Dreaming about clocking out at 50—without stressing every market headline? With a clear plan for spending, investing, healthcare, and taxes, your $2M can work for decades—this is essentially how to retire at 50 with 2 million. Use the planner below to test your numbers, and see how this fits into our financial independence & early retirement guide.

Retirement Planner: Check Your Numbers

Enter today’s dollars. Include property taxes, insurance, HOA dues, medical premiums, and utilities in your annual costs.

Projection Summary

Years Your Portfolio Will Last: — Portfolio Depletion Age: —

For a longer retirement, many households use a 3–3.5% initial withdrawal and adjust as markets change.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Early Retirement

- Is $2M Enough to Retire at 50?

- Safe Withdrawal Rates for a $2M, Age-50 Retirement

- Budget Blueprint for a $2M, Age-50 Retirement

- Investing Strategies for Early Retirement

- Healthcare Before Medicare in Early Retirement

- Tax Strategies for Early Retirement

- Lifestyle Scenarios

- Managing Your Retirement Plan

- Frequently Asked Questions

- Final Thoughts on Retiring at 50

Key Takeaways for Early Retirement

- Plan for longevity: Retiring at 50 means funding 40+ years. Many use a 3–3.5% safe withdrawal rate (SWR); our 4% rule guide explains why.

- Budget drives success: Target $60,000–$70,000 per year and adjust for inflation.

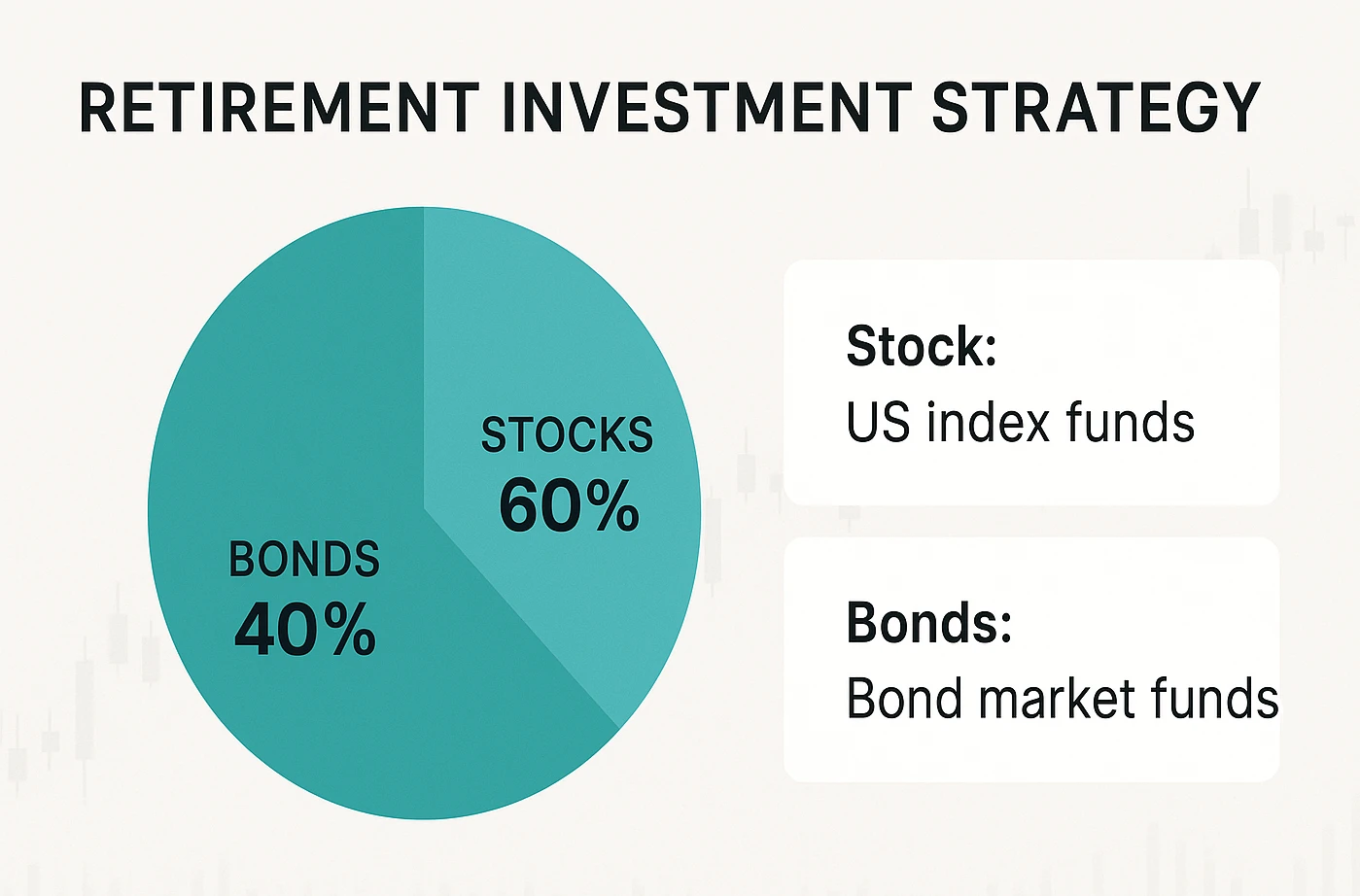

- Stay balanced: A 60% stock / 40% bond mix supports growth and stability.

- Cover healthcare: Before Medicare at 65, compare ACA options.

- Mind taxes: Roth conversions and smart withdrawal order can lower lifetime taxes.

How to Retire at 50 with 2 Million: Is It Enough?

For many households, yes, it’s enough—if you match spending to a prudent plan. Retiring at 50 means planning for 40–60 years of expenses. Your $2 million has to pay the bills and still grow enough to keep up with inflation.

The 4% rule implies about $80,000 from $2 million. For a longer horizon, many prefer 3–3.5%—you’ll need smart moves to make it last.

| Withdrawal Rate | Annual Income from $2M |

|---|---|

| 4.0% | $80,000 |

| 3.5% | $70,000 |

| 3.0% | $60,000 |

Can $60,000–$80,000 sustain your lifestyle? Use the planner above and stress-test for market swings.

“Start with your expenses and a solid withdrawal plan—then the rest of the puzzle gets much easier.”

Safe Withdrawal Rates for a $2M, Age-50 Retirement

Here’s a practical path to retire at 50 on $2M while keeping withdrawals sustainable.

What Is a Safe Withdrawal Rate?

A ‘safe withdrawal rate’ is the share you pull each year and bump up for inflation so your money may last. The classic 4% guideline targets ~30-year retirements. With 40+ years, 3–3.5% is usually safer.

Why a Lower SWR?

- Sequence risk: Early downturns hurt more with high withdrawals.

- Longer lifespan: Plan for 40–50 years.

- Inflation: Protect purchasing power.

Flexible withdrawal strategies: Adjust withdrawals in strong markets and tighten during downturns, use 3–4% guardrails tied to performance, and keep 1–2 years of cash with 3–5 years in bonds as a buffer.

Budget Blueprint for a $2M, Age-50 Retirement

This section shows a practical budget to retire at 50 with a $2M portfolio.

Step 1: Track Current Spending

Track every dollar for a few months using a budgeting app. Categorize expenses to set a baseline.

Step 2: Project Retirement Expenses

Some costs drop while others rise:

- Decreasing: Commuting, work costs, retirement contributions, and possibly mortgage if paid off.

- Increasing: Healthcare (pre-Medicare), travel and hobbies, and inflation on essentials.

Sample Budget for $70,000/Year

A practical example for a couple using a 3.5% SWR:

| Category | Monthly Cost | Annual Cost | Notes |

|---|---|---|---|

| Mortgage/Rent | $0 | $0 | Paid-off house |

| Property Taxes | $350 | $4,200 | |

| Home Insurance | $100 | $1,200 | |

| Utilities | $300 | $3,600 | |

| Home Maintenance | $200 | $2,400 | Repairs, landscaping |

| Groceries | $600 | $7,200 | |

| Dining Out | $300 | $3,600 | |

| Car Insurance | $150 | $1,800 | |

| Gas/EV Charging | $150 | $1,800 | |

| Car Maintenance | $100 | $1,200 | |

| ACA Premiums | $800 | $9,600 | Pre-Medicare estimate |

| Out-of-Pocket Medical | $200 | $2,400 | Co-pays, prescriptions |

| Personal Care/Clothing | $150 | $1,800 | |

| Hobbies/Entertainment | $400 | $4,800 | Movies, concerts |

| Travel | $500 | $6,000 | Vacations |

| Subscriptions | $50 | $600 | Streaming, gym |

| Gifts/Charity | $100 | $1,200 | |

| Contingency | $500 | $6,000 | 10% buffer |

| Total Monthly | $5,750 | ||

| Total Annual | $69,000 | Fits $70,000 budget |

This budget shows how a $2M early-retirement plan at 50 can feel comfortable, especially with a paid-off home.

Investing Strategies for Early Retirement

Balancing Growth and Stability

Your $2 million has to pay the bills and still grow fast enough to outrun inflation. A balanced allocation supports a durable age-50 retirement. If you’re new to index funds, start with our index fund investing 101 guide.

- Stocks (60%): Growth to fight inflation. Use broad index funds.

- Bonds (40%): Stability and income. Choose bond market funds.

- Cash: 1–2 years of expenses for liquidity.

Why Not 100% Bonds?

Bonds alone rarely beat inflation over 40+ years. Equities can help preserve purchasing power.

Implementing Your Strategy

- Diversify: Spread across industries and geographies.

- Low-cost funds: Index funds or ETFs reduce fees.

- Rebalance annually: Maintain your 60/40 split.

Good wealth planning keeps these pieces working together over decades.

“Your portfolio is the engine that powers financial freedom.”

Healthcare Before Medicare in Early Retirement

Healthcare Options

Healthcare is vital when planning an age-50 retirement with $2M, since Medicare starts at 65. For a deeper look at premiums, subsidies, and networks, see our health insurance guide for early retirees. Options include:

- ACA Marketplace: Buy plans via Healthcare.gov. Subsidies depend on MAGI.

- COBRA: Continue employer plans for 18 months, often expensive.

- Private Insurance: No subsidies, higher costs.

- Health Sharing Ministries: Lower cost but not insurance.

- Part-Time Work: Roles with benefits.

Budgeting for Healthcare

Compare ACA plans, budget for deductibles, and use HSAs when eligible.

Healthcare note: Use the official Marketplace at HealthCare.gov or a licensed navigator. Avoid look-alike sites and verify plan details before enrolling.

“A solid healthcare plan protects your nest egg.”

Tax Strategies for Early Retirement

Optimizing Your MAGI

Manage Modified Adjusted Gross Income (MAGI) to qualify for ACA subsidies and lower taxes.

Pro tip: Thoughtful long-term planning ties your taxes, healthcare, and investments together so your MAGI stays in the right range.

Key Tax Strategies

- Roth conversions: Pay taxes now for tax-free withdrawals later.

- Withdrawal order: Use taxable, then Roth, then tax-deferred.

- Tax-loss harvesting: Offset gains and up to $3,000 of income.

- HSAs: Triple-tax benefits if eligible.

To map out a staged conversion plan, use our Roth conversion ladder spreadsheet.

Rule of 55

If you separate from your employer in or after the year you turn 55, certain 401(k) withdrawals may avoid the 10% penalty under the “Rule of 55.” This generally doesn’t apply to IRAs. At 50, consider taxable accounts or a SEPP (72(t)) plan.

Tax note: Strategies like Roth conversions and 72(t) plans have strict rules. Consider working with a fiduciary financial planner or tax professional.

Lifestyle Scenarios

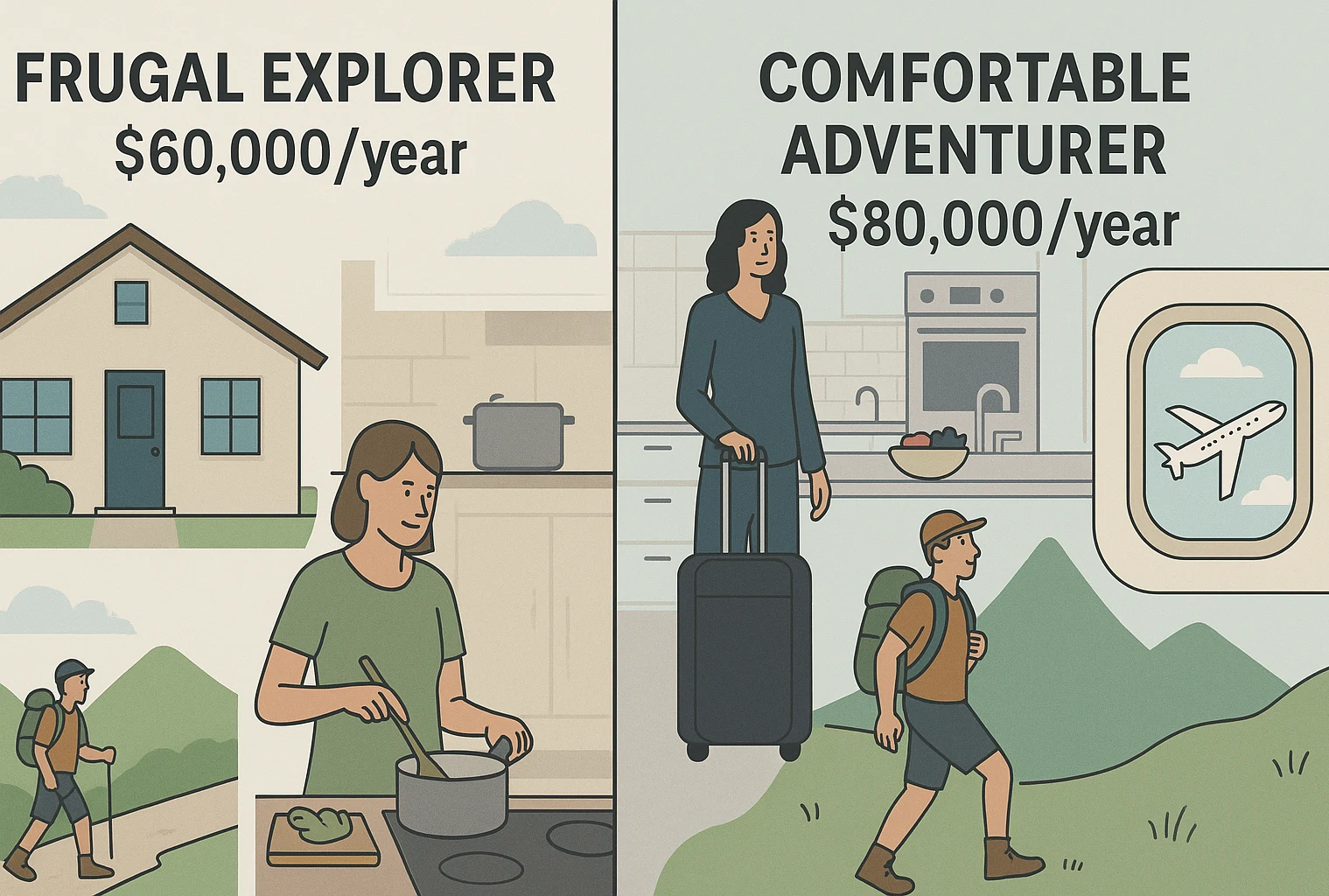

Frugal Explorer ($60,000/Year)

- Housing: Paid-off home in a low-cost area or geo-arbitrage.

- Travel: Budget trips and off-season deals.

- Food: Mostly home-cooked meals.

- Healthcare: Leverage ACA subsidies.

- Benefit: $2M can last 40+ years.

Comfortable Adventurer ($80,000/Year)

- Housing: Mortgage or high-cost area.

- Travel: Frequent international trips.

- Food: Dining out more often.

- Healthcare: Higher costs.

- Trade-off: Requires flexibility around the 4% rule.

Managing Your Retirement Plan (Wealth Planning)

Annual Reviews & Wealth Planning

Review yearly: budget, portfolio (rebalance), taxes, healthcare options, and goals.

Embracing Flexibility

Adapt to succeed:

- Dynamic spending: Adjust withdrawals to markets.

- Side income: Reduce portfolio strain.

- Location: Consider lower-cost regions.

- Emergency fund: Maintain a healthy buffer.

“A dynamic plan is what keeps you on track.”

Frequently Asked Questions

Final Thoughts on Retiring at 50

Retiring at 50 on $2M is about aligning spending with a sustainable plan, keeping enough growth in the portfolio, and staying flexible. Review annually, adjust when needed, and base decisions on your plan—not headlines.

Educational content only—not financial, tax, legal, or healthcare advice. This content is for informational purposes only. Consider consulting qualified professionals before making financial decisions or acting on this information.