Ever catch yourself thinking, “I’ll feel calm about money… once I have more”? Try abundance affirmation money statements—short phrases that shift you from panic to possibility, one tiny decision at a time. If you want the bigger foundation behind this approach, start with our money mindset guide.

Sarah, a 28-year-old teacher, used to check her bank account with dread every morning. Her stomach would twist as she watched a modest salary disappear into rent, student loans, and daily expenses. What changed wasn’t her paycheck—it was her habits: she stopped avoiding numbers, set a few simple automations, and practiced a kinder inner script during money moments.

This page contains paid/affiliate links. As an Amazon Associate we earn from qualifying purchases, and we may earn commissions from other partners—at no extra cost to you. Links marked with ‘#ad’ are affiliate links, meaning we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- How Money Affirmations Actually Work

- A FIRE-Friendly Framework

- 30 Money Affirmations With Action Cues

- How to Build a Daily Routine

- Tracking Your Mindset + Money Wins

- Common Challenges (And What To Do)

- Advanced Techniques

- The Compound Effect

- Frequently Asked Questions

- Conclusion

Key Takeaways

If you want this to feel real (not “positive vibes only”), pair each statement with one small action you can do today.

- Affirmations work best when paired with actions that reinforce the belief through behavior.

- Present tense + identity language (“I’m someone who…”) tends to feel more believable.

- Practice during real money moments (budget check-ins, bill pay, saving) so it sticks.

- Track mindset shifts and metrics to connect thoughts to results.

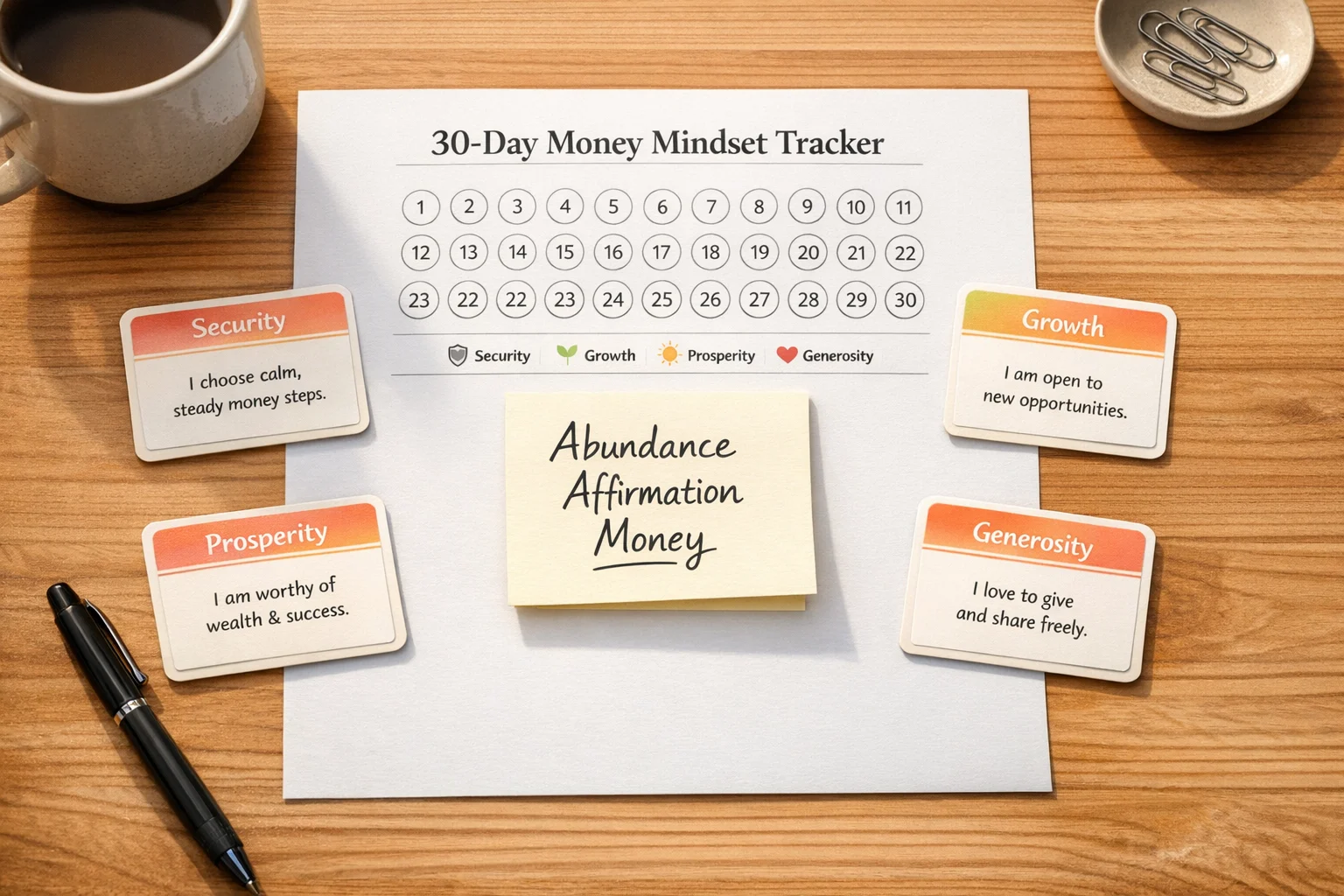

- Use themed statements (security, growth, prosperity, generosity) for balance.

Quick start: New here? Start with these three versatile picks: #1 (security), #7 (confidence), and #20 (mindset → results). Practice them for 7 days before rotating.

Pick a Theme, Get Your 5 Best Statements

Choose what you need today—then practice one line during your next money check-in.

Tip: say it once, then do the action cue immediately.

How Money Affirmations Actually Work

Your brain loves patterns. If you grew up hearing “money doesn’t grow on trees” or “rich people are greedy,” those phrases can quietly steer your choices for years. Repeating a helpful statement isn’t magic—it’s practice—and financial affirmations stick best when you pair them with a real action. Over time, it makes it easier to notice options you used to ignore and to take calmer actions when stress hits.

One reason this can feel powerful is confirmation bias: once you expect a certain outcome, your brain pays more attention to evidence that matches it. The practical win is pairing your statement with a tiny action so your day reinforces the new story.

A FIRE-Friendly Framework

If you’re pursuing Financial Independence, Retire Early, you’ll have seasons where motivation dips—market swings, slower progress, or “why am I doing this?” moments. That’s normal. A simple script + a small action can keep you steady while the numbers compound. If you’re newer to the concept, this FIRE method beginner guide is a helpful overview.

Identity-based lines (“I’m someone who makes wise decisions”) often land better than distant outcomes (“I’ll be rich someday”). Keep it believable, keep it present tense, and keep it tied to something you can do today.

30 Money Affirmations With Action Cues

Below are 30 abundance affirmation money statements, grouped into four themes: security, growth, prosperity, and generosity. If you prefer shorter abundance affirmations, start with one line per theme and rotate weekly.

Financial Security Affirmations

These statements build confidence in your ability to create and maintain stability.

- “I am worthy of financial security and peace of mind.”

Action cue: Check your emergency fund balance and celebrate any progress. - “Money flows to me easily and consistently.”

Action cue: Review your income sources and brainstorm one new possibility. - “I make smart decisions that protect my financial future.”

Action cue: Read one article about personal finance or investing. - “My expenses align perfectly with my values and goals.”

Action cue: Review yesterday’s spending and name one “values” purchase. - “I am building a strong financial foundation every day.”

Action cue: Automate one more financial task (savings transfer, bill pay, investing). - “Financial abundance is my natural state of being.”

Action cue: Write down three things you’re grateful for about your current finances. - “I trust my ability to handle any financial challenge.”

Action cue: Update your budget or spending tracker with recent transactions. - “My financial security grows stronger with each passing day.”

Action cue: Review your progress toward one money goal.

Opportunity and Growth Affirmations

These statements help you recognize and act on opportunities while keeping a growth mindset.

Want a practical way to support the ‘income grows’ theme?

- “I attract lucrative opportunities that align with my skills.”

Action cue: Send one networking message or refresh your LinkedIn headline. - “My income increases as I provide more value to others.”

Action cue: Identify one way to improve your work performance this week. - “I am open to receiving money from multiple sources.”

Action cue: Research one side hustle idea you could try in under 2 hours. - “Every financial setback teaches me valuable lessons.”

Action cue: Write down one lesson from a past money mistake. - “I invest wisely in assets that grow my wealth.”

Action cue: Review your investments or learn one new investing concept. - “My money works hard for me while I sleep.”

Action cue: Set up or review automatic investing contributions. - “I recognize profitable opportunities everywhere I look.”

Action cue: Spot one inefficiency that could save you money or time. - “My financial knowledge expands continuously.”

Action cue: Read a chapter from a money book or listen to one podcast episode.

Abundance and Prosperity Affirmations

These statements help you embody a more prosperous mindset and follow through with consistent action.

- “I am a magnet for financial abundance and prosperity.”

Action cue: Visualize your ideal money day for 60 seconds. - “Wealth flows to me from expected and unexpected sources.”

Action cue: Check for forgotten accounts, rebates, or refunds. - “I deserve to live comfortably and abundantly.”

Action cue: Plan one small joy purchase that fits your budget. - “My positive money mindset creates positive financial results.”

Action cue: Replace one negative money thought with a practical reframe. - “I am aligned with the energy of abundance and success.”

Action cue: Spend five minutes somewhere that makes you feel calm and capable. - “Money is a tool that helps me create the life I desire.”

Action cue: Write three goals money supports (health, time, freedom, family). - “I attract financial success through my consistent actions.”

Action cue: Complete one small task toward a money goal today.

Generosity and Impact Affirmations

These statements support a healthy relationship with money that includes giving and community impact.

- “I have more than enough money to share with others.”

Action cue: Make a small donation or help someone in a meaningful way. - “My wealth enables me to make a positive difference in the world.”

Action cue: Research one cause you’d like to support as you progress. - “I create value for others while building my own wealth.”

Action cue: Offer help or advice to someone in your network. - “Money amplifies my ability to serve and contribute.”

Action cue: Volunteer your time or skills for a cause you care about. - “I am grateful for all the abundance in my life.”

Action cue: Write a thank-you note to someone who helped your journey. - “My financial success inspires others to achieve their goals.”

Action cue: Share one practical tip with a friend who asked for help. - “I use money as a force for good in my life and community.”

Action cue: Plan how you’ll celebrate your next milestone (within budget).

How to Build a Daily Routine

Morning (5 minutes): Read 3–5 statements while you make coffee. Keep it light—this is about consistency, not perfection.

Weekly check-in (15 minutes): During your budget review, read through your current theme. If you need a simple framework, the 50/30/20 budget rule can be a helpful starting point.

Stress reset (2 minutes): When you feel yourself spiraling—unexpected expenses, a market dip, a tough bill—pick one line and do the action cue before making a decision.

Tracking Your Mindset + Money Wins

This part matters because it helps you see progress even when it’s slow. If you already use a spreadsheet or app, great—keep it simple. If you want options, browse this list of free financial tools and pick one you’ll actually stick with.

The Affirmation Journal (simple version): once a week, note your dominant money feeling, one action you took, and one win—big or small.

| Week | Dominant Money Feeling | Key Action Taken | Financial Win |

|---|---|---|---|

| 1 | Anxious → Hopeful | Automated savings | Started an emergency fund |

| 2 | Scarcity → Curious | Explored extra income ideas | Took one small “growth” step |

| 3 | Worried → Confident | Raised retirement contributions | Stayed consistent for the week |

Monthly mindset metrics: Rate yourself (1–10) on confidence, willingness to take smart risks, and gratitude. Watch those scores rise alongside your consistency.

Common Challenges (And What To Do)

“This feels fake when I’m broke.” Start with bridge lines like “I’m learning to build wealth” or “I’m taking one step today.” The goal is believable progress, not pretending.

“I don’t see results fast enough.” Look for behavioral wins first: opening statements you used to avoid, checking your budget without panic, or automating one transfer. If money stress is hitting hard lately, these practical money stress tips can help you steady the basics.

“A downturn makes me doubt everything.” That’s exactly when your routine matters most. Choose one “security” line and one action cue, then do the action cue before you react.

Advanced Techniques

Visualization pairing: While you repeat a line, picture the exact moment you’ll take the action: logging into your bank, setting an auto-transfer, or opening your investing app.

Emotion anchoring: Recall a time you made a decision you’re proud of—paying down debt, negotiating pay, starting a budget. Pair that feeling with your statement so your body “buys in.”

Environmental cues: Put one line where you make decisions: your wallet, your phone lock screen, or a sticky note by your laptop.

The Compound Effect

Here’s the quiet truth: small choices repeat. So do small scripts. Over time, they shape what you do when money gets tense—whether you avoid, overspend, or take a steady next step.

If you want a companion practice, try this abundance mindset exercises list alongside your weekly check-in.

Go Deeper: Practical Money Mindset Reads

If affirmations are helping and you want a practical next step, these two books reinforce the “behavior + compounding” side of money (no woo).

- The Psychology of Money — behavior-first lessons that make calmer money decisions easier over time. Paperback on Amazon.

- Your Money or Your Life — a FIRE-friendly classic that ties values, spending, and tracking together. Paperback on Amazon.

Frequently Asked Questions

Conclusion

You don’t need perfect optimism—you need a repeatable routine. Pick your top 3 abundance affirmation money statements from the picker or the full list, practice them daily, and do the tiny action cue right away. The goal is a calmer money response first—then better decisions follow.

Your Next Steps:

- Use the picker to grab 5 statements, then choose your top 3.

- Practice daily for 14 days during a real money moment (budget check, bill pay, savings transfer).

- Do the action cue immediately—even if it’s just a 2-minute step.

- Track one win weekly so you can see the change compounding.

This guide is for general education, not personalized financial, medical, or mental-health advice. Your situation and results will vary. If money stress feels overwhelming, consider talking with a qualified professional.