You don’t need a “get rich while you sleep” fantasy. You need passive income ideas that feel realistic with your time, your budget, and your tolerance for trial-and-error. Quick honesty: “passive” usually means work up front—then calmer maintenance later. Sound familiar? If you want the bigger picture beyond this list, our increase your income guide covers side hustles and career moves too.

Below are seven options that can grow into steady passive income streams over time, plus a simple way to compare effort and risk. If you’re wondering how to make passive income without burning out, start with just one stream for 30 days.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Pick Your First Passive Income Stream

- Key Takeaways

- 1. Digital Products: Templates, Courses, and Downloads

- 2. Affiliate Marketing Through Niche Micro-Sites

- 3. Dividend Index Funds and ETFs

- 4. High-Yield Savings and CD Ladders

- 5. Print-on-Demand Products

- 6. Licensing Creative Assets and Stock Content

- 7. Renting Underused Assets and Spaces

- Building Your Passive Income Streams Portfolio

- Tax Considerations to Know

- Frequently Asked Questions

- Conclusion

Pick Your First Passive Income Stream

Choose what you have (time, money, risk comfort) and get a best-fit starting point.

Your suggestion will appear here

Pick one option in each row. You’ll get a best-fit idea plus a tiny next step.

💡 Tip: If you’re stuck, start with the option that feels easiest to repeat weekly.

Key Takeaways

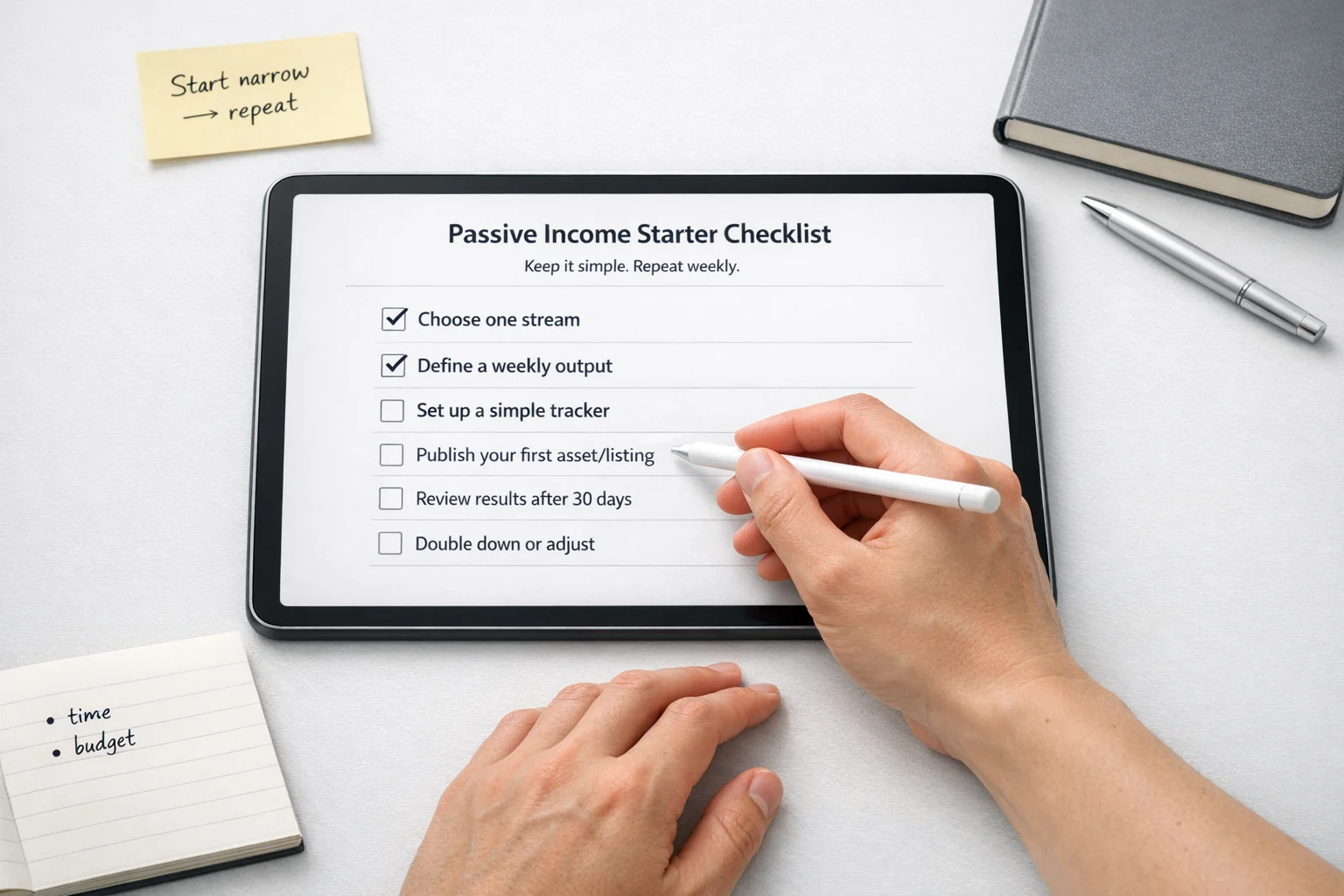

If you only read one section, read this: the fastest wins usually come from simple systems, not “perfect” passive income ideas.

- Start narrow. One stream you can repeat weekly beats seven half-starts.

- Build the asset, then systemize it. Most “passive” comes after the boring setup.

- Match the method to your personality. Creating, investing, and renting feel very different day-to-day.

- Diversify over time. A mix of risk levels helps you sleep at night.

Micro-action: Circle one stream below and commit to one small step today.

1. Digital Products: Templates, Courses, and Downloads

Digital products can be beautifully “quiet” income once you’ve built the thing and tested that people actually want it. Think of a Notion budget template, a meal-planning spreadsheet, or a short “how I do X” mini-course. If you like the “template” route, starting from a zero-based budget spreadsheet layout can spark ideas for what people will actually pay for.

How it works

- Create a helpful asset once.

- Host it on a platform or your site.

- Drive traffic with evergreen content (or simple social posts).

Best for

People who can explain a process clearly and don’t mind a couple rounds of feedback.

Effort vs. maintenance

| Stage | What you do | What makes it easier |

|---|---|---|

| Setup | Build the product, write the description, set up delivery | Use a proven format (template, checklist, swipe file) |

| Maintenance | Light updates, support emails, occasional refresh | Create a short FAQ + “how to use it” guide |

Micro-action

Open a doc and write: “This helps someone who ____ do ____ in ____ minutes.” Then build that.

2. Affiliate Marketing Through Niche Micro-Sites

Affiliate marketing is simple in concept: you recommend something helpful and earn a commission if someone buys through your link. The hard part is trust. If you’re writing reviews that sound like ads, readers bounce. If you’re honest about who it’s for (and who it’s not), you win.

Best for

People who like writing “buyer’s guide” content and answering specific questions.

Keep it ethical

- Be clear that links may be affiliate links.

- Recommend only what you’d feel good about sending to a friend.

- Use pros/cons and real constraints (budget, skill, time).

Micro-action

Pick one niche question you can answer better than Reddit, then outline a 1,000-word post today.

3. Dividend Index Funds and ETFs

If you want the “set it and forget it” feeling, dividend-focused funds can be part of a long-term plan. But they’re not magic. Markets move. Dividends can change. The real win is consistency—contributing steadily and staying calm when headlines get loud.

If you’re new to investing, skim this beginner’s guide to investing first so you understand basics like fees, diversification, and risk.

What you’re really buying

- Broad diversification (if you choose a diversified fund)

- Potential dividend payments

- Long-term growth potential (depending on holdings)

Simple risk framing

| Option | Volatility | Good for |

|---|---|---|

| Broad market index fund | Medium | General long-term investing |

| Dividend-focused index fund | Medium | Income tilt + diversification |

| Single high-dividend stock | High | Advanced investors who accept concentration risk |

Micro-action

Set up an automatic contribution you can keep for 12 months—small beats sporadic.

4. High-Yield Savings and CD Ladders

This is the “sleep-well” lane. It won’t make you rich overnight, but it can protect your momentum—especially if you’re building something else and need a stable buffer. Rates change over time, so focus on the structure (and the habit), not a specific number.

If you want the step-by-step setup, here’s how to build a CD ladder for predictable timing and less guesswork.

Two simple approaches

- High-yield savings: maximum flexibility, lower commitment.

- CD ladder: split money into multiple CDs with staggered maturities.

Micro-action

Open a dedicated savings bucket and automate a weekly transfer, even if it’s tiny.

5. Print-on-Demand Products

Print-on-demand (POD) is great if you like making designs but don’t want to store inventory. The common trap is posting random designs and hoping. The better path is building around one niche and one consistent style—then testing what people actually click.

Where POD wins

- No inventory management

- Easy to test many ideas

- Works well for niche humor, hobbies, and giftable designs

Micro-action

Choose one niche and publish 5 designs with the same visual style this week.

6. Licensing Creative Assets and Stock Content

If you already create photos, videos, music loops, or graphics, licensing can turn your backlog into something that earns over time. Picture that camera roll you never look at—now imagine 20 of those shots cleaned up, tagged, and uploaded with intent.

Common asset types

- Stock photos and short video clips

- Music loops and sound effects

- Icons, textures, and design assets

Micro-action

Pick 10 old files, rename them clearly, and upload them to one platform today.

7. Renting Underused Assets and Spaces

If you have something valuable that sits unused—gear, a parking spot, a spare room, storage space—you may be able to rent it out. The “passive” part comes from rules and templates: clear policies, clean handoff, and predictable scheduling.

Examples

- Parking or storage space

- Tools and hobby gear

- Car sharing (where it’s legal and practical)

Micro-action

List one asset today, then write a short “rules + pickup” template you can reuse.

Building Your Passive Income Streams Portfolio

Most people quit because they try to build everything at once. A calmer strategy is to build in tiers: one “stable” stream, one “growth” stream, and one “experiment.” That way, you’re not betting your motivation on a single idea.

Think of passive income ideas like a menu: pick one now, bookmark the rest, and come back when you’ve got traction.

Risk comparison (quick scan)

| Idea | Upfront effort | Ongoing effort | Risk level | Best when you… |

|---|---|---|---|---|

| Digital products | High | Low–Medium | Medium | Can package knowledge into clear steps |

| Affiliate micro-site | Medium | Medium | Medium | Like writing helpful comparison content |

| Dividend index funds | Low | Low | Medium | Prefer long-term, hands-off investing |

| High-yield savings / CDs | Low | Low | Low | Want stability and a buffer first |

| Print-on-demand | Medium | Medium | Medium–High | Enjoy testing ideas and iterating fast |

| Licensing assets | Medium | Low | Medium | Already create photos, video, audio, or design assets |

| Renting assets/spaces | Low | Low–Medium | Medium | Own underused items and can set clear rules |

Micro-action: Pick one “stable” stream and one “growth” stream. Ignore the rest for 30 days.

Tax Considerations to Know

This is the part people forget until it’s annoying. Many income streams (affiliate commissions, digital sales, rentals, and even interest/dividends) can have tax implications depending on where you live and how you earn. If taxes make you freeze up, this beginner’s guide to filing taxes can help you get the basics straight before you scale.

If you’re building any kind of side income, keep basic records from day one—income, expenses, and supporting documents—so you’re not reconstructing everything at tax time. The IRS has a practical overview of recordkeeping habits that make this easier: recordkeeping guidance.

Micro-action: Create one folder (digital or physical) labeled “Income + Expenses” and drop one receipt in it today.

Frequently Asked Questions

Conclusion

The best passive income ideas are the ones you’ll actually repeat: start small, systemize the boring parts, and let time do its job. Pick one stream, take one micro-step today, and give it room to grow.

This guide is general education, not personalized financial or tax advice. Your situation and results can vary, so consider a qualified professional for decisions that affect your finances.