Picture this: Sarah, a college student working part-time at a local coffee shop, watched her bank account dip dangerously low just days before rent was due. If you’ve ever felt that same knot in your stomach when payday is still a week away, you know the stress. Payday loans felt predatory, traditional banks weren’t much help, and her credit file was thin. Then she discovered Brigit—an app that offers cash advances and credit-building tools without a hard credit inquiry that might hurt a fragile credit score.

In this brigit app review, we’ll look at how well the app really works for people navigating tight budgets and credit stress—and when another credit builder app or tool might be a better fit. The short version: Brigit is a solid 4/5 if you’re dealing with small, short-term cash gaps and want automatic overdraft protection plus a way to report on-time payments without a hard credit check. It’s less ideal if you need large emergency funds or hate monthly subscriptions, so think of it as short-term training wheels for your finances, not a permanent fix. If you’re also looking for a bigger-picture payoff strategy, our guide to a debt management plan walks through structured ways to tackle multiple balances.

Brigit Fit Check Quiz

Answer three quick questions to see if Brigit is worth trying for your situation.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Brigit at a Glance: Key Takeaways

- Understanding Brigit: Core Features and Functionality

- Brigit Pricing: Structure and Plans

- Eligibility Requirements and Application Process

- How Brigit Builds Credit Responsibly

- Brigit App Review: Pros and Cons

- Comparing Brigit to Competitors

- Security, Privacy, and Data Protection

- User Experience and Customer Support

- Who Should (and Shouldn’t) Use Brigit

- Getting Started: Step-by-Step Guide

- Potential Risks and Considerations

- References

- Conclusion: Is Brigit Worth It in 2025?

Tip: As you read, jot down how often you face overdraft scares and compare that to Brigit’s monthly fee before you decide to sign up.

Brigit at a Glance: Key Takeaways

The quick highlights below summarize what Brigit offers around cash advances, credit building, pricing, and basic eligibility so you can decide if it deserves a spot in your wallet.

- No Hard Credit Inquiry: Brigit builds credit through payment reporting without impacting credit scores during the application process.

- Automatic Cash Advances: Eligible users receive up to $250 in advances with automatic overdraft protection.

- Subscription-Based Model: Premium features usually require a monthly fee (often around $9.99–$15.99), so it’s important to weigh that cost against how often you’ll actually use the app.

- Credit Building Focus: On-time payments get reported to major credit bureaus, helping establish positive payment history.

- Eligibility Requirements: Users need consistent income, qualifying bank accounts, and regular direct deposits to access full features.

Who Brigit is really for (at a glance):

- Students and young professionals who hit small cash gaps between paychecks.

- Gig and hourly workers with irregular income and frequent overdraft scares.

- Budgeters with thin credit files who want extra payment history reported.

- People who can afford a modest monthly fee while they build an emergency buffer.

If you see yourself in two or more of these, this review is especially worth reading closely.

Understanding Brigit: Core Features and Functionality

What Makes Brigit Different

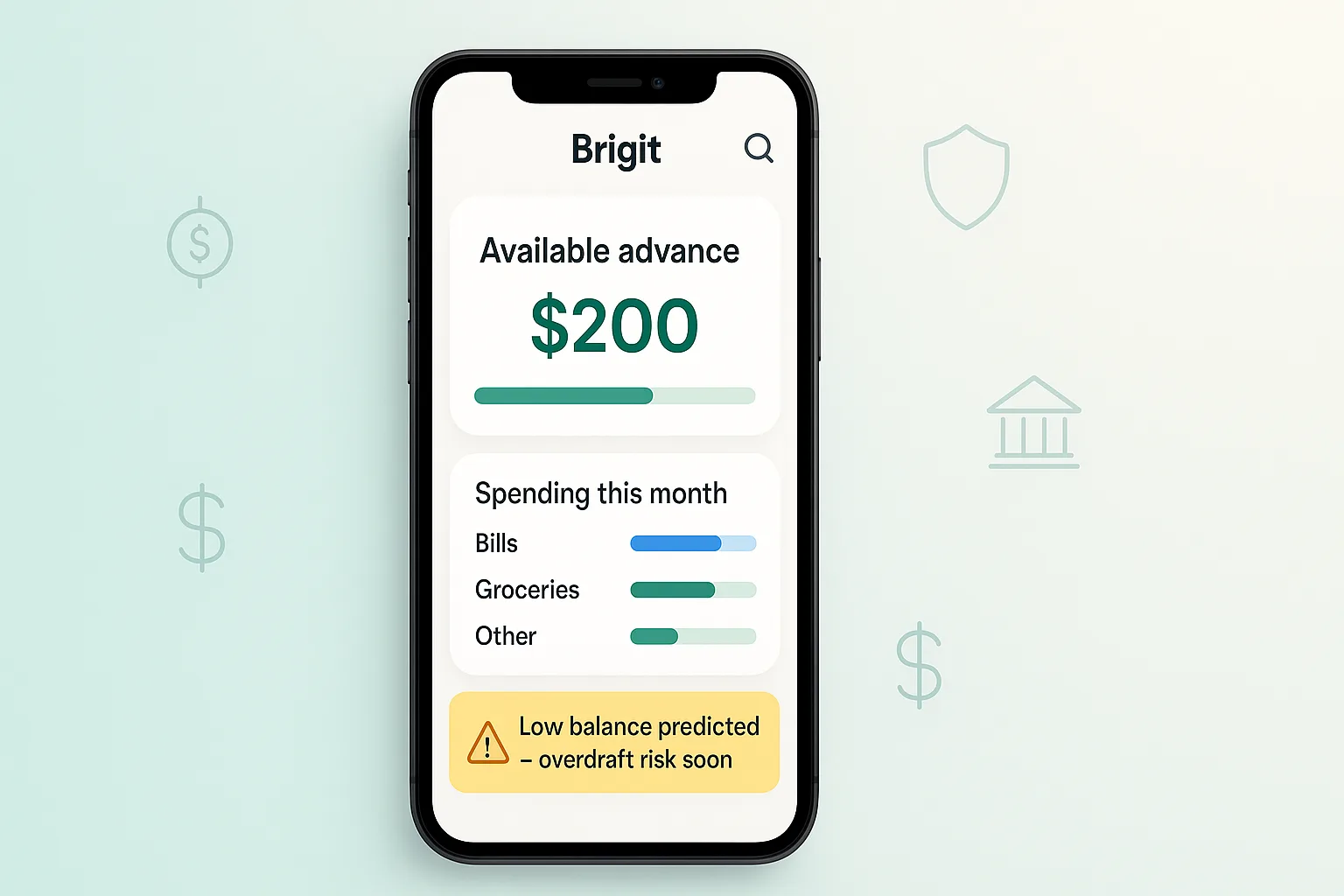

Brigit isn’t just another payday advance app—it’s closer to a financial wellness tool. Instead of only dropping money into your account when you’re already in trouble, it looks at your banking patterns, income, and spending to offer practical insights and smoother cash flow. Behind the scenes, automated tools monitor your connected bank accounts for potential overdrafts and can transfer small amounts to prevent costly bank fees. That proactive angle is what sets it apart from services that only show up after the problem.

Cash Advance System

Brigit’s cash advance feature provides qualifying users with interest-free advances up to $250, depending on their account history and income verification. The system works through:

- Automatic Monitoring: AI tracks account balances and spending patterns.

- Predictive Advances: Funds transfer before accounts hit zero.

- Flexible Repayment: Money gets automatically repaid on the next payday.

- No Interest Charges: Unlike payday loans, advances carry no interest fees.

The advance amount starts small for new users—often $50 to $100—and increases as the system learns spending patterns and verifies consistent income sources.

Credit Building Without Hard Inquiries

Perhaps most significantly for credit-conscious users, Brigit reports positive payment activity to all three major credit bureaus (Experian, Equifax, and TransUnion) without requiring a hard credit check during enrollment. If you’re trying to build credit with no hard inquiry, that kind of reporting can feel especially helpful. If you’re not sure where your current numbers land, our guide on what is a good credit score breaks down common ranges in plain language.

- Students with limited credit history.

- Gig workers with variable income streams.

- Young professionals starting their credit journey.

- Anyone recovering from past credit challenges.

The credit building component tracks on-time subscription payments and advance repayments, gradually establishing positive payment history that forms the foundation of healthy credit scores.

Brigit Pricing: Structure and Plans

Free vs. Premium Features

Brigit operates on a freemium model, offering basic features at no cost while reserving advanced functionality for paying subscribers:

Free Plan Includes:

- Account balance monitoring.

- Spending categorization.

- Basic budgeting tools.

- Financial tips and education.

Plus Plan (around $9.99/month, depending on current pricing):

- Cash advances up to $250.

- Automatic overdraft protection.

- Credit score monitoring.

- Priority customer support.

Premium Plan (often in the $14.99–$15.99/month range):

- Higher advance limits.

- Faster funding (within minutes vs. hours).

- Enhanced credit building features.

- Advanced budgeting and savings tools.

If you’d rather use simple spreadsheets instead of a subscription app, you might like our free budget spreadsheet templates for Excel as a no-fee alternative for tracking income and expenses.

Cost Comparison Analysis

| Service Type | Typical Cost | Brigit Plus Alternative |

|---|---|---|

| Bank Overdraft Fee | $35 per incident | $9.99 monthly prevention |

| Payday Loan | 400%+ APR | $0 interest on advances |

| Credit Card Cash Advance | 25%+ APR + fees | $0 interest, credit building |

For users who frequently face overdraft situations, Brigit’s monthly subscription can cost less than a single bank penalty fee, but it’s still a recurring bill. Not all users qualify for advances or membership, and availability varies by state, so always check the latest details in the Brigit app or help center. If you’re comparing other small-dollar options, it’s also worth reviewing the Consumer Financial Protection Bureau’s payday loan guidance to understand typical costs and risks.

Eligibility Requirements and Application Process

Who Qualifies for Brigit

Brigit’s eligibility criteria don’t require a perfect credit score, but the app does look for a few basics before it can say yes:

Basic Requirements:

- Age 18 or older.

- U.S. bank account in good standing.

- Regular income source (employment, benefits, gig work).

- Consistent direct deposits or account activity.

- Valid email address and phone number.

Enhanced Features Eligibility:

- Monthly income of at least $1,000.

- Direct deposits totaling $500+ monthly.

- Account history showing regular activity.

- No recent bankruptcy or account closures.

Application and Verification Process

The app’s review and approval process is streamlined and can often be completed in about 5–10 minutes from start to finish, although timing varies by user. In general, you’ll:

- Download the app and register with your basic personal information.

- Connect your primary checking account through a secure banking connection.

- Verify your income by linking payroll or uploading documents if requested.

- Wait for pattern analysis and a decision on your membership and advance limits.

Unlike traditional lending, Brigit doesn’t require extensive paperwork or long approval timelines. The platform focuses more on real-time banking data than old credit reports, which can be a plus if your history is thin or imperfect.

How Brigit Builds Credit Responsibly

Reporting Mechanisms

Brigit’s credit building strategy centers on consistent, positive payment reporting rather than extending traditional credit lines. The system reports:

- Subscription Payment History: Monthly plan payments demonstrate reliability.

- Advance Repayment Patterns: On-time repayments show responsible borrowing.

- Account Maintenance: Consistent app usage indicates financial engagement.

Timeline for Credit Impact

Some people may see credit changes gradually over several months of consistent Brigit use, but there’s no guaranteed timeline. On-time payments can help, especially if you have a thin file, yet existing debts, any missed payments elsewhere, and how lenders weigh alternative data still carry a lot of weight. Treat any examples you see online as illustrations, not promises—and consider double-checking major decisions with a qualified financial professional.

Tip: Apps like Brigit can support your credit journey, but they’re only one piece of the puzzle. For personalized advice, consider talking with a certified credit counselor or other qualified financial professional.

Build Credit With Your Everyday Spending

When you keep your Brigit membership and advances paid on time, those payments can be reported to major credit bureaus as part of your overall credit story.

See how Brigit reports your payments

Brigit App Review: Pros and Cons

Advantages of Using Brigit

✅ No Hard Credit Inquiries: You can build credit data without risking score damage from application processes.

✅ Proactive Financial Management: AI-driven overdraft prevention helps you avoid costly bank fees.

✅ Educational Resources: The app provides financial literacy content and personalized spending insights.

✅ Fast, Fee-Free Advances: Approved advances typically arrive within hours, and Brigit doesn’t charge interest on the funds it fronts.

✅ Credit Bureau Reporting: Positive payment history gets reported to all three major bureaus.

Potential Drawbacks and Limitations

❌ Monthly Subscription Costs: Premium features require ongoing payments that may strain tight budgets.

❌ Limited Advance Amounts: The $250 maximum may not cover larger financial emergencies.

❌ Bank Account Requirements: You need an established bank account with regular deposits.

❌ Subscription Dependency: If you rely on advances every month, it can mask underlying budgeting problems.

❌ Income Verification Challenges: Gig workers may struggle with inconsistent income documentation.

❌ Geographic Limitations: Service availability is limited to U.S. customers with domestic bank accounts.

Comparing Brigit to Competitors

Alternative Credit Builder Apps

Chime Credit Builder

- No monthly fees for basic credit building.

- Secured credit card approach.

- Limited cash advance features.

- Requires security deposit for credit line.

Dave Banking

- Similar cash advance model.

- Lower monthly fees ($1/month).

- Smaller advance limits ($25–$100).

- Less comprehensive credit reporting.

MoneyLion

- Higher advance limits (up to $500).

- More expensive monthly plans ($19.99+).

- Additional investment features.

- More complex fee structure.

Overall, Brigit lives in the same space as many credit builder apps but leans harder on short-term cash advances and budgeting support instead of traditional credit cards.

Traditional Banking Alternatives

Credit Union Payday Alternative Loans (PALs)

- Lower interest rates (28% APR maximum).

- Larger loan amounts ($200–$2,000).

- Requires credit union membership.

- Longer application processes.

Bank Secured Credit Cards

- Direct credit line building.

- Security deposit requirements.

- Annual fees common.

- Traditional credit approval processes.

This brigit app review comparison shows Brigit occupying a unique middle ground between free basic services and expensive comprehensive financial platforms.

Security, Privacy, and Data Protection

Financial Data Security

Brigit employs bank-level security measures to protect user information:

- 256-bit SSL encryption for all data transmission.

- Multi-factor authentication for account access.

- Read-only bank connections preventing unauthorized transactions.

- SOC 2 compliance meeting institutional security standards.

Privacy Practices

The platform’s privacy policy generally covers how your information is used to provide services and report to credit bureaus, along with how anonymized data can help improve products and meet regulatory requirements. You can review Brigit’s latest privacy terms in the app or on its website before you connect your accounts.

Important Note: Users maintain control over credit bureau reporting and can often opt out of data sharing for marketing purposes while retaining core service functionality, but details can change, so always read the current policy.

User Experience and Customer Support

User reviews for Brigit are generally mixed-to-positive. Many people like how quickly small advances arrive, the simple interface, and the relief of avoiding surprise overdraft fees. Others appreciate that they can start building credit data even with thin files or nontraditional income. On the downside, some users say the subscription fee feels steep when they don’t use advances often or when eligibility limits the amount they can borrow, and there are occasional complaints about delays or confusion around repayment dates—so it’s important to read the terms carefully before you rely on the app.

If you tend to skim fine print, it can help to set aside a few quiet minutes to read through the terms before you rely on the app.

App Interface and Usability

Brigit’s mobile app receives generally positive reviews for intuitive design and straightforward navigation. Key interface elements include:

- Dashboard Overview: Clear account balance and advance availability.

- Spending Insights: Categorized expense tracking with visual charts.

- Credit Monitoring: Score tracking and improvement recommendations.

- Educational Content: Financial tips integrated throughout the experience.

Customer Service Quality

User feedback indicates mixed experiences with customer support:

Positive Aspects:

- In-app chat feature for immediate assistance.

- Comprehensive FAQ section addressing common issues.

- Email support with typically 24–48 hour response times.

Areas for Improvement:

- Limited phone support availability.

- Complex issues sometimes require multiple contact attempts.

- Premium subscribers report faster response times than free users.

Who Should (and Shouldn’t) Use Brigit

Ideal Brigit Users

Students and Young Professionals

- Building credit for the first time.

- Managing irregular income from part-time work.

- Learning financial management skills.

Gig Economy Workers

- Dealing with income variability.

- Needing cash flow smoothing between payments.

- Establishing credit without traditional employment verification.

Budget-Conscious Consumers

- Frequently facing small overdraft situations.

- Seeking alternatives to expensive payday loans.

- Wanting proactive financial management tools.

Users Who Should Consider Alternatives

High-Income Earners

- May benefit more from traditional credit products.

- Could access better terms through conventional banking.

- Might not need small-dollar advance features.

Users Needing Large Emergency Funds

- $250 advance limit insufficient for major expenses.

- Should explore personal loans or credit lines.

- May benefit from building emergency savings instead.

Inconsistent Technology Users

- The app requires regular engagement for optimal benefits.

- Manual financial management might suit better.

- Traditional banking relationships may be preferable.

Getting Started: Step-by-Step Guide

Initial Setup Process

- Download the app and create your account: Install Brigit on your device, then sign up and verify your email.

- Connect your main checking account: Use the secure connection flow to link the account where your income lands and bills are paid.

- Choose your plan and finish any verification: Decide whether to stick with the free tools or try a paid tier, and upload documents if the app asks for them.

- Turn on the features you want to test first: Start with budgeting tools and alerts, then explore advances or credit-building options once you’re comfortable.

Maximizing Credit Building Benefits

To get the most from Brigit’s credit-building tools, focus on keeping your subscription payments current, allowing automatic repayments on any advances you take, and maintaining regular direct deposits into your linked account. Pair the app with a basic budget, and check in on your credit reports and scores periodically so you can see whether the extra payment data is actually helping over time.

Potential Risks and Considerations

Financial Dependency Concerns

Subscription Reliance: Users may become dependent on monthly advances, potentially masking underlying budgeting issues rather than addressing root causes.

Budget Impact: Monthly subscription fees could strain already-tight budgets, especially if advance features aren’t regularly needed.

Regulators have also raised concerns about how some cash advance apps market their fees and eligibility, so always read the fine print and disclosures before you enroll. If you’d prefer a simpler do-it-yourself route, a printable debt payoff tracker can help you map progress without adding another monthly charge.

Credit Building Limitations

Alternative Credit Data: While Brigit reports to major bureaus, some lenders may not heavily weight alternative credit data in approval decisions.

Limited Credit Mix: Building credit through subscription payments alone may not provide the diverse credit mix that optimizes credit scores.

Cancellation and Account Closure

Users can cancel Brigit subscriptions at any time through:

- In-app settings menu.

- Customer service contact.

- Email request to support team.

Important: Outstanding advances must be repaid before account closure, and credit building benefits stop immediately upon cancellation.

Frequently Asked Questions

Conclusion: Is Brigit Worth It in 2025?

This comprehensive review of the Brigit app looks at how the platform aims to address specific financial challenges for its target audience. The combination of proactive overdraft protection, interest-free cash advances, and credit building without hard inquiries can create genuine value for users with thin credit files and tight budgets when used thoughtfully.

Brigit works best for individuals who:

- Face regular small-dollar cash flow gaps.

- Want to build credit without traditional lending requirements.

- Value proactive financial management over reactive solutions.

- Can afford monthly subscription fees while benefiting from overdraft prevention.

However, the platform isn’t a universal solution. Users needing larger emergency funds, those with inconsistent income, or individuals preferring traditional banking relationships might find better alternatives elsewhere.

The bottom line: For students, gig workers, and budget-conscious consumers seeking accessible credit building combined with cash flow management, Brigit can be one helpful tool among many. The key lies in honest assessment of personal financial patterns and commitment to responsible usage.

See If Brigit Fits Your Plan

If Brigit lines up with your budget and goals, you can test it as a temporary support while you build savings and a stronger credit profile.

Review Brigit plans and features

Next Steps: Potential users should start with the free plan to evaluate the app’s budgeting tools and interface before committing to premium features. Monitor spending patterns for 30 days to determine whether advance features would provide genuine value, then upgrade accordingly. If you’re already behind on bills, facing collections, or feeling overwhelmed by debt, consider speaking with a nonprofit credit counselor in addition to (or instead of) adding another paid app. They can also help you choose between payoff strategies like the debt snowball vs avalanche approach so your Brigit usage fits into a bigger plan.

The financial technology landscape continues evolving rapidly, but Brigit’s focus on helping people build credit with no hard inquiry positions it as a valuable tool for consumers traditionally underserved by conventional banking. Success ultimately depends on using the platform as a stepping stone toward broader financial stability rather than a permanent crutch for budgeting challenges.

References & sources

- Consumer Financial Protection Bureau. “Payday Loans and Deposit Advance Products.” CFPB.gov, 2024.

- Federal Reserve Bank of St. Louis. “Credit Building Strategies for Consumers with Limited Credit History.” Economic Research, 2024.

- Experian. “Alternative Credit Data and Credit Scoring.” Credit Education, 2025.

- National Foundation for Credit Counseling. “Overdraft Fee Analysis and Consumer Impact.” NFCC Research, 2024.

This brigit app review guide is for general educational purposes only and is not financial, legal, or credit advice. Your situation is unique, so consider speaking with a qualified financial professional or nonprofit credit counselor before making major money decisions.