Thursday, June 12, 2025, around 11:30 in the morning (Israel time)

Pay your student loans off faster with our student loan amortization calculator with extra payments. This powerful tool helps you save thousands in interest and ditch debt’s burden to unlock dreams like homeownership or travel. Start now!

Table of Contents

- Key Takeaways

- Why Pay Off Student Loans Faster?

- Understanding Amortization

- Student Loan Amortization Calculator with Extra Payments

- How to Use the Student Loan Amortization Calculator with Extra Payments

- Real-Life Scenarios

- Strategies for Finding Extra Money

- Federal vs. Private Student Loans

- Psychological Benefits of Accelerating Your Payoff

- Common Pitfalls to Avoid

- Commit to Your Plan

Here’s how this student loan payoff calculator and smart strategies can transform your payoff journey.

Key Takeaways

- Learn the Loan Basics: Figure out how your payments split between interest and principal (the loan amount), and see how extra payments make a big difference.

- Rock the Calculator: Use our student loan payoff calculator with extra payments to map out your debt-free plan, save on interest, and nail down your payoff date.

- Save Big with Small Steps: Even tiny extra payments—like $20 a month—can slash your interest costs and get you debt-free years sooner. It’s like giving your future self a high-five!

- Plan Your Payoff Like a Pro: I’ve been there, scraping together extra cash to tackle my loans. With this calculator, you can find clever ways to free up money, figure out federal vs. private loans, and speed up your debt-free journey.

- Take Charge: Get empowered with a clear plan and this student loan payoff calculator to make repayment totally doable.

Why Pay Off Student Loans Faster? The Power of Extra Payments

You might think, “My monthly payment’s already a stretch, so why add more?” Using a payoff calculator that supports extra payments is a game-changer. It saves you cash and opens doors to new possibilities. Here’s why it’s worth it:

- Cut Interest Costs Big Time: Student loans pile on interest every single day. By throwing extra money at the principal (the actual loan amount), you shrink what’s left to charge interest on. I’ve seen friends save thousands this way, and you can too!

- Get Free Sooner: Picture redirecting your loan payment to a vacation, a house, or retirement savings. Paying off loans faster gives you that freedom.

- Less Stress: Debt can feel like a dark cloud. Watching your balance drop lifts that weight and keeps you motivated.

- Better Financial Stats: Lowering your debt-to-income ratio (DTI, or debt vs. income) makes it easier to snag mortgages or car loans with great rates.

- More Cash for Dreams: Without loan payments, you can save for big goals or just enjoy life more.

Every extra buck you toss at your loan’s principal stops interest in its tracks and works for your future.

Understanding Amortization: The Key to Loan Payoff

Amortization (how your loan gets paid off over time) splits your payments between interest (the cost of borrowing) and principal (the loan amount). Early on, most of your payment goes to interest. Extra payments hit the principal, shrinking your loan faster and saving you money. Think of it like paying back a $100 loan from a friend who charges $1 interest per $10 weekly—extra payments make a big dent!

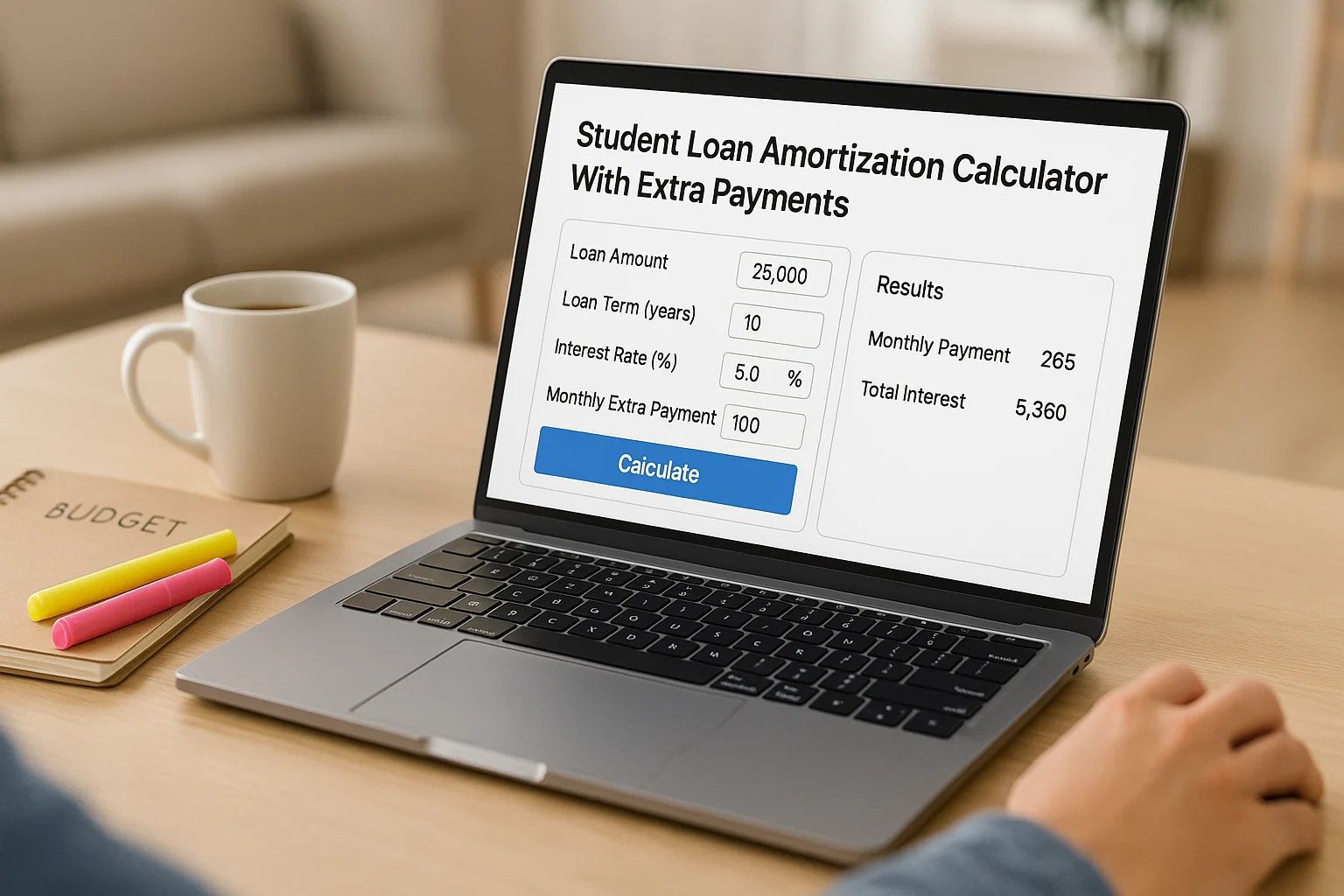

Student Loan Amortization Calculator with Extra Payments

Our payoff calculator is like a GPS for getting debt-free. Plug in your loan details, play with extra payments, and watch your payoff date and savings come to life.

Calculator Features

- Enter Your Info: Add your loan amount, interest rate, and monthly payment.

- Try Extra Payments: Experiment with monthly, bi-weekly, or one-time extra payments.

- See Results Fast: Get your new payoff date and interest savings instantly.

- Detailed Breakdown: Check out a month-by-month payment schedule.

- Color-Coded Progress: A status bar shows how you’re doing:

- Gray: No progress or bad input.

- Yellow: Some savings—nice start! 💡 Try bigger extra payments for more wins!

- Green: Big savings—you’re killing it! 💡 Keep it up to crush your debt!

- Red: Something’s off. 💡 Double-check your numbers or up your payment.

Heads Up: This extra payment calculator shines for fixed-rate loans. For variable-rate or multiple loans, run separate calculations for best results.

Student Loan Amortization Calculator with Extra Payments

Pop in your loan details to see how extra payments can save you cash and time.

Your Payoff Plan

Detailed Amortization Schedule:

| Month | Date | Starting Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|

How to Use the Student Loan Amortization Calculator with Extra Payments

Using our student loan payoff calculator with extra payments is a breeze. Follow these steps to see how this student loan payoff calculator can speed up your journey to debt freedom.

Step 1: Plug in Your Loan Details

- Current Loan Balance ($): The amount you still owe, found on your loan servicer’s website. Example: Enter 25000 for $25,000.

- Annual Interest Rate (%): The yearly rate your loan charges. Example: Enter 6.8 for 6.8%.

- Current Monthly Payment ($): Your minimum required payment. Example: Enter 287 for $287.

Step 2: Add Extra Payments

- Extra Payment Amount ($): The extra cash you can throw at your loan. Even $25 makes a difference. Example: Enter 50 for $50 extra.

- Extra Payment Frequency:

- Monthly: Tack on extra to your regular payment each month.

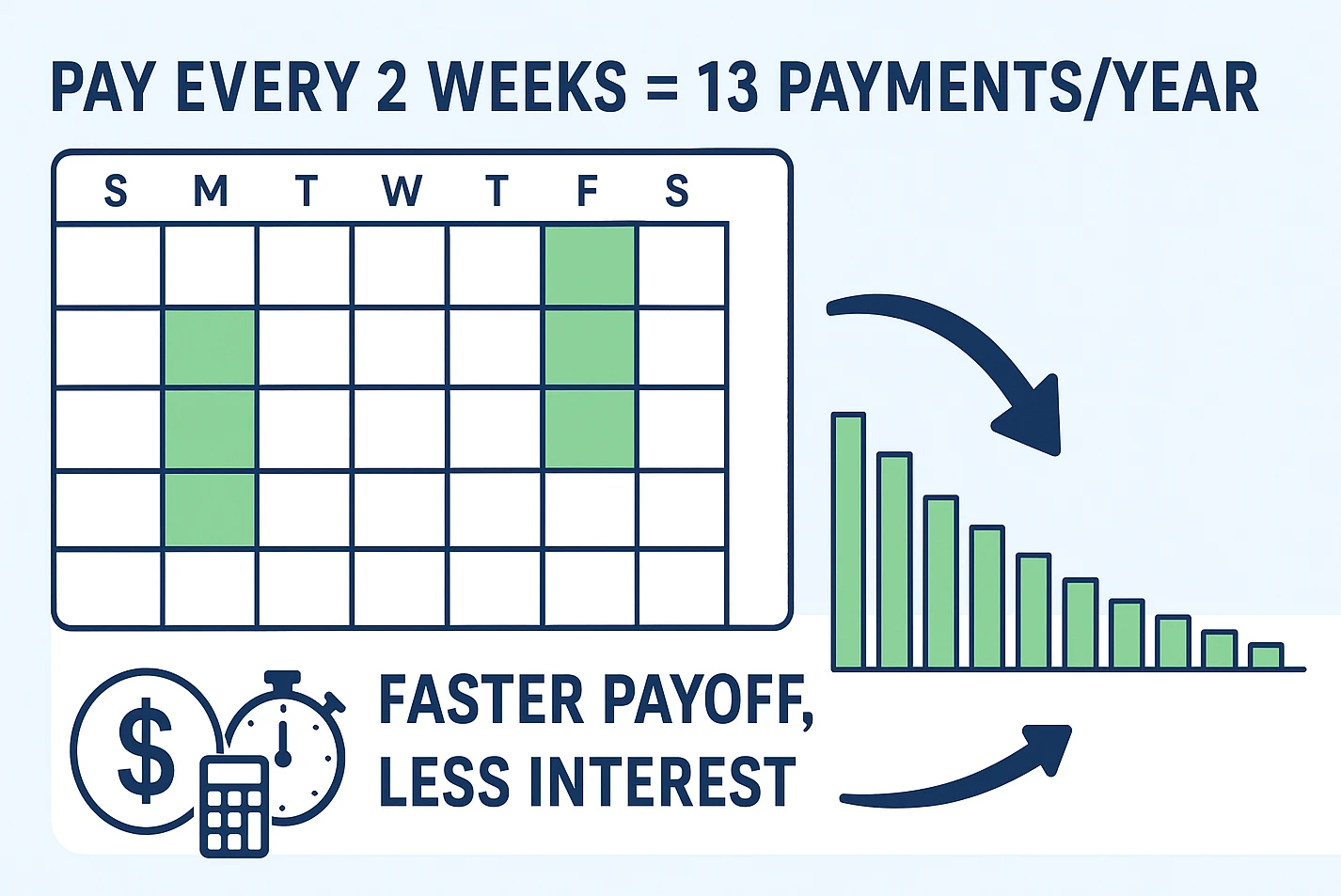

- Bi-weekly: Pay half your monthly amount every two weeks, which adds up to 13 full payments a year (e.g., $100 monthly = ~$108.33 monthly equivalent).

- One-time Lump Sum: Drop a big payment, like a tax refund, in the first month.

Step 3: See Your Payoff Plan

Tweak the inputs and watch your results update instantly, showing your new payoff date and savings.

Step 4: Check Out the Details

- Payoff Dates: Compare your original timeline to the new one.

- Time and Interest Saved: See how much faster you’ll be debt-free and how much you’ll save.

- Status Bar: Gray (no progress), Yellow (some savings), Green (big wins), Red (input errors).

- Amortization Schedule: A table breaking down each payment.

Bi-Weekly Payment Breakdown

Bi-weekly payments save interest by paying more often. Formula: Bi-weekly payment = Monthly payment ÷ 2; 26 bi-weekly payments ≈ 13 monthly payments yearly.

| Example | Monthly | Bi-weekly | Annual Equivalent |

|---|---|---|---|

| $100 payment | $1,200 | $50 × 26 = $1,300 | ~$1,083.33 |

Handling Multiple Loans

Got multiple loans? Run the payoff calculator for each one separately. Focus extra payments on the highest-interest loan first to save the most. For example, toss $50 extra at a 7% loan before a 4% one to cut interest faster.

Real-Life Scenarios: Power of Extra Payments

Let’s see how extra payments change the math using the calculator. Baseline: $25,000 loan, 6.8% interest, $287 monthly payment (10-year plan).

Scenario 1: Small Monthly Extra Payment

Adding $50 extra monthly changes everything:

| Metric | Original Plan | New Plan (+$50/month) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | May 2031 | 2 years, 7 months faster |

| Total Interest Paid | $9,436 | $7,029 | $2,407 saved |

| Total Payments | $34,436 | $32,029 |

Even $50 a month can trim ~3 years and save ~$2,400 in interest.

Scenario 2: Bi-Weekly Payment Strategy

Paying $143.50 bi-weekly (half of $287) means 13 payments a year:

| Metric | Original Plan | New Plan (Bi-Weekly) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | August 2032 | 1 year, 4 months faster |

| Total Interest Paid | $9,436 | $8,445 | $991 saved |

| Total Payments | $34,436 | $33,445 |

This saves almost $1,000 and over a year.

Scenario 3: Lump Sum Payment

Dropping a $1,000 lump sum upfront:

| Metric | Original Plan | New Plan (+$1,000) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | March 2033 | 9 months faster |

| Total Interest Paid | $9,436 | $9,010 | $426 saved |

| Total Payments | $34,436 | $33,010 |

A one-time payment shaves off nearly a year. Want more examples? Check out NerdWallet’s calculator.

Scenario 4: Larger Loan with Extra Payments

For a $50,000 loan, 6.8% interest, $574 monthly payment, adding $100 extra monthly:

| Metric | Original Plan | New Plan (+$100/month) | Impact |

|---|---|---|---|

| Payoff Date | December 2033 | February 2030 | 3 years, 10 months faster |

| Total Interest Paid | $18,872 | $13,258 | $5,614 saved |

| Total Payments | $68,872 | $63,258 |

Bigger loans mean bigger wins with extra payments.

Ways to Scrounge Up Extra Cash for Your Loans

Finding spare change for your student loan amortization calculator with extra payments might feel like a challenge, but little tricks can go a long way. Here’s how to make it happen:

Cutting Expenses

- Make a Budget: Apps like Mint help you track every penny.

- Track Spending: Spot where your money’s slipping away.

- Trim the Fat: Cut back on eating out or unused subscriptions (a daily $5 coffee adds up to $1,825 a year!).

Boosting Your Income

- Pick Up a Side Hustle: Freelancing or tutoring can net $100–$200 a month.

- Ask for a Raise: If you’re rocking it at work, negotiate a pay bump.

- Sell Stuff: Offload clutter on eBay or Facebook Marketplace.

Saving Smarter

- Cook at Home: Meal prepping saves big compared to takeout.

- Shop Savvy: Grab coupons or go for store brands.

- Automate Payments: Set up auto-transfers to your loan for extra payments.

A budget’s like a roadmap—it shows your money where to go instead of letting it wander off.

Federal vs. Private Student Loans: What’s the Difference?

Both types of loans benefit from extra payments, but the details matter. FYI, federal loan interest might be tax-deductible up to $2,500 a year—talk to a tax pro to confirm.

Federal Loans

- No Prepayment Penalties: Pay as much as you want, no fees.

- Principal-Only Payments: (just hitting the loan amount) payments save the most. Call your servicer to confirm.

- Income-Driven Plans: Extra payments cut interest but might not mesh with forgiveness plans.

- Refinancing: Think twice—it wipes out federal perks like forgiveness or deferment.

Private Loans

- Check for Fees: Most new private loans don’t charge for extra payments, but double-check.

- Principal Payments: Make sure extra payments hit the principal.

- Variable Rates: Pay faster to dodge rate hikes.

- Refinancing: Easier to refinance for lower rates if your credit’s improved.

Why Paying Off Loans Feels So Good

Getting rid of your loans faster does more than save money—it lifts your spirits:

- Stay Pumped: Seeing your balance shrink keeps you going.

- Less Worry: Less debt means less stress weighing you down.

- Big Win: Going debt-free is a huge achievement to celebrate.

- Dream Bigger: Extra cash lets you chase goals like travel or buying a home.

Your path to financial freedom starts with steady steps using a student loan amortization calculator with extra payments.

Mistakes to Dodge When Paying Off Loans Faster

While using a student loan amortization calculator with extra payments, steer clear of these traps:

- Skipping Emergency Savings: Build a 3–6 month cushion first.

- Wrong Payments: Confirm extra payments hit the principal.

- Ignoring High-Interest Debt: Tackle credit cards (10%+ rates) before loans.

- Overdoing It: Balance extra payments with enjoying life to avoid burnout.

- Missing Milestones: Celebrate paying off $1,000 or hitting 50%.

Frequently Asked Questions

Kickstart Your Debt-Free Plan

With this payoff calculator, you’re ready to take charge:

- Grab Your Loan Info: Check your balance, rate, and payment.

- Play with the Calculator: Try extra payments like $25, $50, or bi-weekly.

- Find Extra Cash: Cut small expenses or pick up a side gig.

- Set It and Forget It: Automate your regular and extra payments.

- Celebrate Wins:

- Paying off $5,000.

- Shaving 1 year off your loan.

- Hitting the 50% paid mark!

This tool’s your secret weapon to becoming debt-free faster.

Wrap-Up: Give Your Future Self a Raise

Extra payments don’t have to be huge to matter. Use the calculator to test a few “what-ifs,” automate what works for your budget, and keep nudging the principal down. A little consistency today can save you years of payments tomorrow.

This content is for informational purposes only and not financial advice. Consult a professional before making financial decisions.