Dreaming of retiring at 60 with $1 million? You don’t need a perfect plan—just steady steps that actually fit your life. This guide walks you through how to retire at 60 with 1 million dollars—from withdrawals to healthcare and investing—so the numbers feel doable. New to the broader idea? Start with our financial independence and early retirement guide. Ready to start? Let’s go. 🚀

Retirement Snapshot Calculator

Auto-updates as you type. Annualize housing and healthcare inside “Annual Spending.” Mobile-friendly for quick checks.

Your Retirement Snapshot 📈

Plan viability status and key metricsEstimates only. For accuracy, include housing and healthcare in annual spending and revisit yearly as prices and income change.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for a $1M, Age-60 Retirement

- Can You Retire at 60 with $1 Million?

- Mastering Safe Withdrawal Rates

- Retirement Budget (Practical)

- Navigating Healthcare Before Medicare

- Social Security Timing & Strategies

- Smart Investment Drawdown Strategies

- Building a Resilient Retirement Portfolio

- Lifestyle Scenarios: Making $1 Million Work

- Retirement Snapshot Calculator

- FAQs About Retiring at 60 with $1M

- Conclusion: Start Your Retirement Journey Today

Key Takeaways for a $1M, Age-60 Retirement

Here’s the quick version:

- $1 Million Can Work: Pair thoughtful planning with a lifestyle that fits your spending level.

- Safe Withdrawal Rates Matter: A 3.5%–4% range balances income and longevity.

- Budgeting and Healthcare: Build a detailed budget and plan for pre-Medicare coverage (60–65).

- Drawdowns: The order and timing of your withdrawals can stretch your nest egg.

- Review annually: Check in once a year and tweak the plan as your life and the market change.

The big picture: how to retire at 60 with 1 million dollars

Can $1 million really last 30–40 years if you retire at 60? It can—if a few big levers break your way:

- Annual spending: The leaner your lifestyle, the longer your money lasts.

- Health: Surprise medical bills can derail a budget quickly, so plan a cushion.

- Social Security timing: Claim age affects income.

- Investment returns: Portfolio performance matters.

- Inflation: Rising prices compound over decades.

- Flexibility: Willingness to adjust spending helps.

For some, $1 million is enough with careful management; others may add part-time work or choose a more modest lifestyle. Strong retirement planning ties these drivers together. Run your numbers to be sure—your calculator above can help.

Safe Withdrawal Rates for a $1M, Age-60 Plan

If you’re mapping your retirement at 60 with a $1 million nest egg, start with your withdrawal rate—the lever that governs durability and income.

Safe withdrawal rates sit at the core of a $1M, age-60 plan: the percentage you withdraw yearly, adjusted for inflation, designed to avoid depleting funds too soon.

The 4% Rule: A Classic Guideline

The “4% Rule” suggests withdrawing 4% of your initial portfolio in year one, then adjusting for inflation annually.

How it works: With $1,000,000, a 4% rate means $40,000 in year one. If inflation is 3% in year two, you’d withdraw $41,200, and so on.

Pros of the 4% Rule:

- Simplicity: Easy to apply.

- Historical basis: See analysis such as the Financial Planning Association paper on safe withdrawals over 30 years.

Considerations for Early Retirement:

- Longer horizons: You may need 35–40+ years at age 60.

- Sequence risk: Early downturns bite when withdrawals are fixed.

- Market uncertainty: Future returns could be lower than history.

A Safer 3.5% Rule for a Long Retirement

For longer timeframes, many planners prefer ~3.5%.

How it works: With $1,000,000, year-one income is ~$35,000—lower, but typically more durable.

Pros:

- Longevity: Higher odds of lasting 35–40+ years.

- Downturn buffer: More resilient in poor early returns.

Trade-off: Lower initial income, so budgeting matters.

Crafting a Retirement Budget: Every Dollar Counts

Budgeting simply matches what you spend to what your plan can safely pay. Aim for $35,000–$40,000 a year—then trim or flex when life changes. Sound familiar?

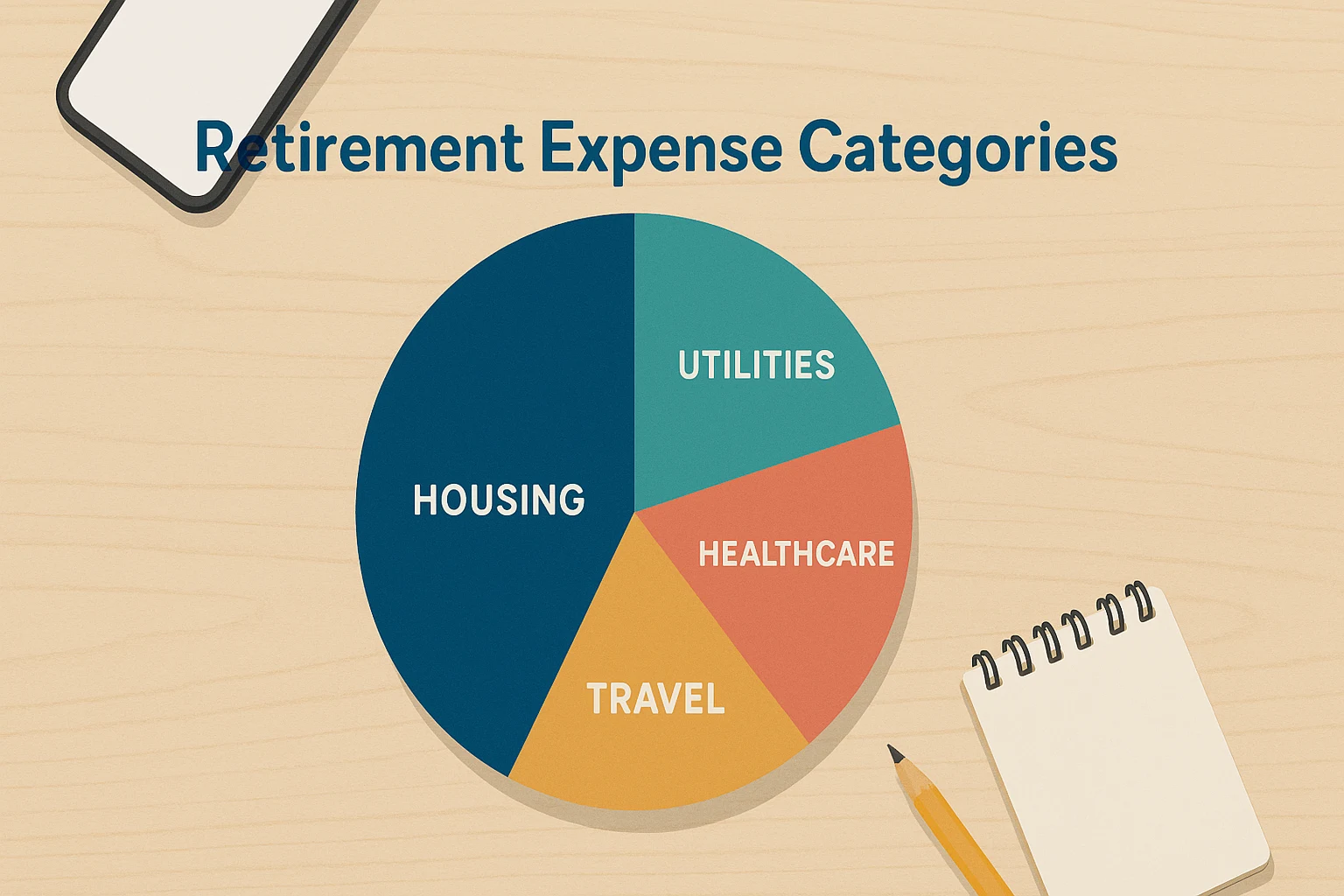

Understanding Your Expenses

Fixed expenses: Housing (mortgage/rent, taxes, insurance), utilities, insurance, debt payments (ideally none), and subscriptions. Keep these lean to reduce your baseline.

Variable expenses: Food, transportation, healthcare (co-pays, prescriptions), entertainment & hobbies (travel, events), clothing/personal care, and gifts/charity. These flex with lifestyle and are your easiest levers. For more ideas on shrinking everyday costs, explore our frugal living and saving guide.

Tips for a $35,000–$40,000 Budget

- Housing: Downsize or relocate to lower-cost areas.

- Transportation: Use one car or a fuel-efficient model.

- Food: Cook at home; limit dining out.

- Travel: Favor local or off-peak trips.

- Healthcare: Budget premiums and out-of-pocket costs.

- Debt: Eliminate high-interest balances.

Sample Budget for Retiring at 60 with $1M

| Category | Monthly Budget | Annual Budget | Notes |

|---|---|---|---|

| Housing (paid off) | $800 | $9,600 | Property taxes, insurance, maintenance |

| Utilities | $250 | $3,000 | Electricity, water, internet, phone |

| Groceries | $400 | $4,800 | Mostly home-cooked meals |

| Transportation | $200 | $2,400 | Gas, insurance, maintenance (one car) |

| Healthcare (pre-Medicare) | $600 | $7,200 | ACA premium, deductibles, co-pays |

| Personal care/misc | $150 | $1,800 | Haircuts, toiletries, small purchases |

| Entertainment/hobbies | $300 | $3,600 | Dining out, movies, local activities |

| Contingency/buffer | $300 | $3,600 | Unexpected expenses, small trips |

| Total | $3,000 | $36,000 | Remaining $2,000 for travel/one-offs |

This sample shows a $36,000 annual plan with a buffer.

Navigating Healthcare Before Medicare (Ages 60–65)

Medicare starts at 65, so you’ll need a five-year bridge. A quick Marketplace check can keep premiums in line with your budget.

To compare concrete plan options and costs, review our health insurance options for early retirees guide.

Your Healthcare Options

- COBRA: Continue your employer’s plan for 18–36 months.

- Pros: Same plan and doctors.

- Cons: Full premium plus fees; often costly.

- Affordable Care Act (ACA) Marketplace:

- Pros: Income-based subsidies can lower premiums.

- Cons: Deductibles may be higher; you’ll need to keep an eye on AGI to qualify.

- Spouse’s health plan:

- Pros: Often the cheaper route.

- Cons: Only works while your spouse is employed and eligible.

- Health sharing ministries:

- Pros: Can cost less than traditional insurance.

- Cons: Not insurance; may limit or deny certain claims.

Budgeting for Healthcare Costs

Start with a monthly line for premiums plus typical out-of-pocket expenses, then adjust for your health and location.

Smart Investment Drawdown Strategies

Withdraw from accounts in a tax-aware order and keep income steady.

If you’re still building your confidence with index funds and asset allocation, walk through our beginner’s guide to index fund investing first.

Bucket Strategy for a 30+ Year Horizon

Organize investments into buckets:

- Bucket 1 (cash, 1–3 years): High-yield savings for near-term needs.

- Bucket 2 (income, 3–10 years): Bonds or dividend payers.

- Bucket 3 (growth, 10+ years): Equities to outpace inflation.

Tax-Efficient Withdrawal Order

- Taxable accounts: Manage capital gains and AGI.

- Tax-deferred accounts: Ordinary income; RMDs often start at age 73 (and later for some younger cohorts), so confirm your exact start age.

- Roth (tax-free): Save for last if possible.

Prefer quick expert guidance on taxes or withdrawal timing?

Rebalancing and Flexibility

Rebalance annually and adjust withdrawals in response to market conditions. Consider simple guardrails (for example, review when stocks or bonds drift ~10% off target) to stay on track without constant tinkering.

Building a Resilient Retirement Portfolio

Balance income, growth, and risk.

Asset Allocation for Age 60

One guideline:

- Equities (40–60%): Broad index funds, ETFs, dividend stocks.

- Fixed income (30–50%): Short- to intermediate-term bonds.

- Cash (5–10%): 1–3 years of expenses.

Diversification and Inflation Protection

Diversify across asset classes and consider TIPS to combat inflation.

Lifestyle Scenarios: Making $1 Million Work

Here’s how $1 million can support different lifestyles with a $35,000–$40,000 draw.

The Frugal Retiree

- Income: $35,000/year (3.5% SWR)

- Traits: Mortgage-free, low-cost area, cooks at home.

- Viability: High with delayed Social Security.

The Moderate Retiree

- Income: $40,000/year (4% SWR) plus later Social Security.

- Traits: Small mortgage, occasional dining out, domestic travel.

- Viability: Medium-high; monitor regularly.

The Part-Time Work Retiree

- Income: $35,000/year + $10,000–$20,000 from part-time work.

- Traits: Supplements income to fund extras and reduce portfolio strain.

- Viability: Very high.

This style of retirement overlaps with a Barista FIRE approach, where part-time work helps cover extras and reduce sequence risk.

Frequently Asked Questions About Retiring at 60 with $1M

Conclusion: Start Your Retirement Journey Today

Retiring at 60 with $1 million is achievable with smart planning. Tune withdrawals, plan healthcare, time Social Security wisely, and keep a balanced, flexible portfolio. Revisit the plan each year and use the calculator above to stress-test your numbers. Build a flexible plan and keep your retirement planning simple and repeatable. You’ve got this. 🥳

This content is educational and for general information only—NOT financial, tax, or legal advice. Talk with a fee-only fiduciary advisor and a licensed tax professional before making decisions. Social Security and tax rules can change; confirm current guidance with official sources.

Optimizing Social Security Benefits for Retirement Planning

Claim timing can reshape your lifetime income—earlier helps cash flow now, later boosts your monthly check.

Claiming Options and Impacts

Strategies for Age 60 Retirement

Fund early years from your portfolio, then choose a claim age based on needs and risk tolerance:

Example (FRA benefit $2,000/month):

If Social Security will be a major part of your income later, plan how to stretch it with our frugal Social Security lifestyle guide.