Refinancing could save you money over your loan term—for example, potentially $10,000 or more in some cases. For many homeowners, it can lower monthly payments, but the key is knowing when you actually come out ahead. This guide walks you through, step by step, how to use a mortgage refinance break even calculator to find your break-even point, decide if a refi makes sense for your plans, and put any savings to work. We’ll keep the math simple and focus on what the numbers mean for your real monthly budget. For a broader look at home loans, see our mortgage guide.

If you’ve been staring at your mortgage statement wondering whether a refinance is worth the hassle, you’re not alone—many homeowners have the same question.

Jump to the refinance calculator

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Mortgage Refinancing

- What Is Mortgage Refinancing?

- Understanding the Break-Even Point

- How to Use a Mortgage Refinance Break Even Calculator

- Interactive Mortgage Refinance Break-Even Calculator

- Is Now a Good Time to Refinance?

- Refinance Break-Even Calculator: Real-World Scenarios

- Other Factors to Consider

- Using Refinance Savings Wisely

- Tips for a Successful Refinance

- Frequently Asked Questions

- Conclusion

Key Takeaways for Mortgage Refinancing

If you only have a minute, skim these quick takeaways first and then come back to the sections that match your situation.

- Break-Even Point: Your break-even point is when monthly savings equal your closing costs—that’s when refinancing starts to truly pay off.

- Break-Even Calculator: A refinance calculator divides your costs by savings to show how long it may take you to break even.

- Benefits: The calculator shows your monthly savings and payoff dynamics in plain numbers, so you’re not guessing.

- Timeline Matters: If you plan to sell before breaking even, refinancing might cost more than it helps; staying longer can maximize savings.

- Other Goals: Refinancing can also shorten your term, switch loan types, or help you access home equity—not just lower your payment.

What Is Mortgage Refinancing?

Refinancing replaces your current home loan with a new one, often with better terms. Most homeowners refinance for lower rates, but there are other compelling reasons. Think of it as trading your old mortgage for a new one that (ideally) fits your life better today. Timing matters—lower rates or improved credit can amplify savings. Here’s why refinancing might work for you.

Maybe you locked in a higher rate a few years ago, or your income has changed and you’d love a little more room in your monthly budget—that’s usually when people start looking at refinancing.

Financial Benefits of Refinancing

Refinancing can improve your financial situation in several ways:

- Lower Interest Rate: Dropped rates mean lower monthly payments.

A lower rate offers instant budget relief, especially if your current payment already feels tight.

- Lower Monthly Payment: Extending your term (e.g., 15 to 30 years) frees up cash, but increases total interest.

- Shorter Loan Term: A 15-year term raises payments but saves interest and speeds ownership—try a mortgage payoff calculator to see how to pay off your mortgage faster. 🥳

- Cash-Out Refinance: Tap into your home’s equity to fund home upgrades or pay off high-interest debt.

- Switch Loan Types: Swap an adjustable-rate mortgage (ARM) for a fixed-rate one to lock in predictable payments.

- Remove Mortgage Insurance: If your home has climbed in value, you can drop pricey PMI or MIP.

Understanding the Break-Even Point

The break-even point is your refinancing sweet spot: the moment monthly savings finally cover closing costs. Example: $3,000 in fees with $100 monthly savings = 30 months to break even. After that, savings accrue—$1,200 a year if you stay five years. Ask yourself: Will I stay in this home long enough to get past that break-even month?

Your break-even point is a simple way to forecast refinancing rewards and avoid surprises later.

How to Use a Mortgage Refinance Break Even Calculator

This tool simplifies finding your break-even point. Instead of doing every step by hand, you can walk through the numbers like a lender would—just in plain English and at your own pace.

If you’re nervous about clicking “apply” with a lender, running through these steps first can help you feel more confident about whether the numbers genuinely work for you.

Step 1: Estimate Closing Costs

Refinancing fees—origination, appraisal, title insurance—typically cost 2%–5% of your loan. For a $300,000 loan, expect $6,000–$15,000. Lenders provide a Loan Estimate within three days. Example (for illustration): Closing costs are $4,500.

Step 2: Calculate New Payment

Enter your balance, new rate, and term. Example: A $250,000 loan at 3.5% over 30 years might yield a $1,122 payment (rounded).

Step 3: Find Monthly Savings

Subtract your new payment from your current one. Example: Current: $1,400; New: $1,122; Savings: $278.

Step 4: Compute Break-Even

Divide costs by savings. Example: $4,500 ÷ $278 = 16.19 months. Stay 17+ months to save.

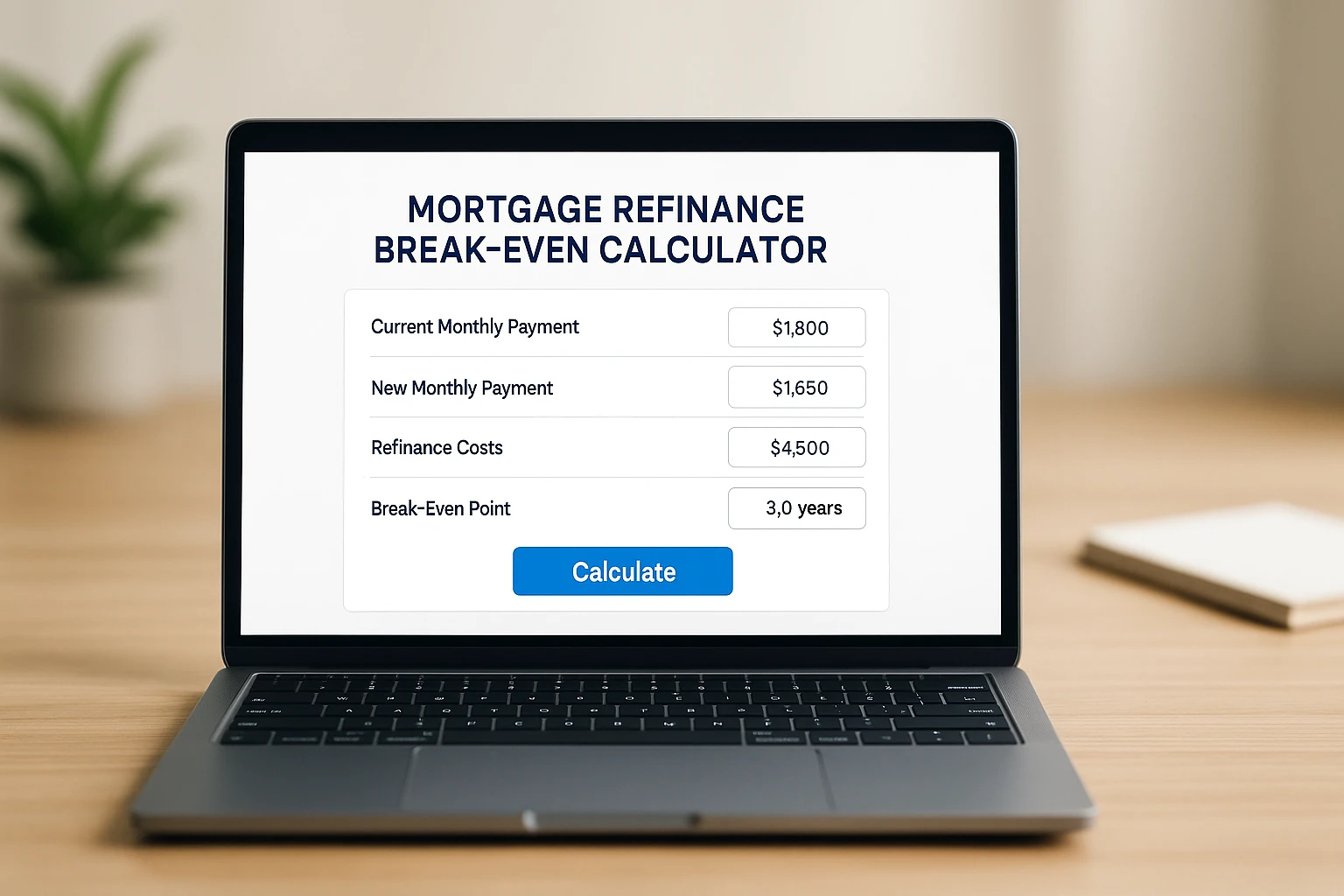

Interactive Mortgage Refinance Break-Even Calculator

Use the refinance calculator below to quickly estimate your break-even point and see, in real numbers, whether a refi might be worth it. If you feel stuck, start by nudging the sliders a little and watching how your break-even month moves—that alone can make the trade-offs much clearer.

Talk Through Your Refi Numbers Live

If you’ve just run your break-even numbers and still feel unsure, you can share them with a finance expert for a quick second look.

This refinancing calculator is for estimates only. Confirm details with your lender or a qualified financial professional who understands your full situation.

For best results, use numbers from your latest mortgage statement, a current rate quote, and your lender’s estimate of closing costs.

Is Now a Good Time to Refinance?

Mortgage rates move with the broader economy and can change quickly. A refinance calculator lets you plug in today’s rates and compare them to your current payment so you’re not relying only on gut feeling. As a rough guide, a 0.5%–0.75% drop can make sense if costs are reasonable and you plan to stay put. Checking offers from a few lenders and tools like Federal Reserve data can give you a clearer picture of where rates are heading.

It can be confusing when headlines shout that rates are “plunging” one week and “surging” the next. Focusing on how today’s rate compares to your own rate—and what that does to your payment in this calculator—is usually more helpful than following every news alert.

Refinance Break-Even Calculator: Real-World Scenarios

Want to see how others saved? Check these examples. 📊 In each case, the calculator clarifies the trade-offs. The names and numbers are simplified, but they’re similar to situations many homeowners run into.

Scenario 1: Short-Term Stay

Example: Sarah owes $200,000 at 5% ($1,073/mo). She refinances to 3.75% ($926/mo), saving $147/mo, with $4,000 costs. She’ll sell in two years.

- Break-Even: $4,000 ÷ $147 = 27.2 months.

- Verdict: She won’t break even in 24 months, losing $472. Not ideal if you’re focused on short-term savings.

Scenario 2: Long-Term Stay

Example: Mark and Lisa owe $300,000 at 4.5% ($1,520/mo), staying 15 years. They refinance to a 15-year loan at 3.25% ($2,100/mo), with $5,000 costs.

- Payment Change: Up by $580.

- Interest Savings: Original: $156,000; New: $78,000; Savings: $78,000.

- Verdict: They save $78,000 and pay off 10 years sooner. Great move if their budget can comfortably handle the higher payment.

Scenario 3: Cash-Out Refinance

A cash-out refinance borrows more than you owe, giving cash for renovations. Use the calculator for your original principal, then weigh cash benefits against any higher loan costs.

| Scenario | Monthly Savings | Break-Even | Verdict |

|---|---|---|---|

| Short-Term Stay | $147 | 27.2 months | Not ideal if selling soon |

| Long-Term Stay | -$580 | N/A (interest focus) | Great for long-term savings |

| Cash-Out Refinance | Varies | Varies | Weigh cash vs. loan costs |

Other Factors to Consider

Look beyond the break-even point for a smart refinance decision that fits your life, not just your spreadsheet.

For example, a refinance that looks great on paper might feel less appealing if your job is unstable or you’re planning a big life change like starting a family or moving cities.

Credit Score Impact

A 740+ score gets the best rates. Refinancing may ding your score temporarily, so avoid new credit during the process and keep paying bills on time.

Loan Term Changes

- Shortening Term: Higher payments, less interest, faster payoff.

- Lengthening Term: Lower payments, more interest over time.

If you want to avoid a full refinance, making biweekly mortgage payments can also reduce interest and speed up your payoff timeline.

Prepayment Penalties

Some loans charge for early payoff. Check your loan terms, as penalties extend break-even time and can change the math.

Also consider how refinancing affects your taxes; our guide to mortgage interest tax deduction rules explains what might change when you adjust your loan.

Home Equity and Loan-to-Value (LTV)

Your available equity and loan-to-value (LTV) ratio influence whether you can refinance and what rate you’re offered. In simple terms, lenders usually prefer that you keep your total mortgage balance below a certain percentage of your home’s value, so a higher down payment or recent value increase can work in your favor. If your home’s value has climbed since you bought, you might qualify for better terms than you expect.

Recasting vs. Refinancing

Instead of refinancing, consider mortgage recasting, which lowers payments by re-amortizing your loan after a lump-sum payment. It’s often cheaper but less flexible than refinancing. You can learn more about mortgage recast vs refinance if you’re deciding between the two.

Using Refinance Savings Wisely

Your savings can transform your finances. Prioritize goals based on your needs, like debt or retirement. Here’s how to use them:

Even an extra $100–$200 a month can feel huge when you’re juggling debt, kids’ activities, or rising grocery costs, so giving those dollars a specific job matters.

- Pay Down Debt: Consider debt consolidation to clear high-interest cards and save more.

- Emergency Fund: Save 3–6 months of expenses.

- Retirement Investments: Low-cost index funds can put savings to work.

- Home Improvements: Boost your home’s value.

- Other Goals: Fund education or travel.

Tips for a Successful Refinance

Maximize benefits with these tips so your refinance feels like a win, not a headache:

If the process feels overwhelming, treat it like a small project: gather documents one evening, request quotes the next, and give yourself a clear “decision date” instead of letting it drag on for months.

- Shop and Negotiate: Compare several lenders and haggle fees.

- “No-Cost” Refinances: These often trade higher rates for lower upfront costs—check total interest.

- Review Documents: Verify Loan Estimates for accuracy.

- Prepare Paperwork: Have pay stubs and tax returns ready.

- Monitor Credit: Avoid new credit to keep your score strong.

- Stress-Test Your Budget: Run the numbers assuming a job change, surprise expense, or childcare cost to be sure your new payment still feels safe.

Frequently Asked Questions

These questions come up a lot when people start playing with the numbers. Use them as a quick reference while you test different scenarios in the calculator.

Quick checklist before you refinance:

- Your break-even point is within about 24–36 months.

- You’re reasonably confident you’ll stay in the home past that break-even month.

- The new payment still fits your budget even if income drops or expenses rise a bit.

Still Unsure About Refinancing?

Bring your calculator results and questions to a finance expert so you can move forward feeling more confident about your next step.

Conclusion

If you’re unsure where to start, spend five minutes plugging your current mortgage and a realistic new rate into the calculator—seeing your own numbers usually feels far less abstract than reading about averages.

Refinancing may save you thousands, but it’s not automatic. Use a mortgage refinance break even calculator to confirm your break-even month, compare lenders, and weigh the costs against how long you’ll realistically stay in the home. Then put any savings to work where they matter most—whether that’s paying down debt, investing for the future, or simply giving your monthly budget a bit more breathing room.

This content is for general education and information only and isn’t personalized financial advice. Your situation is unique, so talk with a qualified mortgage or financial professional before making decisions about refinancing or your home loan. Individual results and savings will vary based on your specific loan terms, credit profile, and housing market.