When Sarah’s car broke down with a 580 credit score, she landed on Explore Credit as one of the few lenders willing to say yes. That yes comes with a big catch: very high APRs compared with what you’d see at most banks or credit unions. In this explore credit loan review, we’ll cut through the marketing and show you when this loan might be a necessary last resort, when it’s too risky, and which cheaper options to look at first. By the end, you’ll know exactly what Explore Credit costs, how it affects your credit score, and how to avoid getting trapped in long-term debt—for ongoing strategies to tackle balances, see our debt management plan guide.

Explore Credit (explorecredit.com) is a real online lender offering short-term installment loans in selected U.S. states; this review is based on publicly available information and borrower reports and is not sponsored by the company. The company’s own marketing has cited APR ranges that can reach into the mid-30% range for some borrowers, which is still far more expensive than many credit union personal loans. It sits in the same high-cost bucket as many emergency loans for fair credit you see online.

Your Best-Fit Explore Credit Loan Review Tool

Answer a few quick questions to see if this high-cost loan fits you.

Question 1 of 4

Your guidance will appear here

Choose an answer above to start tailoring your recommendation.

💡 Tip: Be honest about your budget and alternatives for the most useful result.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Your Best-Fit Explore Credit Loan Review Tool

- Key Takeaways

- Understanding Explore Credit: How This Lender Works

- Explore Credit Loan Terms, Costs & Key Features

- Credit Reporting and Score Impact

- Explore Credit Pros and Cons

- Alternative Options: Better Solutions Than Emergency Loans for Fair Credit

- Making Smart Borrowing Decisions: Practical Guidance

- Real-World Scenarios: When Explore Credit Might Make Sense

- Red Flags and Warning Signs

- Building Long-Term Financial Health

- Frequently Asked Questions

- Explore Credit Loan Review: Final Verdict and Recommendations

- Conclusion

- References

Key Takeaways

- High-cost lending: Explore Credit offers installment loans with APRs that can be much higher than traditional bank or credit union options, especially for fair-credit borrowers.

- Fair credit acceptance: The lender specializes in serving borrowers with credit scores as low as 580, providing access when traditional banks may decline applications.

- Credit building potential: On-time payments are reported to major credit bureaus, offering an opportunity to improve credit scores over time.

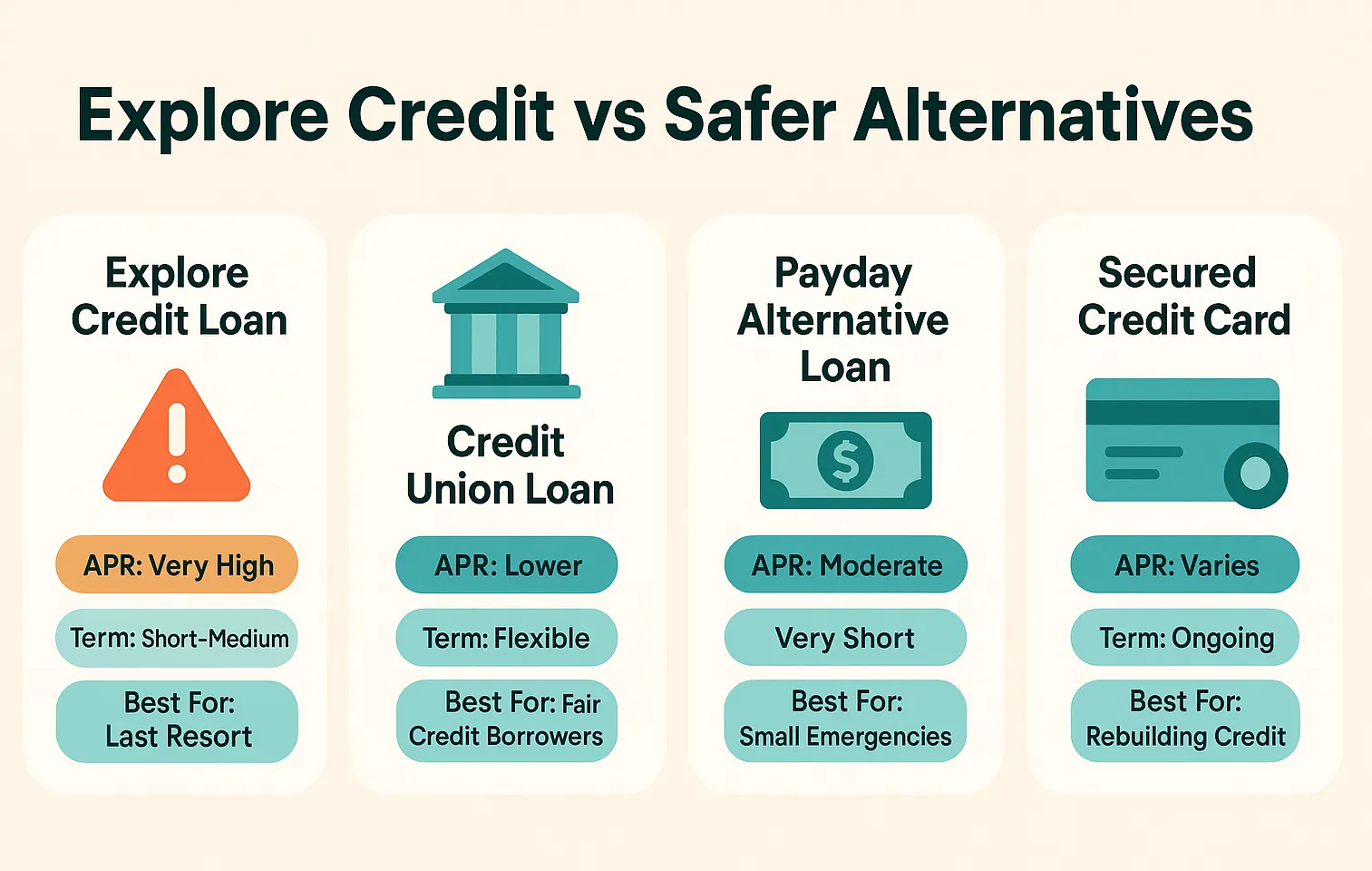

- Alternative options exist: Credit unions, payday alternative loans, and secured credit cards often provide lower-cost solutions for fair credit borrowers.

- Total cost matters: Taking a moment to add up the full repayment amount, including interest and fees, is crucial before you sign any high-cost loan agreement.

Understanding Explore Credit: How This Lender Works

Explore Credit is part of the alternative lending world, serving people who struggle to get approved by traditional banks because of past credit issues. It offers unsecured installment loans that aim to get money into your account quickly, whether you’re dealing with an emergency expense or trying to consolidate higher-interest debt. As one of many installment loans online, it leans on speed and accessibility rather than rock-bottom interest rates.

Eligibility Requirements and Application Process

Explore Credit keeps its eligibility rules looser than many banks. Minimum requirements typically include:

- Credit scores starting around 580 (though some borrowers with lower scores may qualify)

- Steady income from employment or other verifiable sources

- Active checking account for loan funding and automatic payments

- Valid identification and contact information

- Age 18 or older with legal residency status

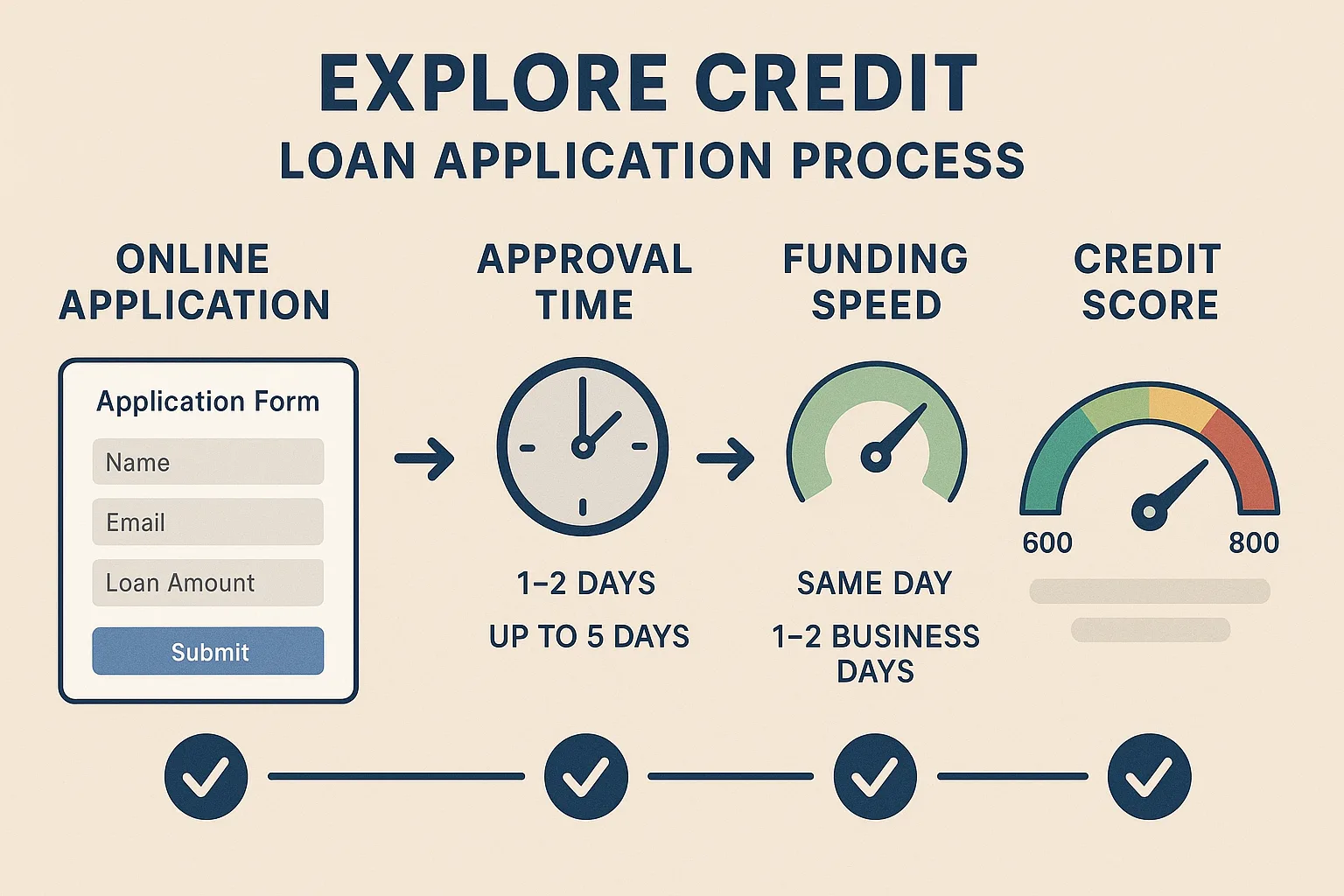

The application itself is built for speed and convenience. You fill everything out online, and in many cases you’ll see a decision within minutes or at least within a few hours. The streamlined process includes:

- Online application submission with basic personal and financial information

- Instant soft credit check that doesn't impact credit scores

- Income verification through bank statements or pay stubs

- Final approval and loan terms presentation

- Electronic signature and funding initiation

Funding Timeline and Loan Disbursement

One of Explore Credit's main selling points is how quickly it can move money. Approved borrowers often receive funds within one business day, and in some cases same-day funding is available. The money is typically deposited straight into your checking account via ACH transfer.

That kind of speed can really matter in an emergency, but it also makes it easy to click through paperwork without fully absorbing the details. The speed of funding shouldn’t distract you from reading the terms, understanding the total cost, and being honest about whether the payment fits your budget.

Explore Credit Loan Terms, Costs & Key Features

To decide whether an Explore Credit loan makes sense for you, it helps to zoom in on the exact terms and costs. This lender’s loans are one of many online installment loans out there, and the details can significantly change what you end up paying overall.

Loan Amounts and Term Lengths

Explore Credit typically offers loans from about $1,000 to $35,000, but the exact amount depends on your credit profile and verified income. First-time borrowers usually qualify for smaller sums and may only see larger offers after they’ve built a track record of on-time payments.

Repayment terms generally span:

- 12 to 60 months for most loan products

- Fixed monthly payments throughout the loan term

- No prepayment penalties, allowing early payoff without additional fees

APR Ranges and Interest Rate Structure

The most important part of any loan review is getting clear on what the loan will really cost you. Explore Credit’s APRs can swing quite a bit based on your credit, the amount you borrow, your term length, and your state. The company and third-party reviewers don’t publish a neat rate chart for every credit tier, but—like many online lenders—fair-credit borrowers are more likely to land toward the higher end of the scale. To get a rough sense of how costs can differ by credit tier across online personal lenders, look at these illustrative APR ranges:

| Credit Score Range | Illustrative APR Range* | Approx. Monthly Payment (24-month, $5,000 loan) |

|---|---|---|

| 580-629 | 25%–35.99% | $265–$300 |

| 630-679 | 15%–25% | $240–$265 |

| 680+ | 8%–15% | $220–$240 |

*These are illustrative ranges based on common online personal-loan offers, not a guaranteed rate sheet for Explore Credit. Your actual APR from Explore Credit or any other lender may be lower or higher depending on your application and state.

State warning: Explore Credit shows your exact APR and maximum cost in state-specific loan agreements and rate charts. Because state laws and small-dollar lending rules change over time, pause before you sign and read the “Truth in Lending” box for your state. Check whether your state caps personal loan APRs (many top out around 36%, while others still allow much higher rates for short-term or tribal loans).

How this compares with mainstream online lenders:

| Lender Type | Typical APR Range | Notes |

|---|---|---|

| Online personal lenders (e.g., Upstart, Best Egg, OneMain) | ~6.5%–35.99% APR | Much lower caps than payday-style loans, but usually require stronger credit or income. |

These example ranges show how much more expensive fair-credit borrowing can be compared with prime borrowers. Even if your offer is nowhere near payday-loan territory, high double-digit personal-loan rates still add up quickly.

Fee Structure and Additional Costs

Beyond the headline interest rate, it’s worth knowing every fee that might show up along the way:

- Origination fees: May range from 1–8% of the loan amount

- Late payment fees: Typically $25–$50 per occurrence

- Returned payment fees: Usually $25–$35 for insufficient funds

- No prepayment penalties: Borrowers can pay off loans early without additional charges

Credit Reporting and Score Impact

One potential upside of Explore Credit loans is that they’re reported to the major credit bureaus. This reporting can help or hurt you, depending on how the loan is managed:

Positive Credit Building Opportunities

Making on-time payments can gradually improve credit scores by:

- Establishing positive payment history (35% of FICO score)

- Adding to credit mix diversity (10% of FICO score)

- Demonstrating responsible debt management over time

Take Marcus, for example. He used an Explore Credit loan to roll several high-interest credit cards into a single payment. By making steady payments for 36 months, his credit score climbed from 595 to 670, and he eventually qualified for a traditional bank loan to refinance at a much lower rate.

If you’re not sure where your own numbers stand, our guide to what is a good credit score explains common score ranges and how lenders interpret them.

Risks of Negative Reporting

On the flip side, missed or late payments are also reported to the credit bureaus and can lead to:

- Immediate score drops of 60–110 points for missed payments

- Long-term negative impact lasting up to seven years

- Increased difficulty qualifying for future credit

Explore Credit Pros and Cons

Advantages of Explore Credit Loans ✅

- Fast approval and funding: Emergency situations often require quick access to funds, and Explore Credit is set up to move quickly.

- Fair credit acceptance: Traditional lenders may automatically decline applications from borrowers with credit scores below 650, while Explore Credit is designed to work with this group.

- Credit building potential: Sticking with on-time payments over time can gradually rebuild a damaged credit score.

- No prepayment penalties: You can pay off the loan early without extra fees, which can cut down the total interest you pay.

- Fixed payments: Having the same payment each month makes it easier to plan your budget and avoid surprises.

Disadvantages and Risks ⚠️

- Extremely high APRs: Many installment loans online, including providers like Explore Credit, can be significantly higher than typical bank or credit union loans, sometimes topping 30% APR. That makes them much more expensive than lower-rate alternatives when you carry the balance for months or years.

- Potential debt trap: High costs can make it hard to stay current, which may lead to more fees and long-term credit damage.

- Limited loan amounts for new borrowers: First-time borrowers may not qualify for larger amounts needed for big-ticket expenses.

- Aggressive marketing: Some lenders market aggressively to people in crisis, which can make it harder to pause and compare options.

- Impact on debt-to-income ratio: A large monthly payment adds to your debt-to-income ratio and can limit your ability to qualify for better loans later.

Alternative Options: Better Solutions Than Emergency Loans for Fair Credit

Before you lock in a high-cost installment loan, it’s worth looking at cheaper paths first—especially if you’ve been seeing lots of flashy ads for expensive emergency loans in your feed.

If high-cost lenders keep saying yes while safer banks say no, it might be time to work on your credit report itself:

Credit Union Personal Loans

Credit unions often provide the most borrower-friendly terms for fair credit consumers. Benefits include:

- APRs typically ranging from 8–18% for fair credit borrowers

- More flexible underwriting considering the whole financial picture

- Lower fees and more forgiving policies

- Financial counseling and education resources

Example: A $5,000 loan at 15% APR over 36 months costs $173 monthly with total interest of $1,228, compared to potentially much higher interest costs with high-APR online lenders.

Payday Alternative Loans (PALs)

Federal credit unions offer PALs as a safer alternative to payday loans. Features include:

- APRs capped at 28% by federal regulation

- Loan amounts from $200–$1,000 (PAL I) or $200–$2,000 (PAL II)

- Terms from 1–6 months

- Lower fees and more reasonable repayment terms

Secured Credit Cards and Credit Builder Loans

For borrowers primarily focused on credit building rather than immediate funding needs:

Secured credit cards require a security deposit but offer:

- Lower costs than installment loans

- Revolving credit that improves credit utilization ratios

- Potential graduation to unsecured cards

Credit builder loans are specifically designed for credit improvement:

- Funds are held in savings while borrower makes payments

- Lower APRs than high-cost installment loans

- Guaranteed access to funds after successful completion

Family and Friends

Borrowing from family or friends won’t be an option for everyone, but when it is, it can offer:

- Zero or low interest rates

- Flexible repayment terms

- No credit check requirements

- Opportunity to avoid predatory lending altogether

Making Smart Borrowing Decisions: Practical Guidance

Calculating Total Cost of Borrowing

Before you say yes to any loan offer, run the math on what you’ll repay in total:

Formula: Monthly Payment × Number of Payments = Total Repayment Amount

Example comparison for $3,000 loan:

- High-APR online lender (36% APR, 24 months): about $177/month × 24 ≈ $4,250 total

- Credit Union (15% APR, 24 months): about $145/month × 24 ≈ $3,490 total

- Difference: roughly $760 in extra costs at the higher APR

Before you apply, look at Explore Credit's key numbers side by side. Check the minimum and maximum APR in your state, the dollar range you're actually being offered, the repayment term, and every fee line (origination, late fees, NSF). Then compare that quote to at least one credit union and one online lender. If Explore Credit's APR is still dramatically higher, you'll know you're paying a premium for speed and flexible approval rather than getting a competitive personal loan. For more detail on how APR captures interest and fees, see this CFPB explainer on APR vs. interest rate.

If you’re weighing how to tackle existing balances once the dust settles, compare the debt snowball vs avalanche methods so your payoff plan matches your personality and motivation.

Avoiding the Debt Cycle

High-cost loans can easily snowball into long-term debt if the payments don’t truly fit your budget. To reduce that risk, try:

- Borrow only what's absolutely necessary: Resist the temptation to borrow the maximum available amount.

- Create a realistic repayment plan: Ensure monthly payments fit comfortably within your budget.

- Build an emergency fund: Even $500 in savings can prevent future borrowing needs.

- Address underlying financial issues: Consider credit counseling or financial education resources.

Questions to Ask Before Applying

- What is the total amount I'll repay over the life of the loan?

- Are there any fees beyond the APR?

- What happens if I miss a payment?

- Are there lower-cost alternatives available?

- Can I realistically afford the monthly payments?

This guide can’t tell you whether a specific loan is right for you. If you’re feeling stuck, consider talking with a nonprofit credit counselor or licensed financial professional who can review your full budget and debts before you sign anything.

Real-World Scenarios: When Explore Credit Might Make Sense

Emergency Situations with Limited Options

For many people, the emergency loans marketed to fair-credit borrowers can feel like the only path left when something breaks at the worst possible time. Consider Jennifer, a single mother whose furnace failed in January. With a 610 credit score and immediate heating needs, traditional lenders couldn't provide quick enough funding. An Explore Credit loan allowed her to repair the furnace immediately, preventing potential health and safety issues for her children.

Key factors that made this reasonable:

- True emergency with immediate safety concerns

- Stable income to support loan payments

- Plan to refinance with a credit union after six months of on-time payments

- No other viable alternatives given the timeline

Debt Consolidation for Credit Building

In some cases, borrowers use high-cost installment loans to roll several credit cards into one payment. This only makes sense when the new APR is clearly lower than the blended rate on their cards and there’s a firm payoff plan. If your score is around 600, our debt consolidation loans for a 600 credit score guide walks through safer consolidation options to compare first.

Strategic elements to look for:

- Lower rate than your existing credit card debt

- A fixed payoff date that fits your budget without adding new balances

Red Flags and Warning Signs

When to Avoid High-Cost Installment Loans

Certain situations are strong signs that taking on a high-cost loan could do more harm than good:

- Non-essential expenses: Vacations, luxury items, or discretionary purchases

- Existing payment difficulties: Already struggling with current debt obligations

- Unclear repayment plan: No realistic strategy for making monthly payments

- Better alternatives available: Credit union membership or family assistance options

- Emotional decision-making: Feeling pressured to borrow immediately without research

Predatory Lending Practices to Watch For

Be especially wary of lenders who:

- Guarantee approval regardless of credit or income

- Pressure immediate decisions without allowing review time

- Offer loans significantly larger than requested

- Charge excessive fees beyond reasonable APRs

- Fail to clearly explain all terms and costs

Building Long-Term Financial Health

Using Loans as Stepping Stones

High-cost loans should be short bridges to better financial products, not something you rely on year after year. The goal is to improve your situation enough that you can move into lower-rate options.

- Monitor your credit and payments so you know when you might qualify for a cheaper loan.

- Build a small emergency fund so you’re less likely to rely on high-cost borrowing again.

Creating a Credit Improvement Plan

Beyond loan payments, focus on comprehensive credit building:

- Pay all bills on time, including utilities and rent.

- Keep credit card balances low relative to credit limits.

- Avoid closing old credit accounts that help credit history length.

- Monitor credit reports for errors and dispute inaccuracies.

- Consider credit monitoring services for ongoing awareness.

To stay organized, you can plug your balances into a simple debt payoff tracker so you can see each win as you move toward being debt-free.

Frequently Asked Questions

Explore Credit Loan Review: Final Verdict and Recommendations

This explore credit loan review boils down to one thing: Explore Credit is a last-resort loan for fair-credit borrowers, not a go-to financing tool. It's most appropriate when you've run through cheaper options, truly can't wait for funding, and have a realistic plan to repay or refinance quickly. If you're already behind on bills, have access to a credit union, or are tempted to borrow for non-essentials, the high APRs and fees are more likely to hurt your finances than help.

When Explore Credit Makes Sense

- True emergencies with immediate funding needs and no alternatives

- Debt consolidation where the loan APR is lower than existing debt

- Credit building strategy with a clear plan for future refinancing

- Stable income that can comfortably support high monthly payments

Better Alternatives to Consider First

- Credit union membership and personal loan applications

- Payday alternative loans for smaller amounts

- Secured credit cards for credit building

- Family or friend assistance with formal repayment agreements

- Credit counseling services for debt management strategies

Action Steps for Borrowers

If considering an Explore Credit loan:

- ✅ Calculate total costs including all fees and interest.

- ✅ Compare at least three alternatives before deciding.

- ✅ Ensure monthly payments fit your budget with room for unexpected expenses.

- ✅ Create a plan for credit improvement and future refinancing.

- ✅ Read all loan documents carefully before signing.

The key to borrowing wisely is treating high-cost loans as temporary tools while you work toward better options. When you slow down, compare choices, and think through the long-term impact, you can cover urgent needs without derailing your bigger financial goals.

Building good credit takes time, and that’s okay. The effort you put into finding lower-cost options and making steady payments now can open the door to much better financial products later.

Conclusion

Navigating high-cost lenders like Explore Credit starts with understanding interest, fees, and your own budget limits. When you compare quotes carefully, ask tough questions, and treat this review as a guide—not a green light—you give yourself the best chance to cover emergencies without wrecking your long-term finances.

References

- [1] Consumer Financial Protection Bureau. "What is a payday loan?" CFPB, 2025.

- [2] National Credit Union Administration. "Payday Alternative Loans (PALs)." NCUA, 2025.

- [3] Fair Isaac Corporation. "What's in my FICO Scores?" myFICO, 2025.

This explore credit loan review guide is for general education only and does not provide personalized financial, legal, or tax advice. Before taking out a loan or making major money decisions, consider speaking with a licensed financial professional or nonprofit credit counselor.