Retiring at 55 with a pension is doable—if you nail three levers: timing (how much the early reduction bites), payout choice (lump sum vs. annuity), and a smart health-care bridge before 65. Use the calculator to see your number and spot the easiest win. For the bigger picture, see our guide to financial independence and early retirement.

Pension Calculator: Estimate Your Benefit at 55

Tip: Use your plan’s normal retirement age and early reduction rate; amounts are annual unless noted.

Annualize rent; include taxes, insurance, HOA, and utilities in costs where relevant.

Your Pension Outlook

Status:

Readiness Score: —/100

Full Annual Pension (at age ): $

Years Retiring Early: years

Total Reduction: %

Net Monthly Pension at : $

Break-Even Age: Age

💡 To optimize your pension, consider delaying retirement or reviewing your plan’s SPD.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Pension Calculator: Estimate Your Benefit at 55

- Key Takeaways for Early Retirement at 55

- The Allure of Retiring at 55

- Understanding Your Pension

- Evaluating Pension Payout Options

- Navigating Early Withdrawal Reductions

- Health Insurance Before Medicare

- Coordinating Income Streams

- Mitigating Inflation’s Impact

- Managing Taxes

- Maximizing Social Security

- Steps to Plan

- Frequently Asked Questions

- Conclusion

Key Takeaways for Early Retirement at 55

- Early retirement is doable: Know your plan’s rules and coordinate income.

- Payout choice matters: Lump sum vs. annuity changes risk, taxes, and flexibility.

- Starting early shrinks your check — and the cut is usually permanent.

- Blend your income sources — 401(k)s, IRAs, and cash — to cover the gaps.

- Plan for health care and Social Security timing: Both move the numbers a lot.

The Allure of Retiring at 55

At 55, you may want time for travel, projects, and family. A pension can make that real with steady income. Want to avoid a steep cut? Know your plan’s rules and pick a start date that works for you.

Understanding Your Pension

A pension delivers a fixed amount based on service, earnings, and age. The plan invests for you, which lowers market stress. If you’re eyeing 55, the rules drive your cash flow.

Core Pension Concepts for Early Retirement at 55

- Vesting: Most plans require 3–5 years of service. Once vested, you keep earned benefits even if you leave.

- Full Benefit Age: Often 60–65 or a “Rule of X” (age + service = target like 80).

- Early Retirement Age: Many plans allow 55 with reduced payments.

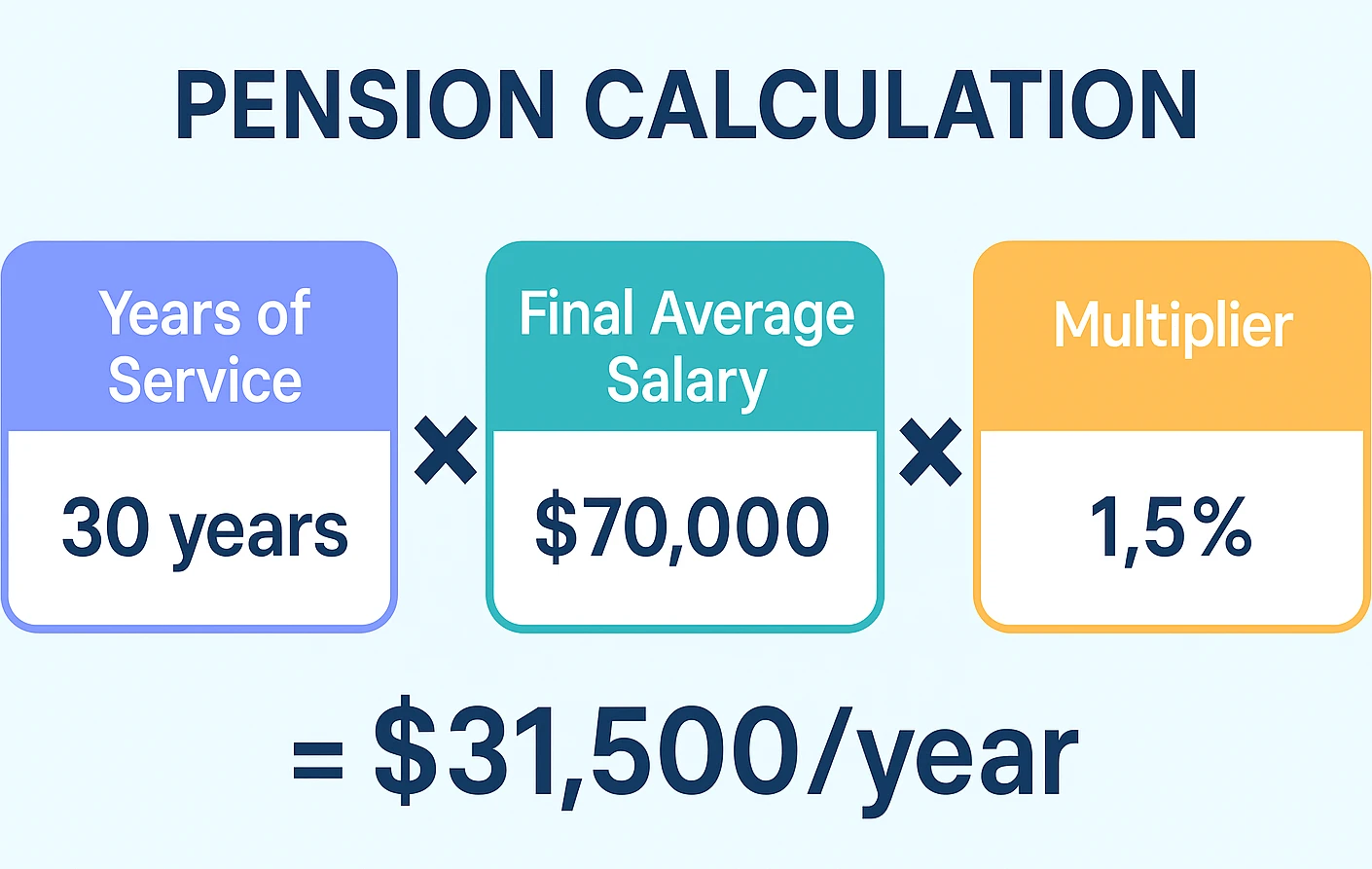

- Pension Formula:

(Years of Service) × (Final Average Salary) × (Multiplier). Example: 30 × $70,000 × 1.5% = $31,500/year at full benefit age; starting at 55 usually reduces it.

Evaluating Pension Payout Options

Choose how to receive money in a way that fits your risk tolerance and goals. Your pension withdrawal approach influences risk, taxes, and flexibility.

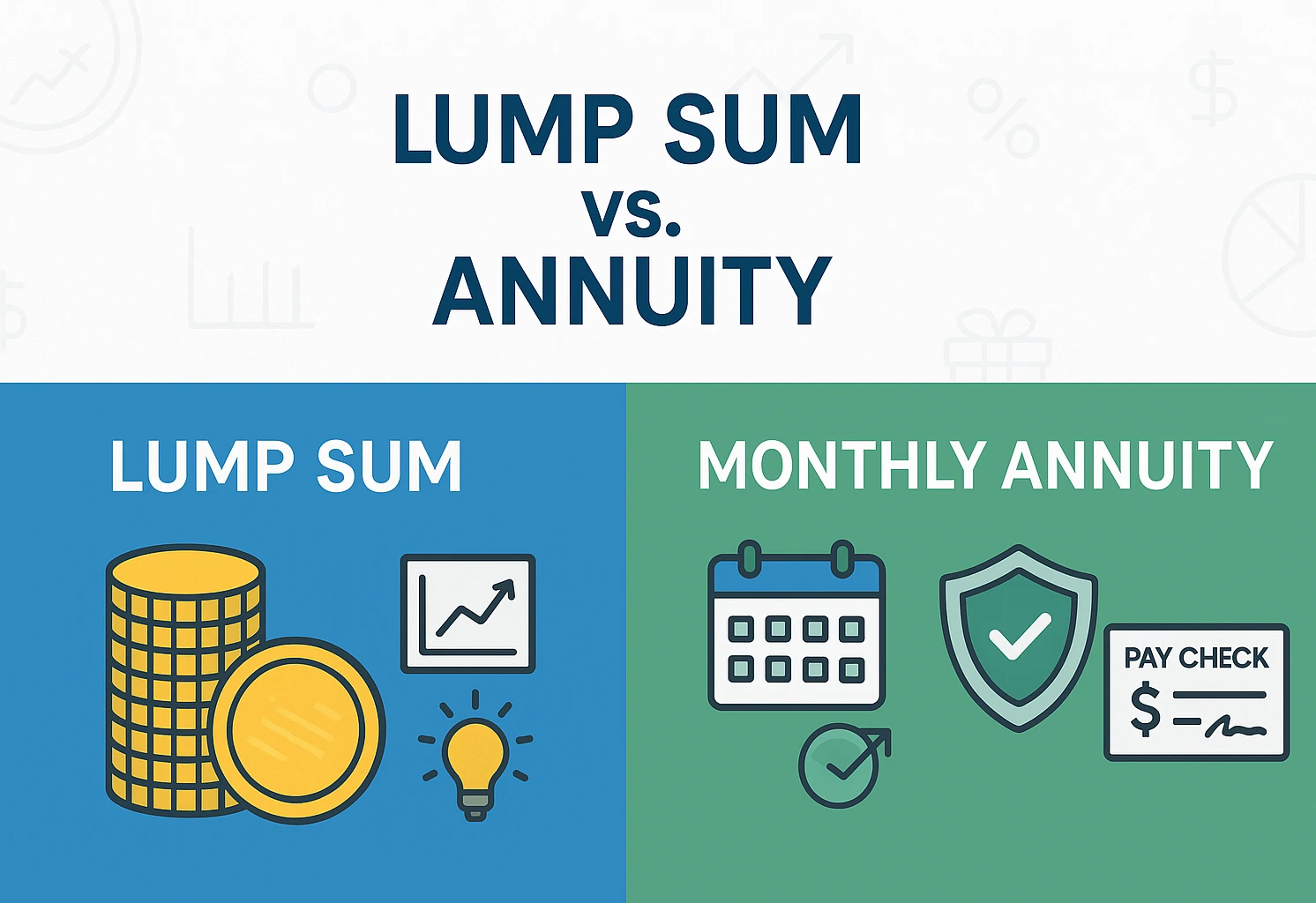

Lump Sum vs. Monthly Annuity

Monthly annuity: A steady check for life. It’s simple and shields you from markets, but offers less flexibility and can lag inflation.

- Pros: Predictable income, no investment risk, longevity protection.

- Cons: Less flexibility, inflation risk, limited legacy with single-life options.

Lump sum: Maximum control and legacy potential, but you take on investment and longevity risk.

- Pros: Flexibility, growth potential, inheritance options.

- Cons: Market risk, risk of outliving money, tax complexity.

Single Life vs. Joint & Survivor Annuity

Single Life: Highest check, ends at your death. Joint & Survivor: Lower check, continues for a spouse.

Navigating Early Withdrawal Reductions at 55

Starting early means more years of payments, so plans cut the monthly amount to keep lifetime value similar.

How to Calculate Your Reduction

- Full Benefit Age: 65

- Retirement Age: 55

- Years Early: 10

- Full Pension: $31,500/year

- Reduction Rate: 5% per year early

Calculation:

- Total Reduction: 10 × 5% = 50%

- Reduced Annual Benefit: $31,500 × 0.50 = $15,750/year

- Monthly Benefit: $15,750 ÷ 12 = $1,312.50/month

Some public plans offer a “Rule of X” (e.g., Rule of 80) that grants unreduced benefits when age + service hits a set number. Check your SPD.

Health Insurance Before Medicare

Bridging coverage before 65? Compare plans that fit your timeline:

Next, revisit your budget with premiums included.

Coverage before 65 is a major cost. Options include COBRA (up to 18 months), ACA marketplace plans for early retirees with potential subsidies, spousal coverage, or employer retiree plans. For a deeper breakdown of premiums, deductibles, and network trade-offs, see our guide to health insurance options for early retirees. Build premiums and out-of-pocket costs into your budget.

Coordinating Income Streams for a Secure Retirement

Your pension can cover essentials while other savings flex with markets and goals.

401(k) and 403(b): Leveraging the Rule of 55

If you separate from your employer in or after the year you turn 55, many 401(k)/403(b) plans allow penalty-free withdrawals from that employer’s plan. This exception doesn’t apply to IRAs. Consider using this as a bridge before Social Security, and coordinate withdrawals with taxes to avoid surprises. See the IRS guide on early distributions here. For more detail on how this exception works, our Rule of 55 guide walks through examples and common pitfalls.

Roth IRA: Tax-Free Flexibility

- Contributions: Withdraw anytime, tax- and penalty-free.

- Earnings: Tax-free after 59½ and a 5-year holding period.

Using contributions first can help manage taxable income.

Other Savings: Brokerage Accounts & HSAs

Brokerage accounts have no withdrawal rules but may trigger capital gains. HSAs are tax-advantaged for qualified medical costs; non-qualified withdrawals before 65 generally face a 20% additional tax (plus income tax). Learn more in IRS Publication 969.

Mitigating Inflation’s Impact on Your Pension

Most pensions lack COLAs, so buying power falls over time. A $1,312.50 check today can feel like $1,000 in 10 years at 2% inflation.

- Invest lump sums in a diversified mix to outpace inflation.

- Use savings from Roths or brokerage to offset rising costs.

If you’re planning to pair pension income with portfolio withdrawals, our explainer on the 4% rule for financial independence can help you sanity-check your assumptions.

Managing Taxes and Pension Withdrawal

Pension payments are ordinary income (Form 1099-R). State rules change frequently—some exempt all or part of pensions while others tax them fully. Check your state’s official tax agency for current details. If you have flexibility about where to live, our overview of the most tax-friendly states for early retirement can highlight big differences in after-tax income.

Tax-Minimization Strategies

- Mix account types: Draw from taxable, tax-deferred, and tax-free buckets.

- Consider Roth conversions in low-income years (get advice); our Roth conversion ladder guide walks through a step-by-step approach.

- Set or adjust withholding on your pension payments (Form W-4P for periodic payments; Form W-4R for one-time distributions) so you’re not underpaid during the year.

- Pay estimated taxes if withholding won’t cover you.

Maximizing Social Security by Delaying

Delaying to your full retirement age—or to 70—raises your benefit, roughly 8% per year after FRA until 70. Many retirees use pensions and savings to wait.

| Claiming Age | % of Full Benefit | Benefit at FRA ($2,000) |

|---|---|---|

| 62 | 70% | $1,400 |

| 65 | 86.7% | $1,734 |

| FRA (67) | 100% | $2,000 |

| 68 | 108% | $2,160 |

| 70 | 124% | $2,480 |

Delaying to 70 can raise your benefit—up to about 8% per year depending on birth year. See the SSA explainer on delayed retirement credits here.

Once you’re claiming, you can stretch your check further with the strategies in our guide to living frugally on Social Security.

Retiring at 55 with a Pension: Key Steps

- Get your pension statement and confirm vesting, benefit, and options.

- Map the rules: reduction rates, any “Rule of X,” and earliest start ages.

- Model scenarios with a planner or your HR team.

- Build a budget that includes healthcare and taxes.

- Maximize savings with catch-up contributions to 401(k)/IRAs.

- Test-drive the plan: live for a month on your projected income.

Frequently Asked Questions

Conclusion: Your Path to Retiring at 55

With a clear plan, retiring at 55 can work. Understand your pension, coordinate other accounts, and plan for healthcare and taxes. Small timing choices can lift lifetime income. Keep refining as your numbers change.

This content is for informational purposes only and not financial, tax, or legal advice. Consult qualified professionals before making financial decisions.