Ever wondered what happens if I make biweekly payments on my mortgage? When I first ran the numbers, I was shocked—over the life of the loan you could potentially save around $40,000 in interest and pay off your home faster without blowing up your budget. My friend Sarah, a teacher from Ohio, used this simple tweak to cut about 5 years off her loan. If you like practical ways to get ahead without feeling deprived, this biweekly mortgage strategy can be a gentle but powerful upgrade to what you’re already doing. If you want the full picture, our homeowner’s guide to mortgages walks through refinancing, tax questions, and more in detail.

Short answer: If you switch from standard monthly payments to true biweekly payments, you’re basically building in one extra full payment per year. That extra chunk goes toward your principal, so you pay less interest overall and can often finish your mortgage several years sooner—without dramatically changing your monthly lifestyle.

Biweekly Mortgage Calculator: Estimate Your Savings

Enter your loan details to estimate time and interest savings.

Your Estimated Savings

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Benefits of Biweekly Payments

- Biweekly Payments: What It Means

- How Biweekly Payments Save Interest (Why It Works)

- Real-World Savings: Mortgage Payoff Examples

- Is This Biweekly Payment Strategy Right for You?

- Set Up a Biweekly Payment Plan

- Key Considerations Before Starting

- Estimate Your Savings with Biweekly Payments

- Frequently Asked Questions About Biweekly Payments

- Your Path to Mortgage Freedom

If I were looking at my own mortgage, I’d start by plugging in today’s balance, interest rate, and the principal-and-interest portion of my payment. Then I’d ask a simple question: does the time and interest saved here feel more valuable than what that extra money could do somewhere else—like paying off a 20% credit card or padding my emergency fund?

Numbers from the calculator and examples in this guide are simplified estimates for learning only. Your interest savings will depend on your exact loan terms, payment amount, and lender policies, so talk with your lender or a qualified financial professional before making changes.

Key Benefits of Biweekly Payments

Wondering how paying every two weeks helps? Here are the biggest perks I’ve seen, especially when paired with smart budgeting:

- One Extra Payment a Year: Paying half your mortgage every two weeks means 26 half-payments—13 full payments instead of 12.

- Quicker Principal Paydown: That extra payment chips away at your principal, slashing interest over time.

- Huge Interest Savings: On a 30-year mortgage, you could save tens of thousands in interest.

- Faster Mortgage Freedom: Paying down principal sooner can cut years off your loan.

- Simple Setup: Join a lender’s program (watch fees) or DIY to keep costs low.

If you’ve ever felt like your balance barely moves from month to month, a biweekly plan can be a quiet way to speed things up in the background so you see progress a little faster over time.

While you’re optimizing how you pay your mortgage, it can also be worth checking whether you’re overpaying for homeowners insurance.

What Happens If I Make Biweekly Payments on My Mortgage? (What It Means)

Most homeowners pay monthly. With a biweekly schedule, you pay half your monthly payment every two weeks. For example:

- A year has 12 months, so monthly payments total 12.

- A year has 52 weeks, so biweekly payments total 26 half-payments.

Those 26 half-payments equal 13 full monthly payments annually—one extra payment without much pain. That small change has a big impact.

How the Math Works

Consider a $1,500 monthly mortgage payment to see the impact of a biweekly schedule:

- Biweekly Payment: $750 every two weeks.

- Annual Biweekly Total: $750 × 26 = $19,500.

- Annual Monthly Total: $1,500 × 12 = $18,000.

- Extra Payment: $19,500 − $18,000 = $1,500 (one full payment).

This extra payment reduces your principal, which lowers interest. For mortgage basics, see CFPB’s guide. If you want to dive deeper into your own numbers, try our simple loan amortization calculator with extra payments.

How Biweekly Payments Save Interest (Why It Works)

Interest accrues on your remaining principal. Early in a loan, most of your payment covers interest (amortization). Biweekly payments help in two ways:

- More Frequent Payments: Paying every two weeks reduces your principal more often, slightly lowering interest each cycle.

- Extra Annual Payment: The 13th payment cuts principal further, compounding savings over time.

“Every dollar paid toward principal is a dollar that won’t accrue interest over decades.”

On a $200,000 loan at 5%, paying more often reduces principal earlier, creating a snowball effect. That’s why even small, consistent changes can feel surprisingly powerful once you see your updated payoff date.

Does It Work for Adjustable-Rate Mortgages (ARMs)?

Yes. The extra payment reduces principal, saving interest. With rate changes, savings vary. Ask your lender how they apply a two-week schedule.

Real-World Savings: Mortgage Payoff Examples

Let’s look at real examples of paying every two weeks. Savings vary by loan amount, rate, and term. You can also plug your own loan into our free mortgage payoff calculator to see a customized schedule.

When Sarah switched to biweekly payments on her ~$280,000 mortgage, the payoff estimate dropped by about 4 years and the projected interest cost fell by roughly $30,000—without her feeling like she’d taken on a second job just to make the payment work. Your numbers will be different, but this is a good example of how meaningful the shift can be over time.

Example 1: 30-Year Mortgage

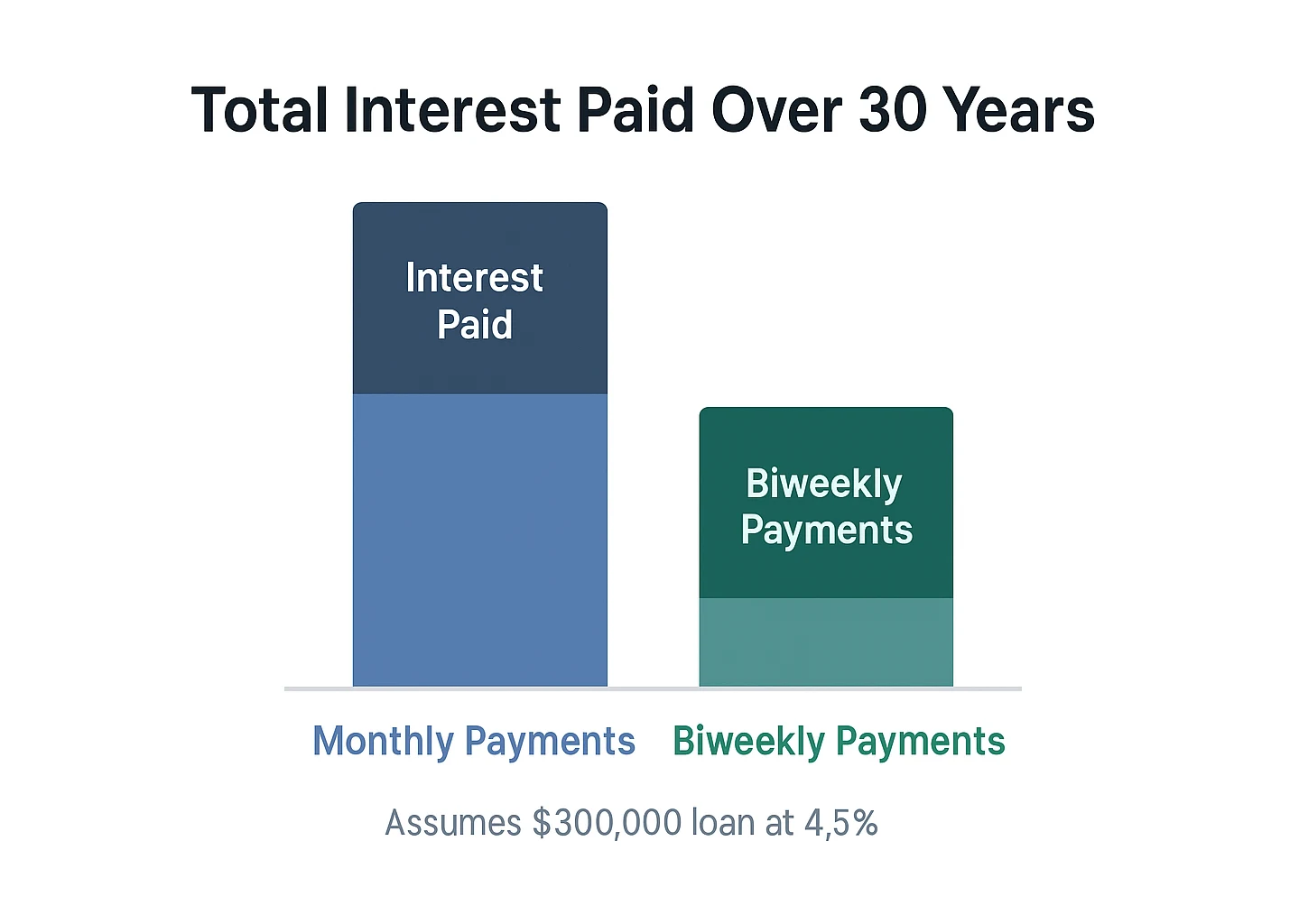

Assume a $300,000 loan at 4.5% over 30 years with a $1,520 monthly payment:

- Monthly Payments: Total interest ~$247,200; payoff in 30 years.

- Biweekly Payments: $760 every two weeks; effective monthly payment $1,646.67.

Results (rounded, for illustration only):

| Mortgage Detail | Monthly Payments | Biweekly Payments |

|---|---|---|

| Loan Amount | $300,000 | $300,000 |

| Interest Rate | 4.5% | 4.5% |

| Loan Term | 30 Years | ~25.5 Years |

| Monthly Payment | $1,520 | (Effective) $1,646.67 |

| Total Interest Paid | ~$247,200 | ~$205,000 |

| Total Savings | N/A | ~$42,200 |

| Time Saved | N/A | ~4.5 Years |

In this example, switching to biweekly payments could save you a little over $40,000 in interest and help you pay off your mortgage roughly 4½ years sooner.

Example 2: 15-Year Mortgage

For a $300,000 loan at 4.0% over 15 years with a $2,219 monthly payment:

- Monthly Payments: Total interest ~$99,420; payoff in 15 years.

- Biweekly Payments: $1,109.50 every two weeks; effective monthly payment $2,403.92.

Results (rounded, for illustration only):

| Mortgage Detail | Monthly Payments | Biweekly Payments |

|---|---|---|

| Loan Amount | $300,000 | $300,000 |

| Interest Rate | 4.0% | 4.0% |

| Loan Term | 15 Years | ~13.5 Years |

| Monthly Payment | $2,219 | (Effective) $2,403.92 |

| Total Interest Paid | ~$99,420 | ~$88,000 |

| Total Savings | N/A | ~$11,420 |

| Time Saved | N/A | ~1.5 Years |

Even on shorter loans, you could save around $11,000 in interest and about 1½ years in this kind of example.

Is a Biweekly Mortgage Right for You?

Considering paying every two weeks? Weigh these pros and cons to see if it fits your goals:

| Pros | Cons |

|---|---|

|

|

For most homeowners with stable income, the benefits can make biweekly payments a smart move. But it’s not a magic trick. If cash flow feels tight, or you’re juggling high-interest credit cards or personal loans, redirecting extra money there first often gives you a bigger win. You can always circle back to biweekly payments once your day-to-day money stress feels lighter.

Biweekly payments tend to work best if your income is predictable, you have an emergency fund in place, and your lender doesn’t charge steep fees or penalties. Sound familiar? If you’re eager to be debt-free sooner but still want breathing room in your monthly budget, this approach can be a helpful middle ground.

When Biweekly Payments Might Not Be the Best Move

- You have high-interest debt: If you’re carrying credit card balances at 20%+, paying those down usually beats accelerating a 3–7% mortgage.

- You’re behind on bills or lack an emergency fund: Catching up on essentials and building 3–6 months of expenses often deserves first priority.

- Your income is very irregular: Commission-based or seasonal income can make rigid biweekly payments stressful.

- Your lender charges high fees: If the biweekly “program” comes with chunky setup or monthly fees, a DIY extra-payment approach is usually better.

If you’d like to compare biweekly payments with other ways to speed up your payoff—like rounding up payments or putting windfalls toward principal—our guide to 7 mortgage payoff hacks to save thousands walks through other practical options you can pair with or use instead of a biweekly plan.

How to Set Up a Biweekly Payment Plan

Ready to try paying every two weeks on your mortgage? Choose between a lender program or DIY. The DIY route often avoids fees.

Option 1: Lender-Assisted Programs

Many lenders offer biweekly payment programs. Here’s how:

- Contact your lender to check for biweekly options.

- Enroll and authorize automatic biweekly deductions.

- The lender applies the extra payment to principal.

Caution: Ask about fees (setup, transaction, or annual) and whether payments are applied immediately.

Option 2: DIY Biweekly Payments

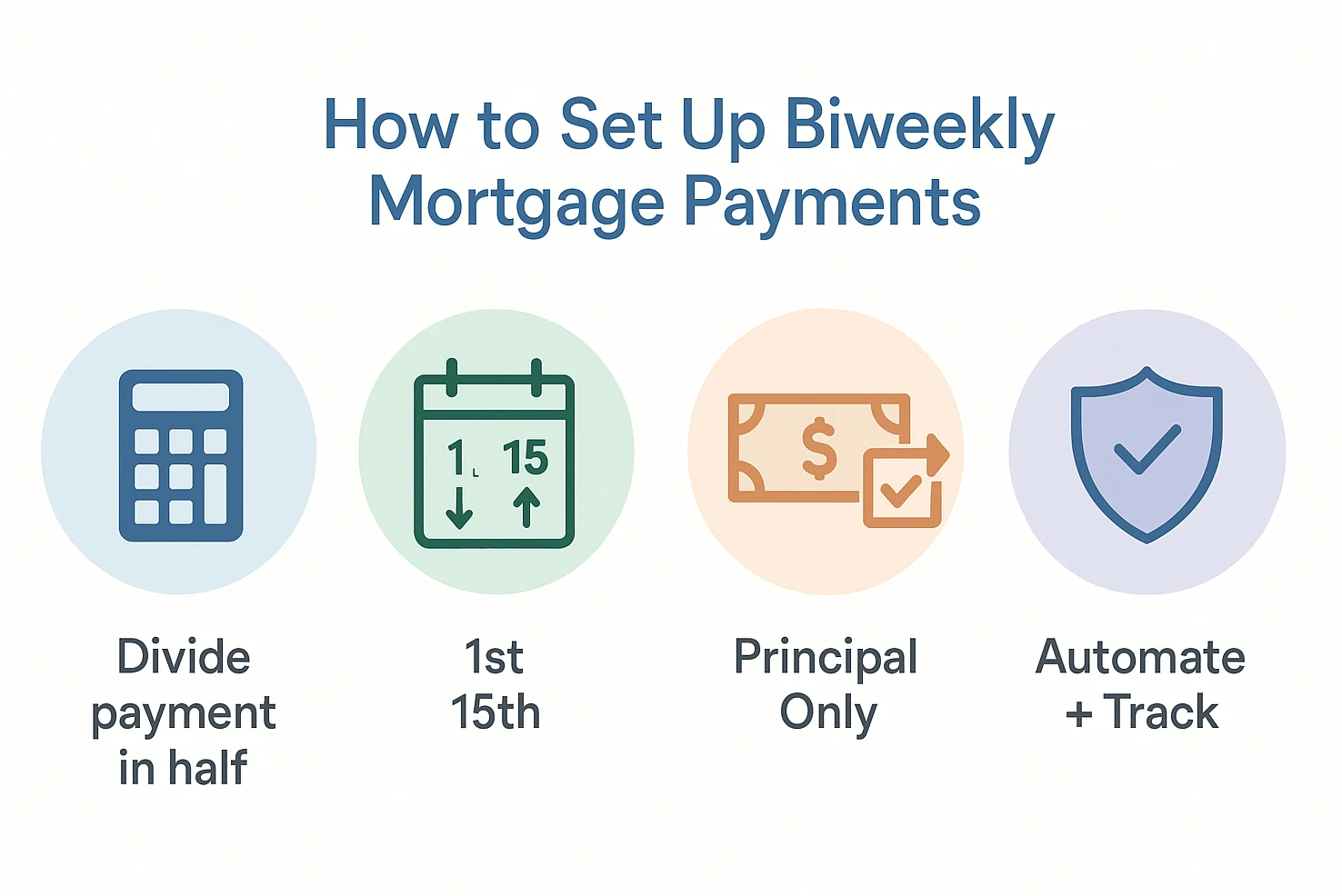

This no-fee approach lets you control your payments and see the benefits. Here’s a simple way to set it up:

- Figure Out Your Payment: Halve your monthly principal & interest (e.g., $1,500 → $750).

- Schedule Payments: Set automatic transfers every two weeks (e.g., 1st and 15th).

- Direct to Principal: Ensure extra funds are applied to principal.

- Plan for Three Half-Payments: A couple of months each year will include a third half-payment, creating that “extra” annual payment.

Key Considerations Before Starting

Before you jump in, here’s what to watch for when exploring biweekly payments:

- Prepayment Penalties: Rare, but check your loan docs.

- Escrow Accounts: Keep escrow monthly; biweekly applies to principal & interest.

- Stay Consistent: Skipped payments shrink savings.

- Paycheck Timing: If you’re paid biweekly, matching payments to your pay schedule can simplify budgeting.

- Chat with Your Lender: Confirm how extra payments are handled, and double-check your next statement to be sure extra money is labeled as principal, not just “unapplied funds.” If something looks off, call your servicer and ask them to walk you through how they apply biweekly and extra payments.

- Your Bigger Money Picture: Make sure biweekly payments won’t crowd out building a 3–6 month emergency fund or paying down high-interest debt that’s costing you far more than your mortgage rate.

If you’re still fine-tuning your money plan, you might find it helpful to read our main guide on how to live frugally and save money before committing to biweekly payments. If you’re unsure what to tackle first, a quick conversation with your lender or a HUD-approved housing counselor can help you see the trade-offs clearly. If you’ve ever made an extra payment and later noticed it sitting in an “unapplied” line on your statement, you know how confusing this can be—clear communication with your servicer helps you avoid that frustration.

If you’d rather talk through these trade-offs with a real person, you can ask a pro:

Chat with a finance pro about your mortgage

Ask a finance expert online

Frequently Asked Questions About Biweekly Payments

Your Path to Mortgage Freedom

So, are biweekly payments worth it? You unlock a simple strategy that can help you save thousands and shorten your payoff timeline. Whether through your lender or DIY, small, steady changes can make a big difference. If the idea of smaller, more frequent payments fits your budget, start today—you’ll thank yourself later when your mortgage is gone years sooner.

And if you’re wondering whether a rate change might help more than a payment schedule change, our mortgage refinance break-even calculator can help you see how long it would take for a refinance to pay for itself.

For more background on mortgages, prepayments, and your rights as a borrower, it’s also worth reviewing guidance from your lender and public resources from agencies like the CFPB or HUD so you understand how these strategies apply to your specific loan.

This content is for informational and educational purposes only and does not constitute financial, tax, or legal advice. All calculations and examples are simplified estimates—not guarantees of future results—and your situation may look very different. Consider talking with a qualified financial professional or your lender before making changes to your mortgage or budget, because individual circumstances and goals can vary a lot.