Retire by 40 is absolutely possible—but one surprise $10,000 IRS bill from misapplying mortgage interest tax deduction rules can feel like it wipes out a year of progress. If you’re chasing Financial Independence, Retire Early (FIRE), juggling investments, withdrawals, and a mortgage can make every tax letter feel scary. The right tax relief professional can help you get organized and respond with confidence, especially when you pair this guide with a simple written plan for your withdrawal and deduction strategy, like our guide to retirement accounts and taxes.

This guide breaks down how the mortgage interest deduction works for FIRE households, dives into tax traps for early retirees, and spotlights trusted tax relief companies.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for FIRE Tax Planning

- Why FIRE Individuals Face Mortgage Interest Tax Challenges

- What Do Tax Relief Services Do?

- When Should FIRE Individuals Seek Tax Relief?

- How Tax Relief Companies Help FIRE Individuals

- Top Tax Relief Companies for FIRE

- Choosing a Tax Relief Company

- FIRE Tax Relief Company Finder

- Before Hiring a Tax Relief Company

- Frequently Asked Questions About the Mortgage Interest Deduction

- 2025 Mortgage Interest Rule Updates

- Mortgage Interest Checklist for FIRE

- Protect Your FIRE Dream

Key Takeaways: Mortgage Interest Tax Deduction Rules for FIRE

- FIRE tax headaches: Early retirees deal with tricky income streams like capital gains or early withdrawals, often tripping over the mortgage-interest deduction rules.

- Tax relief perks: Pros handle IRS issues like audits, back taxes, or liens, advocating on your behalf.

- Pick wisely: Go for companies with clear fees, solid credentials (EAs, CPAs, tax attorneys), and strong reviews.

- Top picks: Optima Tax Relief, Anthem Tax Services, Community Tax, and Tax Defense Network shine for FIRE tax needs.

- Act fast: Ignoring tax issues snowballs into bigger problems. Quick action saves stress and money.

Skimming? If you only have a couple of minutes, start with these bullet points and the checklist section below, then bookmark the rest for later.

Why FIRE Individuals Face Mortgage Interest Tax Challenges

The FIRE lifestyle is awesome, but tax rules can still trip you up. When you’re juggling investments, withdrawals, and a big mortgage, it’s easy to break the mortgage interest tax deduction rules without realizing it—and get hit with surprise penalties later.

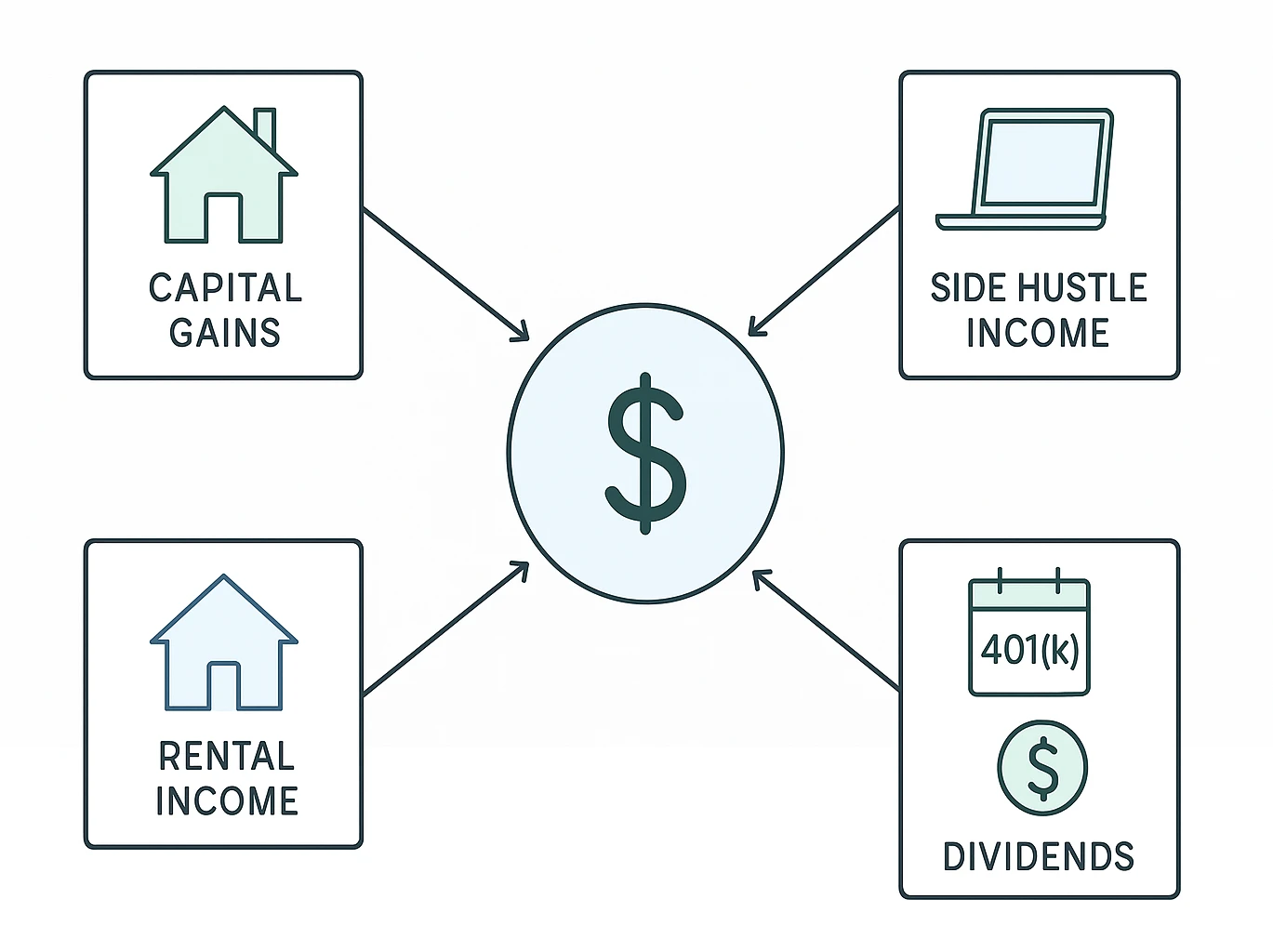

Diverse Income Streams

Unlike traditional retirees with pensions, FIRE folks juggle all sorts of income:

- Capital Gains: Selling stocks or real estate sparks taxes. Messing up basis or short-term vs. long-term gains can mean big bills. Those spikes in income can also change whether itemizing mortgage interest beats the standard deduction in a given year.

- Self-Employment Income: Consulting or side gigs come with self-employment taxes and quarterly payments. Missing these invites penalties, and irregular income makes it easy to over- or underestimate the benefit of claiming mortgage interest versus taking the standard deduction.

- Early Withdrawals: Tapping 401(k)s before 59½ can slap you with a 10% penalty unless you nail exceptions like Rule 72(t). Extra taxable income from early withdrawals can reduce or eliminate other tax breaks, so you want your mortgage deduction strategy dialed in before pulling the trigger.

- Rental Income: Rental properties bring depreciation and passive loss rules, making things messy. You’ll track mortgage interest for rentals separately from your home, and mixing them up is a common audit trigger.

Common mistakes with the mortgage-interest deduction

Getting deductions right is huge for FIRE, but the rules for deducting mortgage interest catch many people off guard. I once helped a pal who thought all HELOC interest was deductible, only to get a tax bill. Per IRS Publication 936, the Tax Cuts and Jobs Act (TCJA) shook things up:

- Debt Limit: For mortgages after December 15, 2017, interest is deductible on up to $750,000 of qualifying debt ($375,000 for married filing separately). Older mortgages often keep a higher $1 million cap.

- Home Equity Loans: Interest is deductible only if funds improve the home securing the loan, not for daily expenses.

- Itemizing Requirement: You must itemize to claim the deduction, but higher standard deductions often make it less worthwhile.

- Rental Properties: Rental mortgage interest is a business expense, but the rules are a maze.

Here’s a quick 2025 snapshot of the key mortgage-interest limits:

| Debt Type | 2025 Deductible Limit (Federal) | Why It Matters for FIRE |

|---|---|---|

| New primary & second home mortgages (after Dec. 15, 2017) | Interest on up to $750,000 of total qualifying acquisition debt ($375,000 if married filing separately). | Large mortgages may leave some interest non-deductible, especially in high-cost housing markets. |

| Older mortgages (on or before Dec. 15, 2017) | Often grandfathered under a $1,000,000 cap ($500,000 if married filing separately). | Legacy loans can generate bigger deductions, but FIRE plans sometimes involve refinancing and losing this benefit. |

| Home equity loans & HELOCs | Interest generally deductible only when funds buy, build, or substantially improve the home securing the loan. | Using a HELOC for living expenses, travel, or investing usually means no mortgage interest deduction. |

To slash mortgage-related tax burdens, check out our mortgage payoff hacks guide.

Real Story: A FIRE friend used a HELOC for living expenses and later owed thousands because that interest wasn’t deductible.

Quick check: itemizing vs. the standard deduction

- Estimate this year’s mortgage interest, property taxes, charitable gifts, and any other itemized deductions.

- Look up the current standard deduction for your filing status (and any age 65+ additions) on IRS.gov or in your tax software.

- Compare the totals. If your itemized deductions only beat the standard deduction by a small amount, your mortgage interest is providing limited extra benefit and it might not justify a lot of extra record-keeping.

- Project high- and low-income years in your FIRE plan so you know when it makes sense to itemize and when to keep things simple.

Where mortgage interest shows up on your tax return

In most cases, your lender sends you Form 1098 summarizing the mortgage interest you paid for the year. If you itemize, that interest usually flows through Schedule A of Form 1040 along with your property taxes and charitable contributions, so keeping those forms together makes tax time much easier.

Lack of Employer Withholding

Without a paycheck withholding taxes, FIRE folks must estimate and pay quarterly. I learned this the hard way when I underestimated my income one year, facing penalties. To stay on track, see our tips for avoiding tax filing fees. Missing payments can lead to costly IRS penalties.

Audit Risks

Complex FIRE returns with big deductions or mixed income raise audit red flags. A buddy’s rental property deductions triggered an audit, which could’ve been dodged with better prep. Learn how to cut risks with our guide on avoiding IRS underpayment penalties. Unfiled returns can also spark serious IRS trouble.

Block 30 minutes on your calendar this week to review your income streams, recent IRS letters, and Form 1098s so you can spot any gaps before the IRS does.

What Do Tax Relief Services Do?

Tax relief services act like a buffer between you and the IRS, tackling both federal and state tax headaches so you don’t have to handle everything alone. If letters from the IRS make your stomach drop or you freeze up on phone calls, having a team in your corner can make the whole process feel much more manageable. They usually bring in:

- Enrolled Agents (EAs): Federally licensed to represent you.

- CPAs: Accountants who know taxes inside out.

- Tax Attorneys: Lawyers for heavy legal tax fights.

“When the IRS came knocking, my tax relief team took over, letting me enjoy my FIRE life stress-free.”

If you’re not ready to call yet, start by listing your notices, balances, and questions so you feel more in control when you do speak with a pro.

When Should FIRE Individuals Seek Tax Relief?

Worried a tax mistake could derail your FIRE plan? You’re not alone. Reach out for help if you’re hit with:

- Back Taxes: Unpaid taxes piling up from past years.

- Unfiled Returns: Missing tax filings.

- Audits: IRS poking around your return.

- Liens or Levies: IRS grabbing your property or wages.

- Penalties: Fines for mistakes or late payments.

- Complex Issues: Overseas income or big capital gains.

If even one of these bullets sounds familiar, set a reminder to schedule a free consultation this week instead of waiting for the next IRS letter.

How Tax Relief Companies Help FIRE Individuals

Tax relief companies can offer a range of options tailored to common FIRE tax messes, so you’re not guessing which IRS form or program might apply to you. It might look like this: you get a scary notice, send your documents to the firm, and they map out which relief programs—if any—fit your income, assets, and FIRE timeline.

Back Taxes Help from Tax Pros

These tax relief companies may help you tackle old IRS balances instead of ignoring them. Common options include:

- Offer in Compromise (OIC): Settle your debt for less if you can’t pay it all.

- Installment Agreement (IA): Pay off taxes over time.

- Currently Not Collectible (CNC): Hit pause on collections during tough times.

Penalty Abatement

Firms can request penalty reductions, especially when taxpayers misunderstand these deduction rules.

Lien and Levy Release

Services fight to stop wage garnishments or bank levies, shielding your FIRE assets.

Unfiled Returns Assistance

Experts prepare overdue returns, helping minimize penalties.

As you read through your IRS letters, circle any unfamiliar terms and bring them to your first call so you can get clear, specific answers.

Top Tax Relief Companies for FIRE

Picking the right firm is key. If you’re already getting collection calls or letters, this comparison can help you narrow your first consultation down to one or two realistic options.

| Company | Services | Best For |

|---|---|---|

| Optima Tax Relief | Audits, OIC, liens, levies | Complex FIRE tax issues |

| Anthem Tax Services | OIC, payment plans, levies | Personalized service |

| Community Tax | Resolution & preparation | Ongoing tax needs |

| Tax Defense Network | Back taxes, state issues | Federal & state taxes |

Optima Tax Relief

- Pros: Wide-ranging services, seasoned team, solid rep.

- Cons: Upfront fees, occasional comms hiccups.

- Best For: Tricky FIRE tax problems.

Anthem Tax Services

- Pros: Happy clients, dedicated case managers.

- Cons: Smaller team, limited reach.

- Best For: Debt resolution with a personal touch.

Community Tax

- Pros: Handles resolution and prep, flexible payments.

- Cons: Mixed reviews, some sales pressure.

- Best For: Ongoing tax prep needs.

Tax Defense Network

- Pros: Broad services, free consult, BBB accredited.

- Cons: Can feel impersonal, pricing varies.

- Best For: Federal and state tax issues.

Choose one or two of these firms to research in more detail, then book a single low-pressure consult to compare how they’d handle your case.

Choosing a Tax Relief Company

When you’re on a FIRE path, it’s easy to feel pressure and say yes to the first persuasive salesperson. Keep these points in mind before you sign anything:

- Credentials: Make sure they’ve got EAs, CPAs, or tax attorneys.

- Transparency: Steer clear of murky fees or wild promises.

- Reputation: Scope out BBB, Google Reviews, Trustpilot.

- Communication: Look for dedicated case managers.

- FIRE Expertise: Check if they know capital gains or early withdrawals.

Before you sign, read through this list out loud and make sure the firm you’re considering checks every box.

FIRE Tax Relief Company Finder

Choose your tax issue and estimated IRS balance to see which tax relief companies might fit your FIRE situation.

Prefer to skip the DIY tools and have a human walk through your numbers?

After your questions are answered, revisit this checklist to keep refining your plan.

Before Hiring a Tax Relief Company

Before you sign a contract while stressed and tired, pause and walk through these steps to make a smarter pick:

Avoid Scams

Watch out for guaranteed results, pushy tactics, or sketchy upfront fees.

Review Contracts

Read the fine print—check services, fees, and how to cancel.

IRS Fresh Start Program

This program offers OIC, penalty relief, and payment plans. Reputable firms tap into it for you.

Consult for Big Settlements

For debts over $100,000, a tax attorney brings legal muscle.

Keep notes from each sales call in one place so you can compare fees, services, and gut feelings side by side.

Frequently Asked Questions About the Mortgage Interest Deduction

2025 Mortgage Interest Rule Updates to Watch

Tax law keeps shifting, especially for homeowners in FIRE. If you’re planning a home purchase, refi, or big remodel in the next few years, these shifts can change how much of your interest actually reduces your tax bill. Here are a few highlights to keep on your radar for the 2025 filing season and beyond:

- Mortgage interest caps: Under current federal rules, homeowners can generally deduct interest on up to $750,000 of qualifying acquisition debt across a main home and one second home ($375,000 if married filing separately), with many mortgages taken out before December 16, 2017 still effectively covered by a higher $1 million cap. New tax legislation in 2025, often called the “One Big Beautiful Bill,” keeps the $750,000 limit in place going forward instead of letting it automatically revert to a different cap after 2025.

- SALT (state and local tax) deductions: For many taxpayers with incomes below roughly $500,000, the cap on state and local tax deductions is temporarily higher—up to about $40,000 of combined property and income taxes from 2025 through 2029—before phasing back down. Where you live and how much you earn now play an even bigger role in whether itemizing with mortgage interest beats the standard deduction.

- Still-high standard deduction: The standard deduction remains relatively high and continues to be indexed for inflation. Some older taxpayers may also qualify for an additional senior deduction under the new law, which can make itemizing—including mortgage interest—less attractive in years when their other deductions are low.

Because lawmakers keep tweaking these rules, always confirm the latest numbers with IRS instructions (such as Publication 936) or a qualified tax pro before you bank on a specific deduction in your FIRE plan.

Tip: Tax rules change quickly. Before you lock in a strategy, double-check current limits on IRS.gov or with a qualified tax professional.

Mortgage Interest Deduction Checklist for FIRE Households

Before you file, use this quick checklist to make sure you’re applying the mortgage interest tax deduction rules in a way that actually supports your FIRE plan instead of accidentally fighting it. Grab your latest mortgage statement and last year’s tax return so you can tick these off in five minutes.

- ✅ My home loan qualifies as acquisition debt on my main home and/or one second home.

- ✅ My total qualifying home debt is within the current IRS limits for deductible mortgage interest.

- ✅ I’ve checked whether itemizing (with mortgage interest included) beats the standard deduction for this tax year.

- ✅ I’ve separated any rental or home office portion of mortgage interest from personal-use interest on the return.

- ✅ I’ve saved Form 1098s and key closing documents in one place in case the IRS ever asks for backup.

Protect Your FIRE Dream

FIRE means financial freedom, but the mortgage-interest deduction rules can still throw a wrench in your plans. From audits to back taxes, IRS issues can mess things up. Tax relief companies may help you address these problems and lower your stress, so you can focus on living your life. To map out your financial independence, check out our Coast FIRE calculator. Pick a trustworthy firm, double-check credentials, and jump on issues early to keep your financial freedom safe.

This content is for general informational purposes only and does not constitute individualized tax, investment, or financial advice. Tax laws change frequently, and the examples here are simplified; always consult a qualified tax professional or the IRS for guidance on your specific situation. Your situation may differ from the examples used here, and outcomes will always vary based on your own numbers and decisions.