Picture this: you’re finally ready to chase lower mortgage rates, but the idea of an appraiser poking through every room makes you want to put it off again. Between work and family, letting a stranger roam your house feels exhausting. What many homeowners don’t realize is that they may qualify for a mortgage refinance without appraisal, a streamlined option that can cut the hassle, save money, and still get them better terms. And if you want to zoom out first, our step-by-step mortgage guide walks through how mortgages work from payoff to refinancing.

If you’re like Sarah and want to refinance your mortgage in 2025 without the hassle of a traditional appraisal, you’re in luck. Several programs and options exist that allow qualified homeowners to bypass this step entirely. Whether you have an FHA, VA, USDA, or conventional loan, there may be a path forward that eliminates appraisal requirements while still securing better terms.

No-Appraisal Refinance Savings Calculator

Estimate your monthly savings and how quickly you’ll recoup a typical appraisal fee.

Estimated savings

Adjust the sliders to see your estimated monthly payment reduction and first-year savings.

💡 Try lowering the potential new rate or increasing your loan balance if your savings look small.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Understanding No-Appraisal Refinance Options

- Conventional Loan Appraisal Waivers: PIW and ACE Programs

- Government Loan Streamline Programs

- How Lenders Estimate Value Without an Appraisal

- Who Actually Qualifies (By Loan Type)

- Documentation Requirements

- Costs and Timeline Comparison

- Pros and Cons of No-Appraisal Refinancing

- When an Appraisal Is Still Required

- Alternative Options: HELOC vs. Home Equity Loans

- Frequently Asked Questions

- Regional Considerations and Market Factors

- Working with Lenders and Loan Officers

- Preparing for Your No-Appraisal Refinance

- Technology and Future Trends

- Conclusion

Key Takeaways

- Multiple no-appraisal options exist: Conventional loans offer appraisal waivers through automated systems, while government loans provide streamline refinance programs.

- Eligibility depends on loan type and history: Strong payment history, adequate equity (typically 80% LTV or better), and property occupancy are common requirements.

- Speed and cost savings are major benefits: No-appraisal refinances typically close 2–3 weeks faster and save $400–$600 in appraisal fees (Source: typical ranges reported by major mortgage lenders; always confirm current fees and timelines with your lender).

- Not all situations qualify: Cash-out refinances, investment properties, and certain property types may still require traditional appraisals.

- Documentation requirements remain: While appraisals are waived, lenders still need income verification, credit checks, and other standard refinance paperwork.

If you’ve put off looking at your mortgage because the process feels overwhelming, think of these points as a quick reality check: there are structured programs designed to make refinancing simpler, not scarier.

Quick next step: jot down your current interest rate, remaining loan balance, and loan type so you have them handy as you read.

What’s new for no-appraisal refinancing in 2025?

- Conforming loan limits have increased again, so more borrowers can stay in conventional (non-jumbo) territory when they refinance (Source: annual conforming loan limit announcements from the Federal Housing Finance Agency).

- Fannie Mae and Freddie Mac continue to expand the use of appraisal alternatives on well-documented, lower-risk loans, making no-appraisal approvals more common (Source: recent guidance from Fannie Mae and Freddie Mac on appraisal waivers and appraisal alternatives).

- Newer credit scoring models are rolling out across the mortgage industry, which can help some borrowers with strong rent and utility histories qualify more easily (Source: lender and agency updates about adopting newer credit scoring models; check with your lender to see what they use).

- With rates easing from their recent peaks, even modest drops in your rate can pair with no-appraisal savings to create meaningful year-one benefits, depending on the market.

Before you dive into the details, here’s a quick way to see if skipping a new appraisal on your refinance is even on the table for you: Conventional: 12 months of on-time payments and roughly 20% equity or more; FHA: existing FHA loan, on-time payments, and a clear “net tangible benefit” like a lower rate; VA: current VA loan with a history of on-time payments and a lower, safer new payment; USDA: existing USDA loan in an eligible rural area with a clean payment record.

Understanding No-Appraisal Refinance Options

If you’ve ever thought, “I’d love a lower rate, but I don’t want someone inspecting my house again,” you’re exactly who no-appraisal refinance programs are built for. A no-appraisal refinance lets you update your loan based on data rather than a stranger walking through your home. Instead of scheduling an inspection, your lender leans on automated valuation tools, recent sales, and public records to estimate what your place is worth. If the numbers look solid and you meet the program rules, they can approve the new loan without sending anyone out. That means less stress, fewer surprises, and a much faster path to lower payments.

This setup actually helps both sides. Lenders move files through the system faster and keep their costs down, while you get to close more quickly without juggling appointments or worrying that a nitpicky report will derail the deal. If you’ve ever cleaned your house top to bottom for an inspection only to reschedule, skipping that step can feel like a huge weight off.

Quick next step: grab your latest mortgage statement so you know your current balance and rate as you compare the options below.

How No-Appraisal Refinancing Works

Instead of sending an appraiser to your home, lenders use sophisticated algorithms that analyze:

- Recent comparable sales in your neighborhood 📊

- Property tax records and assessments

- Previous appraisal data on your home

- Market trends and appreciation patterns

- Automated valuation models from multiple sources

The system generates a property value estimate that lenders use for loan-to-value calculations. If the automated system provides a confident value assessment and you meet other eligibility criteria, the appraisal requirement is waived. If you’re picturing a mysterious computer making the call, you’re not alone—this section is meant to give you a clearer idea of what it’s actually looking at.

Conventional Loan Appraisal Waivers: PIW and ACE Programs

For conventional loans backed by Fannie Mae and Freddie Mac, two primary systems determine mortgage refinance without appraisal eligibility:

Fannie Mae’s Property Inspection Waiver (PIW)

Fannie Mae’s Desktop Underwriter (DU) system automatically evaluates loans for Property Inspection Waiver eligibility. When DU has sufficient confidence in its automated valuation, it may grant a PIW, eliminating the appraisal requirement.

PIW Eligibility Requirements:

- Loan-to-value ratio: Typically 80% or lower

- Payment history: No late payments in the last 12 months

- Property type: Single-family homes, condos, and 2–4 unit properties

- Occupancy: Owner-occupied or second homes (investment properties excluded)

- Credit score: Generally 620 or higher (Source: typical eligibility ranges published for conventional conforming loans; individual lender guidelines may differ.)

Freddie Mac’s Appraisal Waiver (ACE)

Freddie Mac’s Loan Product Advisor (LPA) offers Automated Collateral Evaluation (ACE) waivers under similar circumstances. The ACE system uses comparable sales data and property characteristics to determine value confidence.

ACE Eligibility Factors:

- Strong borrower profile: Good credit and stable income

- Conservative loan-to-value: Usually 75–80% maximum

- Property data availability: Sufficient recent sales comparables

- Loan purpose: Rate-and-term refinances (not cash-out)

Real-World Example: Mark, a software engineer in Austin, refinanced his conventional loan from 4.5% to 3.2% in 2024 using a PIW. His excellent payment history and 65% loan-to-value ratio qualified him automatically. The process took just 18 days from application to closing, saving him both time and the $550 appraisal fee.

Quick next step: if you have a conventional loan, check your estimated home value and loan balance to see whether your LTV might already be at or below 80%.

Government Loan Streamline Programs

Government-backed loans offer their own streamlined refinance options that often skip a full appraisal, designed to help borrowers access better rates with minimal documentation. If your budget already feels tight, the idea of sending in a giant stack of paperwork can be overwhelming, so these lighter-document options can be a real relief.

FHA Streamline Refinance

The FHA Streamline Refinance program allows existing FHA borrowers to refinance without an appraisal, income verification, or extensive credit checks in many cases. You can review the official HUD guidelines for more detail (Source: FHA streamline refinance overview on HUD.gov).

FHA Streamline Requirements:

- Current loan status: Must be FHA-insured

- Payment history: No late payments in the last 12 months

- Net tangible benefit: New loan must provide clear financial advantage

- Occupancy: Must be owner-occupied

- Waiting period: Typically 210 days since last closing

Two FHA Streamline Options:

| Credit Qualifying | Non-Credit Qualifying |

|---|---|

| Income verification required | No income verification |

| Credit check performed | No credit check |

| Debt-to-income analysis | No DTI analysis |

| Lower rates typically offered | Slightly higher rates |

VA Interest Rate Reduction Refinance Loan (IRRRL)

Veterans and eligible service members can use the VA IRRRL program for a no-appraisal refinance on existing VA loans.

VA IRRRL Benefits:

- No appraisal required: Property value assessment waived

- No income verification: Employment check not needed

- No credit score minimum: VA doesn’t set credit requirements, although individual lenders may still apply their own minimum score (Source: VA IRRRL program information from va.gov; confirm any lender overlays directly with your loan officer).

- Funding fee: Reduced compared to purchase loans (0.5% for most borrowers)

- Cash back allowed: Up to $6,000 for energy improvements

VA IRRRL Eligibility:

- Current loan must be VA-guaranteed

- Must result in lower interest rate (with exceptions for ARM to fixed-rate conversions)

- No cash-out beyond closing costs and prepaid items

- Certificate of Eligibility on file

USDA Streamline Assist Refinance

Rural homeowners with USDA loans can access the Streamline Assist program for no-appraisal refinance processing.

USDA Streamline Features:

- No appraisal: Property inspection waived

- Reduced documentation: Limited income and asset verification

- No credit report: Previous credit approval carries forward

- Lower guarantee fee: Reduced compared to standard USDA loans

Quick next step: look at your last closing documents or online loan portal to confirm whether your current mortgage is FHA, VA, USDA, or conventional so you know which streamline options are worth exploring.

How Lenders Estimate Value Without an Appraisal

Behind the scenes, lenders rely on a mix of tools to estimate your home’s value without stepping inside. Automated valuation models scan public records and recent sales, brokers can provide quick price opinions based on nearby listings, and appraisers sometimes complete “desktop” reviews using photos and past reports. Together, these methods give lenders enough confidence to move ahead on an appraisal-waived refinance, while you skip the scheduling headaches and still get a value that’s grounded in real market data.

Automated Valuation Models (AVMs)

AVMs use statistical modeling to estimate property values based on:

- Public records data

- Recent sales transactions

- Property characteristics

- Market trends and conditions

If you’re imagining a black-box number popping out of nowhere, remember that most AVMs are leaning on the same sale prices and public records a human appraiser would start with—just processed much faster.

Broker Price Opinions (BPOs)

Some lenders may request a BPO instead of a full appraisal. A real estate broker or agent provides a market value opinion based on:

- Exterior property inspection

- Comparable sales analysis

- Market knowledge and experience

- Desktop research and data review

Desktop Appraisals

A hybrid approach where licensed appraisers provide valuations without visiting the property, relying on:

- Public records and MLS data

- Satellite imagery and street view photos

- Previous appraisal reports

- Statistical modeling tools

Quick next step: when you talk with a lender, ask whether your file is likely to qualify for an automated valuation, a desktop appraisal, or a traditional in-person visit.

Who Actually Qualifies (By Loan Type)

While specific requirements vary by program, common eligibility factors for skipping a new appraisal on your refinance include. If you’ve had a bump or two in your payment history, don’t panic—these guidelines are ballparks, and a good loan officer can walk you through where you stand.

Loan-to-Value Considerations

Most programs require conservative LTV ratios:

- Conventional loans: Typically 80% LTV maximum

- FHA Streamline: Based on current loan balance

- VA IRRRL: No specific LTV requirement

- USDA Streamline: Limited to current loan balance

(Source: general underwriting ranges used by many conventional lenders and the GSEs; exact cutoffs vary by lender.)

Payment History Requirements

Lenders want evidence of responsible payment behavior:

- No late payments: Usually 12 months of on-time payments required

- No mortgage modifications: Recent loan modifications may disqualify

- Stable payment pattern: Consistent payment history demonstrates reliability

Property Type Restrictions

Eligible property types typically include:

- ✅ Single-family detached homes

- ✅ Condominiums (with some restrictions)

- ✅ Townhomes and row houses

- ✅ 2–4 unit properties (owner-occupied)

- ❌ Investment properties (most programs)

- ❌ Manufactured homes (limited options)

- ❌ Properties with significant modifications

Mortgage Insurance and PMI Considerations

If you’re currently paying private mortgage insurance (PMI), a no-appraisal refinance doesn’t automatically make that cost disappear. Many lenders still want either a full appraisal or very strong documented evidence before they’ll cancel mortgage insurance. Think of appraisal waivers as a way to simplify the rate-and-term side of your refinance, while PMI removal may still require a more traditional valuation step (Source: typical private mortgage insurance cancellation rules from major insurers and lender guidelines).

Credit Score and Income Factors

While streamline programs may have relaxed requirements, conventional waivers typically require:

- Credit score: 620+ for most conventional programs

- Debt-to-income ratio: 43% maximum for many lenders

- Employment stability: Two years of consistent income

- Asset reserves: Some programs require 2–6 months of payments in reserves

If your score isn’t where lenders want it yet, you can still work on it step by step.

Once your credit looks stronger, you can revisit which no-appraisal refinance options fit best.

Quick next step: take five minutes to check your most recent credit score estimate and skim your last 12 months of mortgage payments for any late marks.

Documentation Requirements

Even with a no-appraisal refinance, you’ll still work through a decent stack of documentation. It might feel like a lot at first, but pulling these pieces together now can save days later if the underwriter has questions.

Standard Documentation Checklist

Income Verification:

- Recent pay stubs (30 days)

- W-2 forms (2 years)

- Tax returns (2 years for self-employed)

- Bank statements (2 months)

Asset Documentation:

- Checking and savings account statements

- Investment account statements

- Retirement account balances

- Gift letter documentation (if applicable)

Property Documentation:

- Current mortgage statement

- Property tax records

- Homeowners insurance policy

- HOA documentation (if applicable)

Credit and Identity:

- Government-issued photo ID

- Social Security card

- Credit report authorization

- Divorce decree (if applicable)

Streamline Program Exceptions

Government streamline programs may reduce documentation requirements:

FHA Non-Credit Qualifying Streamline:

- Current mortgage statement

- Signed application

- Property insurance verification

- Employment verification letter

VA IRRRL Minimal Documentation:

- VA loan verification

- Current payment history

- Occupancy certification

- Funding fee documentation

If you’ve ever scrambled to find a missing tax return while your lender waits, you know how stressful that can be. Quick next step: set aside 20 minutes this week to create a single folder—digital or paper—where your income, asset, and property documents live together.

Costs and Timeline Comparison

Understanding the financial and time benefits of a no-appraisal refinance helps borrowers make informed decisions.

Cost Savings Breakdown

| Cost Category | Traditional Refinance | No-Appraisal Refinance | Savings |

|---|---|---|---|

| Appraisal fee | $400–$600 | $0 | $400–$600 |

| Processing time | 30–45 days | 15–30 days | 2–3 weeks faster |

| Rush fees | $100–$200 | Not applicable | $100–$200 |

| Total potential savings | $500–$800 |

Here’s a quick example. Say you owe $350,000 at 6.0% and qualify to drop to 5.25% with a no-appraisal refinance. Your principal-and-interest payment would fall by roughly $170 a month, or about $2,000 in the first year. Skip a $550 appraisal fee and you’re closer to $2,500 in total year-one savings, all without rearranging your schedule for a home visit (Example only; your numbers will vary). If you want to run your own scenario, our mortgage refinance break-even calculator can do the math for you.

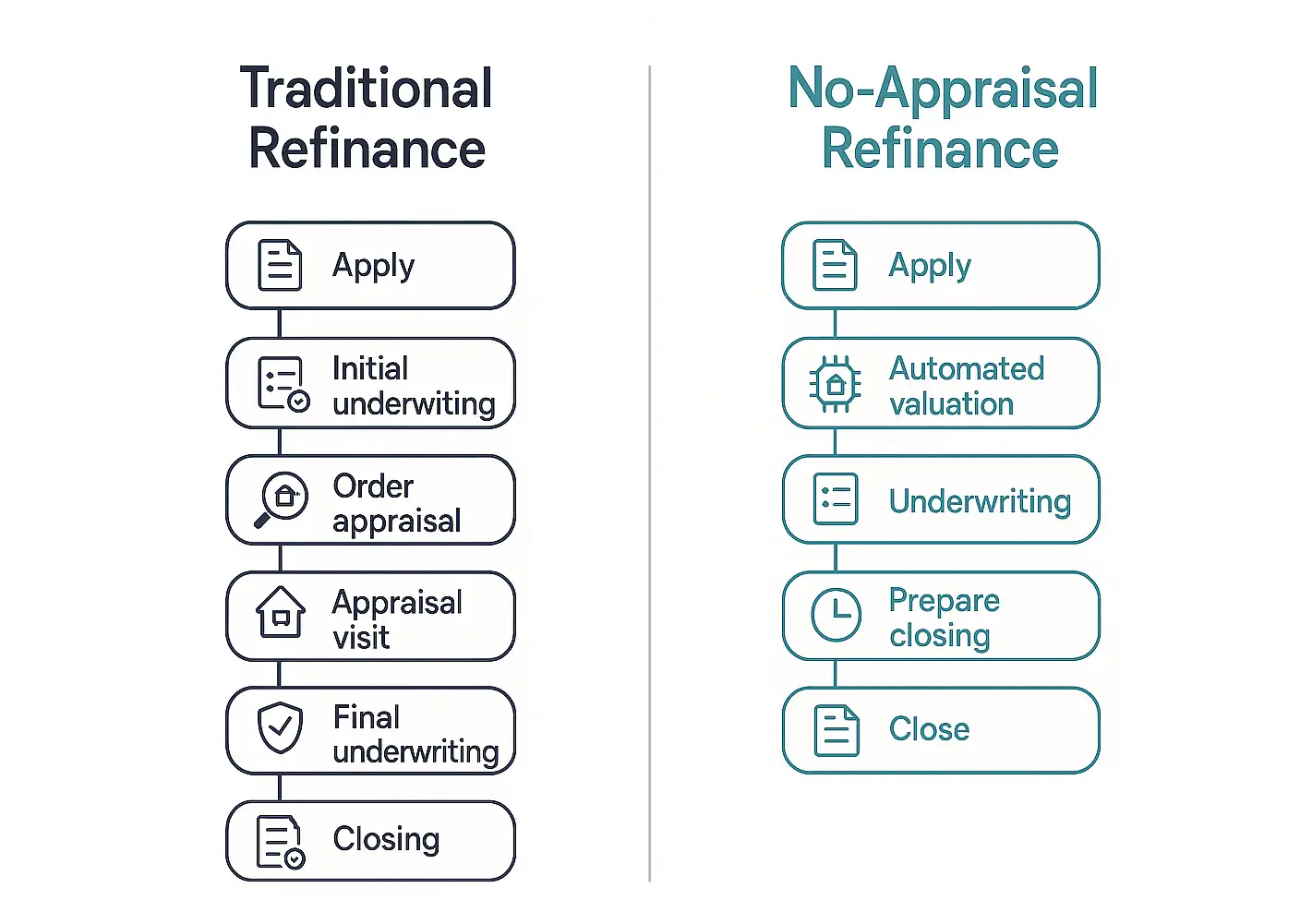

Timeline Advantages

Traditional mortgage refinance timeline:

- Application submission (Day 1)

- Initial underwriting (Days 2–7)

- Appraisal ordering (Day 8)

- Appraisal scheduling (Days 10–15)

- Appraisal completion (Days 16–20)

- Final underwriting (Days 21–35)

- Closing preparation (Days 36–40)

- Closing (Days 40–45)

No-Appraisal Refinance Timeline:

- Application submission (Day 1)

- Automated valuation (Days 2–3)

- Underwriting process (Days 4–15)

- Closing preparation (Days 16–20)

- Closing (Days 20–30)

Success Story: Jennifer, a teacher in Phoenix, used an FHA Streamline refinance to lower her rate from 4.75% to 3.25% in just 22 days. The no-appraisal process saved her $500 in fees and allowed her to close before her summer vacation, avoiding scheduling conflicts with the new school year.

Quick next step: plug your own numbers into the calculator on this page or your lender’s tool to see roughly how much a lower rate could save you in the first year.

Pros and Cons of No-Appraisal Refinancing

Advantages of a No-Appraisal Refinance

Speed and Convenience ⚡

- Faster processing and closing times

- No scheduling appointments with appraisers

- Reduced risk of delays due to appraiser availability

Cost Savings 💰

- Eliminates $400–$600 appraisal fees

- Reduces overall closing costs

- No risk of additional repair requests

Reduced Fall-Through Risk 🛡️

- No low appraisal concerns

- Property condition issues don’t derail the transaction

- More predictable closing timeline

Privacy Benefits 🏠

- No strangers entering your home

- No need to prepare property for inspection

- Maintains personal privacy and security

Potential Disadvantages

Limited Property Information ⚠️

- Lender unaware of property improvements

- No opportunity to showcase home enhancements

- Potential undervaluation of unique features

Pricing Adjustments 📊

- Some lenders charge slightly higher rates

- Risk-based pricing may apply

- Less negotiating leverage on terms

Eligibility Restrictions 🚫

- Not available for all borrowers

- Property type limitations

- LTV ratio constraints

Market Risk 📉

- No current market validation

- Potential issues if refinancing again soon

- Limited recourse if value estimates are low

Quick next step: jot down one benefit that matters most to you (speed, savings, or privacy) and one tradeoff you’re willing to accept; this will make lender conversations much clearer.

When an Appraisal Is Still Required

Despite the availability of mortgage refinance without appraisal options, certain situations still mandate traditional property valuations:

Cash-Out Refinancing

Most no-appraisal programs only allow rate-and-term refinances. Cash-out refinancing typically requires:

- Full property appraisal

- Income and asset verification

- Higher credit score requirements

- Lower maximum LTV ratios

Investment Properties

Rental and investment properties generally don’t qualify for appraisal waivers due to:

- Higher risk profiles

- Limited automated valuation data

- Different underwriting standards

- Occupancy verification challenges

Significant Property Modifications

Homes with substantial changes may need appraisals:

- Major additions or renovations

- Converted spaces or non-conforming improvements

- Structural modifications

- Unique or custom features

Market Conditions

Volatile or declining markets may trigger appraisal requirements:

- Stricter credit score and loan-to-value requirements

- More conservative automated valuations and documentation requests

Quick next step: if you’re considering cash-out or have made major renovations, ask your lender directly whether a full appraisal will be required so you’re not surprised later.

Alternative Options: HELOC vs. Home Equity Loans

When a no-appraisal refinance isn’t available or suitable, homeowners might consider other options, including a more traditional mortgage refinance, loan recasting, HELOCs, or home equity loans. Our mortgage recast vs. refinance guide breaks down when adjusting your existing loan might make more sense than starting a new one.

Home Equity Line of Credit (HELOC)

HELOCs offer access to equity without refinancing the first mortgage:

HELOC Advantages:

- Keep existing mortgage rate

- Access funds as needed

- Interest-only payment options

- Potential tax deductibility

HELOC Considerations:

- Variable interest rates

- Credit line fees and costs

- Draw period limitations

- Payment shock risk

Home Equity Loans

Fixed-rate second mortgages provide lump-sum funding:

Home Equity Loan Benefits:

- Fixed interest rates

- Predictable monthly payments

- No impact on first mortgage

- Potentially lower costs than refinancing

Home Equity Loan Drawbacks:

- Higher rates than first mortgages

- Additional monthly payment

- Closing costs and fees

- Reduced total equity access

Quick next step: decide whether your top priority is tapping equity for cash or simply lowering your monthly payment—this choice often points you toward either a refinance, a HELOC, or a home equity loan.

Frequently Asked Questions

Regional Considerations and Market Factors

High-Appreciation Markets

Areas experiencing rapid price growth may have better no-appraisal refinance availability due to abundant comparable sales data, conservative automated valuations, and strong market confidence.

Examples of favorable markets: Think big metro areas with steady growth, nearby suburbs with new construction, and regions with diverse, stable employers.

Rural and Remote Areas

Properties in less populated areas may face challenges:

- Limited comparable sales data

- Fewer automated valuation options

- USDA Streamline programs may be the best option

- Consider working with local community banks

For example, a homeowner in a small rural town might find that USDA or local credit union options show up much more often than big national banks when they start asking about no-appraisal refis.

Market Volatility Considerations

During uncertain economic times, lenders may tighten appraisal waiver criteria:

- Stricter credit score and loan-to-value requirements

- More conservative automated valuations and documentation requests

Quick next step: search recent home sales in your neighborhood or talk to a local agent to get a rough sense of how active and stable your market is before you apply.

Working with Lenders and Loan Officers

Choosing the Right Lender

Not all lenders offer the same no-appraisal refinance options. Consider:

Large National Banks:

- Extensive technology platforms

- High volume of automated approvals

- Competitive pricing

- Streamlined processes

Credit Unions:

- Member-focused service

- Flexible underwriting

- Competitive rates

- Local market knowledge

Mortgage Brokers:

- Access to multiple lender programs

- Program comparison shopping

- Personalized service

- Expert guidance

Online Lenders:

- Digital-first processes

- Quick approvals

- Competitive pricing

- 24/7 application access

Questions to Ask Your Lender

- Which no-appraisal programs do you offer?

- What are your specific eligibility requirements?

- How do your rates compare between appraisal and no-appraisal options?

- What’s your typical timeline for no-appraisal refinances?

- Do you have backup options if the automated valuation fails?

- What documentation will you need from me?

- Are there any additional fees for appraisal waivers?

Loan officers who work on these files every day often say the smoothest refinances come from borrowers who ask clear questions up front. Quick next step: pick two lenders and send them a short email or chat message asking, “Based on my current loan, do I qualify for any no-appraisal refinance options?”

Preparing for Your No-Appraisal Refinance

Document Organization

If you want your refinance to move smoothly, start gathering the key paperwork earlier than you think:

Create organized folders for:

- Income documentation

- Asset statements

- Property records

- Insurance information

- Current loan details

Credit Preparation

Optimize your credit profile before applying:

- Pay down credit card balances

- Avoid new credit applications

- Check credit reports for errors

- Consider rapid rescore if needed

Property Maintenance

While no appraisal is required, maintain your property:

- Keep up with routine maintenance

- Address any obvious issues

- Maintain homeowners insurance

- Stay current on property taxes

A 20-Minute Refinance Check-In

If the whole idea still feels big, shrink it down to a quick 20-minute check-in you can do this week:

- Open your last 12 months of mortgage statements and note any late payments.

- Estimate your home value with two online tools and write down the average.

- List your current interest rate and remaining loan balance in one place.

- Write down one concrete goal for this refinance, like “lower my payment” or “pay the home off sooner.”

If you tackle these items a little at a time instead of all at once, the process feels much more manageable when your lender starts asking for documents.

Technology and Future Trends

Artificial Intelligence Integration

The no-appraisal refinance landscape continues evolving with technological advances:

- Enhanced data analysis capabilities

- Improved accuracy in value estimates

- Faster processing with fewer manual bottlenecks

Blockchain and Digital Verification

Emerging technologies may further streamline processes:

- Automated document verification

- Secure data sharing platforms

- Reduced fraud risk and clearer audit trails

Regulatory Evolution

Government agencies continue refining programs:

- Expanded eligibility criteria

- Improved consumer protections

- Streamlined application and quality-control processes

Quick next step: when you talk to lenders, ask whether they use automated appraisal waivers, desktop appraisals, or other tech that could simplify your refinance.

Conclusion

The opportunity to complete a mortgage refinance without appraisal in 2025 represents a significant advancement in mortgage lending, offering homeowners faster, more convenient access to better loan terms. Whether through conventional appraisal waivers, government streamline programs, or alternative valuation methods, qualified borrowers can save time, money, and stress while securing improved mortgage conditions.

Success with no-appraisal refinancing comes from understanding your options and working with an experienced lender, just like Sarah and Jennifer in the examples above.

Your next steps should include:

- Assess your eligibility by reviewing your loan type, payment history, and estimated loan-to-value ratio.

- Compare multiple lenders to find the best rates and terms for your situation.

- Gather required documentation to ensure a smooth application process.

- Consider your long-term goals to determine if a no-appraisal refinance aligns with your financial objectives.

- Act promptly if you qualify, as market conditions and program availability can change.

If your main goal is paying off your home sooner, you can model different extra-payment strategies with our mortgage payoff calculator with extra payments.

Remember that while a no-appraisal refinance offers compelling advantages, it’s not suitable for every situation. Cash-out refinancing, investment properties, and certain market conditions may still require traditional appraisals. However, for rate-and-term refinances on owner-occupied properties with strong borrower profiles, these programs provide an excellent path to mortgage savings in 2025.

Take advantage of the technological advances and program options available today to potentially save money and time on your next mortgage refinance, whether you qualify for a no-appraisal option or need a more traditional approach. The mortgage industry’s shift toward efficiency and convenience puts powerful tools in the hands of qualified homeowners – tools that Sarah, Jennifer, and thousands of others have used to improve their financial situations.

This no-appraisal refinance guide is for general education only and isn’t personalized financial or legal advice. Your situation, rates, and program eligibility can differ from the examples here, and individual results will always vary. Before changing your mortgage, consider speaking with a qualified loan officer, financial planner, or HUD-approved housing counselor who can review your full picture.