Want to pay off your loan faster and keep more cash in your pocket? One tool can show you how. Our simple loan amortization calculator with extra payments makes the math painless. For a broader strategy, see our debt management plan.

Figuring out your loan can feel like a puzzle with half the pieces missing. You send in a payment every month, but how much is actually chipping away at your debt versus just covering interest? What if a little extra cash could save you time and money? That’s where our amortization calculator comes in handy.

This guide breaks down amortization in a way that makes sense, showing you how it works and why our free, easy-to-use loan payoff calculator can help you plan a faster payoff. You’ll see exactly how your payments are split and how small additional payments can shorten your term and reduce interest. Ready to dive in?

Simple Loan Amortization Calculator with Extra Payments

Enter loan amount ($), APR (%), term (years). Extras reduce principal.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Amortized Loans

- Understanding Loan Amortization Basics

- Why Extra Payments Rock

- Meet Our Free Loan Payoff Calculator (Extra Payments)

- Simple Loan Amortization Calculator

- How to Use the Calculator

- Deep Dive into the Amortization Table

- Frequently Asked Questions

- Conclusion

Key Takeaways for Amortized Loans

- Clear Payment Breakdown: See how each payment splits between principal and interest.

- Front-Loaded Interest: Early payments mostly cover interest; that flips over time.

- Additional Payments Help: Small principal-only add-ons can shorten your term and cut interest.

- Plan Your Payoff: Use the calculator to model savings and timelines.

Understanding Loan Amortization Basics

Ever notice your loan balance barely budges early on, even though you’re paying every month? That’s amortization doing its thing. It might sound tricky, but it’s just a way to show how your payments whittle down your debt over time. For a simple explanation, check out this loan amortization explained by Investopedia.

What Is Amortization?

Picture amortization as your loan’s game plan. Every monthly payment splits into two chunks:

- Principal: The cash you borrowed, which shrinks your debt directly.

- Interest: The fee the lender charges for letting you borrow their money.

An amortization schedule maps how much of each payment goes to principal and interest until you’re debt-free. The calculator makes this easy to see.

How Loan Amortization Works: The Interest-Heavy Truth

Early on, most of your payment goes to interest, with less going to principal. Interest is based on your remaining balance, which is highest at the start. As the balance shrinks, less interest accrues and more of each payment goes to principal.

Why Extra Payments Rock

Once you understand the split, you can make it work for you. Additional payments toward principal can accelerate payoff and reduce total interest.

How Extra Payments Speed Things Up

- Shrinks Debt Fast: Extra principal lowers your balance right away.

- Cuts Interest: Lower balance → less interest charged going forward.

- Shortens the Term: You finish earlier without changing the original rate.

- Saves Money: Less interest paid over the life of the loan.

Graph it in your head: Imagine your balance as a line sloping down. Principal-only add-ons make the slope steeper and the line end sooner.

Before sending extras, ask your lender about prepayment penalties and how to apply payments to principal only so they count as intended. See CFPB guidance on prepayment.

Refinance vs. Additional Payments — quick guide

- Refinance wins when you can drop the rate or term enough to beat costs (use our mortgage recast vs. refinance explainer).

- Additional payments win when rates aren’t meaningfully lower or you want flexibility without fees.

Real-Life Extra Payment Wins (Illustrative)

For a $20,000 loan at 6% APR over 5 years:

- Original: Monthly ≈ $386.66; Total interest ≈ $3,199.

- +$25/month (e.g., cancel one streaming service + round-up): Payoff ≈ 56 months (save ~4); Interest ≈ $2,969 (save ~$230).

- +$50/month (e.g., small post-tax raise or two fewer takeouts): Payoff ≈ 53 months (save ~7); Interest ≈ $2,770 (save ~$429).

Planning for a vehicle? Try our auto loan payoff calculator to model car-specific numbers.

Meet Our Free Loan Payoff Calculator (Extra Payments)

Try our simple loan amortization calculator with extra payments to see your payoff and savings in seconds. It gives you a clear path to manage debt and see potential savings.

- Track Payments: See how each payment splits.

- Test Extras: Model monthly add-ons or a one-time lump sum.

- Find Savings: View new payoff time and interest saved.

- Plan Ahead: Use outputs to guide budgeting or refinancing.

If you’re focused on a home loan, you can also try our mortgage payoff calculator with extra payments to test mortgage-specific scenarios.

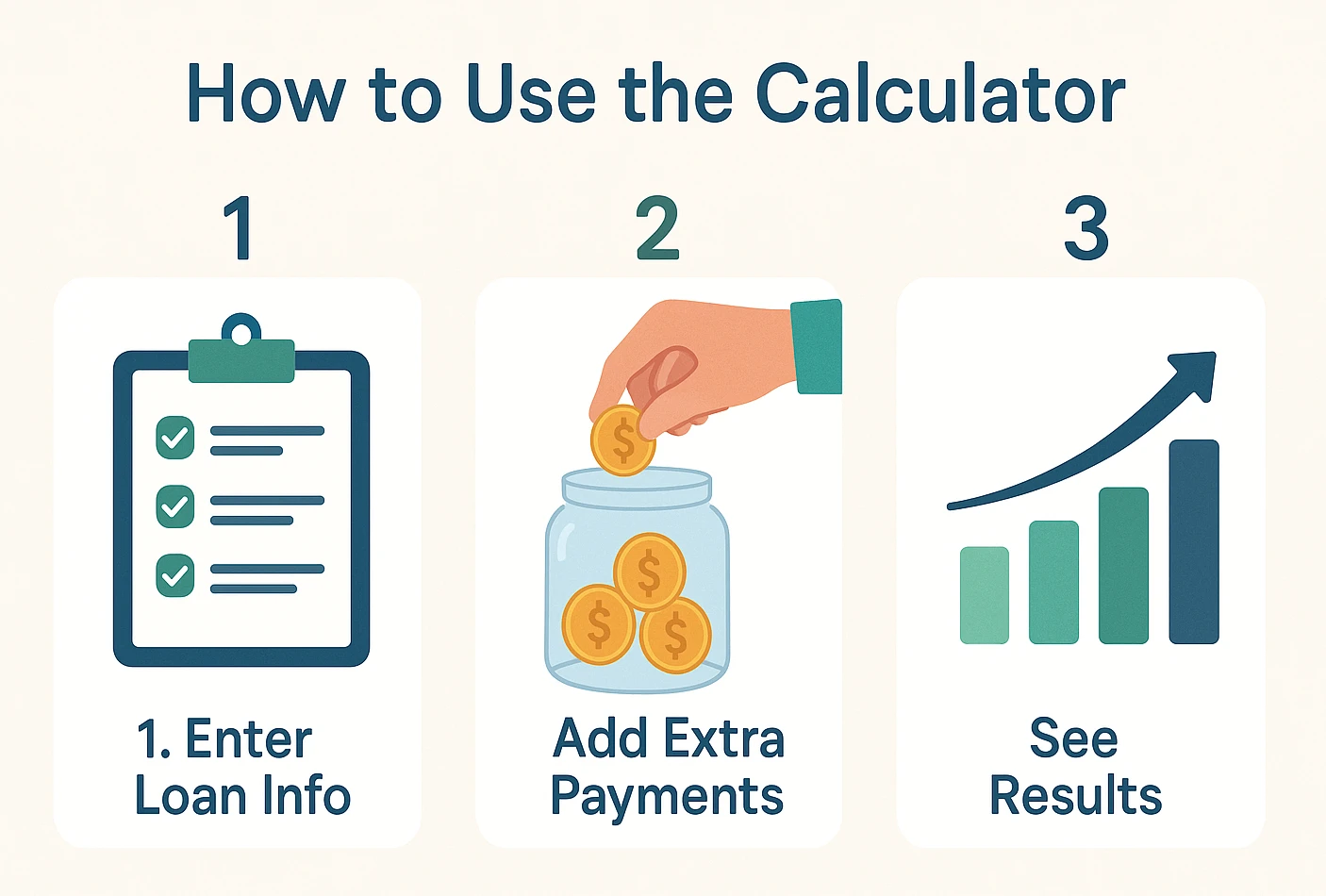

How to Use the Calculator

Step 1: Plug in Your Loan Basics

- Loan Amount: Total borrowed (e.g., $15,000).

- Interest Rate (APR): Annual percentage rate (e.g., 6.5%).

- Loan Term: Years to repay (e.g., 5 years).

Step 2: Try Extra Payments

- Monthly Add-On: Add a fixed amount each month (e.g., $50)—or compare payoff tactics with our debt snowball vs. avalanche guide.

- One-Time Lump Sum: A single payment in a chosen month (e.g., $500 in month 12).

Step 3: See Your Results

As you adjust sliders and inputs, the results panel updates with your monthly payment, new payoff time, and estimated interest saved. You’ll also see your amortization schedule in action—consider automating add-ons on payday or using windfalls for one-time boosts.

Deep Dive into the Amortization Table

The amortization table—your payoff schedule—shows each payment so you can track progress and plan next steps.

| Column Name | What It Tells You |

|---|---|

| Payment # | Which payment you’re on (1, 2, 3, etc.). |

| Starting Balance | Your debt at the month’s start. |

| Interest Paid | How much went to interest. |

| Principal Paid | How much cut down your debt. |

| Original Ending Balance | What you’d owe without extra payments. |

| Extra Payment | Any bonus cash you paid that month. |

| New Ending Balance | Your actual balance after all payments. |

Example (first 3 rows): $15,000 at 6.5% APR, 5 years, no extras.

| Payment # | Starting Balance | Interest | Principal | Ending Balance |

|---|---|---|---|---|

| 1 | $15,000.00 | $81.25 | $212.24 | $14,787.76 |

| 2 | $14,787.76 | $80.10 | $213.39 | $14,574.37 |

| 3 | $14,574.37 | $78.94 | $214.55 | $14,359.82 |

It’s your loan payoff adventure in numbers—use it to stay motivated and course-correct as needed.

If your loan terms include extra fees or fine print that still feels confusing, it can help to walk through the details with someone who sees these questions every day:

Frequently Asked Questions

Conclusion

Small, steady additional payments can create outsized results. Use the calculator above to test “what-ifs,” see your potential interest savings, and lock in a payoff strategy that fits your budget. Keep it simple, keep it consistent, and celebrate each milestone on the way to debt-free.

This content is for informational purposes only and not financial advice. Consult a qualified professional before making financial decisions. Policies and fees vary by lender.