Ever open your bank app, feel that little stomach drop, and close it again? You’re not alone. The right abundance books for beginners can help you swap “I’m behind” thinking for calmer, more practical money decisions—and if you want a simple money mindset book to start with, this list is a great first step. For the bigger picture, start with our money mindset guide.

This list is intentionally beginner-friendly: each pick includes who it fits, what to try first, and a real-world way to turn “mindset” into action (like saving automatically or making one confident career move).

Find Your Best-Fit Abundance Book for Beginners

Choose one option in each row—your recommendation updates instantly.

1) Your goal right now

2) The style you’ll actually finish

3) How much time you have

Pick 3 options to get a match

Start with your goal, then your preferred style, then your available time. I’ll point you to the best-fit book section below.

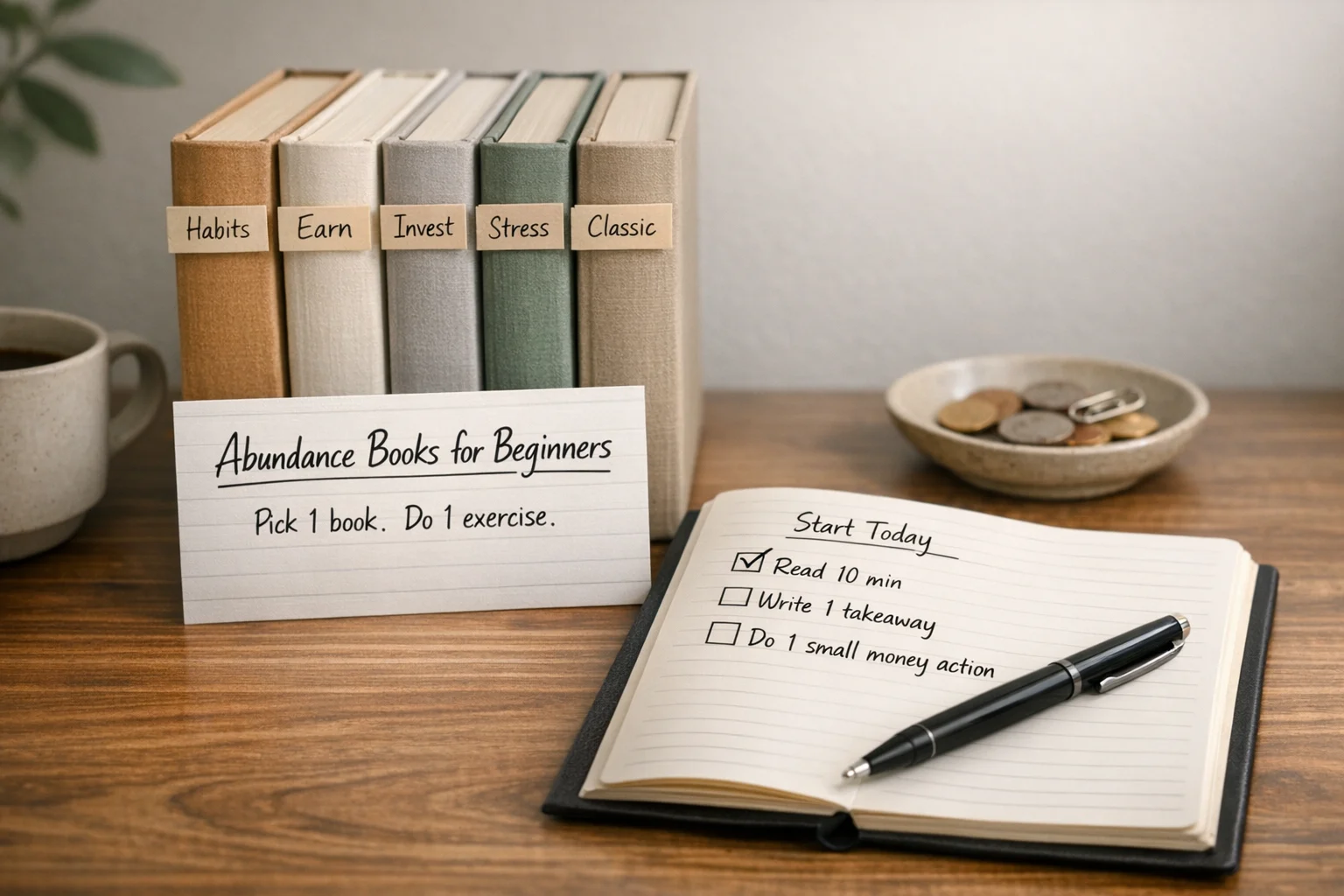

Tip: Once you choose a book, do one exercise within 24 hours.

This page contains paid/affiliate links. As an Amazon Associate we earn from qualifying purchases, and we may earn commissions from other partners—at no extra cost to you. Links marked with ‘#ad’ are affiliate links, meaning we may earn a commission at no extra cost to you. Learn more.

Top 3 beginner-friendly picks

Top 3Choose the one that matches what you need most right now—structure, calm, or a quick reset.

Get Good with Money — Tiffany Aliche

If your brain wants a simple “do this next” plan, this one feels supportive and practical—without the overwhelm.

- Best for: Readers who want structure and checklists

The Psychology of Money — Morgan Housel

Perfect when money anxiety shows up as overthinking—these stories make “steady” feel easier to hold onto.

- Best for: Reducing money stress and second-guessing

The Richest Man in Babylon — George S. Clason

A fast reset that nudges you into simple habits—great when you want a win this week, not a long project.

- Best for: Quick momentum and “pay yourself first” habits

Table of Contents

- Find Your Best-Fit Abundance Book for Beginners

- Key Takeaways

- What Makes Great Abundance Books for Beginners?

- The 7 Best Abundance Books for Beginners

- Creating Your Abundance Reading Plan

- Translating Mindset Into Money Behaviors

- Building Your Abundance Library

- Frequently Asked Questions

- Conclusion

Quick idea: Pick one book, try one exercise, then track one tiny win this week.

Key Takeaways

If you only remember a few things, make them these. They’ll keep you grounded—and keep “abundance” from turning into vague vibes.

- Start with mindset fundamentals: You’ll move faster when you tackle beliefs before tactics.

- Look for actionable frameworks: Exercises beat inspiration-only chapters every time.

- Balance classics with modern practical advice: A mix helps the ideas “stick” in real life.

- Practice consistency over perfection: Small daily reps compound into big confidence.

- Pair reading with one real action: A book works best when it changes a habit.

- Don’t collect—commit: The best money mindset books for beginners work when you do one exercise within 24 hours.

What Makes Great Abundance Books for Beginners?

Not every “abundance” book is worth your time. The best abundance mindset books help you think differently and do something differently—especially when you’re tired, stressed, or second-guessing every purchase.

- Clear frameworks: You should be able to explain the main idea in one sentence.

- Practical money tie-ins: Look for concrete behaviors like saving, spending boundaries, and earning.

- Beginner-friendly language: No jargon marathon. You want clarity you can repeat.

- Balanced perspective: Optimism + effort. No “magical shortcut” energy.

If money stress is the loudest thing in your head right now, you may also like our guide on overcoming money stress—it pairs well with the emotional-side books below.

The 7 Best Abundance Books for Beginners

1. Think and Grow Rich — Napoleon Hill

Who it’s for: You want classic goal-setting principles and a “big vision” mindset. Time to read: Deep dive (best in chunks).

About the author: Napoleon Hill was an early self-help writer known for interviewing successful business leaders and synthesizing common success themes.

Core takeaways: The book argues that clarity, persistence, and focused planning matter more than motivation bursts. It’s not about wishing—it’s about committing to a definite aim and building your environment around it.

Standout exercises:

- Definite chief aim: Write one financial goal, a deadline, and the next 3 actions.

- Mastermind: Get accountability from people who won’t laugh at your goals.

Real-world application: Pair your “definite aim” with one automated step (like a recurring transfer) and one skill sprint. If investing feels intimidating, start with Investing 101 so your actions match your mindset.

If you want to browse editions and formats, see Think and Grow Rich.

Caution: Some passages feel dated. Stick to the planning and persistence parts.

2. Get Good with Money — Tiffany Aliche

Who it’s for: You want a modern, practical plan you can follow without guesswork. Time to read: Medium (easy to apply as you go).

About the author: Tiffany “The Budgetnista” Aliche is a personal finance educator known for simple, step-by-step money systems.

Core takeaways: This is abundance through structure: build a foundation, clean up leaks, and create repeatable habits that make progress feel inevitable.

Standout exercises:

- Checklist-style “next steps”: Great when your brain feels overloaded.

- System building: Set routines once so you don’t rely on willpower daily.

Real-world application: Use her plan to tighten your basics (budget, bills, savings). If you like simple rules, the 50/30/20 budget rule is a clean companion framework.

If you want to compare formats and reviews, see Get Good with Money.

3. You Are a Badass at Making Money — Jen Sincero

Who it’s for: You need motivation, confidence, and a push to stop playing small. Time to read: Medium (best with journaling).

About the author: Jen Sincero is a motivational author known for humorous, direct writing and belief-shift exercises.

Core takeaways: The main value is permission: you’re allowed to want more and go after it. The exercises are designed to expose your money stories and get you moving even when you’re scared.

Standout exercises:

- Money story audit: Spot the beliefs you repeat without noticing.

- Fear-to-action plan: Turn “what if it fails?” into one step you’ll take anyway.

Real-world application: Try one bold money move: ask for a raise, raise your rates, or apply for one job that feels slightly out of reach. Then do one habit from our abundance mindset habits guide to keep that momentum steady.

If you want to see the different formats, check You Are a Badass at Making Money.

4. The Abundance Mind-Set: Success Starts Here — Joel Osteen

Who it’s for: You want faith-based encouragement and a gratitude-forward approach. Time to read: Medium (reflective pace).

About the author: Joel Osteen is a pastor and author whose books focus on hope, resilience, and personal growth through faith.

Core takeaways: This one centers on expectancy, gratitude, and generosity as a daily posture—not just a thought exercise. It’s helpful if you want abundance to include purpose and peace, not only income.

Standout exercises:

- Expectancy practice: Start the day assuming good things can happen—and then act like it.

- Gratitude journaling: Train your brain to notice what’s working.

Real-world application: Pair the mindset work with one practical step (set a savings transfer, review bills, or plan a side income hour). Mindset lands better when it touches real life.

If you want the exact title and edition, see The Abundance Mind-Set.

5. The Psychology of Money — Morgan Housel

Who it’s for: You want calm, common-sense money thinking—without hype. Time to read: Weekend read (short chapters).

About the author: Morgan Housel is a finance writer known for explaining behavior and decision-making in plain, story-driven language.

Core takeaways: Your money outcomes aren’t just math—they’re behavior. This book helps you see why people make irrational choices and how to design rules that protect you from your worst impulses.

Standout exercises:

- Create “money rules”: A few simple guardrails beat constant self-control.

- Define “enough”: A powerful antidote to endless comparison.

Real-world application: Write one rule you’ll follow the next time you feel triggered (panic selling, impulse spending, or doom scrolling investment takes). Then practice one quick exercise from our abundance mindset exercises post to reinforce it.

If you want to browse formats and reviews, see The Psychology of Money.

6. The Richest Man in Babylon — George S. Clason

Who it’s for: You want timeless money habits in story form. Time to read: Quick start this week.

About the author: George S. Clason wrote short financial parables designed to teach simple saving and investing principles.

Core takeaways: Pay yourself first, spend with intention, and protect your gains. It’s the kind of book that makes you want to set up one good habit the same day you finish a chapter.

Standout exercises:

- Pay yourself first: Automate a small percentage before you can spend it.

- Track “leaks”: Find the money that disappears without making you happier.

Real-world application: If you want a simple worksheet-style starting point, the federal budget worksheet is an easy way to map your cash flow in one sitting.

If you want to compare editions and formats, see The Richest Man in Babylon.

7. Happy Money — Ken Honda

Who it’s for: You want to heal your emotional relationship with money. Time to read: Weekend read (gentle pace).

About the author: Ken Honda is a Japanese author who writes about the emotional side of money—stress, gratitude, and what “enough” feels like.

Core takeaways: This book is for the part of you that feels guilty, anxious, or ashamed around money. It’s less about grinding and more about creating a healthier “money energy” so your choices feel steadier.

Standout exercises:

- Money gratitude: Practice a quick “thank you” when you receive or spend money.

- Forgiveness work: Release the emotional weight of past mistakes so you can move forward.

Real-world application: Try a one-minute check-in before you spend: “Will this purchase support the life I’m building?” If the answer is no, pause and choose one smaller action instead.

If you want to compare formats and reviews, see Happy Money.

Creating Your Abundance Reading Plan

Here’s a simple way to stay consistent without turning reading into another “should.” Keep it boring. Keep it doable. That’s how habits stick when life gets busy.

- Phase 1 (2 weeks): Start with Babylon for quick momentum and one automatic habit.

- Phase 2 (2–4 weeks): Add Get Good with Money for structure and a clean plan.

- Phase 3 (ongoing): Rotate in the mindset books based on your mood: motivation, calm, or faith.

Micro-action: Put a 10-minute reading block on your calendar for the next 7 days. Small, scheduled, done.

Translating Mindset Into Money Behaviors

Mindset is powerful—but it gets real when it changes what you do on a random Tuesday. If you’re thinking “cool, but what do I actually do?” start here.

- Auto-save one small amount: Even a tiny weekly transfer builds trust with yourself.

- Run a “skill sprint”: 15 minutes a day learning a money skill (negotiation, investing basics, or side income).

- Make one “brave” move: Apply, ask, pitch, or follow up—one step that nudges your income upward.

Micro-action: Choose one habit above and do it once today—just once. Then repeat tomorrow.

Building Your Abundance Library

Once you finish your first book, you’ll know what style works for you. The best books about abundance are the ones you’ll actually finish—so build around what you’ll read, not what looks impressive.

- If you love structure: Add more checklist-style money systems.

- If you love stories: Stick with narrative books that teach without lecturing.

- If you’re motivation-driven: Pick authors whose tone makes you take action.

Micro-action: Write one sentence: “Abundance means ___ for me.” Keep it specific (peace, options, time, safety).

Frequently Asked Questions

Conclusion

Abundance isn’t a magic trick—it’s a set of calmer thoughts that lead to better actions. Start with one book from this list, do one exercise, and let the small wins stack. One reader started with Babylon, set a tiny automatic transfer, and said the real “upgrade” wasn’t the dollars—it was finally sleeping without that constant money hum.

This guide is for general education, not personalized financial advice. Your situation and results can vary. For decisions specific to your finances, consider consulting a qualified professional.