Best balance transfer credit cards no fee: Want a faster way to pay down high-interest balances? No-fee balance transfer cards can help—there’s no transfer charge and many offer a 0% intro APR, so more of every payment hits principal. If you need a broader plan, see our debt management plan.

This quick guide shows how no-fee balance transfers work, who typically qualifies, and smart ways to use them to save more.

Balance Transfer Card Finder

| Card Name | 0% Intro APR (Months) | Regular APR | BT Fee | Annual Fee | Est. Savings* | Rating |

|---|---|---|---|---|---|---|

| Move the sliders to see matches. | ||||||

*Savings based on paying off the balance within the 0% intro APR period, compared to 19.99% APR.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- What is a Balance Transfer?

- Why Excellent Credit Matters for No-Fee Balance Transfers

- Benefits of No-Fee Balance Transfer Cards

- Key Features to Look for in No-Fee Balance Transfer Cards

- Best Balance Transfer Credit Cards No Fee: Our Picks

- How to Choose a No-Fee Balance Transfer Card

- The Balance Transfer Process: Step-by-Step

- Pitfalls to Avoid

- Balance Transfer Card Finder

- Maximizing Your No-Fee Balance Transfer Strategy

- Frequently Asked Questions

- Conclusion

Key Takeaways

- Excellent Credit Unlocks No-Fee Cards: A FICO score of 740+ often qualifies you for longer 0% intro APR periods with no transfer fee.

- Maximize Interest Savings: With no fee and 0% APR, every payment goes to principal during the promo window.

- Prioritize Long 0% APR Periods: Aim for 12–15 months to give yourself time to pay off debt.

- Plan Your Payoff: Clear the balance before the intro period ends to avoid higher regular APRs.

- Simplify Finances: Consolidate multiple high-interest debts into one payment without transfer costs.

What is a Balance Transfer?

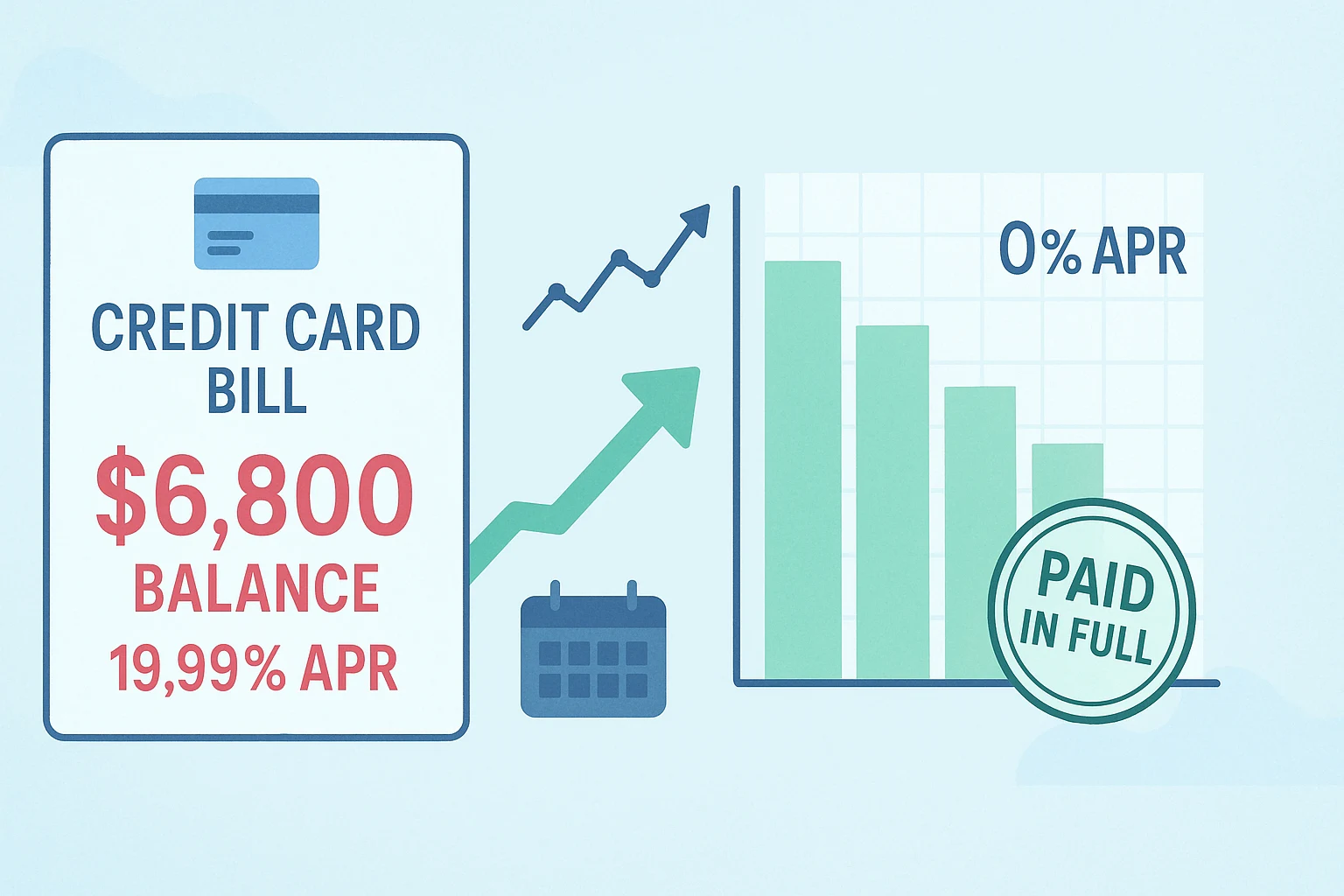

A balance transfer moves debt from one or more credit cards (or sometimes loans) to a new card, ideally one with a 0% intro APR and no transfer fee. If you’re carrying a $6,800 balance—the average U.S. credit card debt—a 12-month 0% APR lets every payment chip away at that $6,800, saving roughly $200 to $340 in interest. For broad trends on credit card usage and costs, see the CFPB’s Consumer Credit Trends: Credit Cards. If you want to compare this strategy to classic payoff methods, look at our breakdown of debt snowball vs. avalanche to see which order pays down your balances fastest.

Why Choose a No-Fee Balance Transfer?

Open a new card, move your balances to it, and the new issuer pays off the old ones. During a 0% intro APR period, you’re not racking up interest—so every payment knocks down the principal. Example: shift a $5,000 balance to a no-fee transfer with 12 months at 0% and pay $417 per month; that full $417 goes straight to the $5,000. On a 19% APR card, a big slice would go to interest first, slowing your progress.

Why Excellent Credit Matters for No-Fee Balance Transfers

Excellent credit (740–850 FICO) signals low risk to lenders and unlocks rare no-fee transfer offers. Here’s how a higher score helps you qualify and save:

- Access to Premium Offers: The longest 0% periods are usually reserved for top-tier credit.

- Lower Regular APRs: After the intro period, stronger profiles often receive lower ongoing rates.

- Higher Credit Limits: Bigger limits allow larger transfers while keeping utilization lower.

- Better Approval Odds: Fewer denials and fewer unnecessary hard inquiries.

- No-Fee Opportunities: Credit unions sometimes offer true no-fee transfers, saving you upfront costs.

Benefits of No-Fee Balance Transfer Cards

These no-fee transfer options do more than dodge interest—paired with a simple plan, they can accelerate savings:

- Big Interest Savings: With 0% APR and no transfer fee, you keep more cash. A $6,800 balance at 19.99% APR might add about $204 in annual interest; a no-fee card can eliminate that during the promo.

- Faster Debt Payoff: Every payment hits principal during the intro period.

- One Easy Payment: Combine high-interest debts into a single payment to cut missed-payment risk.

- Potential Score Boost: Lower utilization can nudge your credit score upward.

- Extra Perks: Some credit-union cards include rewards or purchase protection.

Key Features to Look for in No-Fee Balance Transfer Cards

Check these details to maximize savings on a no-fee transfer:

No Balance Transfer Fee

No-fee cards can be hard to find and are often offered by credit unions like Navy Federal (e.g., Platinum Card: 0% fee, 0.99% intro APR for 12 months). Verify the fee is truly $0.

Length of 0% Intro APR Period for 0% APR cards

A longer 0% APR period gives you more time. No-fee offers typically run 12–15 months (vs. 18–21 for fee-based cards).

Regular APR After Intro Period

If you don’t clear the balance before the promo ends, the regular APR applies. Aim for low-to-mid teens with excellent credit.

No Annual Fee

Most no-fee balance transfer cards also skip annual fees—useful when your priority is debt reduction.

Additional Perks

Rewards, extended warranties, or purchase protection can be helpful after payoff.

Best Balance Transfer Credit Cards No Fee: Our Picks

Here are strong no-fee balance transfer options based on current issuer terms (always confirm before applying):

- The No-Fee Wonder: Navy Federal Credit Union Platinum (0% fee, 0.99% intro APR for 12 months; membership required).

- The Credit Union Gem: ESL Visa Credit Card (0% fee, 12 months 0% APR; regional membership).

- The Hybrid Option: BECU Low Rate Visa (0% fee, 12 months 0% APR) with solid long-term rates.

Card terms change. Always confirm the current 0% APR window, balance transfer fee, and membership eligibility on the issuer’s site before you apply.

Note: Many no-fee cards require credit-union membership (e.g., military ties for Navy Federal, Washington residency for BECU). Check eligibility before applying.

How to Choose a No-Fee Balance Transfer Card

If your credit is excellent, you’ll have options. Use this quick process:

- Estimate Payoff Time: Divide your debt by your monthly payment (e.g., $6,800 ÷ $567/month ≈ 12 months).

- Match the 0% Period: Choose a card with an intro period at least as long as your payoff timeline.

- Confirm Fees Are $0: Double-check balance transfer and annual fees.

- Check Credit Limits: Ensure the limit covers your transfer to keep utilization lower.

- Verify Terms: Confirm promo duration, regular APR, and any membership requirements.

If you don’t quite qualify for the very best offers, compare more flexible options in our guide to balance transfer cards for a 600 credit score so you still move high-interest debt to a cheaper card.

Can’t join those credit unions or unsure about approval? Try this instead:

The Balance Transfer Process: Step-by-Step

Once you’ve picked a card, here’s how to proceed:

- Apply: Submit your application online or in person.

- Request the Transfer: During the application, provide the accounts and amounts to move.

- Await Approval: Issuers typically pay off old cards within 1–3 weeks.

- Confirm Transfer: Verify old balances are $0; keep paying until confirmed.

- Pay on Schedule: Set autopay and clear the balance before the intro ends.

Pitfalls to Avoid

These offers are powerful, but watch out for:

- Missing Payments: A missed payment can end your 0% APR early. Use autopay.

- New Spending: Avoid purchases during the promo; new charges may accrue interest.

- Short Window: No-fee promos are usually 12–15 months; plan accordingly.

- Credit Score Impact: Expect a small, temporary dip from the hard inquiry.

- Membership Restrictions: Some issuers require specific eligibility (e.g., military, residency).

Maximizing Your No-Fee Balance Transfer Strategy

To make the most of a no-fee transfer, stick to a simple plan:

- Create a Payoff Plan: Pick a monthly amount that clears the balance before the promo ends (e.g., $6,800 ÷ $567/month ≈ 12 months).

- Automate Payments: Use autopay for at least the minimum—ideally your target payoff amount.

- Avoid New Debt: Pause spending on both old and new cards until the balance is gone.

- Consider a Second Transfer: For larger debts, plan a second no-fee transfer if needed.

- Use Rewards Afterward: After payoff, consider rewards for new purchases paid in full monthly.

It also helps to monitor progress visually—download a free debt payoff tracker and line up your transfer’s 0% window with your payoff date.

Frequently Asked Questions

Conclusion

With excellent credit, the best balance transfer credit cards no fee can help you sidestep interest and speed up payoff. Move high-interest debt to a 0% APR, no-fee card, simplify your finances, and stay on schedule. Since these offers—often from credit unions—are rare and time-sensitive, review options and apply when the fit is right.

This content is for informational purposes only and not financial advice. Consult a professional before making financial decisions.