Debt payoff success stories can be the spark that turns overwhelm into action. Feel like you’re drowning in debt? The wins below show real people who crushed balances from $10,000 to $120,000. Credit cards, student loans, or medical bills can feel like quicksand—but there’s a path out. For the broader strategy, see our debt management plan.

Think of these as a roadmap to your own freedom—practical wins, not just numbers. We’ll cover the strategies they used and simple steps you can try so you can start writing your own debt-free stories.

Table of Contents

- What You’ll Learn from These Stories

- Debt-Free Date Estimator

- Why These Debt-Free Stories Inspire

- Real Stories of Paying Off Debt (1–10)

- Strategy Comparison

- Frequently Asked Questions

- Your Debt Payoff Journey Starts Now

What You’ll Learn from These Stories

These payoff journeys offer practical lessons for anyone ready to tackle debt:

- Debt is beatable: Different incomes and debt loads, real results.

- No one-size-fits-all: Snowball, avalanche, budgeting, side gigs—pick what sticks.

- Mindset matters: Celebrate wins and recover fast from setbacks.

- Small changes stack: Tiny tweaks add up quickly.

- Freedom feels great: Less stress, more options.

Debt-Free Date Estimator

Enter your debt, APR, and monthly budget to see an estimated payoff date.

Estimate uses a simplifying amortization model; actual results vary with changing rates and payments.

Once you like your plan, you can plug it into our simple free debt payoff tracker to stay on course.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Why These Debt-Free Stories Inspire

These debt-free stories feel real and reachable—and that’s what actually keeps you going. Tips are useful, but hearing how regular people turned hard choices into progress is the spark.

They also show that methods like snowball or avalanche work in the real world, giving you:

- Relatability: You’ll recognize your own hurdles.

- Proof: Practical strategies get results.

- Drive: Motivation to keep going.

- Fresh ideas: New tactics to try.

Ready to see what works in real life? Explore the wins below.

Real Stories of Paying Off Debt

These debt payoff success stories show how everyday people crushed balances in different ways. If you love debt-free stories, you’ll see a path that fits your situation. Note: Visual cues show payoff pace: faster, average, or slow but steady.

How to Use These Debt-Free Stories

Skim the story that matches your situation, borrow one tactic, and try it this week. Bookmark a second story for backup—momentum beats perfection.

Sarah’s Snowball to Freedom from Credit Card Debt

Visual cue: Average payoff pace, balanced strategy

Sarah, a 32-year-old from Atlanta, was swamped with $25,000 in credit card debt. “It snuck up,” she said. “Car repairs, vet bills, and a trip I couldn’t afford piled up. Minimum payments barely budged. I felt stuck.”

Debt Details

- Starting Debt: $25,000 (credit cards)

- Key Strategy: Debt Snowball Method, strict budgeting

- Time to Payoff: 2 years, 8 months

Challenges

“There were months I just wanted to throw in the towel,” Sarah shared. “It felt like I was barely moving forward, and I missed my old carefree spending.”

Breakthrough

“When I paid off my first card? I was jumping around my place like a kid! That moment gave me the spark to keep pushing.”

Emotional Impact

“Bill alerts used to give me major anxiety. Now, I’m free from debt, grinning ear to ear, and saving up for my dream home. It’s wild!”

“Tiny wins pack a big punch. That first card sparked my drive!” —Sarah

David’s Payoff Success Story with Student Loans

Visual cue: Fast payoff pace

David’s journey began with $75,000 in student loans. The 28-year-old coder in Seattle said, “It was scary. High interest meant I had to get smart fast.”

Debt Details

- Starting Debt: $75,000 (student loans)

- Key Strategy: Debt Avalanche Method, side hustles

- Time to Payoff: 3 years, 1 month

Challenges

“Burnout hit hard. Late-night coding and missing friends sucked.”

Breakthrough

“Knocking out that first $20,000 loan felt like a win. Interest savings kept me focused.”

Emotional Impact

“I’m free now. Loans used to loom over me. I can dream big without them.”

“Side hustles are your freedom boost!” —David

Maria’s Medical Debt Payoff Success Story

Visual cue: Average payoff pace

Maria, a 45-year-old teacher and single mom from Ohio, had $18,000 in medical debt after surgery. “Insurance barely helped,” she said. “It felt unfair.”

Debt Details

- Starting Debt: $18,000 (medical debt, small credit card)

- Key Strategy: Budgeting, negotiating bills, balance transfers

- Time to Payoff: 1 year, 10 months

Challenges

“Telling my kids we couldn’t afford movies was tough. Pinching pennies wore me out.”

Breakthrough

“That 0% card was a game-changer. Meal planning saved hundreds—like magic!”

Emotional Impact

“Medical debt stress is brutal. Dropping it was like losing a boulder. My kids see me happier.”

Considering a transfer? See our no-fee balance transfer cards.

“Negotiate bills. Every saved dollar helps!” —Maria

The Lees’ Multi-Debt Payoff Success Story

Visual cue: Fast payoff pace

John and Emily Lee, a Denver couple, faced $120,000 in debt: $60,000 student loans, $30,000 car loan, $30,000 credit cards. “We were faking the ‘American dream,’” John said.

Debt Details

- Starting Debt: $120,000 (student loans, car, credit cards)

- Key Strategy: Hybrid snowball/avalanche, lifestyle overhaul

- Time to Payoff: 4 years, 5 months

Challenges

“Saying no to friends was rough. We argued when tired, but we kept at it.”

Breakthrough

“Selling the car was huge. Clearing credit cards felt like a fresh start.”

Emotional Impact

“We’re closer now. We value moments over stuff and save for our kids.”

“Freedom beats fancy cars any day.” —John & Emily

Ben’s Slow but Steady Debt Payoff Journey

Visual cue: Slow but steady payoff pace

Ben, a 55-year-old librarian from Portland, had $23,000 in student and personal loans. “On $35,000 a year, I needed to be debt-free for retirement,” he said.

Debt Details

- Starting Debt: $23,000 (student loans, personal loan)

- Key Strategy: Small extra payments, meticulous budgeting

- Time to Payoff: 6 years, 2 months

Challenges

“Six years felt forever. Slow progress and wanting to splurge were tough.”

Breakthrough

“Three years in, I saw my consistency paying off. That kept me going.”

Emotional Impact

“I’m calm now. My retirement savings are mine, not debt’s. It’s quiet joy.”

“Every dollar counts. Keep at it!” —Ben

The Johnsons’ Debt Payoff with Community Support

Visual cue: Average payoff pace

Mark and Lisa Johnson, a young couple, faced $40,000 in debt after Mark’s layoff. “Our savings vanished,” Lisa said. “Credit cards kept us afloat.”

Debt Details

- Starting Debt: $40,000 (credit cards, personal loan)

- Key Strategy: Community support, side jobs, debt management plan

- Time to Payoff: 2 years, 3 months

Challenges

“Shame hit hard. Job uncertainty stressed us out big time.”

Breakthrough

“Mark’s new job changed everything. Our friends’ support made us feel less alone.”

Emotional Impact

“We’re tougher now. We live simply, with a solid emergency fund.”

Alicia’s Gig-Economy Sprint to $0

Visual cue: Fast payoff pace

Alicia, 26, tackled $15,000 in mixed credit card debt while working retail in Phoenix. She layered micro-income—food delivery, online tutoring, and selling unused tech—on top of a tight budget.

Debt Details

- Starting Debt: $15,000 (credit cards)

- Key Strategy: Avalanche on highest APR + gig income

- Time to Payoff: 9 months

Challenges

Balancing shifts and gigs meant little downtime and plenty of temptation to splurge.

Breakthrough

Batching deliveries on peak nights doubled her side income without burning out.

Emotional Impact

“My money finally listens to me. I’m keeping the side hustle for savings.”

If Alicia’s gig sprint sounds like your style, you can start with small freelance projects:

Next, you’ll see how others used mindset shifts and automation to stay out of debt.

Nate’s Post-Divorce Reset

Visual cue: Average payoff pace

After a divorce, Nate, 38, faced $35,000 in mixed debt in Milwaukee. He negotiated a few small settlements, picked up weekend contract work, and leaned on a bare-bones budget.

Debt Details

- Starting Debt: $35,000 (credit cards, personal loan)

- Key Strategy: Budget reset, targeted settlements, steady automation

- Time to Payoff: 3 years

Challenges

Guarding motivation when progress felt slow and life changes kept stacking up.

Breakthrough

Automating extra $150/month on payday removed second-guessing and drift.

Emotional Impact

“I got my footing back. Peace beats the old payment shuffle.”

Priya’s High-Earner Wake-Up Call

Visual cue: Fast payoff pace

Priya, 33, a marketing manager in Toronto, cleared $80,000 of lifestyle debt in 18 months. She paused luxury travel, sold a second car, and redirected bonuses to principal.

Debt Details

- Starting Debt: $80,000 (cards + personal loan)

- Key Strategy: Avalanche + expense slashing + windfalls

- Time to Payoff: 18 months

Challenges

Social pressure and FOMO made cuts feel awkward at first.

Breakthrough

Tracking interest saved each month turned sacrifice into a visible win.

Emotional Impact

“I kept my career—and ditched the debt. Confidence reset.”

Evelyn’s Downsizing for Quiet Joy

Visual cue: Slow but steady payoff pace

Retired teacher Evelyn, 67, paid off $12,000 over four years in Asheville. She sold hobby gear, moved to a smaller place, and trimmed utilities with simple home fixes.

Debt Details

- Starting Debt: $12,000 (credit card + medical)

- Key Strategy: Downsizing, low-interest plan, tiny extras

- Time to Payoff: 4 years

Challenges

Letting go of stuff and routines built over decades.

Breakthrough

One afternoon of selling items funded her emergency buffer and momentum.

Emotional Impact

“Less to maintain, more to enjoy. Freedom feels quiet and steady.”

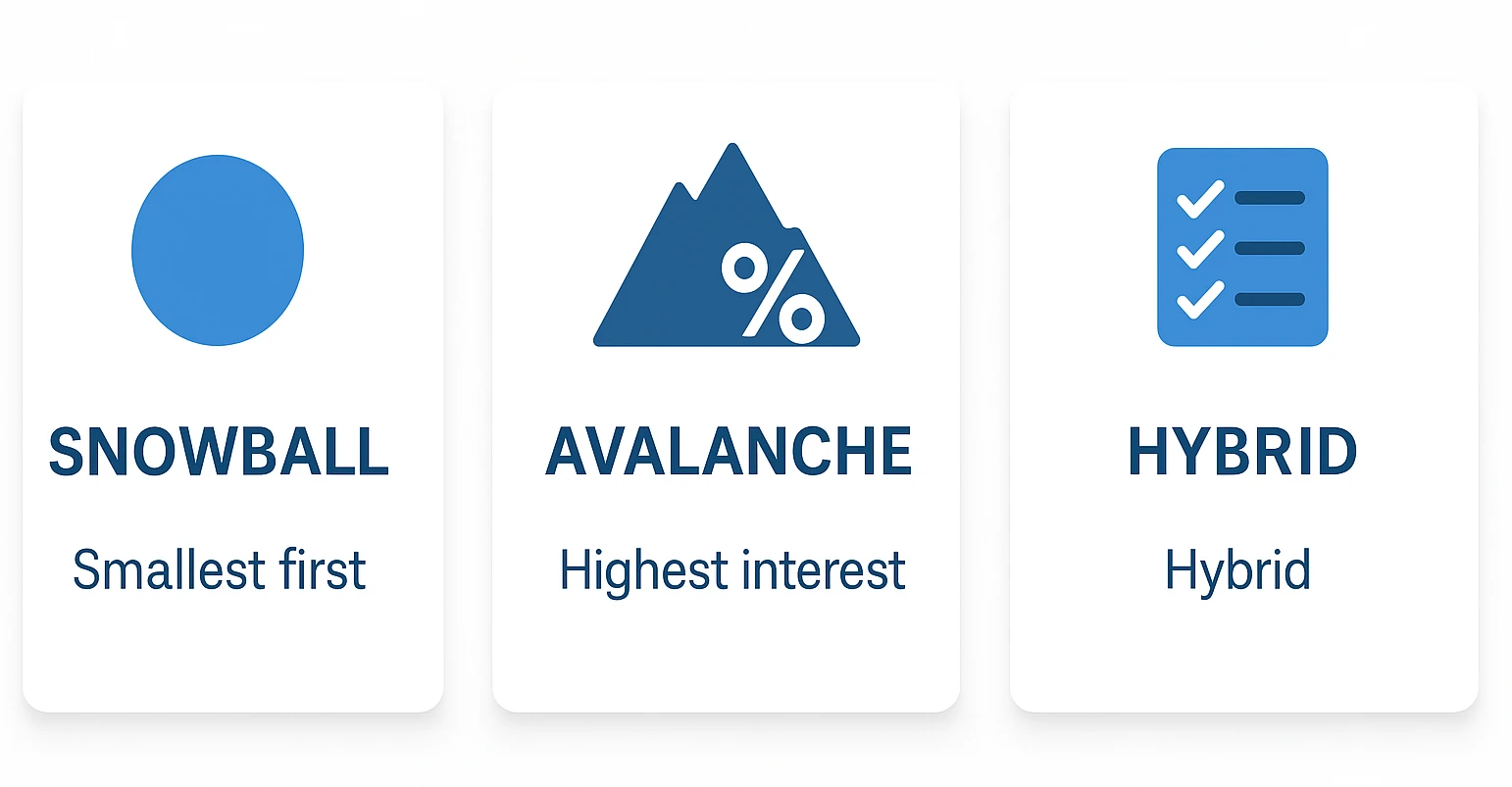

Strategy Comparison

| Method | Best For | Pros | Cons | Story Example |

|---|---|---|---|---|

| Snowball | Motivation | Quick wins | May pay more interest | Sarah (#1) |

| Avalanche | Max savings | Lowest total interest | Slower early wins | David (#2) |

| Hybrid | Balance of both | Flexible, adaptable | Needs discipline | The Lees (#4) |

Frequently Asked Questions

Your Debt Payoff Journey Starts Now

These debt payoff success stories prove you can write your own path. Sarah leaned on small wins, David added side jobs, Maria negotiated bills, the Lees overhauled lifestyle, Ben stayed steady, the Johnsons used community support—plus four more diverse wins.

Many people carry credit card balances—but you can beat them. Try tools like YNAB or the snowball method to kick things off. Want help sticking to a budget? Use our zero-based budget spreadsheet.

Next steps:

- Find your “why”: Jot down why you want to be debt-free.

- Get organized: List all your debts clearly.

- Pick a plan: Snowball, avalanche, or something else?

- Start budgeting: Track spending for 30 days. Use our zero-based budget spreadsheet.

- Grab a win: Cut one cost or sell something small.

You don’t have to be perfect to start. A small step today beats waiting. 🥳

This content is educational and not financial advice. Your situation is unique—consider speaking with a qualified professional before making borrowing, payoff, or budgeting decisions.