Picture this: Sarah, a 28-year-old marketing professional, stares at her bank statement with growing anxiety. Despite a decent salary, she has no idea where her money went. Sound familiar? If you’ve ever looked at your bank app and thought, “Wait, where did it all go?”, you’re in the right place. If budgeting feels overwhelming or you’ve bounced off complicated systems, the 50/30/20 budget rule gives you a simple starting point. By the end of this guide, you’ll know whether this framework fits your life and how to start using it without tracking every single line item. If you also want a broader strategy for cutting costs and saving more, check out our how to live frugally and save money guide.

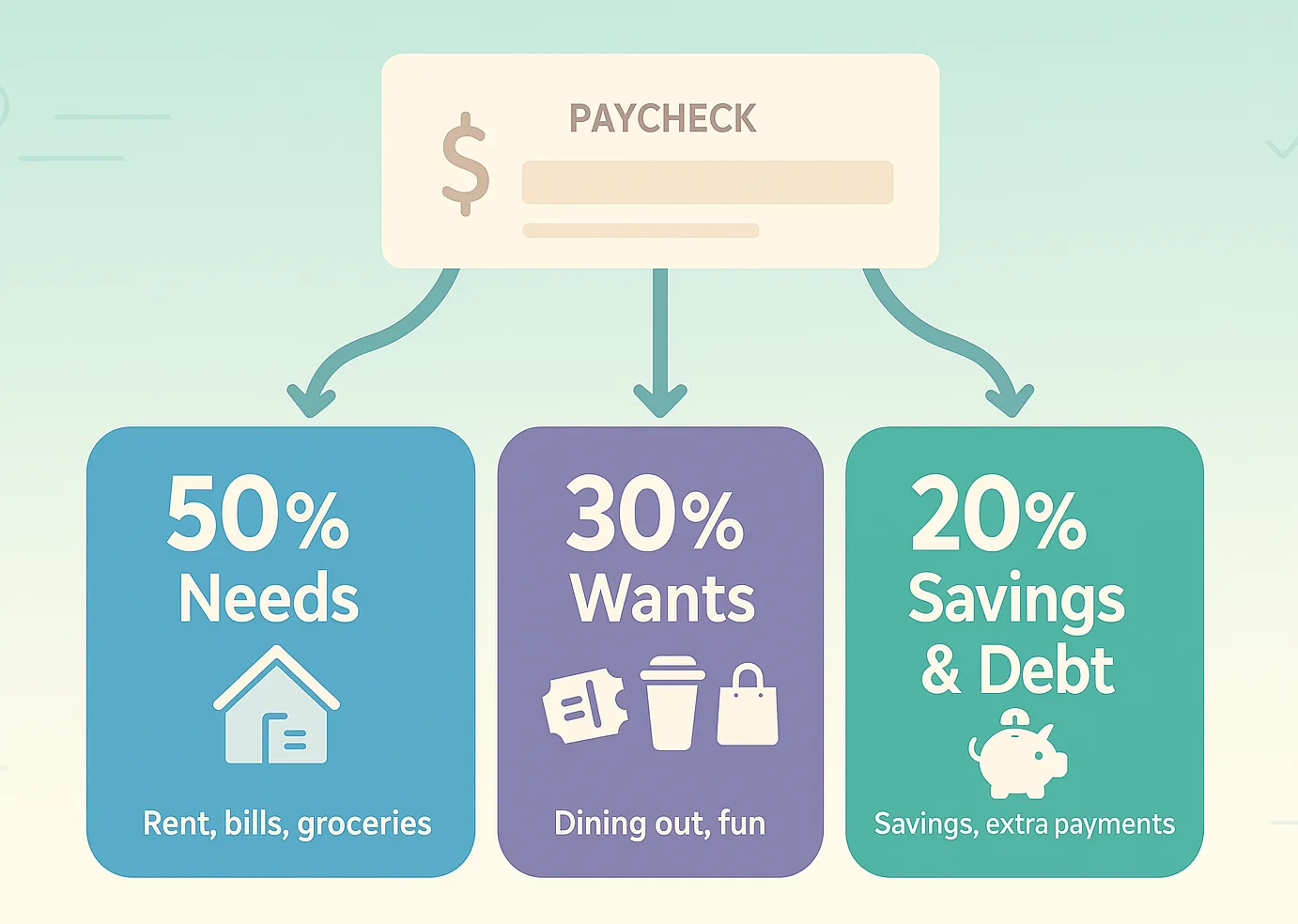

This 50/30/20 budgeting framework breaks down your after-tax income into three simple categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Created by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth,” this budgeting method offers a balanced approach to money management that doesn’t require you to live like a monk or become a spreadsheet wizard.

Your Best-Fit 50/30/20 budget rule Tool

Answer 4 quick questions to see if this framework fits your budget.

Question 1/4

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Understanding the 50/30/20 Budget Breakdown

- How to Calculate Your 50/30/20 Budget Targets

- Adapting the 50/30/20 Budget for Different Situations

- Comparing the 50/30/20 Budget Method to Other Approaches

- Pros and Cons of the 50/30/20 Budget Rule

- Common Pitfalls and How to Avoid Them

- Implementing the 50/30/20 Budget: Tools and Techniques

- Is the 50/30/20 Budget Rule Right for You?

- Frequently Asked Questions

- Conclusion

Tip: Skim the key takeaways first, then focus on the sections that match your biggest money stress so this guide feels easier to act on.

Key Takeaways

Before you get into the details below, here are the key points to keep in mind as you decide whether this framework fits your money life.

Quick fit check — who this rule is for (and not):

- ✅ Works well if your income is steady and debt is moderate.

- ✅ Works well if you want a simple, percentage-based budget.

- ⚠️ May be tough if housing alone eats 60%+ of your take-home pay.

- ⚠️ May fall short if you need very aggressive debt payoff or savings goals.

- The 50/30/20 budget rule allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt payments.

- This method works best for people with stable incomes and moderate debt levels.

- Success depends on accurately categorizing expenses as needs versus wants.

- The rule can be adapted for different life stages, income levels, and cost-of-living areas.

- While simple to implement, it may not suit everyone’s financial situation or goals.

- If your “needs” regularly take more than about 60% of income even after trimming, treat 50/30/20 as a long-term target rather than a strict starting rule.

As you read, you don’t have to memorize every percentage on the spot—just notice which ideas feel doable with your current money situation.

If you’re just starting to cut expenses and build better habits, our how to start living frugally guide walks you through simple changes that make the 50/30/20 rule easier to stick with.

Understanding the 50/30/20 Budget Breakdown

The 50% Needs Category 🏠

The largest portion of your budget goes to needs – expenses you absolutely cannot avoid. These are the bills that keep a roof over your head and food on your table. Think of needs as expenses that would create serious hardship if eliminated.

When you write these out for the first time, don’t be surprised if this list feels longer than you expected—that’s a discovery moment, not a failure.

Essential needs include:

- Housing costs (rent, mortgage, property taxes, insurance)

- Utilities (electricity, gas, water, basic internet)

- Groceries and essential household items

- Transportation (car payments, gas, public transit, insurance)

- Minimum debt payments (credit cards, student loans)

- Basic healthcare and insurance premiums

- Childcare (if you work)

Important note: The 50% category covers minimum requirements, not premium versions. Your basic internet plan counts as a need, but upgrading to the fastest available speed becomes a want.

The 30% Wants Category 🎯

This category covers everything that makes life enjoyable but isn’t strictly necessary for survival. The 30% wants allocation gives you permission to spend on things you enjoy without guilt – as long as you stay within the limit.

Common wants include:

- Dining out and takeaway meals

- Entertainment (streaming services, movies, concerts)

- Hobbies and recreational activities

- Travel and vacations

- Shopping for non-essential items

- Gym memberships and fitness classes

- Premium versions of services (upgraded phone plans, luxury car features)

The key challenge? Distinguishing between needs and wants. For example, groceries are a need, but organic specialty items might fall into the wants category if they significantly exceed basic nutritional requirements.

You don’t have to eliminate every latte or night out to be “good with money”; you just want those choices to live inside a clear boundary.

The 20% Savings and Debt Repayment Category 💰

This final category secures your financial future through savings and accelerated debt elimination. Many financial experts consider this the most crucial component because it builds long-term wealth and financial security.

The 20% should cover:

- Emergency fund contributions (aim for 3–6 months of expenses).

- Retirement savings (401(k), IRA contributions).

- Extra debt payments beyond minimums.

- Short-term savings goals (vacation fund, car down payment).

- Investment accounts (stocks, bonds, mutual funds).

Even if you can’t hit the full 20% right away, consistently putting something aside builds the “I can do this” habit that matters most long term.

How to Calculate Your 50/30/20 Budget Targets

If you’re trying to figure out how to budget money without turning your life into a spreadsheet, this simple percentage formula gives you a realistic starting point.

Using Take-Home Pay vs. Gross Income

Always base your 50/30/20 calculations on take-home pay (after taxes), not gross income. This approach provides realistic numbers you can actually work with each month.

Most people accidentally base their plans on their salary before taxes, which makes everything look easier on paper than it feels in real life.

Here’s a practical example:

- Monthly take-home pay: $4,000

- Needs budget (50%): $2,000

- Wants budget (30%): $1,200

- Savings/debt budget (20%): $800

Step-by-Step Calculation Process

- Determine your monthly after-tax income from all sources.

- Multiply by 0.50 for your needs budget.

- Multiply by 0.30 for your wants budget.

- Multiply by 0.20 for your savings/debt budget.

- List all current expenses and categorize them.

- Compare actual spending to target allocations.

- Adjust spending to fit the framework.

Pro tip: If you’re paid bi-weekly, multiply one paycheck by 2.17 to get your monthly income (since there are 26 pay periods per year, not 24).

If the numbers you calculate don’t match your current reality yet, treat them as a direction to move toward rather than a judgment on where you are.

Adapting the 50/30/20 Budget for Different Situations

Variable Income Earners 📊

Freelancers, commissioned salespeople, and gig workers face unique challenges with this 50/30/20 budget approach. Here’s how to make it work:

If your income jumps around from month to month, you’re not bad with money — you just need a system that bends with your reality instead of fighting it.

Strategy 1: Use Your Lowest Monthly Income

Base calculations on your worst month in the past year. This conservative approach ensures you can always meet basic obligations.

Strategy 2: Create a Rolling Average

Calculate your average monthly income over the past 6–12 months and use that figure for budgeting.

Strategy 3: Implement a Tiered System

- Tier 1 (Low income months): Focus heavily on needs, minimal wants.

- Tier 2 (Average income months): Follow standard 50/30/20 allocation.

- Tier 3 (High income months): Boost savings rate to 30–40%.

The goal here isn’t to make your income magically predictable, it’s to give you a calm, repeatable way to react when it swings up or down.

High Cost-of-Living Areas 🏙️

In expensive cities like San Francisco or New York, housing costs alone might exceed 50% of income. Consider these modifications:

Modified allocation example:

- Needs: 60–65% (acknowledging higher housing costs)

- Wants: 20–25% (reduced but not eliminated)

- Savings: 15–20% (maintain minimum for financial security)

Think of these ranges as waypoints you move toward over time, not hard rules you must hit immediately. If your rent already eats more than half your take-home pay, treat the classic 50/30/20 split as a long-term North Star, not a starting line.

Alternative strategies:

- House hack with roommates to reduce housing costs.

- Consider geographic arbitrage (remote work from lower-cost areas).

- Focus on increasing income rather than just managing expenses.

Different Life Stages 👨👩👧👦

Young professionals (20s–30s):

- May need higher wants percentage for social activities and career development.

- Can potentially reduce needs percentage if living with roommates.

- Should prioritize building an emergency fund in the savings category.

Families with children:

- Childcare and education costs increase needs percentage.

- May need to reduce wants temporarily during high childcare cost years.

- Should maintain savings for children’s future education expenses.

Pre-retirees (50s–60s):

- Often have lower housing costs (paid-off mortgage).

- Should increase savings percentage to 25–30% for retirement catch-up.

- May have higher healthcare costs in the needs category.

Comparing the 50/30/20 Budget Method to Other Approaches

50/30/20 vs. Zero-Based Budgeting

Zero-based budgeting requires assigning every dollar a specific purpose before spending, creating a detailed plan where income minus expenses equals zero.

You don’t have to marry one method forever—testing for a month or two is usually enough to see what your brain naturally cooperates with.

If you want to test that stricter style alongside the 50/30/20 budget rule, you can download our free zero-based budgeting spreadsheet and compare how each method feels for a month.

| Feature | 50/30/20 Rule | Zero-Based Budgeting |

|---|---|---|

| Complexity | Simple, three categories | Detailed, many categories |

| Time Investment | Low (monthly check-ins) | High (weekly tracking) |

| Flexibility | High within categories | Low, specific allocations |

| Best For | Budgeting for beginners | Detail-oriented planners |

50/30/20 vs. Envelope System

The envelope system allocates cash to specific spending categories, preventing overspending through physical limitations.

Envelope system advantages:

- Prevents overspending completely.

- Works well for cash-heavy lifestyles.

- Provides tangible spending awareness.

50/30/20 advantages:

- Works with digital payments and credit cards.

- Less restrictive within categories.

- Easier to implement with modern payment methods.

50/30/20 vs. Pay-Yourself-First

Pay-yourself-first prioritizes savings by immediately setting aside money for financial goals before any other spending.

When pay-yourself-first works better:

- High income earners who can save 30%+.

- People with strong spending discipline.

- Those focused primarily on wealth building.

When 50/30/20 works better:

- Moderate income levels.

- People who struggle with overly restrictive budgets.

- Those seeking work-life balance in financial planning.

Pros and Cons of the 50/30/20 Method

Advantages ✅

Simplicity and ease of implementation make this the most beginner-friendly budgeting method. Unlike complex systems requiring dozens of categories, the 50/30/20 rule provides clear guidelines without overwhelming detail.

If traditional budgets have made you feel “bad with money,” this simpler setup can be a nice reset button for your confidence.

Built-in balance prevents extreme frugality that often leads to budget abandonment. The 30% wants allocation acknowledges that life should be enjoyable, not just financially responsible.

Automatic savings prioritization ensures financial progress even if you’re not naturally inclined to save. The 20% allocation builds wealth consistently over time.

Flexibility within categories allows personal preferences and changing circumstances without requiring budget restructuring.

Disadvantages ❌

May not suit high-debt situations where more than 20% should go toward debt elimination. Someone with significant credit card debt might need to allocate 40–50% to debt repayment temporarily.

Doesn’t account for irregular expenses like annual insurance premiums, holiday gifts, or car maintenance. These costs can disrupt monthly allocations if not planned for separately.

Can be too loose for aggressive financial goals like early retirement or major purchases requiring higher savings rates.

Requires honest categorization of needs versus wants, which many people struggle with initially.

Common Pitfalls and How to Avoid Them

Mislabeling Wants as Needs ⚠️

The biggest mistake people make with this kind of budget involves convincing themselves that wants are actually needs.

Common mislabeling examples:

- Premium cable packages (basic internet is a need, 200+ channels are wants).

- Brand-name groceries when generic options exist.

- Eating out for convenience (groceries are needs, restaurant meals are wants).

- Latest smartphone models (basic phone service is a need, premium features are wants).

Solution: Ask yourself, “What would happen if I eliminated this expense for three months?” If the answer is inconvenience rather than hardship, it’s probably a want.

Ignoring Irregular Expenses

Many people successfully follow the 50/30/20 allocation for months, then get derailed by car repairs, holiday spending, or annual insurance premiums.

Prevention strategy: Create a separate “irregular expenses” fund within your 20% savings allocation. Estimate annual irregular costs and save monthly toward them.

Setting Unrealistic Expectations

Some people expect immediate perfection with this budgeting method and abandon it after one imperfect month. Reality check: Budget mastery usually takes 3–6 months of consistent effort, with plenty of tweaks as you learn your true spending patterns.

Think of your first few months as data gathering rather than pass/fail.

Implementing the 50/30/20 Budget: Tools and Techniques

Spreadsheet Method 📊

Create a simple three-column spreadsheet tracking needs, wants, and savings/debt payments. Update weekly or bi-weekly to monitor progress. If you prefer a basic template to start from, you can use a simple budget worksheet from Consumer.gov and adapt it to the 50/30/20 categories.

If you’re an Excel person, our free Excel budget spreadsheet templates give you ready-made layouts you can plug 50/30/20 percentages into.

Basic spreadsheet structure:

- Column A: Expense description.

- Column B: Amount.

- Column C: Category (Need/Want/Savings).

- Row totals showing percentage of income for each category.

Budgeting Apps Integration

Popular apps like Mint, YNAB (You Need A Budget), and Personal Capital can automate 50/30/20 tracking by categorizing transactions and providing visual progress reports.

App advantages:

- Automatic transaction categorization.

- Real-time spending alerts.

- Visual progress tracking.

- Bank account integration.

Quick setup tip: In apps like Mint or YNAB, create three top-level category groups labeled “Needs (50%)”, “Wants (30%)”, and “Savings & Debt (20%)”. Drag your existing categories underneath these groups, set monthly targets for each bucket, and then use the app’s reports to see how closely your real spending matches the 50/30/20 percentages.

Bank Account Structure

Some people find success using separate bank accounts for each category:

- Checking account 1: Needs (50% of income).

- Checking account 2: Wants (30% of income).

- Savings account: Savings and debt payments (20% of income).

This method provides automatic spending limits and clear category separation.

If you’d like a checking option to plug into this kind of 50/30/20 setup, here’s one you can look into:

No matter which bank you choose, the real win is keeping your needs, wants, and savings in clearly separated buckets so your 50/30/20 plan is easier to stick with.

Weekly Check-ins

Schedule brief weekly reviews to track progress and make adjustments. Ask yourself:

- Am I staying within each category’s limits?

- Are there any upcoming expenses I need to plan for?

- Do any expense categorizations need adjustment?

If you want more structure for those check-ins, our budgeting habits that actually stick article gives you simple routines to pair with your 50/30/20 plan.

Is the 50/30/20 Budget Rule Right for You?

Ideal Candidates ✨

The 50/30/20 budget rule works best for people who:

- Earn stable, predictable income from employment or established businesses.

- Have moderate debt levels (total monthly minimums under 10–15% of income).

- Prefer simple systems over detailed tracking and categorization.

- Want work-life balance in their financial approach.

- Are new to budgeting and want a simple budgeting for beginners starting point.

When to Consider Alternatives 🔄

Look for different budgeting methods if you:

- Have high debt levels requiring aggressive repayment (consider a debt snowball vs avalanche guide to choose a payoff strategy).

- Earn highly variable income that fluctuates dramatically month-to-month.

- Live in extremely high cost-of-living areas where 50% doesn’t cover basic needs.

- Have specific aggressive financial goals like early retirement requiring 40%+ savings rates.

- Prefer detailed control over every spending category.

If you check several of these boxes, start with a more detailed method first and revisit 50/30/20 later once your income and debt feel more stable.

If your situation feels a bit messy and you’d like a second opinion before you commit, you can run your numbers past a professional:

A quick chat with a finance expert can help you tailor this rule to your exact income, debt, and goals.

Success Stories and Real-World Examples

Maria’s transformation: A single mother earning $45,000 struggled with overspending on her children’s activities and impulse buys. After switching to the 50/30/20 budget method, she cut restaurant delivery to once a week, switched to a cheaper phone plan, and set up a simple split: $1,500 for needs, $900 for wants (including the kids’ activities), and $600 for savings. Within 18 months, she built a $5,000 emergency fund and paid off $8,000 in credit card debt.

David and Jennifer’s house fund: This couple earning $85,000 combined used the 50/30/20 rule to save for a home down payment. They limited streaming subscriptions to one service at a time, swapped two restaurant dates a month for low-cost at-home nights, and found ways to reduce needs through house-hacking with roommates, helping them save $24,000 in three years for their first home purchase.

Frequently Asked Questions

Conclusion

This 50/30/20 budget framework offers a refreshingly simple approach to money management that has helped many individuals and families move toward greater financial stability. By allocating 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment, this framework provides structure without overwhelming complexity.

The rule works best when you:

- Accurately categorize needs versus wants.

- Adapt percentages to your specific life situation.

- Use it as a starting point rather than a rigid mandate.

- Combine it with regular financial check-ins and adjustments.

- Start with one category at a time and allow your first version to be a little messy.

If at any point you feel overwhelmed, come back to just one action—usually tracking where your money went this month is the best reset.

Remember, the perfect budget is the one you’ll actually follow consistently. If this approach resonates with your lifestyle and financial goals, start implementing it gradually. Begin by tracking your current spending for one month, then slowly adjust your allocations to match the framework.

Your next steps:

These steps walk you through how to budget money using the 50/30/20 framework:

- Calculate your monthly take-home income.

- Determine your 50/30/20 target amounts.

- Track current spending for 2–4 weeks.

- Identify areas where adjustments are needed.

- Choose your preferred tracking method (app, spreadsheet, or separate accounts).

- Start with one category at a time rather than overhauling everything at once.

Financial success isn’t about perfection – it’s about consistent progress toward your goals. This rule provides a practical framework that balances financial responsibility with life enjoyment, making it an excellent choice for anyone seeking sustainable money management in 2025 and beyond.

References

[1] Warren, Elizabeth, and Amelia Warren Tyagi. “All Your Worth: The Ultimate Lifetime Money Plan.” Free Press, 2005.

This 50/30/20 budget rule guide is for general education only and is not financial, investment, or tax advice. For personalized guidance, consult a qualified financial professional.