Picture a quiet sunrise at 60, coffee in hand and work off your plate. If you’re exploring fire planning, these steps keep things realistic and flexible. Can $2 million really carry you? Many ask how to retire at 60 with 2 million dollars. Making it work comes down to clear spending, right-sized withdrawals, and smart moves around Social Security, healthcare, and taxes. This guide walks through the pieces and lets you test ideas with a simple simulator. For the bigger framework, see our guide to financial independence and early retirement.

Interactive Retirement Simulator

Annualize rent; include taxes, insurance, HOA, and utilities in costs.

Move the sliders to see how long your $2M may last.

*Assumes 5% portfolio growth and 3% inflation (historical averages). Markets vary. Consult a financial advisor.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Retiring at 60

- Interactive Retirement Simulator

- Can You Retire at 60 with $2 Million?

- How to Retire at 60 with 2 Million Dollars: Safe Withdrawal Rates

- Social Security: Timing Your Benefits

- Asset Allocation: Protecting Your $2 Million

- How to Retire at 60 with 2 Million Dollars: Your Step-by-Step Plan

- Frequently Asked Questions

- Summary: Your Path to Retire at 60 with 2 Million Dollars

Key Takeaways for Retiring at 60

- $2M Can Work: It can support a comfortable retirement when your spending matches a realistic plan.

- Withdrawal Rate: A 3.5%–4% range has supported 30+ years in past research; tailor it to your horizon.

- Budget & Healthcare: Build a real budget and price healthcare carefully — they drive sustainability.

- Social Security Timing: When you claim changes lifetime income; coordinate with your withdrawals.

- Flexibility: Stress-test and review yearly so you can trim in rough markets and add back later.

Can You Retire at 60 with $2 Million?

Is $2 million enough to retire at 60? It depends on lifestyle, expenses, health, and time horizon. A well-managed $2 million portfolio can generate income for 30 years or more, making retirement at 60 achievable. For example, if you live on $80,000 annually, $2 million could last 25 years without growth. With reasonable returns, your money can stretch further. If your savings are closer to $1 million, our guide to retiring at 60 with $1 million walks through a leaner version of this plan.

Start with Your Lifestyle

Before you run numbers, picture a week in retirement. Will you travel often, pick up new hobbies, or stay close to home? Those choices set your budget. Then total your annual expenses.

Estimating Your Annual Expenses

Many retirees underestimate costs. Commuting may drop, but travel or healthcare can rise. Map the big buckets — housing (mortgage, taxes, utilities, maintenance), food, transportation, healthcare, insurance, leisure/travel, taxes, and a small buffer. Track a few months of spending and include irregular bills like premiums and repairs. Suppose your target is $75,000 a year.

Your retirement budget should match spending to your values. Be honest about needs versus wants.

Healthcare Costs: The Big Challenge

Healthcare is a major wildcard before Medicare at 65. If you retire earlier, you’ll need private insurance via the Affordable Care Act (ACA) or COBRA. Premiums vary by state, income, and plan—roughly $500–$1,500 monthly. After 65, Medicare reduces costs, but premiums, coinsurance, and Medigap add up. For a deeper walkthrough of your pre-Medicare coverage choices, see our guide to health insurance options for early retirees. Long-term care is another consideration. For federal marketplace info, see Healthcare.gov.

Travel and Leisure Costs

Expect travel to rise in early retirement. Budget $5,000–$20,000 annually depending on frequency and distance.

Accounting for Inflation

Inflation erodes purchasing power. At 3% annually, $75,000 today becomes about $100,750 in 10 years. Your portfolio needs some growth to keep pace. Consider holding a slice of bonds in TIPS as an inflation hedge.

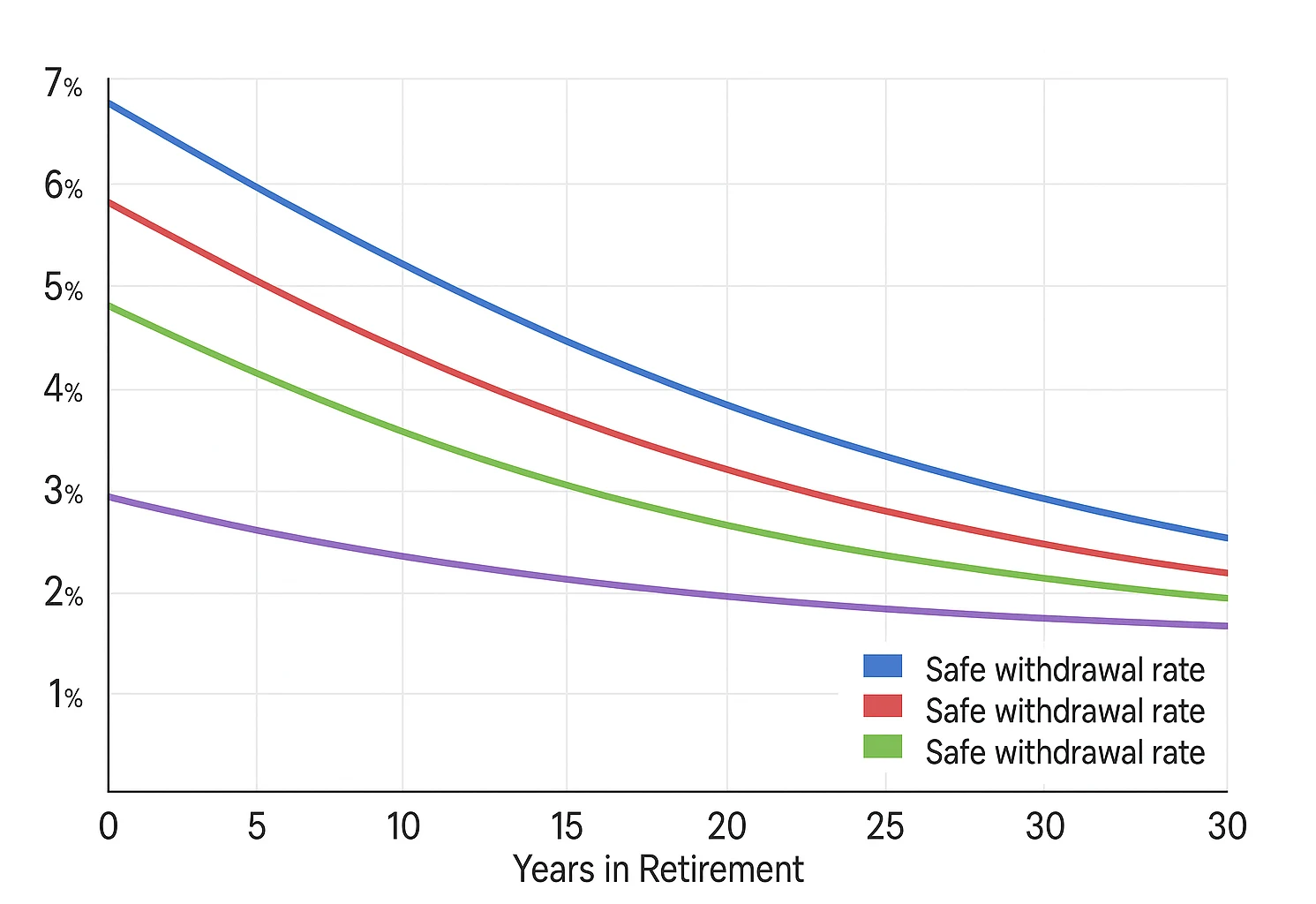

Safe Withdrawal Rates for Retiring at 60 on $2 Million

If you’re asking how to retire at 60 with 2 million dollars, your withdrawal rate is the lever that decides how long your nest egg lasts.

Your $2 million is like a well you sip from carefully. A safe withdrawal rate (SWR) guides how much to take each year without depleting the portfolio.

The 4% Rule Explained

The 4% rule, based on research like the Trinity Study, suggests withdrawing 4% of your initial portfolio ($80,000 from $2 million) in year one, then adjusting for inflation. Historically, this lasted ~30 years for balanced portfolios, but low returns or longer retirements may require caution.

The 3.5% Rule for Extra Safety

For a 35+ year horizon, a 3.5% rate ($70,000 from $2 million) is more conservative—especially in uncertain markets.

Flexible Withdrawals for Resilience

Rigid withdrawals can backfire during market dips. Use dynamic spending: trim in bad years and increase in good ones to reduce sequence-of-returns risk.

Social Security: Timing Your Benefits

Social Security can meaningfully ease the load on your portfolio. Timing matters.

Claiming Options: Early, Full, or Delayed

You can claim at 62 (reduced benefits), at Full Retirement Age (66–67, full benefits), or delay to 70 (delayed retirement credits can raise your monthly amount). If your FRA benefit is $2,500/month ($30,000/year) and you retire at 60, your portfolio covers $75,000 until 67. Then Social Security reduces withdrawals to $45,000—under 3% of $2M. If you expect Social Security to be your primary income source later on, our guide to living frugally on Social Security shows how to stretch those checks further.

Strategic Delaying

If your portfolio allows, delaying provides a built-in, inflation-adjusted increase via SSA’s delayed retirement credits. Increases generally stop at age 70; verify your specific credit rate on SSA.gov and coordinate with your broader plan.

Rules change. Verify official details at SSA.gov’s delayed retirement credits page before you claim.

Asset Allocation for FIRE Planning: Protecting Your $2 Million

You’re balancing growth with stability. Too conservative invites inflation risk; too aggressive can stress the plan during down markets. Aim for a mix that lets you sleep at night and still outpace rising costs.

Balanced Portfolio Approach

A simple starting point is 40–60% stocks for growth, 30–50% bonds for stability, and 1–2 years of cash. Adjust to your risk tolerance and spending needs. If you’re newer to low-cost funds, our index fund investing 101 guide walks through choosing simple stock and bond funds.

The Bucket Strategy

Divide your portfolio into:

- Short-Term (1–3 years): Cash/CDs for immediate needs.

- Mid-Term (3–10 years): Bonds for income.

- Long-Term (10+ years): Stocks for growth.

Pull from Bucket 1 and refill from others strategically to avoid selling low.

How to Retire at 60 with 2 Million Dollars: Your Step-by-Step Plan

Now, combine the pieces into a simple plan.

Step 1: Build Your Budget

Create a detailed budget, separating needs from wants. Include healthcare and inflation. Aim for $63,000–$70,000 annually, depending on Medicare status. If you want more help tightening expenses, start with our guide on living frugally and saving money to build a sustainable baseline.

Step 2: Model Income Streams for fire planning

Calculate withdrawals ($75,000 = 3.75% of $2 million initially). Plan Social Security (e.g., $30,000 at 67). Consider part-time work or pensions to diversify income.

| Item | Annual Amount ($) | Notes |

|---|---|---|

| Projected Expenses | ||

| Housing | 10,000 | Taxes, insurance, utilities |

| Food | 12,000 | Groceries, dining |

| Transportation | 5,000 | Car, gas, maintenance |

| Healthcare (Pre-Medicare) | 15,000 | ACA, deductibles (until 65) |

| Healthcare (Post-Medicare) | 8,000 | Premiums, Medigap (from 65) |

| Travel | 10,000 | 1–2 trips |

| Hobbies & Entertainment | 6,000 | Golf, streaming |

| Miscellaneous | 5,000 | Gifts, emergencies |

| Total Expenses | 63,000–70,000 | Varies by Medicare |

| Projected Income | ||

| Social Security (FRA) | 30,000 | At 67 |

| Portfolio Withdrawal | 33,000–40,000 | Expenses minus Social Security |

| Withdrawal Rate | 1.65%–2.0% | Based on $2M |

Note: Adjust for inflation annually.

Step 3: Optimize Asset Allocation

Use a 50/50 or 60/40 stock/bond split. Implement the bucket strategy and rebalance yearly.

Step 4: Plan Taxes

Traditional IRA withdrawals are taxed as income; Roth withdrawals are tax-free. Consider Roth conversions in low-income years (60–73). Manage capital gains in taxable accounts.

Step 5: Address Healthcare

Research ACA plans for ages 60–64 and understand Medicare options (Parts A, B, D, and Medigap) before 65. Budget for healthcare-specific inflation.

Prefer licensed help to compare ACA options?

Step 6: Stress-Test Your Plan

Stress-test your plan by checking a deep market drop, 4% inflation, and living to 100. A Monte Carlo run shows how often the plan holds up.

Step 7: Stay Flexible

Do a yearly check-in — budget, portfolio, and withdrawals — and adjust as life or markets change.

Frequently Asked Questions

Summary: Your Path to Retire at 60 with 2 Million Dollars

Retire at 60 on $2 million by budgeting $63k–$75k, using a 3.5–4% withdrawal rate, timing Social Security wisely, keeping a balanced allocation, and planning taxes; stress-test for inflation and market dips and review annually. With discipline—and guidance from a fiduciary advisor—your $2 million can support a confident, flexible retirement.

This content is educational and not financial, tax, or legal advice. Verify Social Security rules at SSA.gov and health coverage details at HealthCare.gov. Consider guidance from a fiduciary advisor and a tax professional before acting.