Struggling to track your money? I’ve been there. Grab our free zero budget spreadsheet for Excel or Google Sheets (plus a simple interactive tool) to give every dollar a job—so you finally feel in control. For the bigger picture, see how to live frugally and save money.

Unlike traditional budgeting, the zero-based approach puts you in charge of every penny. Imagine saving for a dream trip, paying off debt, or building an emergency fund without the worry. It turned my financial chaos into calm—and it can help you, too. This guide has everything you need to take control with a customizable budgeting tool. Let’s get started!

Interactive Zero-Based Budget Tool

Amounts in your currency; data stays in your browser. Use this simple budgeting spreadsheet to build your plan in real time.

Estimates vary and this isn’t financial advice. For personalized guidance, consider consulting a qualified professional.

Pop in your income and spending categories to whip up a zero-based budget in real time.

1. Your Monthly Income

Enter all the money you expect this month.

2. Add Spending Categories

Budget Summary

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Interactive Budget Tool

- Key Takeaways (ZBB)

- What is Zero-Based Budgeting?

- Benefits of the Zero-Based Method

- Setting Up Your Budget Plan

- Free Budget Templates (Zero-Based)

- Monthly Flow for Your Zero Budget

- FAQs About Zero Budget Spreadsheets

- Start Your Financial Journey Today

Key Takeaways of a Zero-Based Budget

- Every Dollar Gets a Job: Zero-based budgeting means you give each dollar a role, so your income minus expenses and savings equals zero.

- Take Charge of Your Money: This approach keeps you in the driver’s seat, making sure your spending matches what matters most to you.

- Free Budget Templates: Grab our Excel templates designed for zero-based budgets—perfect for getting started without hassle.

- Interactive Tool: Our budget builder shows your allocations in real time, spotting overages and helping you hit that zero balance.

- Build Smart Money Habits: Regular tracking turns budgeting into a powerful tool for lasting financial freedom.

What is Zero-Based Budgeting?

Simply put, zero-based budgeting (ZBB) gives every dollar a job so nothing’s left drifting. Unlike traditional budgeting, where money might just sit there, ZBB means your income minus expenses equals zero. For example, your dollars go to bills, groceries, fun, savings, or debt—nothing’s left unplanned. Looking for apps to help? Try our best budgeting tools.

This method pushes you to spend with purpose. Instead of crossing your fingers, you decide where each dollar goes, lining up your finances with your dreams. Many households struggle to stay on plan—see research on why a budget matters. For a government overview of budgeting basics, visit the Consumer Financial Protection Bureau’s budgeting guide.

Benefits of the Zero-Based Method

A zero-based budget sheet can completely change how you manage your money. Here’s why it’s such a big deal:

- Clarity: It’s like getting a clear map of your money—you know exactly where every dollar’s headed. I found $50 a month in unused subscriptions and redirected it to savings, which felt like a win!

- Accountability: Giving every dollar a job keeps you honest—spending too much on coffee means less for groceries.

- Prioritization: ZBB helps you focus on what counts, like saving for a house instead of eating out. I skipped impulse buys to fund a trip, and it was so worth it.

- Reduced Stress: Knowing your money’s plan reduced my stress and helped me sleep better.

- Spot Waste: Catch those sneaky “money leaks” and put them toward your goals.

- Faster Savings: Planning your savings upfront grows your nest egg quicker.

- Adaptability: Adjust categories each month to roll with life’s changes.

Setting Up Your Zero-Based Budget

Ready to start strong? Pull last month’s statements, then pick a realistic target for groceries, gas, and fun. If you’re budgeting with a partner, agree on two or three goals for the month before you begin. You’ll move faster—and argue less—when your zero-based plan is built on shared priorities. To free up more cash for your plan, skim our frugal living guide.

- Income: Jot down all your monthly sources (paychecks, side hustles).

- Fixed Expenses: List regular bills (rent, loans, subscriptions).

- Variable Expenses: Note costs that change (groceries, gas, fun).

- Savings Goals: Include emergency fund, vacation, or retirement.

- Debt Repayment: Add extra payments beyond minimums.

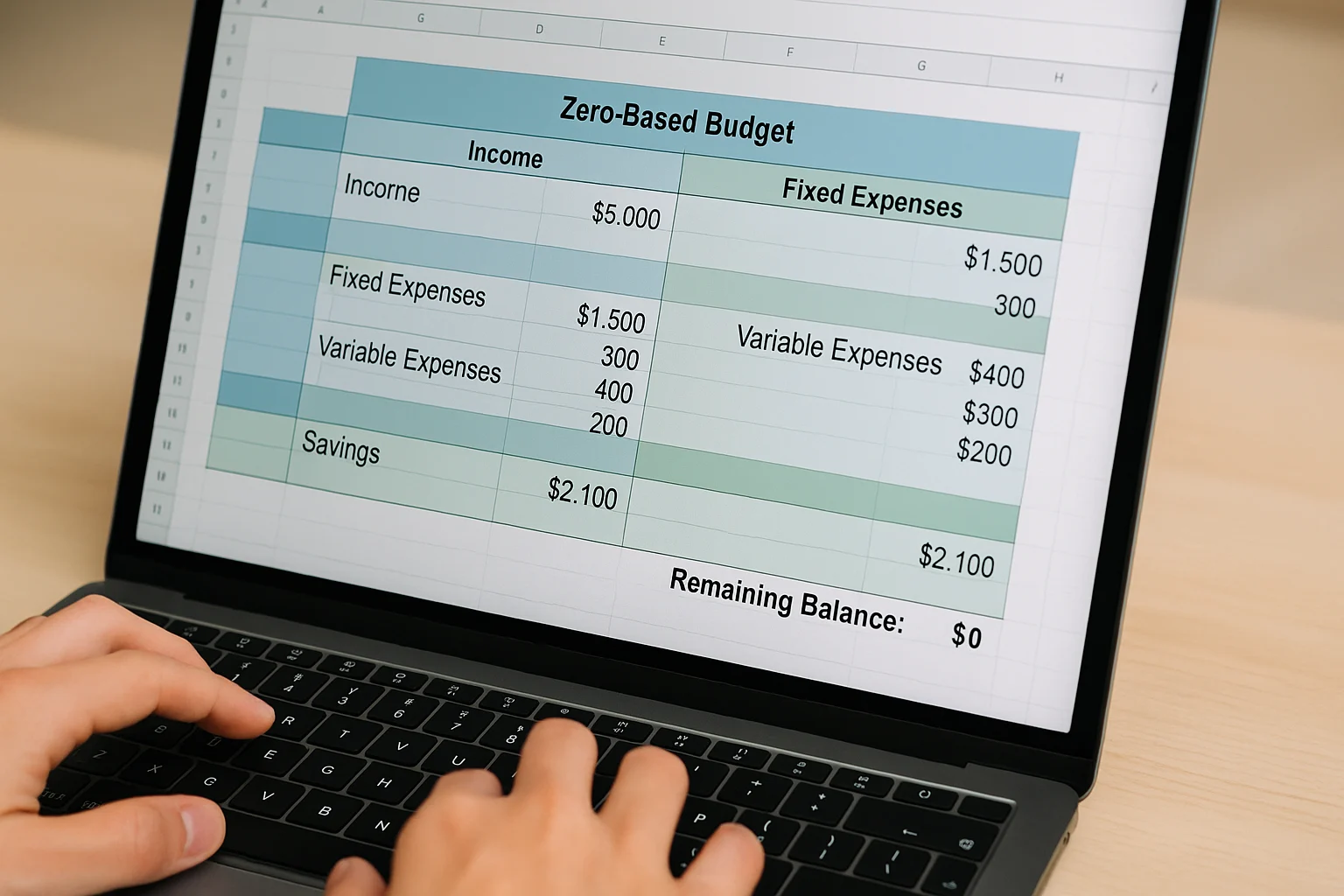

Step-by-Step Guide to Your Zero-Based Budget

Here’s how to build your budgeting spreadsheet from the ground up:

Step 1: Set Up the Layout

Create sections for Income, Expenses (Fixed & Variable), Savings & Debt, and Summary.

Step 2: Input Income

List all your expected income:

| Source | Expected Amount | Actual Amount |

|---|---|---|

| Paycheck 1 | $2,000 | |

| Paycheck 2 | $2,000 | |

| Side Gig | $300 | |

| Total Income | $4,300 | $0 |

Tip: Use =SUM(B2:B4) to add up your income.

Step 3: List Fixed Expenses

Include your regular bills:

| Category | Expected Amount | Actual Amount |

|---|---|---|

| Rent/Mortgage | $1,500 | |

| Car Payment | $350 | |

| Insurance | $150 | |

| Phone Bill | $70 | |

| Internet | $60 | |

| Subscriptions | $40 |

Step 4: List Variable Expenses

Estimate costs that vary:

| Category | Amount | Actual |

|---|---|---|

| Groceries | $500 | |

| Dining Out | $200 | |

| Gas/Transit | $150 | |

| Utilities | $100 | |

| Personal Care | $50 | |

| Entertainment | $100 | |

| Clothing | $50 | |

| Miscellaneous | $50 |

Step 5: Plan Savings & Debt

Focus on your future goals. Use our debt payoff tracker to map extra payments and celebrate progress.

| Category | Amount | Actual |

|---|---|---|

| Emergency Fund | $200 | |

| Vacation Fund | $100 | |

| Credit Card Debt | $100 | |

| Retirement Savings | $100 |

Step 6: Create a Zero Balance Check

Do a quick ‘zero check’: income minus expenses, savings, and debt should land on 0. If it’s not zero, nudge a category up or down until it is.

| Item | Amount |

|---|---|

| Total Income | $4,300 |

| Total Expenses | |

| Total Savings | |

| Total Debt Repayment | |

| Total Allocated | $0 |

| Remaining Balance | $0 |

Use these Excel formulas: =SUM(Expenses+Savings+Debt) for Total Allocated, and =Income-Allocated for Remaining Balance.

Step 7: Track Actual Spending

Do a quick weekly check-in—it’s basically a 2-minute chat with your budget. Pop your actual costs into the “Actual Amount” columns and compare with your plan. It keeps future budgets sharp and your zero-based plan honest—no guesswork. For long-term consistency, build budgeting habits that stick.

Unsure how to adjust for irregular income?

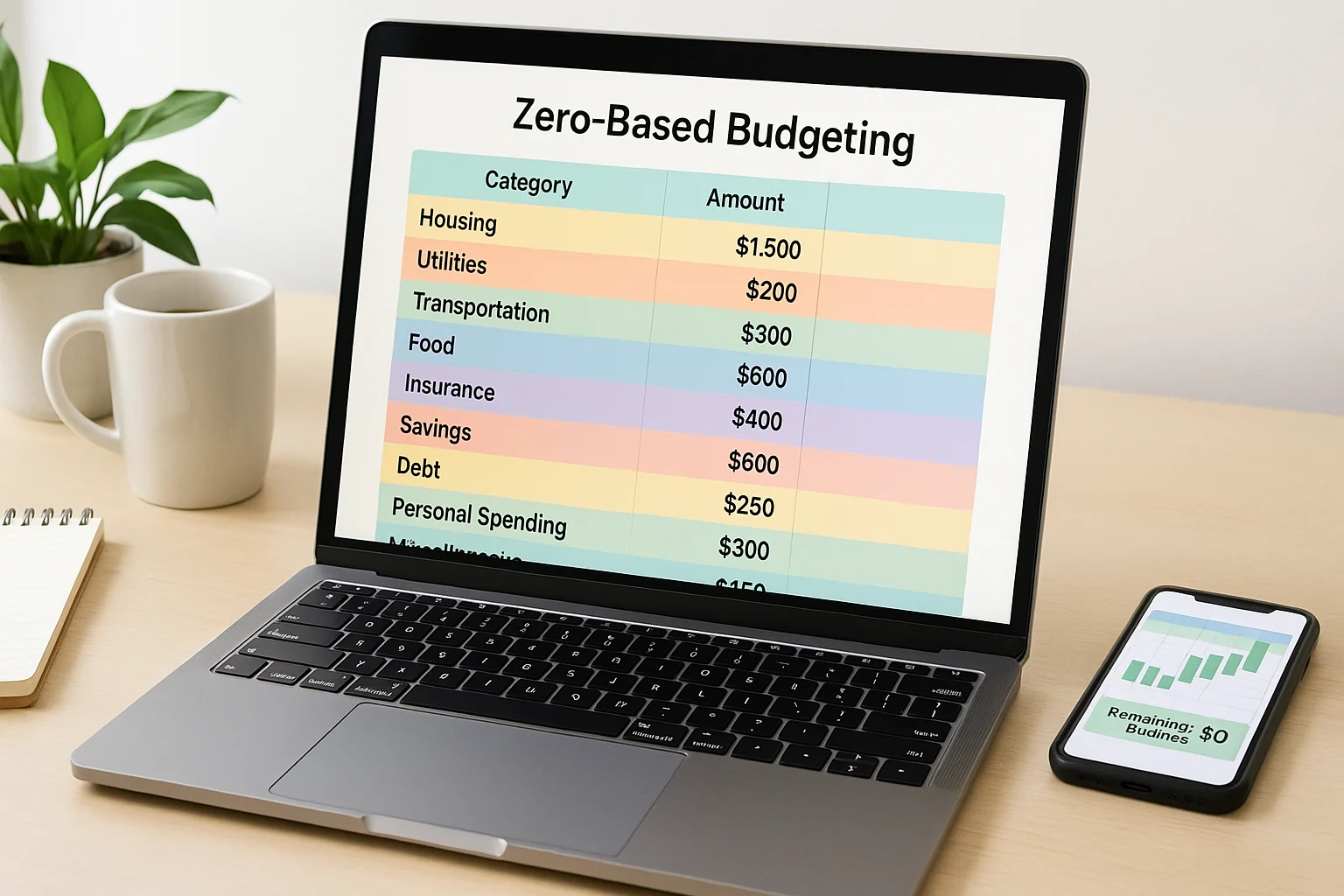

Free Zero Budget Spreadsheet Templates

Building a budget from nothing can be tough, so we’ve made it easy with free Excel and Google Sheets templates. They come with:

- Ready-made categories for income, expenses, and savings.

- Formulas that do the math for you, no errors.

- Customizable spots to match your life.

- Spaces to track what you planned versus what you spent.

Grab them here:

Download Excel Budget Template (.xlsx)Setup: Excel — open and enable editing. Google Sheets — open the blank sheet, then choose File → Import and upload the Excel template above.

On mobile: long-press a download button to save, or open the Sheets link in the Google Sheets app.

Monthly Flow for Your Zero Budget

Sticking to a zero-based budget takes a bit of effort, but it’s worth it. Start small, track weekly, and adjust as life happens. Big takeaway: consistency—not perfection—moves your money goals forward. Sound familiar?

Plan at Month’s Start

Round up your income and bill details, then:

- Open your budgeting spreadsheet.

- Enter your income and give every dollar a job across expenses, savings, and debt.

- Tweak until your income minus expenses equals zero.

Track During the Month

Log your spending in the “Actual Amount” columns. If something like a car repair pops up, trim another category (like dining out) to stay at zero.

Review at Month’s End

Check your actual spending against your plan, spot trends, celebrate wins, and adjust next month’s budget.

FAQs About Zero Budget Spreadsheets

Start Your Financial Freedom Today!

With a budgeting tool, you’re in the driver’s seat of your finances. Our free templates and interactive tool make it super easy to get started. Consistent tracking builds habits that lead to lasting freedom. Download your budget template and kick things off now!

This content is for informational purposes only and not financial advice. Consult a qualified professional before making financial decisions.