Sarah stared at her bank statement in disbelief. The money she thought would finally move her ahead had vanished into rent, utilities, and subscriptions she barely uses. If you’ve ever wondered where your paycheck went — and how to cut monthly expenses without feeling miserable — you’re in the right place.

When I say “cut monthly expenses,” I’m talking about the recurring bills and everyday spending that sneak out of your account month after month. In many households, 70–80% of take-home pay disappears into these costs before you even notice [1]. If you’re trying to figure out how to save money on bills without feeling deprived, this guide walks you through quick wins, bigger long-term changes, and a simple one-month action plan so you actually keep more of what you earn. For even more ideas, see our how to live frugally and save money guide.

Monthly Savings Potential Tool

Move the sliders to estimate your monthly savings from spending cuts.

Progress toward $1,000/month potential savings

Your estimated savings: $350/month

That’s about 35% of a $1,000/month stretch goal.

Nice start! Redirecting a few subscriptions, trimming driving costs, and planning meals could free up a few hundred dollars every month.

💡 Tip: Start with the slider that feels easiest to change in the next 30 days.

Whether you're drowning in debt, saving for a major purchase, or simply want more financial breathing room, learning how to reduce spending each month is one of the fastest ways to improve your financial health. Use the Monthly Savings Potential Tool above to estimate your own savings, then apply the 25 tactics below to trim recurring bills and build a stronger financial foundation.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Quick Wins to Shrink Your Monthly Bills and Reduce Spending

- Strategic Changes to Reduce Monthly Expenses Long-Term

- Advanced Strategies to Lower Recurring Costs

- Smart Spending to Cut Monthly Expenses

- Avoiding False Savings

- Creating Your Expense-Cutting Action Plan

- Strategies for Variable Incomes

- Frequently Asked Questions

- Conclusion

Key Takeaways

- Quick wins can save $200-500 monthly through subscription audits, plan downgrades, and simple negotiations.

- Housing and transportation typically offer the largest savings opportunities, representing 50-70% of most budgets.

- The 50/30/20 rule helps maintain balance: 50% needs, 30% wants, 20% savings after implementing these strategies.

- Automation and bulk buying create sustainable long-term savings without constant effort.

- Track progress monthly to maintain momentum and identify new opportunities to reduce expenses.

Put together, most readers who apply a mix of quick wins and a few bigger moves can realistically free up $300–$800 per month, depending on income, location, and current spending patterns.

To see how this works in real life, imagine Alex, who brings home $3,500 a month. By canceling $60 in unused subscriptions, negotiating $40 off their phone and internet, meal planning to save $120 on groceries, and cutting $80 of impulse buys with a 24-hour rule, Alex frees up $300 every month. That’s $3,600 a year that can go toward debt, an emergency fund, or a big goal like a move or wedding — all from a handful of small, repeatable changes.

Quick Wins to Shrink Your Monthly Bills and Reduce Spending

Before you start cutting, spend at least a week tracking every expense. Seeing where your money actually goes makes it much easier to choose the three to five changes that will have the biggest impact. You might be surprised which “little” costs quietly add up the fastest — this is often the moment people say, “Oh wow, no wonder my account feels empty.”

1. Audit Your Subscriptions 💳

Start with the low-hanging fruit. The average household pays for 12 subscriptions but only uses 5 regularly [2].

Action steps:

- Check your bank statements for recurring charges.

- Use apps like Truebill or Honey to identify forgotten subscriptions.

- Cancel unused services immediately.

Potential savings: $50-150/month

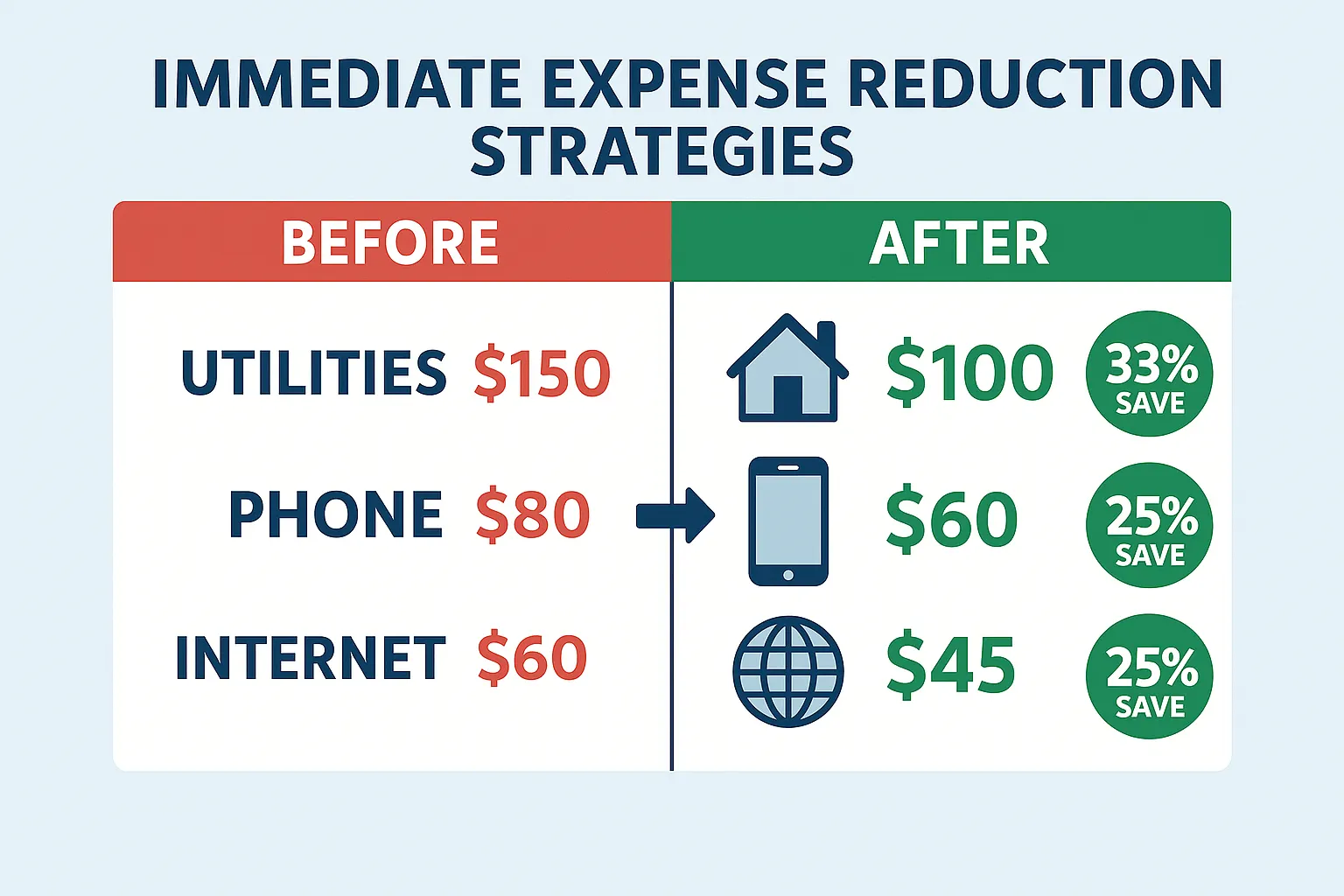

2. Negotiate Your Internet and Phone Bills 📱

Telecom companies expect customers to negotiate. Call your providers and ask for current promotions or mention you are comparing competitor offers.

Script to use: “I've been a loyal customer for [X years], but I'm considering switching to [competitor] for their lower rates. What can you offer to keep my business?”

Potential savings: $30-80/month

3. Switch to Generic Brands 🛒

Store brands often offer similar quality at noticeably lower prices. Start with non-perishables like cleaning supplies, medications, and pantry staples.

Potential savings: $40-100/month

4. Optimize Your Insurance Deductibles 🛡️

Raising your auto and home insurance deductibles from $500 to $1,000 can reduce premiums by 15-30%. Just ensure you have enough emergency savings to cover the higher deductible.

Potential savings: $25-75/month

5. Use the 24-Hour Rule ⏰

Before any non-essential purchase over $50, wait 24 hours. That short pause cuts down on impulse buys and gives you time to decide whether the purchase really matters.

Potential savings: $75-200/month

Strategic Changes to Reduce Monthly Expenses Long-Term

The biggest savings usually come from housing and transportation. Start by checking whether you’re overpaying for space you don’t truly need — could you downsize, negotiate a rent reduction, or take on a roommate for a year? Then look at how you get around. This part isn’t overnight, but it’s where most of the magic happens for people who really want to cut monthly expenses. Running one reliable used car instead of two, switching a few commutes a week to public transit, or carpooling with coworkers can cut gas, insurance, and parking costs fast, sometimes trimming $300–$800 from your monthly expenses.

6. Master Meal Planning 🍽️

Food waste can cost the average family around $1,500 a year in uneaten food. Plan weekly menus, create detailed shopping lists, and prep meals in advance.

Pro tip: Cook double portions and freeze half for busy weeks.

Potential savings: $100-300/month

7. Embrace Public Transportation 🚌

If available in your area, public transit can dramatically reduce transportation costs. Consider the total cost of car ownership: payments, insurance, gas, maintenance, and parking.

Example: Maria in Seattle saves $450/month by using public transit instead of driving downtown for work.

Potential savings: $200-600/month

8. Refinance High-Interest Debt 💰

With good credit, you can often refinance credit cards through personal loans at lower rates or transfer balances to 0% APR promotional cards.

If you're unsure whether refinancing or balance transfers are right for you, talk with a trusted financial professional or nonprofit credit counselor before making changes.

For a full step-by-step approach to paying off what you owe, see our debt management plan guide.

Potential savings: $50-300/month in interest

Prefer a simple way to compare consolidation options in one place?

Even a small drop in interest can free up real money each month — once that’s set, housing is usually your next big lever.

9. Downsize Your Housing 🏠

Housing often consumes around 30% of many households’ budgets. Consider downsizing, getting roommates, or moving to a less expensive area if your housing costs are much higher than that.

Potential savings: $300-1,500/month

10. Buy in Bulk (Strategically) 📦

Purchase non-perishable staples in bulk, but only items you regularly use. Focus on household essentials, frozen foods, and pantry staples.

Potential savings: $50-150/month

11. Implement Energy-Saving Measures ⚡

Small changes yield big savings:

- Program your thermostat (can save up to about 10% on heating/cooling).

- Switch to LED bulbs.

- Unplug electronics when not in use.

- Use cold water for laundry.

Potential savings: $30-100/month

For more detailed ideas, see this energy-saving guide from the U.S. Department of Energy.

12. Cancel Gym Memberships 🏃♀️

Replace expensive gym memberships with home workouts, outdoor activities, or community center facilities.

Potential savings: $30-80/month

Advanced Strategies to Lower Recurring Costs

13. House Hack Your Living Situation 🏡

Rent out a room, basement, or garage to offset housing costs. Even a small space can generate $300-800 monthly income.

14. Optimize Your Tax Withholdings 📊

If you receive large tax refunds, you're giving the government an interest-free loan. Adjust your withholdings to increase monthly take-home pay.

15. Use Cashback Credit Cards Strategically 💳

If you pay balances in full monthly, cashback cards can reduce effective spending by 1-5%. Focus on cards that match your spending patterns.

16. Negotiate Medical Bills 🏥

Medical providers often accept payment plans or reduced amounts. Always ask for itemized bills and question charges.

17. DIY Basic Maintenance 🔧

Learn simple home and car maintenance tasks. YouTube tutorials can teach you to change oil, fix leaky faucets, and perform basic repairs.

Potential savings: $100-400/month

18. Use the Library 📚

Libraries offer free books, movies, internet access, and often community programs. Cancel entertainment subscriptions and use library resources instead.

Potential savings: $20-60/month

19. Grow Your Own Food 🌱

Even apartment dwellers can grow herbs and small vegetables. A $20 investment in seeds can yield much more than that amount in fresh produce over a season.

20. Optimize Your Banking 🏦

Avoid fees by:

- Choosing banks with no monthly fees.

- Maintaining minimum balances.

- Using in-network ATMs.

- Setting up direct deposit.

Potential savings: $15-50/month

Even if you don’t switch banks right now, knowing what you pay in fees makes it much easier to negotiate or move later.

Smart Spending to Cut Monthly Expenses

21. Invest in Quality Items 👔

Sometimes spending more upfront saves money long-term. Buy quality shoes, appliances, and tools that last longer than cheap alternatives.

22. Use Seasonal Shopping Strategies 🛍️

Buy winter clothes in spring, summer items in fall. Shop end-of-season clearances for next year's needs.

23. Automate Your Savings 🤖

Set up automatic transfers to savings accounts. Treating savings like a bill ensures consistent progress toward financial goals.

24. Use Apps and Technology 📱

Leverage technology to save money:

- Honey: Automatic coupon codes.

- Rakuten: Cashback on purchases.

- GasBuddy: Find cheapest gas prices.

- Mint: Track spending patterns.

25. Practice the 30-Day List 📝

Keep a running list of items you want to buy. After 30 days, you'll often find you no longer want many items, preventing unnecessary purchases.

Avoiding False Savings

Not all “deals” actually save money. Avoid these common traps:

- Buying items just because they're on sale.

- Choosing cheaper options that break quickly.

- Signing long-term contracts for small monthly savings.

- Extreme couponing that leads to buying unneeded items.

Remember: The best way to save money is often to not spend it at all.

Creating Your Expense-Cutting Action Plan

Week 1: Quick Assessment

- Track all expenses for one week.

- Audit subscriptions and cancel unused services.

- Call internet/phone providers to negotiate.

Week 2: Strategic Planning

- Create a realistic budget using the 50/30/20 budget rule.

- Research better insurance rates.

- Plan next month's meals.

Week 3: Implementation

- Make necessary switches (insurance, phone plans).

- Start new habits (meal prep, energy saving).

- Set up automatic savings transfers.

Week 4: Optimization

- Review progress and adjust strategies.

- Identify next month's targets.

- Celebrate your wins!

If you like seeing everything laid out in one place, our zero-based budget spreadsheet can help you plug these changes into a clear monthly plan.

Strategies for Variable Incomes

If your income fluctuates, focus on these flexible strategies:

- Build a larger emergency fund (3-6 months expenses).

- Use percentage-based budgeting instead of fixed amounts.

- Prioritize reducing fixed expenses over variable ones.

- Create “good month” and “lean month” spending plans.

For example, you might decide that each month 50% of take-home pay goes to needs, 30% to wants, and 20% to savings and debt, even though the actual dollar amounts change with your income. On high-income months, you simply plug in the new numbers using the same percentages instead of guessing from scratch — no complicated spreadsheet skills required.

Frequently Asked Questions

Conclusion

Learning how to cut monthly expenses effectively requires both quick wins and strategic long-term changes. Start with the easiest tactics—auditing subscriptions and negotiating bills—then gradually implement larger changes like meal planning and transportation alternatives.

Your next steps:

- Choose 3 quick wins from this list to implement this week.

- Calculate your potential savings using the ranges provided.

- Set up a simple tracking system to monitor your progress.

- Automate what you can to maintain momentum without constant effort.

Remember, small changes compound over time. Saving an extra $300 monthly equals $3,600 annually—enough for a substantial emergency fund or major financial goal. The key is starting today and staying consistent with simple ways to reduce spending.

If you want more everyday ideas to layer on, these frugal habits that save money pair nicely with the monthly expense cuts in this guide.

The families who successfully lower their monthly bills don't do everything at once. They pick a few strategies, master them, then gradually add more. Take 30 seconds to write down your top three tactics from this list and stick that note somewhere you’ll see it—Which three will you start with this week?

References

[1] Bureau of Labor Statistics, Consumer Expenditure Survey 2025

[2] Waterstone Management Group, Subscription Economy Report 2025

[3] Journal of Consumer Research, Impulse Buying Behavior Study 2024

This cut monthly expenses guide is for general information only and isn’t financial, tax, or legal advice. For persistent money issues or big decisions, consider speaking with a qualified professional.