner:

This template is our gift to you and a simple first step toward calmer money conversations. Download it once, use it in Excel or upload it to Google Sheets, and adapt it to your relationship over time.

Download The Free Ultimate Couples Budget Planner

Template Structure Overview:

| Sheet Name | Purpose | Key Features |

|---|---|---|

| 1. Dashboard | Monthly financial overview and health check. | Spending by category chart, goal progress visuals, partner contribution status. |

| 2. Budget | Set and track monthly spending limits. | Conditional formatting alerts, actual vs. budgeted comparison. |

| 3. Transactions | Main log for all income and spending. | Date, category dropdown, description, amount and payer (Partner A, Partner B, Shared). |

| 4. Goals & Funds | Track long-term savings and debt payoff. | Sinking fund targets plus optional snowball or avalanche-style payoff planning. |

Why Couples Love It:

It bridges the gap between basic free templates and more advanced paid apps. You get serious customization and visibility without a subscription, and you can tune the system to fit your unique income, goals and money personalities.

4. Notion’s All-in-One Couples Financial Planner

Best For: Couples who want budgeting integrated with broader life planning.

Notion’s database-driven approach creates a comprehensive financial ecosystem. Beyond budgeting, couples can track shared goals, plan major purchases, and maintain financial documents in one organized space.

Unique Advantages:

- Integrated calendar for bill due dates

- Document storage for financial records

- Collaborative note-taking for financial discussions

- Customizable views for different planning horizons

Template Components:

- Monthly budget tracker with category breakdowns

- Annual goal planning with milestone tracking

- Bill reminder system with notification options

- Financial decision-making framework

Cost: Free personal plan for most couples, with paid tiers available if you need more collaboration features or advanced limits.

Learning Investment: Notion requires initial setup time but offers unmatched flexibility.

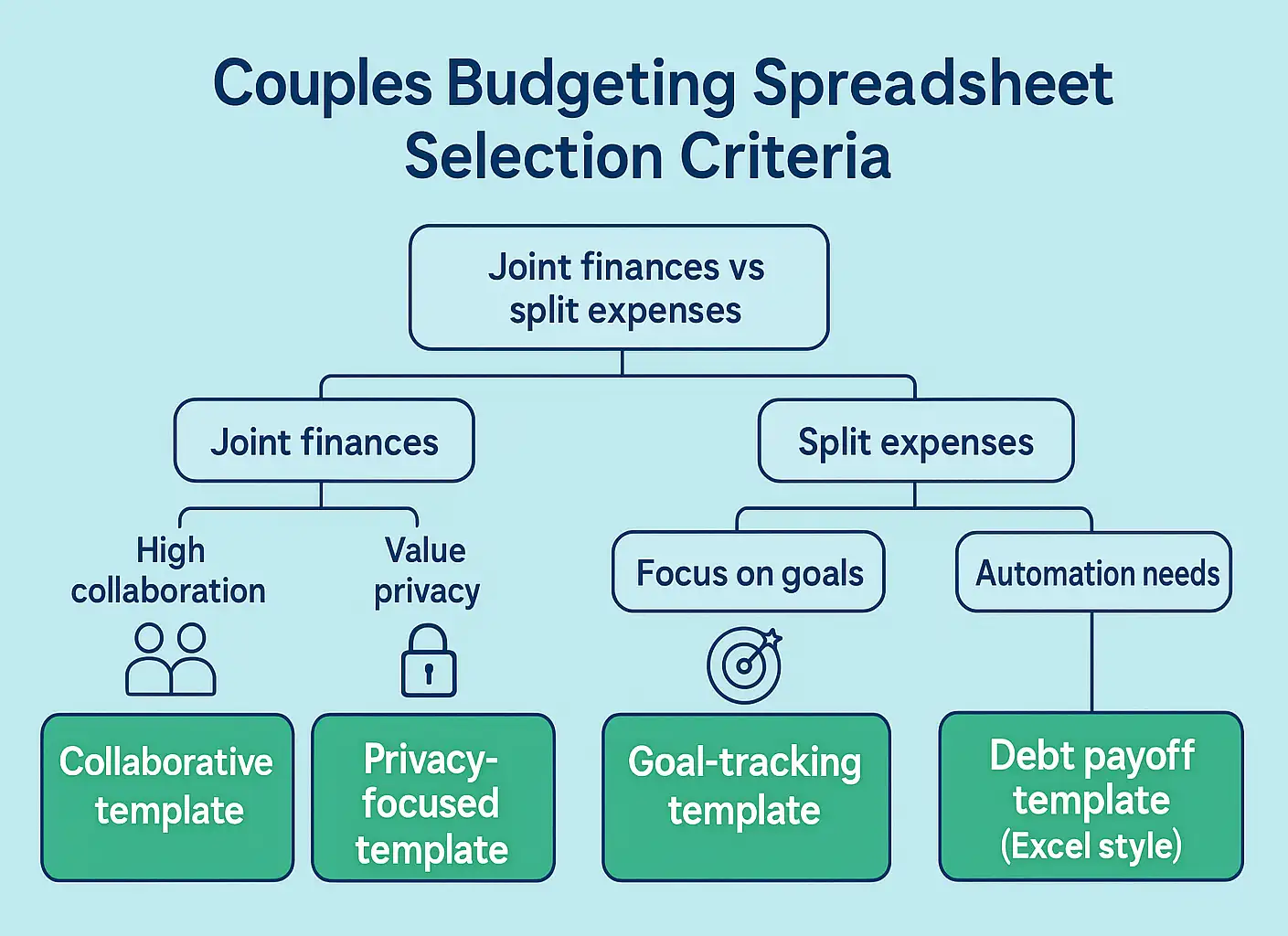

How to Choose the Right Budget Spreadsheet for Couples

Not sure which couples budgeting spreadsheet to pick? Start by asking how you and your partner like to handle money now—together, separately, or somewhere in between.

Once you’re clear on that, it becomes much easier to rule out setups that would frustrate one of you and focus on a few templates that genuinely fit how you already live day to day.

Assess Your Collaboration Style

The Delegators: One partner handles most financial management.

Recommendation: Excel-based templates with sharing capabilities.

The Collaborators: Both partners actively participate in budgeting.

Recommendation: Google Sheets for real-time updates.

The Planners: Budgeting is part of broader life planning.

Recommendation: Notion for integrated goal management.

Consider Your Technical Comfort Level

Financial harmony shouldn’t require a computer science degree. Evaluate templates based on setup complexity and ongoing maintenance requirements.

Beginner-Friendly Options:

- Pre-built Google Sheets templates

- Vertex42’s guided Excel templates

- Tiller’s automated solutions

Advanced User Features:

- Custom formula creation

- Advanced pivot table analysis

- Automated report generation

Privacy and Access Considerations

Successful couples budgeting requires balancing transparency with individual autonomy. Consider these access scenarios:

- Full Transparency: Complete sharing of all financial information.

- Partial Sharing: Joint expenses visible, individual spending private.

- Goal-Focused: Shared savings targets with individual spending freedom.

For example, you might agree that anything above a certain amount goes in the shared sheet, while smaller “fun” purchases stay in your personal logs.

Implementation Tips for Couples Budgeting Success

Start with a Financial Conversation Framework

Before diving into spreadsheets, establish ground rules for money discussions. Successful couples often use these conversation starters, and our couples budget planning guide walks you through setting them up step by step.

- “What financial goals excite us most?”

- “Where do we each need individual spending freedom?”

Set Up Your Shared Budget Spreadsheet for Success

Week 1: Choose your template and platform.

Week 2: Customize categories and goals together.

Week 3: Input historical data and set baselines.

Week 4: Begin tracking and establish review rhythm.

If you love the idea of giving every dollar a specific job, consider building your plan on our zero-based budgeting Excel template and then layering couples-specific categories on top.

Monthly Review Best Practices

Transform budget reviews from dreaded chores into productive partnerships:

The 15-Minute Monthly Check-In:

- Review previous month’s actual vs. budgeted spending (5 minutes).

- Adjust next month’s budget based on learnings (5 minutes).

- Celebrate wins and problem-solve challenges (5 minutes).

Make it feel like a mini money date—grab a drink you both like, sit somewhere comfortable, and keep the tone curious rather than critical.

Quarterly Deep Dives:

- Assess progress toward annual goals.

- Plan for upcoming major expenses.

Need a neutral pro to sanity-check your couples budget?

If you struggle to stay consistent, our budgeting habits that actually stick guide breaks these reviews into simple weekly and monthly routines.

Common Pitfalls and How to Avoid Them

The best budget spreadsheet for couples is the one you’ll both actually use, even on your most chaotic weeks. A “good enough” system you stick with beats a perfect one you avoid. Start simple, add complexity only when you’re ready and treat tweaks as experiments instead of proof that you “failed” at budgeting.

Research on financial secrecy backs this up too — the Financial Infidelity 2021 study from NEFE shows how hidden purchases and undisclosed debt can erode trust and fuel money arguments between partners.

If money stress or conflict feels overwhelming, consider speaking with a qualified financial professional or couples therapist. They can help you work through both the numbers and the emotions behind them.

Over-Complicating the System

Warning Signs of Over-Complication:

- Spending more time on the budget than reviewing it.

- One partner avoiding the system due to complexity.

- Categories so detailed that classification becomes burdensome.

Neglecting Individual Needs

Even in fully joint financial arrangements, each partner needs some individual spending autonomy. Build “fun money” or “no questions asked” allowances into your system.

Inconsistent Updates

Real-time collaboration tools only work when both partners commit to regular updates. Establish clear expectations for transaction entry and review schedules.

Advanced Features for Budget Spreadsheets for Couples

If you’re the spreadsheet geek in the relationship, this section is for you. If you’re not, feel free to skim or skip it and let your resident nerd have some fun here.

Automated Insights and Alerts

- Spending Pattern Recognition: Set up formulas to highlight unusual spending patterns or category overruns so you can spot issues early without checking every line.

- Bill Due Date Reminders: Use simple date-based formulas or calendar integrations to flag upcoming bills and avoid late fees.

Scenario Planning Tools

- Income and Major Change Modeling: Prepare for job changes, new childcare costs or big purchases by copying your sheet and testing “what if” numbers before you commit.

- Retirement Contribution Optimization: Use your spreadsheet to compare different contribution levels to 401(k)s, IRAs or local equivalents so you see how today’s choices impact long-term goals.

Frequently Asked Questions

Conclusion

A well-chosen budget spreadsheet for couples is more than a tracking tool. It gives you a simple place to talk about money, plan ahead and reduce those “wait, what did we spend?” moments. The journey to financial harmony doesn’t require perfection—it requires the right tools and consistent communication.

Whether you choose the automated convenience of Tiller, the customization power of Excel templates, the collaborative simplicity of Google Sheets, or eventually try marriage and finance software, success lies in selecting a system that matches your unique partnership style and committing to regular use together.

Your Next Steps:

- Discuss your financial collaboration style with your partner before choosing a template.

- Start with a simple system and add complexity as your comfort level grows.

- Schedule your first monthly review within two weeks of implementation.

- Celebrate small wins to build positive associations with budgeting together.

Remember Sarah and Mike from our opening story? Six months after implementing their shared budget spreadsheet, they’ve paid off $8,000 in credit card debt and saved enough for their dream vacation to Italy. More importantly, they’ve transformed money conversations from sources of stress into opportunities for partnership and planning.

The right shared budget spreadsheet helps you turn those conversations into real progress, building the financial foundation for your shared future one conversation and one dollar at a time.

References

- National Endowment for Financial Education. “Couples and Money Survey 2024.” NEFE.org.

- American Psychological Association. “Stress in America: Money and Relationships.” APA.org, 2024.

- Financial Planning Association. “Technology in Personal Financial Management.” FPAnet.org, 2025.

This couples budgeting spreadsheet guide is for general education only and is not financial, legal, tax or mental health advice. For personalized guidance or safety concerns, talk with a qualified professional.