When Sarah, a 62-year-old teacher, faced the reality of retirement planning, she found herself caught between two frustrating choices: keeping her $100,000 nest egg in a low-yield savings account earning barely 0.5%, or locking it away in a single 5-year CD at 4.5% but losing all access to her money. That’s when her financial advisor introduced her to something that seemed almost too good to be true—a cd ladder plan that could deliver higher returns while maintaining regular access to portions of her savings. If you also want to see how CDs fit alongside long-term investing, our beginner’s guide to investing walks you through the broader wealth-building picture.

Quick definition: A CD (certificate of deposit) is like a time-locked savings account. You agree to leave your money in the bank for a set term, and in return the bank usually pays a higher interest rate than a regular savings account.

Find Your Best CD Ladder Setup

Choose your goal and time frame to see a simple ladder structure that fits your needs.

Your main goal

Pick the goal that feels most important right now.

Your time horizon

Think about when you might really need this money.

Your ladder suggestion will appear here

Select a goal and time horizon to see a recommended ladder length and reinvestment approach.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Talk Through Your CD Ladder With a Pro

Before you dive into the full guide below, you can have a finance expert walk through your numbers with you, help choose CD ladder lengths, and show how they fit alongside your retirement accounts.

Start a chat with a finance expert

Table of Contents

- Key Takeaways

- Understanding CD Ladder Fundamentals

- Designing Your CD Ladder Strategy

- Step-by-Step CD Ladder Setup

- Comparing CD Types and Structures

- Managing FDIC and NCUA Coverage

- Rate Environment Strategies

- Advanced CD Ladder Techniques

- Evaluating APY vs. Penalty Trade-offs

- Common CD Ladder Mistakes to Avoid

- Real-World CD Ladder Examples

- Frequently Asked Questions

- Conclusion

Key Takeaways

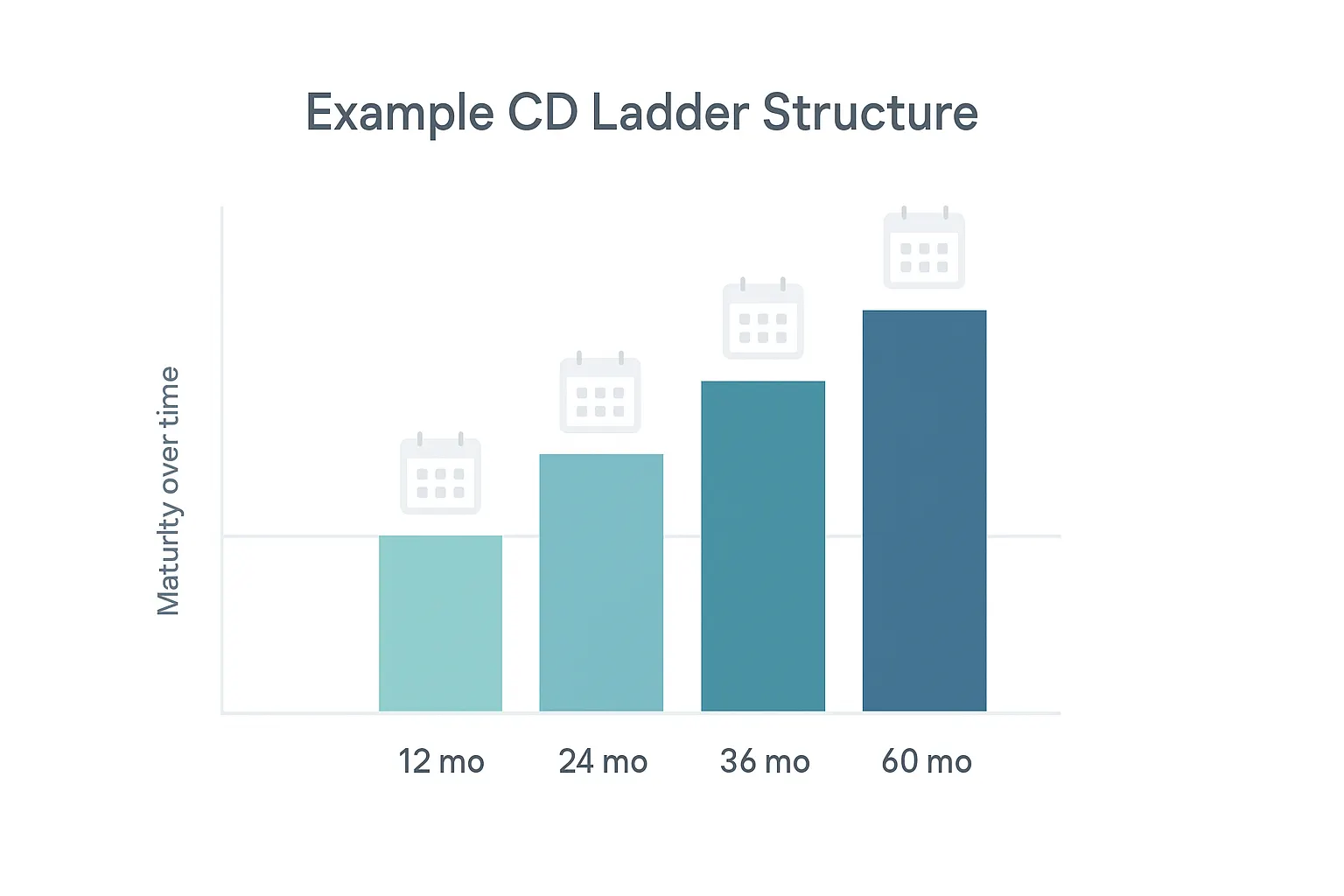

- A CD ladder spreads deposits across multiple CDs with staggered maturity dates, providing regular access to funds while capturing higher long-term rates as part of your overall safe savings plan.

- Ladder lengths typically range from 3 to 60 months, with 12-month intervals being most popular for balancing yield and liquidity.

- FDIC/NCUA insurance covers up to $250,000 per depositor per institution, making CD ladders extremely safe for conservative investors.

- Rising rate environments favor shorter ladders, while falling rates benefit longer ladder structures.

- Proper planning can sync CD maturities with major expenses like property taxes, insurance premiums, or planned purchases.

If you’ve ever felt torn between “locking in” a rate and keeping cash available for surprises, a simple ladder can make those decisions feel much calmer.

Micro-action: Write down one upcoming bill or goal and imagine which month you’d want a CD to mature to cover it.

Understanding CD Ladder Fundamentals

If CDs are new to you: think of them as safe savings you can’t touch for a while. You pick a term (say 12 or 36 months), lock in a rate, and get your money plus interest back at the end.

What Is a CD Ladder (and How Does It Work)?

A CD ladder plan is a strategy where you buy several certificates of deposit with different maturity dates, creating a “ladder” of CDs that come due at regular, predictable times. Instead of putting all funds into a single CD, you divide your money across several CDs with staggered terms.

If you’ve ever hesitated to open a longer-term CD because you were afraid of “what if I need the money,” this structure can feel like a relief by giving you regular, scheduled access to part of your savings.

Why CD Ladders Beat Single CDs

Traditional CD investing forces an uncomfortable trade-off between yield and liquidity. Longer-term CDs typically offer higher rates, but lock up funds for extended periods. A well-constructed CD ladder strategy eliminates this dilemma by providing:

- Regular liquidity without early withdrawal penalties

- Higher average yields than short-term CDs alone

- Protection against rate risk in changing interest environments

- Predictable cash flow for budgeting and planning

Consider this comparison: A $50,000 investment in a single 3-year CD at 4.2% generates $6,300 in interest but provides zero liquidity. The same amount in a 5-rung ladder might average 4.1% while providing $10,000 in accessible funds annually.

Micro-action: List how much of your savings you’d feel comfortable splitting into 3–5 CDs as a starting point.

Designing Your CD Ladder Strategy

Choosing the Right Ladder Length

The optimal ladder length depends on your financial goals, risk tolerance, and how you balance safe savings with growth over time. If you’re five years from retirement, you might crave shorter rungs so you’re not locked in too long, while a younger saver may feel comfortable committing to longer terms. Here are the most common structures:

Short Ladders (3–12 months):

- Best for emergency fund enhancement

- Provides maximum flexibility in rising rate environments

- Lower yields but excellent liquidity

- Ideal for near-term goal funding

Medium Ladders (12–36 months):

- Balances yield optimization with reasonable liquidity

- Most popular choice for conservative investors

- Works well for quarterly or annual expense planning

- Suitable for retirees needing regular income

Long Ladders (36–60 months):

- Maximizes yield potential in stable rate environments

- Requires patience and long-term planning

- Best for investors with other liquidity sources

- Effective for major purchase planning (home down payment, car replacement)

Micro-action: Circle whether you’re closer to “I want flexibility” or “I want maximum yield,” then pick the short-, medium-, or long-ladder idea above that matches.

Calculating Optimal Deposit Splits

Equal distribution across ladder rungs provides the simplest approach, but smart investors often weight their allocations based on specific needs. Consider these strategies:

Equal Weighting Example ($60,000 total):

- 12-month CD: $12,000

- 24-month CD: $12,000

- 36-month CD: $12,000

- 48-month CD: $12,000

- 60-month CD: $12,000

Front-Loaded Strategy (Higher Liquidity Needs):

- 12-month CD: $20,000

- 24-month CD: $15,000

- 36-month CD: $12,000

- 48-month CD: $8,000

- 60-month CD: $5,000

Back-Loaded Strategy (Yield Optimization):

- 12-month CD: $5,000

- 24-month CD: $8,000

- 36-month CD: $12,000

- 48-month CD: $15,000

- 60-month CD: $20,000

Step-by-Step CD Ladder Setup

Step 1: Assess Your Financial Situation

Before building any CD ladder, take a quick look at your overall financial picture. If it’s late at night and you’re worrying whether you could handle a surprise bill, this quick check can give you more confidence before you lock anything in.

Liquidity Analysis:

- Calculate monthly expenses and emergency fund needs

- Identify upcoming major expenses and their timing

- Determine how much money can be committed to CDs

- Assess other investment and savings account balances

Risk Tolerance Evaluation:

- Consider comfort level with interest rate fluctuations

- Evaluate need for FDIC/NCUA insurance protection

- Determine acceptable trade-offs between yield and liquidity

Step 2: Research CD Rates and Terms

Not all CDs are created equal. Successful ladder building requires comparing:

Rate Structures:

- Fixed vs. variable rate CDs

- Promotional rates vs. standard offerings

- Minimum deposit requirements

- Rate tiers based on deposit amounts

Institution Types:

- Traditional Banks: Convenient but often lower rates

- Credit Unions: Competitive rates for members

- Online Banks: Typically highest rates, limited physical presence

- Brokered CDs: Access to national rates through investment accounts

Step 3: Execute Your CD Ladder Plan

Opening Strategy:

- Start with the longest-term CD to lock in current long-term rates

- Work backward through shorter terms

- Stagger purchase dates if building over time

- Document maturity dates and renewal strategies

Account Management:

- Set up automatic renewal instructions where beneficial

- Create calendar reminders for maturity dates

- Establish clear reinvestment criteria

- Monitor rate changes for optimization opportunities

Many financial planners suggest reviewing your CDs once or twice a year rather than reacting to every tiny rate change you see in the news.

Micro-action: Set a 15-minute calendar reminder for six months from now labeled “Check CD rates and ladder maturities.”

If you’d rather have someone walk through your CDs and savings with you, you can also talk with a finance expert about your ladder and get a personalized walkthrough.

Step 4: Maintain and Optimize Your Ladder

Maturity Management: When each CD matures, investors face three choices:

- Withdraw funds for immediate needs

- Reinvest in a new long-term CD to maintain the ladder

- Adjust the ladder structure based on changing needs or rates

Rate Environment Adaptation:

- Rising Rates: Consider shorter reinvestment terms to capture higher future rates

- Falling Rates: Lock in longer terms to preserve current yields

- Stable Rates: Maintain consistent ladder structure for predictable returns

Comparing CD Types and Structures

Bank CDs vs. Brokered CDs

| Feature | Bank CDs | Brokered CDs |

|---|---|---|

| Rate Shopping | Limited to institution’s rates | Access to national market rates |

| Minimum Deposits | Often $500–$1,000 | Typically $1,000–$10,000 |

| Early Withdrawal | Penalty fees | Must sell on secondary market |

| FDIC Coverage | Direct protection | Protected through issuing bank |

| Convenience | Direct relationship | Single brokerage account |

If you like having everything in one login, sticking with your main bank may feel easier; if you enjoy comparing offers and squeezing out every bit of interest, brokered CDs might feel more rewarding.

Micro-action: Decide whether you’re more “simplicity first” or “rate optimizer,” and jot down whether bank CDs, brokered CDs, or a mix fits you best.

Callable vs. Non-Callable CDs

Callable CDs allow the issuing bank to redeem the CD before maturity, typically when interest rates fall significantly. While they often offer higher initial rates, they introduce call risk that can disrupt your carefully built ladder strategy.

Non-callable CDs provide guaranteed terms until maturity, making them ideal for ladder construction despite potentially lower initial rates.

Expert Tip: For ladder building, non-callable CDs provide the predictability essential for long-term planning. The slightly higher rates on callable CDs rarely compensate for the disruption risk they introduce.

Managing FDIC and NCUA Coverage

Understanding Insurance Limits

According to current FDIC and NCUA guidelines, deposit insurance generally protects up to $250,000 per depositor, per institution, per ownership category. For larger cd ladder plans, this requires strategic account structuring. If you’ve opened accounts at several banks over the years, it’s completely normal to feel unsure about what’s covered where — you can confirm the latest rules directly on the FDIC’s official deposit insurance page.

Single Institution Strategy:

- Maximum $250,000 total across all CDs

- Simplest management and tracking

- Limits diversification opportunities

Multi-Institution Strategy:

- Spread CDs across multiple banks/credit unions

- Multiply insurance coverage

- Requires more complex tracking

- Access to broader rate shopping

Joint Account and Beneficiary Strategies

Joint Accounts:

- Each owner receives separate $250,000 coverage

- Total protection: $500,000 per institution

- Both owners must have equal rights and access

Beneficiary Designations:

- Revocable trust accounts can multiply coverage

- Each unique beneficiary adds $250,000 protection

- Requires proper account titling and documentation

Micro-action: Make a quick list of your banks and approximate balances, then run them through an online FDIC or NCUA coverage estimator to see how well you’re protected today.

If you’re also comparing CDs with retirement accounts like 401(k)s and IRAs, our retirement accounts and taxes guide explains how tax-advantaged accounts fit into an overall plan.

Rate Environment Strategies

Rising Rate Environments

When interest rates are climbing, CD ladder strategies should lean toward flexibility. It can feel frustrating to lock in a CD and then see a better rate appear a few weeks later, so flexibility helps you adapt as conditions change.

Short-Term Focus:

- Weight ladders toward 6–12 month terms

- Accept lower current yields for reinvestment opportunities

- Consider Treasury bills for ultra-short terms

- Maintain larger cash reserves for rate timing

Ladder Acceleration:

- As CDs mature, reinvest in shorter terms initially

- Gradually extend terms as rate increases slow

- Use promotional CD rates for temporary advantages

Falling Rate Environments

When rates are declining, lock in current yields with longer terms:

Extension Strategy:

- Reinvest maturing CDs in longest available terms

- Front-load new money into long-term CDs

- Accept reduced liquidity for yield protection

- Consider locking in 4–5 year terms before further declines

Yield Curve Positioning:

- Analyze yield differences between terms

- Optimize ladder spacing for maximum advantage

- Consider bullet strategies for specific time horizons

Micro-action: Look at how rates have moved over the past six months, then decide whether your next CD purchase should have a shorter or longer term than your last one.

Advanced CD Ladder Techniques

Partial Ladders for Emergency Funds

Traditional emergency funds in savings accounts earn minimal returns. A partial CD ladder setup can boost emergency-fund yields while still keeping reasonable access. If you’ve ever watched a large cash cushion sit in a low-yield account and felt torn about “wasting” that potential, this kind of ladder can be a comfortable compromise.

3-Month Emergency Ladder:

- Divide 6-month emergency fund in half

- Ladder first half across 3, 6, 9, and 12 months

- Keep second half in high-yield savings

- Provides monthly liquidity access with higher average yield

Micro-action: Decide what percentage of your emergency fund you’d feel okay moving from a savings account into short-term CDs, even if that number is just 10–20% to start.

Expense-Synchronized Ladders

Align CD maturities with known future expenses:

Annual Expense Planning:

- Property taxes (typically due twice yearly)

- Insurance premiums (annual or semi-annual)

- Holiday and vacation spending

- Home maintenance and repairs

Example Structure:

- March maturity: Spring property taxes

- June maturity: Summer vacation funding

- September maturity: Fall property taxes

- December maturity: Holiday expenses

Barbell Strategies

Combine very short and very long CDs for specialized goals:

Conservative Barbell:

- 50% in 3–6 month CDs for liquidity

- 50% in 4–5 year CDs for yield

- Skips intermediate terms

- Provides flexibility with yield enhancement

Micro-action: If you already have some long-term CDs, consider whether adding one small 3–6 month CD for extra flexibility would make you sleep better at night.

If you’re exploring more advanced strategies that blend CDs with tax planning, a Roth conversion ladder guide can show how to move funds into tax-free accounts over time while keeping part of your savings in safe CDs.

Evaluating APY vs. Penalty Trade-offs

Understanding True Costs

Early withdrawal penalties can significantly reduce your CD returns, making penalty analysis crucial for CD ladder success. It’s frustrating to lose months of interest because you needed cash a little sooner than expected, so it’s worth checking the numbers before you commit.

Typical Penalty Structures: Many banks and credit unions use penalty schedules similar to the examples below, but always check your specific CD disclosure.

- Short-term CDs (under 1 year): 90–180 days interest

- Medium-term CDs (1–2 years): 180–365 days interest

- Long-term CDs (over 2 years): 365+ days interest

Break-Even Analysis: Calculate how long a CD must be held to overcome penalties and beat alternative investments like high-yield savings accounts.

Micro-action: Look up the early withdrawal penalty on one CD you’re considering and compare the “lost interest” cost to what you’d earn in a high-yield savings account instead.

When Treasury Bills Make Sense

For terms under 12 months, Treasury bills issued by the U.S. government often provide competitive alternatives to CDs, especially according to rate comparisons from major financial sites. If you’re nervous about locking money into a bank CD, T-bills can feel like a more flexible, government-backed option.

T-Bill Advantages:

- No early withdrawal penalties

- State tax exemption in most states

- High liquidity through secondary markets

- Backed by U.S. government (no $250,000 limit)

CD Advantages:

- Often higher yields than T-bills

- FDIC insurance familiarity

- Automatic renewal options

- No secondary market price risk

Common CD Ladder Mistakes to Avoid

Mistake #1: Ignoring Rate Shopping

The Problem: Many investors build ladders using only their primary bank’s CDs, potentially leaving significant yield on the table.

The Solution: Compare rates across multiple institutions, including online banks and credit unions. Even a 0.5% rate difference compounds significantly over time.

Mistake #2: Poor Timing Coordination

The Problem: Building entire ladders during rate peaks or valleys without considering future rate movements.

The Solution: Dollar-cost average ladder construction over 2–3 months, or weight ladder terms based on rate environment expectations.

Mistake #3: Inadequate Record Keeping

The Problem: Losing track of maturity dates, renewal terms, and rate changes across multiple CDs.

The Solution: Create a simple spreadsheet tracking:

- Institution and account numbers

- Principal amounts and rates

- Maturity dates and renewal instructions

- Contact information for each institution

Mistake #4: Inflexible Ladder Structures

The Problem: Building ladders without considering changing financial needs or market conditions.

The Solution: Review and adjust your CD ladder structure at least once a year, tweaking term lengths and allocations as your life and the rate environment change. If you’ve ever realized a CD is maturing right after a big bill is due, that’s a sign your ladder could use a quick tune-up.

Micro-action: Add a simple annual “CD ladder review” reminder to your calendar so you catch mismatched maturities before they cause stress.

Real-World CD Ladder Examples

Example 1: Retirement Income Ladder

Situation: 65-year-old retiree with $150,000 seeking predictable income to supplement Social Security.

Strategy:

- $30,000 each in 12, 24, 36, 48, and 60-month CDs

- Annual maturity provides $30,000 yearly income

- Reinvest principal, withdraw interest for living expenses

- Provides predictable cash flow with capital preservation

Results:

- Generates approximately $6,000 annual interest income

- Maintains purchasing power through reinvestment

- Provides flexibility for changing needs

If you’re retiring soon and want more ideas beyond CDs, you may also like our retirement savings hacks after 60 guide, which focuses on stretching income without sacrificing your lifestyle.

Example 2: Home Purchase Ladder

Situation: Young couple saving $75,000 for house down payment needed in 3 years.

Strategy:

- Build 36-month ladder with quarterly maturities

- $25,000 in 12, 24, and 36-month CDs

- Provides access to funds if perfect house appears early

- Maximizes yield while maintaining goal flexibility

Results:

- Earns 2–3% more than savings accounts

- Provides quarterly access points for opportunities

- Maintains FDIC protection for entire amount

Micro-action: Notice which example feels closer to your own situation right now—retirement income or future home purchase—and use it as a template when sketching your first ladder.

Frequently Asked Questions

Get a Second Pair of Eyes on Your Plan

Before you move real money into CDs, a finance expert can double-check your ladder, FDIC coverage, and retirement goals so you can catch any gaps before they cost you.

Chat with a finance expert online

Conclusion

A well-designed CD ladder plan represents one of the most effective strategies for conservative investors seeking to balance safety, yield, and liquidity for truly safe savings. By spreading investments across multiple certificates of deposit with staggered maturity dates, savers can capture competitive returns while maintaining regular access to their funds, solving the age-old dilemma between earning and accessibility.

The key to successful CD ladder implementation lies in matching ladder structure to individual financial goals, whether that’s generating retirement income, funding future expenses, or enhancing emergency fund yields. With FDIC and NCUA insurance providing strong protection, CD ladders offer peace of mind that volatile stock markets simply cannot match. For long-term growth, you can pair a simple ladder with broad index funds and tools like a Coast FIRE calculator to keep your bigger retirement plan on track.

Take Action Today:

- Assess your liquidity needs and determine how much money you can commit to a CD ladder.

- Research current CD rates across multiple institutions to identify the best opportunities.

- Choose your ladder structure based on your financial goals and the current rate environment.

- Start building your CD ladder with the longest-term CD to lock in current rates.

- Set up tracking systems to monitor maturity dates and reinvestment opportunities.

Remember Sarah from our opening story? Eighteen months after setting up her ladder, she’s earning solid interest while accessing $20,000 annually for her retirement needs, proving that smart savers don’t have to choose between yield and flexibility.

This cd ladder plan guide is for general educational purposes only and isn’t personalized financial advice. Everyone’s situation is different, so consider speaking with a qualified financial professional or advisor before making decisions about CDs or other investments. Actual results, interest rates, and tax outcomes will vary over time.