Imagine paying off your debt months sooner with our free, easy spreadsheet. Tired of the never-ending cycle of debt? Do you dream of a day when your hard-earned money isn’t disappearing into interest payments? You’re not alone. Many are on a journey to become debt-free, but the path can feel overwhelming. With multiple balances, it’s tough to know where to start or how to stay motivated. For a broader plan that ties everything together, see our debt management plan.

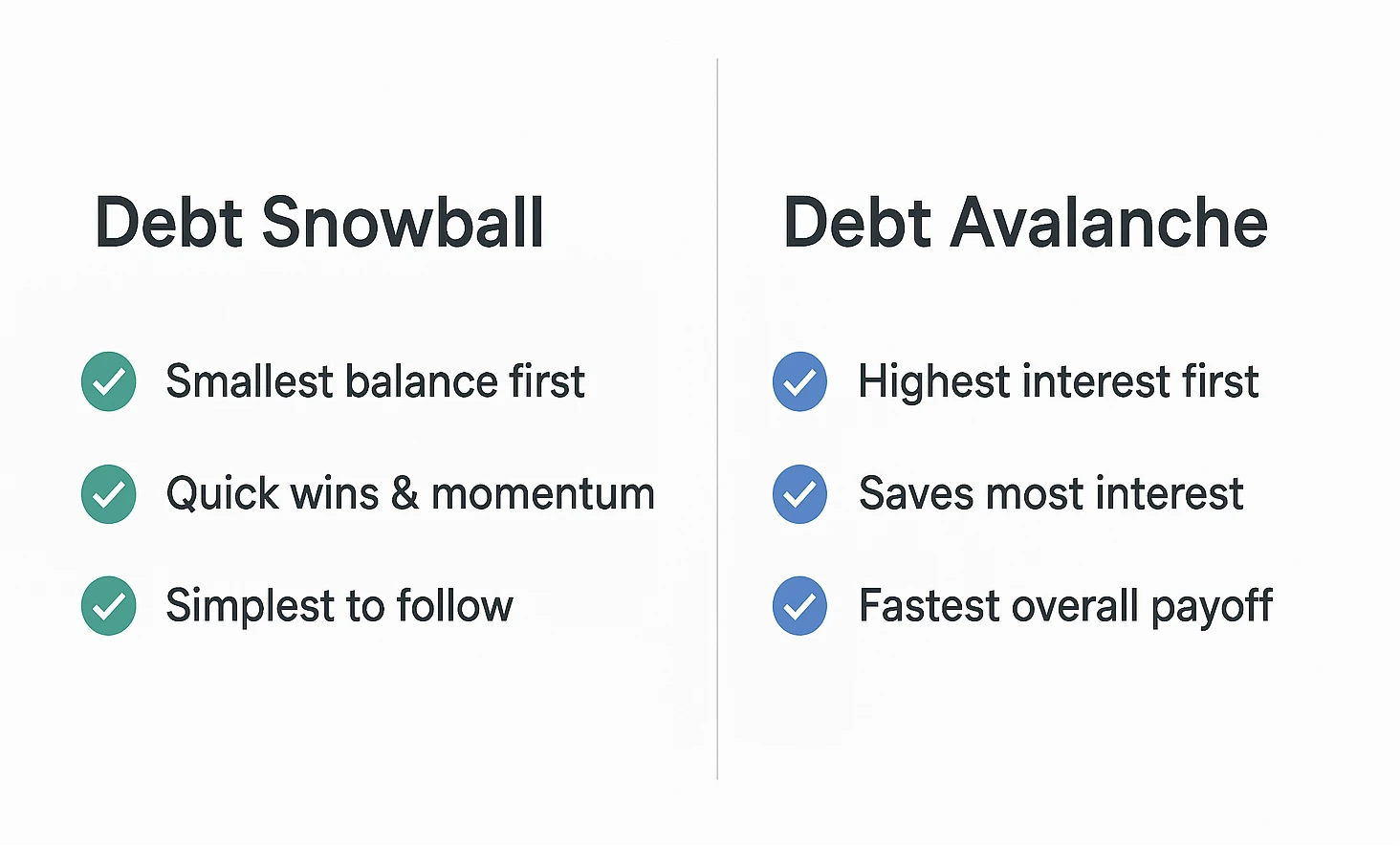

Fortunately, strategic payoff methods help. The Debt Snowball and Debt Avalanche tackle debt differently—one fuels quick wins, the other maximizes savings.

The good news? You don’t have to guess. We’ve created a free debt snowball vs avalanche excel spreadsheet that compares both methods side-by-side so you can pick a path and accelerate progress. Let’s dive in.

Blast Your Debt Away!Table of Contents

- Key Takeaways

- Debt Repayment Strategies

- Debt Snowball Explained

- Debt Avalanche Explained

- Debt Snowball vs. Avalanche Comparison

- Interactive Debt Comparison Tool

- Choosing Your Method

- Free Excel Payoff Spreadsheet

- Power of Visual Tracking

- Frequently Asked Questions

Key Takeaways

- Debt Snowball: Pay off the smallest balance first to build momentum and motivation.

- Debt Avalanche: Target the highest APR first to save the most interest.

- Choosing Your Method: Match your personality: snowball boosts motivation; avalanche maximizes savings.

- Free Excel Tool: Input debts, compare both methods, and track a clear payoff timeline.

- Stay Motivated: Visual, color-coded tracking helps you see progress and celebrate wins.

Debt Payoff Methods: Snowball vs. Avalanche

This section explains both debt payoff methods so you can pick what fits your budget.

Before diving into our free payoff spreadsheet, let’s clarify the two titans of debt payoff: the Debt Snowball and Debt Avalanche. Both are effective—think of them as two routes to the same destination: debt freedom.

Debt Snowball Explained: Build Momentum 🌨️

The Debt Snowball method, popularized by financial expert Dave Ramsey, focuses on momentum through quick wins. It’s ideal for those needing motivation to stay on track. Need a boost? Read these debt payoff success stories.

How the Debt Snowball Works

- List all debts: Include every debt, from credit cards to personal loans or car loans.

- Order by balance: Arrange debts from smallest to largest balance, ignoring interest rates.

- Pay minimums: Make minimum payments on all debts except the smallest one.

- Attack smallest debt: Put every extra dollar on the smallest debt above the minimum.

- Roll payment: After payoff (🎉), add that payment to the next smallest debt.

- Repeat: Continue snowballing until all debts are gone.

Debt Avalanche Explained: Maximize Savings 🏔️

The Debt Avalanche often results in the lowest interest cost. It’s ideal for disciplined individuals focused on minimizing interest. If you qualify, consider no-fee balance transfer credit cards to reduce interest during payoff.

How the Debt Avalanche Works

- List all debts: Include all debts, as with the snowball.

- Order by interest rate: Arrange from highest to lowest APR.

- Pay minimums: Cover minimums on all debts except the highest-APR one.

- Attack highest interest: Apply extra payments to the highest-APR debt.

- Roll payment: After payoff (🥳), roll its payment to the next highest.

- Repeat: Continue avalanching until debt-free.

Debt Snowball vs. Avalanche: A Side-by-Side Comparison

Here’s a quick side-by-side so the differences are easy to spot:

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Priority | Smallest balance first | Highest interest rate first |

| Primary Benefit | Psychological wins, motivation | Saves most money on interest |

| Payoff Speed | Feels faster initially | Often similar or slightly faster overall |

| Total Cost | May pay more in interest | Pays least in interest |

| Best For | Those needing motivation | Disciplined savers |

| Complexity | Very simple | Requires interest rate knowledge |

| Feeling | Empowering, addictive | Financially savvy |

Interactive Debt Payoff Comparison Tool

Enter balance & APR; minimums auto-calc (assumes the greater of 2% or $25). Results auto-update.

Estimates only. Results vary by lender terms and your payments. For impartial basics, see the CFPB’s guide to reducing debt.

Use the snowball vs. avalanche spreadsheet below to preview both methods with mobile-friendly inputs. Add debts only if needed. Want to understand a single loan schedule? Try our loan amortization calculator.

Your Debt Payoff Comparison

Debt Snowball

Total Interest Paid: $0.00

Estimated Payoff Time: 0 month(s)

Snowball focuses on smaller balances first to help keep motivation high.

Debt Avalanche

Total Interest Paid: $0.00

Estimated Payoff Time: 0 month(s)

Avalanche prioritizes higher-interest debts to reduce total interest paid.

Please enter at least one debt with balance & APR.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Choosing the Right Debt Payoff Method for You

No method is automatically “the best”—it’s about what works for you. Consider:

- Are you a starter or a finisher? If kicking things off feels tough, the snowball’s quick wins can help. If you’re highly disciplined, the avalanche will save more.

- Savings or motivation? The avalanche cuts interest. The snowball provides early victories. If a bit of extra interest keeps you on track, view it as a motivation fee.

- Your debt mix? If high-APR debts are small, you may get both benefits; if they’re large, avalanche may feel slow at first.

For an impartial overview of payoff strategies, see the CFPB’s guide to reducing debt. You can also build momentum with a debt payoff tracker.

Hybrid approach (mix & match)

Start with one or two quick snowball wins to build momentum, then switch to avalanche for maximum interest savings. If motivation fades, swap back for a small win—your plan can evolve.

Ultimately, consistency matters most. The best method is the one you stick with. Our spreadsheet shows both paths clearly.

Real Story: Sarah, a teacher, felt overwhelmed by $15,000 in credit card debt. Using our spreadsheet, she chose the snowball method, paid off two small cards in six months, and gained the confidence to tackle larger debts. Now, she’s debt-free and saving for a home.

Free Debt Snowball vs Avalanche Excel Spreadsheet 🚀

Seeing is believing, and our free spreadsheet is your debt payoff companion. Use it to compare both paths side-by-side and stay motivated.

Features of Our Debt Payoff Spreadsheet

- Debt Input: Enter creditor, balance, interest rate, and minimum payment.

- Automatic Calculations: The spreadsheet sorts debts for both methods.

- Side-by-Side Comparison: See payoff time and interest for each method.

- Interest Savings: Discover how much you save with the avalanche.

- Payoff Timeline: Get a debt-free date for each strategy.

- Color-Coded Tracker:

- Gray ⚪: Inactive or paid-off debts.

- Yellow 🟡: Current target debt.

- Green 🟢: Paid-off debts—celebrate! 🎉

- Blue 🔵: Needs review (off-track or missed update).

Download the Spreadsheet (.xlsx)

How to Use the Spreadsheet

- Download: Click the button above.

- Open: Use Excel, Google Sheets, or LibreOffice Calc.

- Google Sheets quick setup: Upload the file → File > Make a copy → start editing.

- Enter Debts: In “Debt Entry,” input names, balances, APRs (%), and minimums.

- Set Extra Payment: Specify your monthly extra payment.

- View Plans: Check “Snowball” and “Avalanche” tabs for order, dates, and interest paid.

- Choose Method: Pick based on comparison and motivation style.

- Track Progress: Update balances monthly to see accounts shrink.

- Use Colors: Watch targets turn yellow, then green, as you progress.

Want a monthly plan? Pair it with our zero-based budget spreadsheet to free up cash for extra payments.

The Power of Visual Tracking and Motivation

Why is our spreadsheet effective? Because visual progress fuels motivation. Watch your balances shrink in real time.

- Clarity: It shows exactly what to pay and when.

- Accountability: Regular updates keep you on track.

- Motivation: Seeing debts turn green is satisfying.

- Budget tie-in: Redirect a small, steady amount (e.g., $50 from dining out) into your extra payment and see your payoff date move up.

- Flexibility: Adjust extra payments as income changes.

“What gets measured, gets managed. Our spreadsheet turns payoff into a winnable game!”

Frequently Asked Questions

Final Thoughts on Your Debt-Free Path

The journey to debt freedom is a marathon, not a sprint—but with our spreadsheet, it’s a marathon you can win. Whether you choose the motivational boost of the snowball or the savings of the avalanche, this tool lights the way. Start your debt-free future today—you’ve got this! ✨

This content is for informational purposes only and not financial advice. Consult a qualified professional before making financial decisions.