Pay your loans off faster with our student loan payoff calculator that supports extra payments. This powerful tool can save thousands in interest (depending on your inputs) and lighten debt’s burden to unlock dreams like homeownership or travel. Start now! For the bigger picture, see our debt management plan.

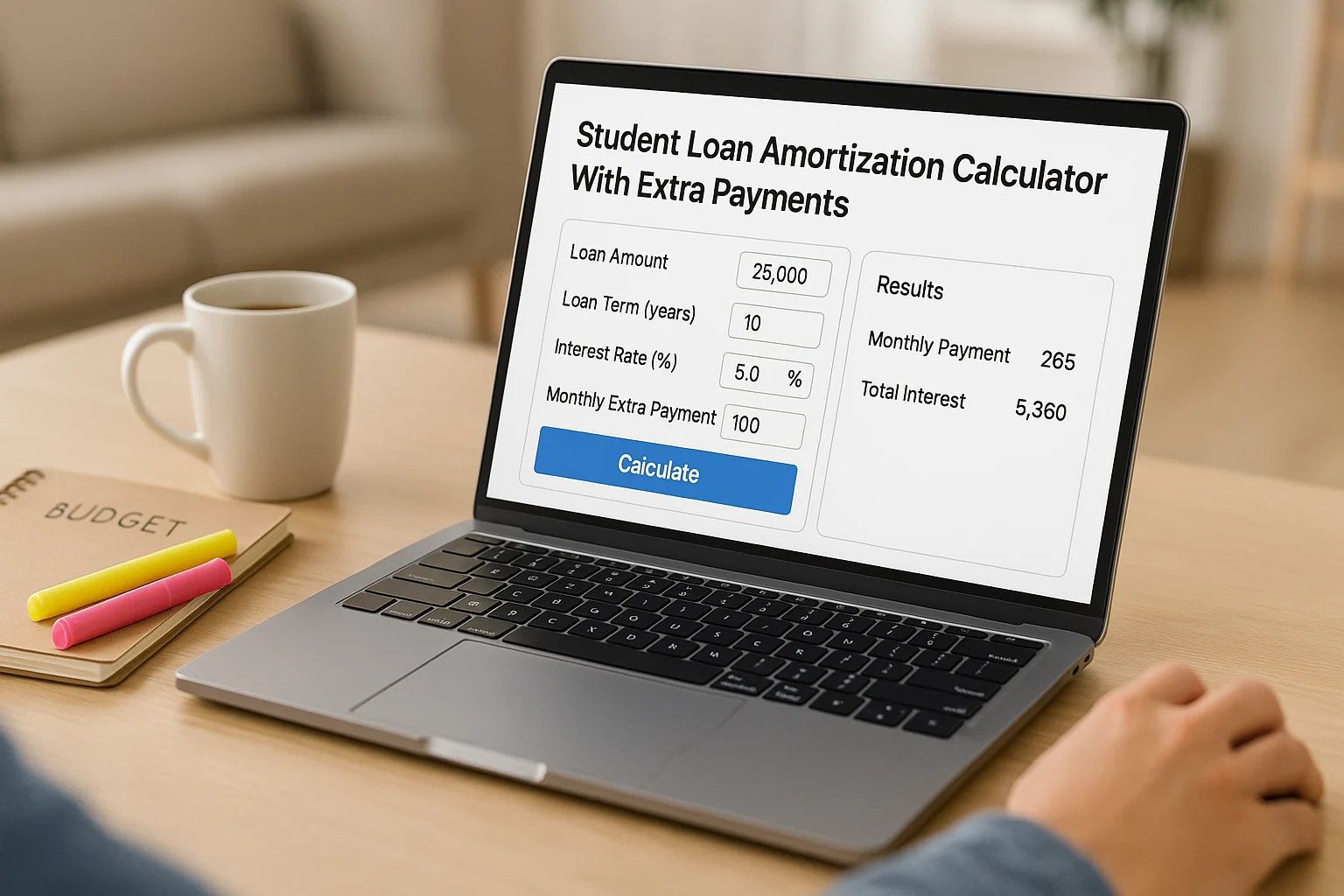

Student Loan Amortization Calculator with Extra Payments

Enter balance ($), APR (%), and payment ($). Results update instantly as you type.

💡 Try a small monthly extra or switch to bi-weekly—both can shave months off your payoff.

Detailed Amortization Schedule

| Month | Date | Starting Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|

Estimates only — confirm details with your loan servicer or a qualified professional.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways

- Why Pay Off Student Loans Faster?

- Understanding Amortization

- Student Loan Amortization Calculator with Extra Payments

- How to Use the Student Loan Amortization Calculator with Extra Payments

- Real-Life Scenarios

- Strategies for Finding Extra Money

- Federal vs. Private Student Loans

- Psychological Benefits of Accelerating Your Payoff

- Common Pitfalls to Avoid

- Commit to Your Plan

Here’s how this student loan payoff calculator and smart strategies can transform your payoff journey.

Key Takeaways

- Learn the Loan Basics: Figure out how your payments split between interest and principal (the loan amount), and see how extra payments make a big difference.

- Use the Calculator: Map your student loan repayment plan, estimate interest saved, and pin down a payoff date.

- Save Big with Small Steps: Even tiny extra payments—like $20 a month—can slash your interest costs and get you debt-free years sooner.

- Plan Your Payoff Like a Pro: I’ve been there, scraping together extra cash to tackle my loans. With this calculator, you can find ways to free up money, compare federal vs. private loans, and speed up your debt-free journey.

- Take Charge: Get empowered with a clear plan and this calculator to make repayment doable.

Why Pay Off Student Loans Faster? The Power of Extra Payments

You might think, “My monthly payment’s already a stretch, so why add more?” Using a payoff calculator that supports extra payments is a game-changer. It can save you cash and open doors to new possibilities. Here’s why it’s worth it:

- Cut Interest Costs: Most student loans accrue interest daily. By throwing extra money at the principal (the actual loan amount), you shrink what’s left to calculate interest on.

- Get Free Sooner: Picture redirecting your loan payment to a vacation, a house, or retirement savings. Paying off loans faster can give you that freedom.

- Less Stress: Debt can feel like a dark cloud. Watching your balance drop lifts that weight and keeps you motivated.

- Better Financial Stats: Lowering your debt-to-income ratio (DTI) can make it easier to qualify for mortgages or car loans with better rates.

- More Cash for Dreams: Without loan payments, you can save for big goals or just enjoy life more.

Every extra buck you toss at your loan’s principal reduces future interest and works for your future.

Understanding Student Loan Repayment & Amortization

Amortization (how your loan gets paid off over time) splits your payments between interest (the cost of borrowing) and principal (the loan amount). Early on, most of your payment goes to interest. Extra payments hit the principal, shrinking your loan faster and saving you money. Think of it like paying back a $100 loan from a friend who charges $1 interest per $10 weekly—extra payments make a big dent!

Our payoff calculator is like a GPS for getting debt-free. Plug in your loan details, play with extra payments, and watch your payoff date and savings come to life.

Calculator Features

- Enter Your Info: Add your loan amount, interest rate, and monthly payment.

- Try Extra Payments: Experiment with monthly, bi-weekly, or one-time extra payments.

- See Results Fast: Get your new payoff date and interest savings instantly.

- Detailed Breakdown: Check out a month-by-month payment schedule.

- Color-Coded Progress: The summary box and badge change color to show how your plan looks:

- Gray: Waiting for inputs or still neutral.

- Yellow: Some savings — a solid start.

- Green: Strong savings with a faster payoff.

- Red: Payment too low or an input issue — adjust your numbers.

Heads Up: This extra payment calculator shines for fixed-rate loans. For variable-rate or multiple loans, run separate calculations for best results.

How to Use the Calculator

This section shows you how to use our student loan amortization calculator with extra payments to test scenarios.

Using our calculator is a breeze. Follow these steps to see how it can speed up your journey to debt freedom.

Step 1: Plug in Your Loan Details

- Current Loan Balance ($): The amount you still owe, found on your loan servicer’s website. Example: Enter 25000 for $25,000.

- Annual Interest Rate (%): The yearly rate your loan charges. Example: Enter 6.8 for 6.8%.

- Current Monthly Payment ($): Your minimum required payment. Example: Enter 287 for $287.

Step 2: Add Extra Payments

- Extra Payment Amount ($): The extra cash you can throw at your loan. Even $25 makes a difference. Example: Enter 50 for $50 extra.

- Extra Payment Frequency:

- Monthly: Tack on extra to your regular payment each month.

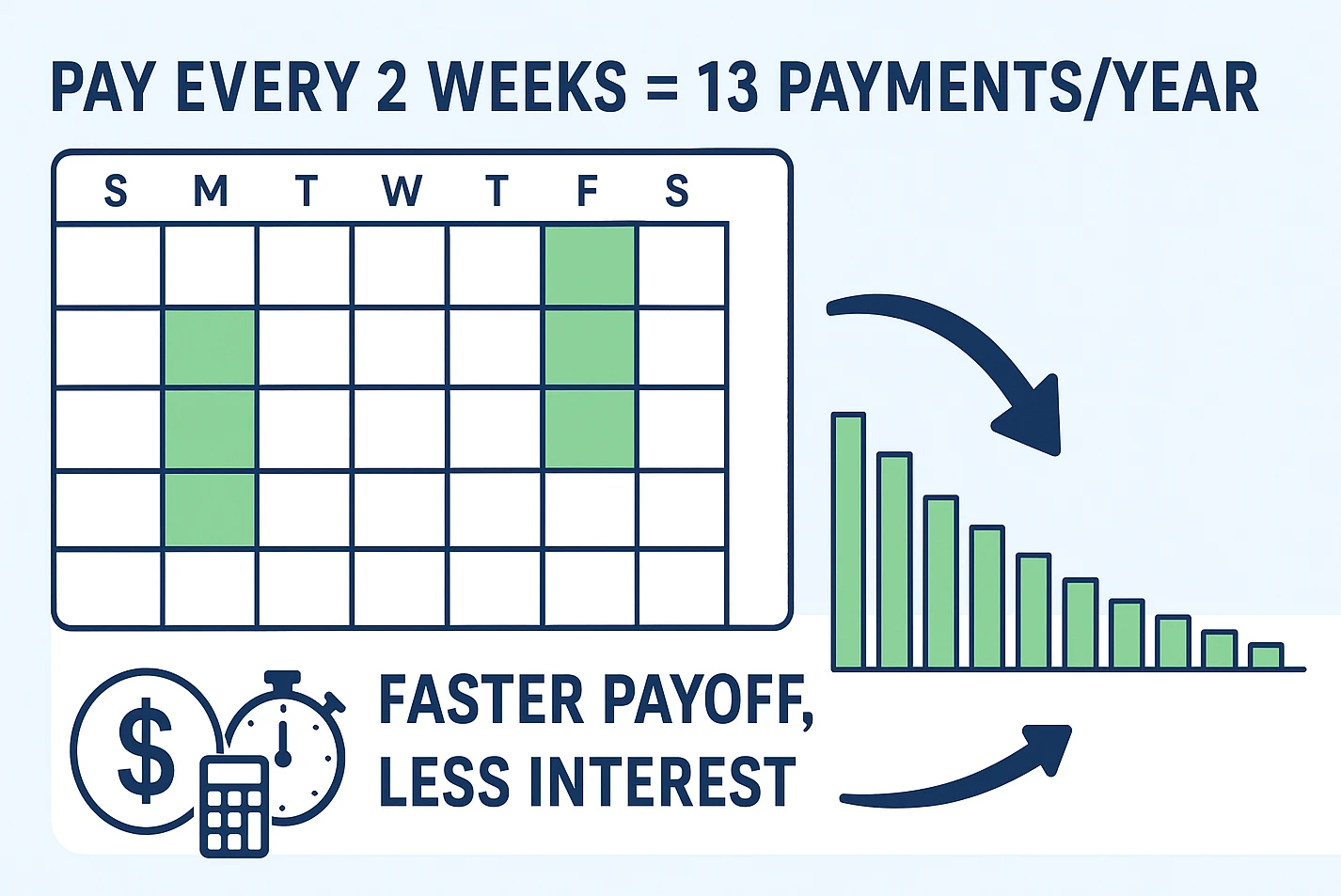

- Bi-weekly: Pay half your monthly amount every two weeks, which adds up to 13 full payments a year (e.g., $100 monthly ≈ $108.33 monthly equivalent).

- One-time Lump Sum: Drop a big payment, like a tax refund, in the first month.

Step 3: See Your Payoff Plan

Tweak the inputs and watch your results update instantly, showing your new payoff date and savings.

Step 4: Check Out the Details

- Payoff Dates: Compare your original timeline to the new one.

- Time and Interest Saved: See how much faster you’ll be debt-free and how much you’ll save.

- Status Bar: Gray (no progress), Yellow (some savings), Green (big wins), Red (input errors).

- Amortization Schedule: A table breaking down each payment.

Want official comparisons across federal plans? Try the U.S. Department of Education’s Loan Simulator.

Bi-Weekly Payment Breakdown

Want simple math? Cut your monthly in half and pay it every two weeks—by year’s end you’ve made the equivalent of 13 full payments, which trims interest and time.

| Example | Monthly | Bi-weekly | Monthly Equivalent |

|---|---|---|---|

| $100 payment | $1,200 | $50 × 26 = $1,300 | ~$108.33 |

Note: Servicers often still apply payments monthly; the interest reduction comes from making the extra 13th payment each year.

Handling Multiple Loans During Student Loan Repayment

Got multiple loans? Run the payoff calculator for each one separately. Focus extra payments on the highest-interest loan first to save the most. See our debt snowball vs. avalanche guide to pick a payoff strategy.

Real-Life Scenarios: Power of Extra Payments

Let’s see how extra payments change the math using the calculator. Baseline: $25,000 loan, 6.8% interest, $287 monthly payment (10-year plan).

Scenario 1: Small Monthly Extra Payment

Adding $50 extra monthly changes everything:

| Metric | Original Plan | New Plan (+$50/month) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | May 2031 | 2 years, 7 months faster |

| Total Interest Paid | $9,436 | $7,029 | $2,407 saved |

| Total Payments | $34,436 | $32,029 |

Even $50 a month can trim ~3 years and save ~$2,400 in interest.

Scenario 2: Bi-Weekly Payment Strategy

Paying $143.50 bi-weekly (half of $287) means 13 payments a year:

| Metric | Original Plan | New Plan (Bi-Weekly) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | August 2032 | 1 year, 4 months faster |

| Total Interest Paid | $9,436 | $8,445 | $991 saved |

| Total Payments | $34,436 | $33,445 |

This saves almost $1,000 and over a year.

Scenario 3: Lump Sum Payment

Dropping a $1,000 lump sum upfront:

| Metric | Original Plan | New Plan (+$1,000) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | March 2033 | 9 months faster |

| Total Interest Paid | $9,436 | $9,010 | $426 saved |

| Total Payments | $34,436 | $33,010 |

A one-time payment shaves off nearly a year.

Scenario 4: Larger Loan with Extra Payments

For a $50,000 loan, 6.8% interest, $574 monthly payment, adding $100 extra monthly:

| Metric | Original Plan | New Plan (+$100/month) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | February 2030 | 3 years, 10 months faster |

| Total Interest Paid | $18,872 | $13,258 | $5,614 saved |

| Total Payments | $68,872 | $63,258 |

Bigger loans mean bigger wins with extra payments.

Ways to Scrounge Up Extra Cash for Your Loans

Finding spare change for extra payments might feel like a challenge, but little tricks can go a long way. Here’s how to make it happen:

Cutting Expenses

- Make a Budget: Apps like Mint help you track every penny. Or use our zero-based budget template to plan your month.

- Track Spending: Spot where your money’s slipping away.

- Trim the Fat: Cut back on eating out or unused subscriptions (a daily $5 coffee adds up to $1,825 a year!).

Boosting Your Income

- Pick Up a Side Hustle: Freelancing or tutoring can net $100–$200 a month.

- Ask for a Raise: If you’re rocking it at work, negotiate a pay bump.

- Sell Stuff: Offload clutter on eBay or Facebook Marketplace.

Saving Smarter

- Cook at Home: Meal prepping saves big compared to takeout.

- Shop Savvy: Grab coupons or go for store brands.

- Automate Payments: Set up auto-transfers to your loan for extra payments.

A budget’s like a roadmap—it shows your money where to go instead of letting it wander off.

Federal vs. Private Student Loans: What’s the Difference?

Both types of loans benefit from extra payments, but the details matter.

Federal Loans

- No Prepayment Penalties: Pay as much as you want, no fees.

- Principal-Only Payments: (just hitting the loan amount) payments save the most. Call your servicer to confirm.

- Income-Driven Plans: Extra payments cut interest but might not mesh with forgiveness plans.

- Refinancing: Think twice—it wipes out federal perks like forgiveness or deferment.

Private Loans

- Check for Fees: Most new private loans don’t charge for extra payments, but double-check.

- Principal Payments: Make sure extra payments hit the principal.

- Variable Rates: Pay faster to dodge rate hikes.

- Refinancing: Easier to refinance for lower rates if your credit’s improved.

Policies vary by servicer—read your loan agreement and confirm how extra payments are applied.

Why Paying Off Loans Feels So Good

Getting rid of your loans faster does more than save money—it lifts your spirits:

- Stay Pumped: Seeing your balance shrink keeps you going.

- Less Worry: Less debt means less stress weighing you down.

- Big Win: Going debt-free is a huge achievement to celebrate.

- Dream Bigger: Extra cash lets you chase goals like travel or buying a home.

Your path to financial freedom starts with steady steps using this calculator.

Mistakes to Dodge When Paying Off Loans Faster

While using the calculator, steer clear of these traps:

- Skipping Emergency Savings: Build a 3–6 month cushion first.

- Wrong Payments: Confirm extra payments hit the principal.

- Ignoring High-Interest Debt: Tackle credit cards (10%+ rates) before loans.

- Overdoing It: Balance extra payments with enjoying life to avoid burnout.

- Missing Milestones: Celebrate paying off $1,000 or hitting 50%.

Frequently Asked Questions

Kickstart Your Debt-Free Plan

With this tool, you’re ready to take charge:

- Grab Your Loan Info: Check your balance, rate, and payment.

- Play with the Calculator: Try extra payments like $25, $50, or bi-weekly.

- Find Extra Cash: Cut small expenses or pick up a side gig.

- Set It and Forget It: Automate your regular and extra payments.

- Celebrate Wins:

- Paying off $5,000.

- Shaving 1 year off your loan.

- Hitting the 50% paid mark! Track it with our debt payoff tracker.

This tool’s your secret weapon to becoming debt-free faster.

Wrap-Up: Give Your Future Self a Raise

Extra payments don’t have to be huge to matter. Use the calculator to test a few “what-ifs,” automate what works for your budget, and keep nudging the principal down. A little consistency today can save you years of student loan repayment tomorrow.

This content is for informational purposes only and not financial advice. Consult a professional before making financial decisions.