Feeling the squeeze on your wallet in 2025? 💸 Maybe you’ve watched your grocery bill creep up even though your cart looks the same. You’re definitely not alone—prices are biting almost everyone right now. The good news is that learning how to be frugal in 2025 doesn’t mean giving up the things you love. It’s more about small, thoughtful choices, zeroing in on what truly matters, and using a few smart tricks to save cash. Ready to make your money feel a bit calmer? Let’s jump in! For a broader roadmap, see our how to live frugally and save money guide.

Answer honestly—this quick check looks at your money habits, not your income level.

Frugal Living Assessment

Choose one option per question; your results update automatically as you go.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Frugal Living in 2025

- What Does It Mean to Be Frugal?

- Step 1: How to Be Frugal in 2025 by Getting a Handle on Your Money

- Step 2: Cut Costs the Smart Way

- Step 3: Building Habits to Stay Frugal in 2025

- Step 4: Using Tech to Be Frugal in 2025

- Step 5: Embracing a Frugal Mindset

- Frugal Living Checklist

- Conclusion: Your 2025 Frugal Game Plan

Key Takeaways for Frugal Living in 2025

- Frugal living in 2025 goes beyond clipping coupons—it’s about thoughtful spending and using today’s tools to help.

- Budgeting, tracking expenses, and actually noticing savings opportunities make up the core of a frugal plan.

- Small moves like meal planning, simple DIY projects, and trimming subscriptions can free up more than you’d expect.

- Frugal habits build slowly, so it helps to notice and celebrate each small win along the way.

- Spend on what aligns with your values to move toward financial freedom.

What Does It Mean to Be Frugal in 2025?

New to this and wondering how to start frugal living? It isn’t about pinching pennies—it’s about spending smart. In 2025, being frugal means using apps, getting resourceful, and choosing what’s worth your money. For example, skip that shiny new gadget and opt for a cozy family game night instead. Frugality helps you focus on what brings real joy, not just more stuff. That’s the heart of a mindful money approach!

“Frugality is all about cherishing the little joys—like a homemade meal with friends—over chasing shiny new things.”

Step 1: How to Be Frugal in 2025 by Getting a Handle on Your Money

If you want your 2025 budget to feel lighter, start by noticing where your money quietly sneaks off to. Tracking your spending is like catching those “just this once” coffee runs and impulse buys before they pile up.

Budgeting Basics: How to Start Frugal Living

Think of a budget as a simple plan for your money, not a punishment. It keeps the essentials covered, shows you what’s left for fun, and helps you tuck something away for bigger goals. Here are some easy ways to start budgeting and ease into frugal living in 2025, like exploring smart budgeting habits or checking out budgeting strategies from NerdWallet:

- Traditional Budgeting: Use a spreadsheet or apps like GoodBudget to track every dollar.

- 50/30/20 Rule: Spend 50% on needs (rent, food), 30% on wants (fun stuff), and 20% on savings or paying off debt.

- Zero-Based Budgeting: Give every dollar a job, so your income minus expenses equals zero.

- Envelope Budgeting: Use cash envelopes to cap spending in areas like groceries.

Example: Got $3,000 a month? With the 50/30/20 rule, that’s $1,500 for needs, $900 for wants, and $600 for savings or debt. It’s a simple way to start living frugally this year.

Tracking Expenses to Save Money

Writing down what you spend makes it much easier to see where you can gently cut back. Maybe it’s that “no big deal” coffee that quietly adds up to $50 a month. Here’s how to keep tabs and stay frugal in 2025:

- Budgeting Apps: Try YNAB or another budgeting app that auto-sorts your spending.

- Spreadsheets: Build a quick Excel sheet for hands-on tracking.

- Notebook: Jot down every purchase in a small notebook—retro but super effective!

Tip: A quick weekly check-in with your spending is enough to spot patterns and adjust your budget before things drift too far. For app and spreadsheet picks, see our free financial tools.

Many readers like using a separate checking account just for bills or everyday spending, so one bank holds income and savings while another keeps the day-to-day budget clear.

Step 2: Cut Costs the Smart Way

Great—now let’s trim those expenses by starting with your biggest bills and making a few simple changes.

Smart Grocery Shopping

Groceries can quietly eat up a big chunk of your budget, but a little planning goes a long way. According to the U.S. Bureau of Labor Statistics, food-at-home spending increased in 2023. Here are a few ways to trim that bill and still keep your meals feeling good:

- Meal Planning: Plan your meals for the week so you’re not stuck ordering last-minute takeout.

- Shop with a List: Bring a short list and try to buy mostly what’s on it.

- Compare Prices: Check prices at places like Aldi or Walmart and see which store usually wins for your basics.

- Buy in Bulk: Stock up on shelf-stable staples like rice or canned beans when the price is good.

- Use Leftovers: Turn last night’s veggies into a tasty soup or lunch bowl instead of tossing them.

- Go Generic: Store brands often taste similar and can save you up to 30%.

2025 Tip: Food prices are still shifting. Keep a simple price book, favor seasonal produce, and add a small buffer to your grocery line so rising staples don’t derail your plan. Cooking for two? Try our budget grocery plan.

Affordable Housing Options

Housing is often your biggest bill. Here’s how to trim it down and stay frugal in 2025:

- Downsize: Move to a smaller place to save on rent or mortgage.

- Rent a Room: Earn extra cash by renting out a spare room.

- Consider Refinancing: If the math works after fees and term, refinancing may lower your total cost.

- Negotiate Rent: Sweet-talk your landlord for a discount.

- Get a Roommate: Split rent to lighten the load.

Reducing Transportation Costs

Between gas, parking, and repairs, cars and commutes can quietly eat your budget. Try these ideas to bring those costs down:

- Walk or Bike: Ditch the car for short trips.

- Public Transit: Hop on a bus or train for cheap travel.

- Carpool: Share rides with coworkers to cut gas costs.

- Maintain Your Car: Regular upkeep prevents pricey repairs.

- Shop for Insurance: Compare rates for better deals.

Example: Biking to work saves gas, cuts maintenance costs, and keeps you fit—a triple win for your wallet, health, and the planet!

Low-Cost Entertainment

You don’t have to spend much to have a good time. Here are some low-cost ways to enjoy yourself while staying frugal:

- Free Events: Check out local festivals or free museum days.

- Library Resources: Borrow books, movies, or even board games.

- Game Nights: Invite friends over for a fun, cheap evening.

- Outdoor Fun: Go hiking or have a picnic in the park.

Managing Subscriptions

Streaming services and apps feel cheap on their own, but together they add up quickly. Canceling even one $15/month subscription frees up $180 a year—that’s money back in your pocket. A quick review every month keeps them in check and helps you stay frugal in 2025:

- Review Subscriptions: Ditch ones you barely use.

- Negotiate Rates: Call providers and ask for discounts.

- Share Plans: Split costs with family or friends.

- Go Free: Check out free platforms like YouTube.

Conserving Utilities

Lower your bills with these simple tricks to reduce monthly costs:

- Save Energy: Unplug devices and switch to LED bulbs.

- Conserve Water: Fix leaks and take quick showers.

- Tweak the Thermostat: Lower it in winter, raise it in summer.

- Seal Drafts: Stop heat from escaping around windows.

- Claim Rebates: Check 2025 utility or local-government rebates for LEDs, smart thermostats, insulation, or heat pumps.

Rebate and tax-credit programs change and vary by location—start with DOE Home Energy Rebates and ENERGY STAR federal tax credits to see what may apply.

Step 3: Building Habits to Stay Frugal in 2025

Frugality isn’t a one-and-done challenge—it’s a set of habits you keep coming back to. Friends will still suggest pricey outings, but you can find a middle ground. One of my friends, Sarah, saved around $600 last year simply by hosting potluck dinners instead of going out every time. The ideas below can help that kind of frugal rhythm stick.

Mindful Spending Practices

Before you buy, pause for a second and ask a couple of questions, like “Do I really need this?” or “Is there a cheaper version that would work just as well?” That quick check-in slows down impulse buys and keeps your spending honest.

DIY Projects for Savings

DIY projects can be genuinely fun and often cheaper than buying new. Try these ideas to boost your frugal game in 2025:

- Home Repairs: Fix a leaky faucet with a YouTube tutorial.

- Gardening: Grow herbs or veggies to cut grocery costs.

- Crafts: Make homemade gifts like candles or scarves.

- Cleaning Hacks: Mix vinegar and water for a cheap cleaner.

Example: Sarah scored a $20 thrift store table, sanded it down, and painted it for a fresh look, saving $200 over a new one. Pair these with frugal minimalism to prevent clutter from creeping back.

If you’d love a bit more breathing room beyond cutting costs, a small freelance side gig can help:

Even one or two small clients a month can give your frugal budget a little extra breathing room.

Embracing Minimalism

Minimalism is all about less clutter, more freedom. Clear out your space, skip impulse buys, and focus on experiences like a sunset hike over buying the latest tech. It’s a big part of sustainable saving.

No-Spend Days

Try no-spend days to hit pause on buying. A weekend or one-week reset helps you finish what you have at home and spot easy savings.

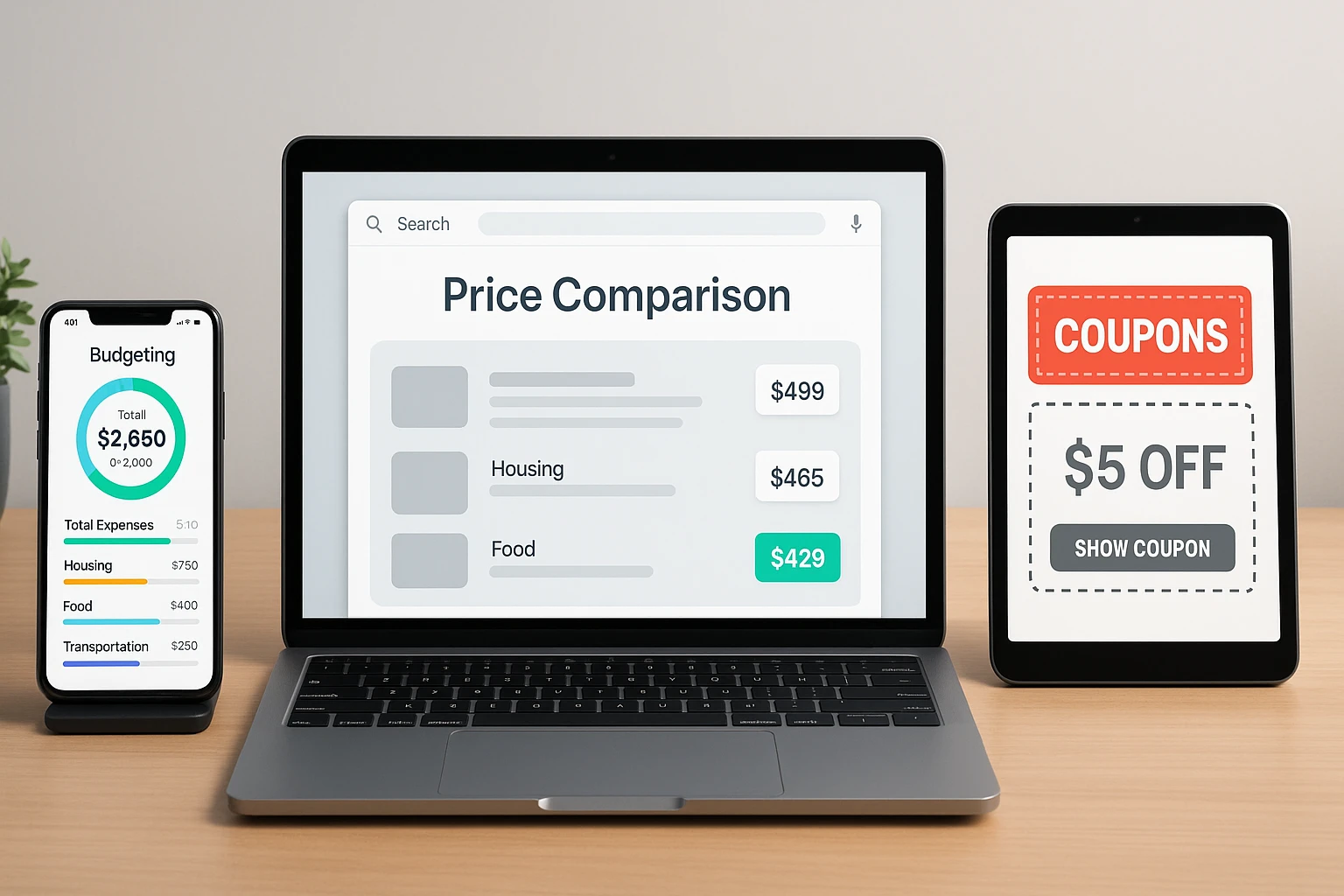

Step 4: Using Tech to Be Frugal in 2025

In 2025, tech can quietly handle a lot of the frugal work for you. A few well-chosen apps can track, nudge, and remind you so you don’t have to think about every tiny money decision.

Budgeting Apps

Apps like GoodBudget or PocketGuard track your spending and set goals, keeping you on track.

AI helpers: Newer budgeting apps can auto-categorize, surface wasteful subscriptions, and forecast cash flow—look for “AI” or “smart insights” in features.

Price Comparison Tools

Sites like CamelCamelCamel help you snag the best deals by comparing prices across stores—a smart way to avoid overspending.

Coupon Apps

Apps like Honey or RetailMeNot can test available coupon codes for you at checkout, shaving a bit off the things you were already planning to buy.

Cashback Programs

Cashback sites such as Rakuten give you a small percentage back when you shop through their links. For more picks, see our roundup of the best budgeting tools.

Step 5: Embracing a Frugal Mindset

The thing that keeps frugality going long term is your mindset. Simple habits like practicing gratitude can make impulse shopping feel a lot less tempting.

Gratitude and Appreciation

Noticing what you already have and enjoy makes “I need this right now” feel less urgent. It’s a simple way to spend more on purpose, not by accident.

Long-Term Thinking

Keeping a couple of big goals in mind—like paying off debt or building a rainy-day fund—can make the day-to-day trade-offs feel worth it.

Example: Pick a method (avalanche = highest APR first, snowball = smallest balance). Commit an extra $25–$50 each month to the target account; when it’s gone, roll that amount to the next. Not sure which to choose? Compare the debt snowball vs. avalanche methods.

Patience and Perseverance

Frugality’s a long haul, not a quick dash. Slip up? No worries—just dust off and keep moving!

Celebrating Small Wins

Give yourself a pat on the back for small wins, like skipping takeout to pocket a few bucks.

Frugal Living Checklist

Ready to test your frugal skills? Use these steps as a quick guide on how to start frugal living, then try the interactive quiz above for personalized tips to keep your savings momentum going.

Bonus: Grab Your Free Frugal Living Checklist

Want a quick guide to stay frugal in 2025? Drop your email below to download our free Frugal Living Checklist and keep smart money moves top of mind!

[Opt-in Form Placeholder – Replace with your actual opt-in form code here]

Frugal Living FAQs (2025)

Conclusion: Your 2025 Frugal Game Plan

Nailing your 2025 frugal plan is one of the simplest ways to feel calmer about money. With a more mindful approach, a few trusted tools, and steady small changes, your budget will start to feel lighter. Swap a few fancy outings for low-key, budget-friendly nights in, notice what’s working, and keep building from there.

This content is for informational purposes only and not financial advice. Consult a professional before making financial decisions. Offers, apps, and rebate programs change over time and vary by location.