Bad credit doesn’t end your options—fast cash is still possible. If you’re eyeing a balance transfer with a 600 credit score, know that these cards are built to move existing debt, not provide emergency money. This guide shows when a transfer helps (and when it doesn’t), plus faster alternatives like quick loans and emergency loans. If you’re comparing balance transfer credit card 600 credit score options, we’ll show when a transfer fits—and when a loan is faster. For the bigger picture, see our Debt Management Plan.

Interactive Loan Finder Tool

Choose your credit range, amount, and speed. The results update automatically.

Results

Fill in the fields to see a tailored recommendation and alternatives.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for a 600 Credit Score

- Why a Balance Transfer Credit Card 600 Credit Score Isn’t Ideal for Cash

- Emergency Loans: Best Alternative

- What Lenders Evaluate for Bad Credit Loans

- How to Get Fast Loan Approval

- Interactive Loan Finder Tool

- Spotting Predatory Lenders: Red Flags to Avoid

- FAQs About 600 Credit Scores & Balance Transfers

- Rebuilding Your Credit for Better Options

- Conclusion: Navigating Cash Needs with a 600 Credit Score

Key Takeaways for a 600 Credit Score

- Balance transfers aren’t for cash: They’re meant to consolidate existing debt, and qualifying at ~600 can be tough.

- Emergency loans are faster: Consider personal installment loans, payday alternatives, or cash-advance apps for urgent needs.

- Lenders look beyond scores: Income, job stability, and collateral can raise approval odds.

- Speed matters: Apply online, keep your ID and income handy, and know how fast each option pays out.

- Stay safe: Avoid upfront fees and “guaranteed approval.”

Why a Balance Transfer Credit Card 600 Credit Score Isn’t Ideal for Cash

When you need money fast, a balance transfer card is rarely the right tool—especially with a fair score.

What Is a Balance Transfer Card?

A balance transfer helps pay off existing debt more efficiently by moving balances to a 0% intro APR card (often 12–21 months). It may help you pay down what you already owe, but it won’t provide new cash. If you’re comparing offers, review our picks for no-fee balance transfer cards to see where a transfer could still fit later.

Balance transfer cards are for consolidating existing debt, not delivering emergency cash.

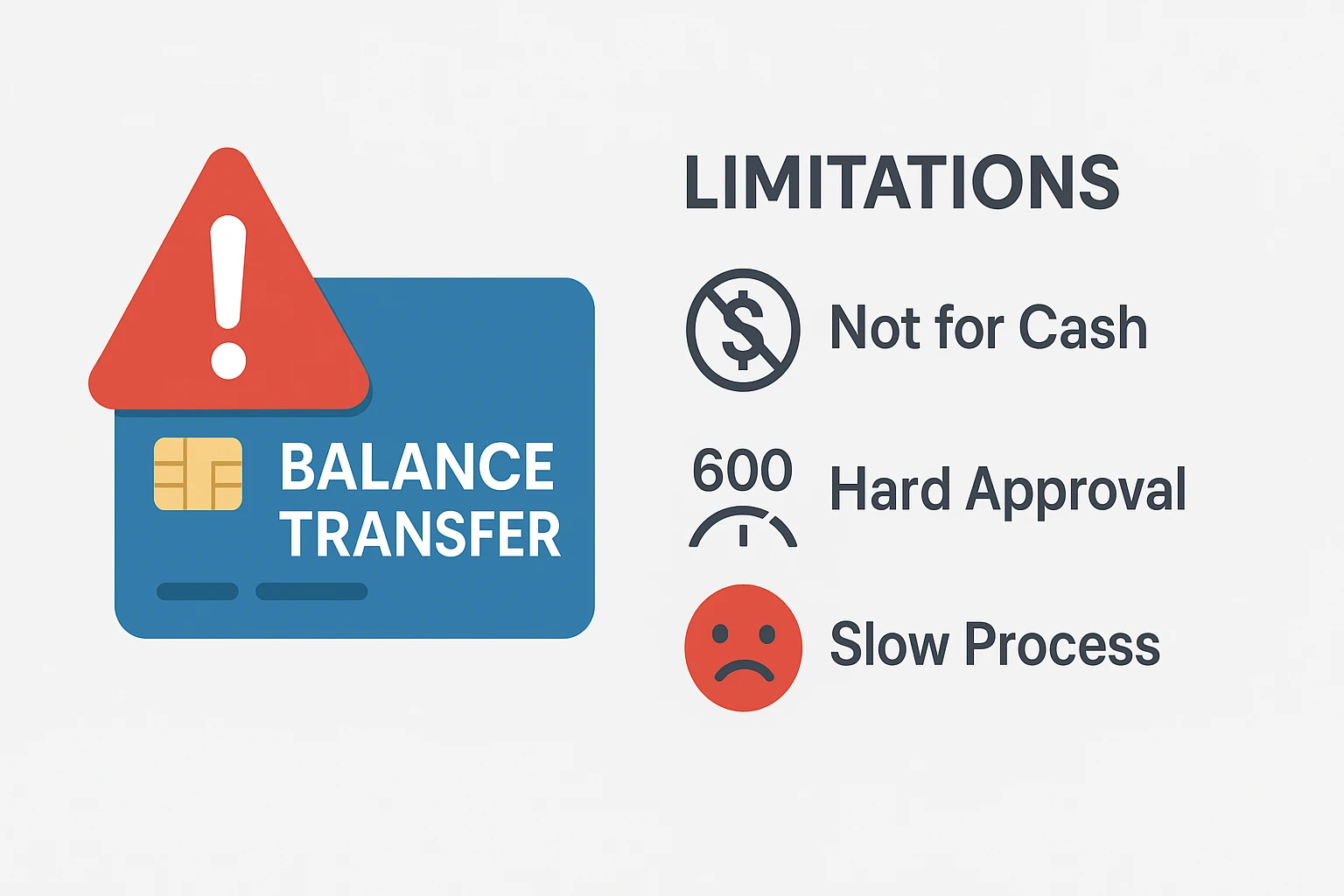

Challenges at a 600 Credit Score

Using a balance transfer for quick cash runs into common roadblocks:

- Not for new cash: Transfers move existing balances. Cash advances have fees (often 3–5%) and high APRs that bypass intro offers.

- Approval barriers: Many top offers favor ~670+ FICO, making approval at 600 difficult.

- Slow process: Applying, approval, and card delivery can take days or weeks—too slow for same-day needs.

Debunking the Emergency Cash Myth

Freeing room on a card doesn’t create cash, and interest on the old balance can climb again if spending continues.

Emergency Loans: Best Alternative

If a transfer isn’t an option, emergency loans—often called quick loans—are built for speed and simpler approvals. If you expect to combine balances later, compare debt consolidation loans for a 600 credit score once the immediate need is covered.

What Are Emergency Loans?

They aim to cover urgent expenses (car repairs, medical bills) with quick applications and predictable terms.

Types of Quick Loans for Bad Credit

| Loan Type | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Personal Installment Loans | Lump sum, fixed payments over months/years | Lower rates than payday loans, predictable | Harder to qualify, 1–3 day funding | Larger emergencies, longer repayment |

| Payday Loans | Small, short-term, repaid on payday | Fast approval, minimal checks | APRs can exceed 400%, debt-cycle risk | Very small urgent needs |

| Title Loans | Vehicle title as collateral | Fast funding, easy approval | High APRs, repossession risk | Only if confident in quick repayment |

| Pawn Shop Loans | Valuable item as collateral | No credit check, fast cash | Small amounts, item loss risk | Short-term needs with collateral |

| Cash Advance Apps | Small paycheck advances | Instant, low/no interest | Small amounts, requires direct deposit | Bridging a gap until payday |

| Credit Union PALs | Small loans, capped APR | More affordable, can build credit | Membership required | Safer short-term borrowing |

What Lenders Evaluate for Bad Credit Loans

Even with a 600 score, lenders weigh repayment ability more than the number. Expect focus on:

- Stable income: Pay stubs or bank statements to show capacity to repay.

- Employment history: Consistency signals reliability.

- Debt-to-income (DTI): Lower DTI leaves room for payments.

- Bank account activity: Direct deposit and steady balances help.

- Collateral (if any): Assets reduce lender risk.

- Existing obligations: Total debts and recent delinquencies.

Income and repayment ability often matter more than your exact score for emergency loans.

How to Get Fast Loan Approval

When time is critical, preparation speeds things up. Choose specialized lenders that focus on emergencies and fair credit—or ask a finance expert online to sanity-check your plan before you apply.

- Prepare documents: ID, income proof, bank details, and collateral info.

- Apply online: Fintech lenders typically move faster than banks.

- Choose specialized lenders: Search for “emergency loans” or “bad credit loans.”

- Know funding times:

- Same-day: Payday, title loans, some cash-advance apps.

- ~24 hours: Online personal loans via ACH.

- 2–3 days: Some installment loans.

- Request a smaller amount: Smaller loans often approve faster.

- Use direct deposit: Ensure your bank supports quick transfers.

Prefer a quick gut-check before you apply? Try this:

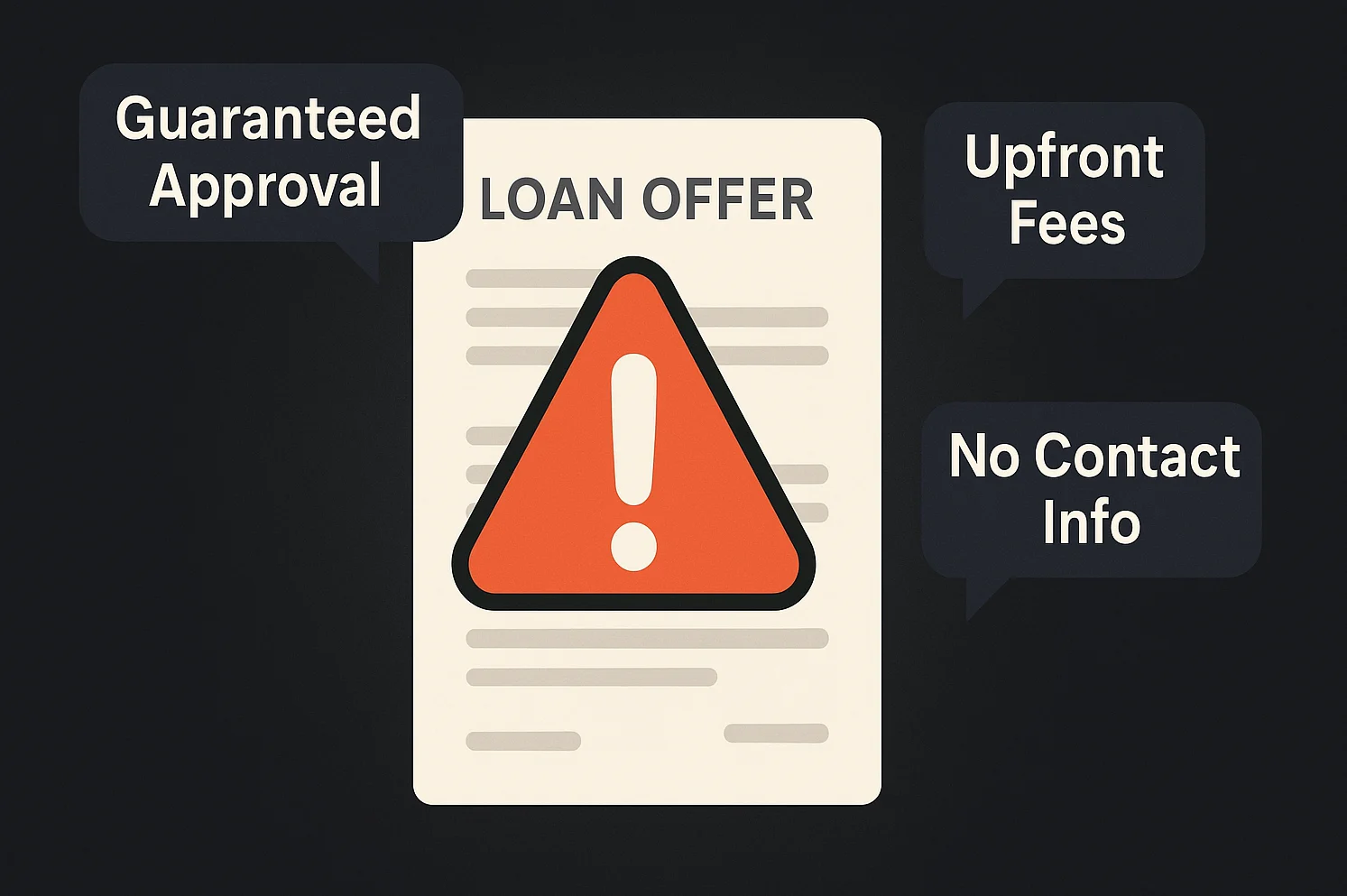

Spotting Predatory Lenders: Red Flags to Avoid

Fast cash can attract bad actors. Watch for these signs and walk away if you see them.

Common Red Flags

- “Guaranteed” approval: Legitimate lenders review applications.

- Upfront fees: Fees should be disclosed and deducted after approval.

- High-pressure tactics: Don’t sign until you’ve read terms.

- Hidden APR/fees: Rates over 36% are high risk.

- Unusual data requests: Never share passwords.

- No physical address: Reputable lenders list contact details.

- Unsolicited offers: Be skeptical of surprise pitches.

If it sounds too good to be true, it’s a trap. Review the terms in writing before you agree.

FAQs About 600 Credit Scores & Balance Transfers

Quick answers for common questions about using balance transfers and getting cash with fair credit.

Rebuilding Your Credit for Better Options

Emergency loans can solve today’s problem while you build toward better terms later. Improving your score can unlock stronger balance-transfer deals. For a payoff strategy, compare the debt snowball vs. avalanche methods and pick one you can stick with.

Steps to Boost Your Credit

- Secured credit cards: A deposit-backed card that reports on-time payments builds history.

- Credit-builder loans: Save while building payment history.

- Pay on time: Payment history is a major FICO factor—use reminders or autopay.

- Keep accounts open: Longer history helps.

- Lower utilization: Try to stay below 30% of your limit.

- Monitor reports: Check AnnualCreditReport.com for errors.

Conclusion: Navigating Cash Needs with a 600 Credit Score

Urgent needs at a 600 score feel stressful, but you have options. For speed, compare installment loans and cash-advance apps, have documents ready, and apply online. Stay alert to red flags like upfront fees. With careful choices and steady credit habits, you can cover today’s expense and move toward stronger terms tomorrow.

Practical Steps to Get Started

- Figure out your need: How much and how fast?

- Evaluate options: Use the loan finder tool.

- Gather documents: ID, income proof, bank details.

- Research lenders: Prefer reputable online lenders or credit unions.

- Read terms: Check APRs and fees before signing.

- Avoid red flags: Skip guaranteed approvals and pressure tactics.

Info only: Policies, APR caps, and lender rules can change by state and institution. Compare offers carefully and talk with your bank or a credit union loan officer if you’re unsure.

This content is for informational purposes only and not financial advice. Consult a professional before making financial decisions.