Feeling lost picking an index fund? Deciding between VTSAX vs FXAIX can feel like a big money showdown. Index funds help grow savings without high fees or stress—great for anyone learning how to be frugal in 2025. Let’s unpack Vanguard’s VTSAX (Vanguard Total Stock Market Index Fund Admiral Shares) and Fidelity’s FXAIX (Fidelity 500 Index Fund). They’re both excellent but cover the market differently. Ready to pick confidently for 2025? For a broader foundation, see beginner’s guide to investing.

If you’ve ever opened a brokerage app, stared at a list of fund names, and thought, “I have no idea what to pick,” you’re not alone. This guide walks you through the choice step by step so you can stop second-guessing and pick a fund you feel good about.

Interactive Fund Picker: VTSAX or FXAIX?

Answer a few quick questions to see which fund may fit your situation. This is educational only and not financial advice.

1. Where are you investing?

2. How much are you starting with today?

3. What sounds more like you?

Select one or more options above to see our lean between VTSAX/VTI and FXAIX.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways at a Glance

- Why Index Funds Matter

- Introducing VTSAX and FXAIX

- VTSAX vs FXAIX: Head-to-Head

- Interactive Fund Picker: VTSAX or FXAIX?

- A Real Investor’s Story

- Platform Comparison: Vanguard vs Fidelity

- Who Should Choose Which Fund? (Whole U.S. Market vs S&P 500)

- Glossary: Key Terms

- Frequently Asked Questions

Key Takeaways at a Glance

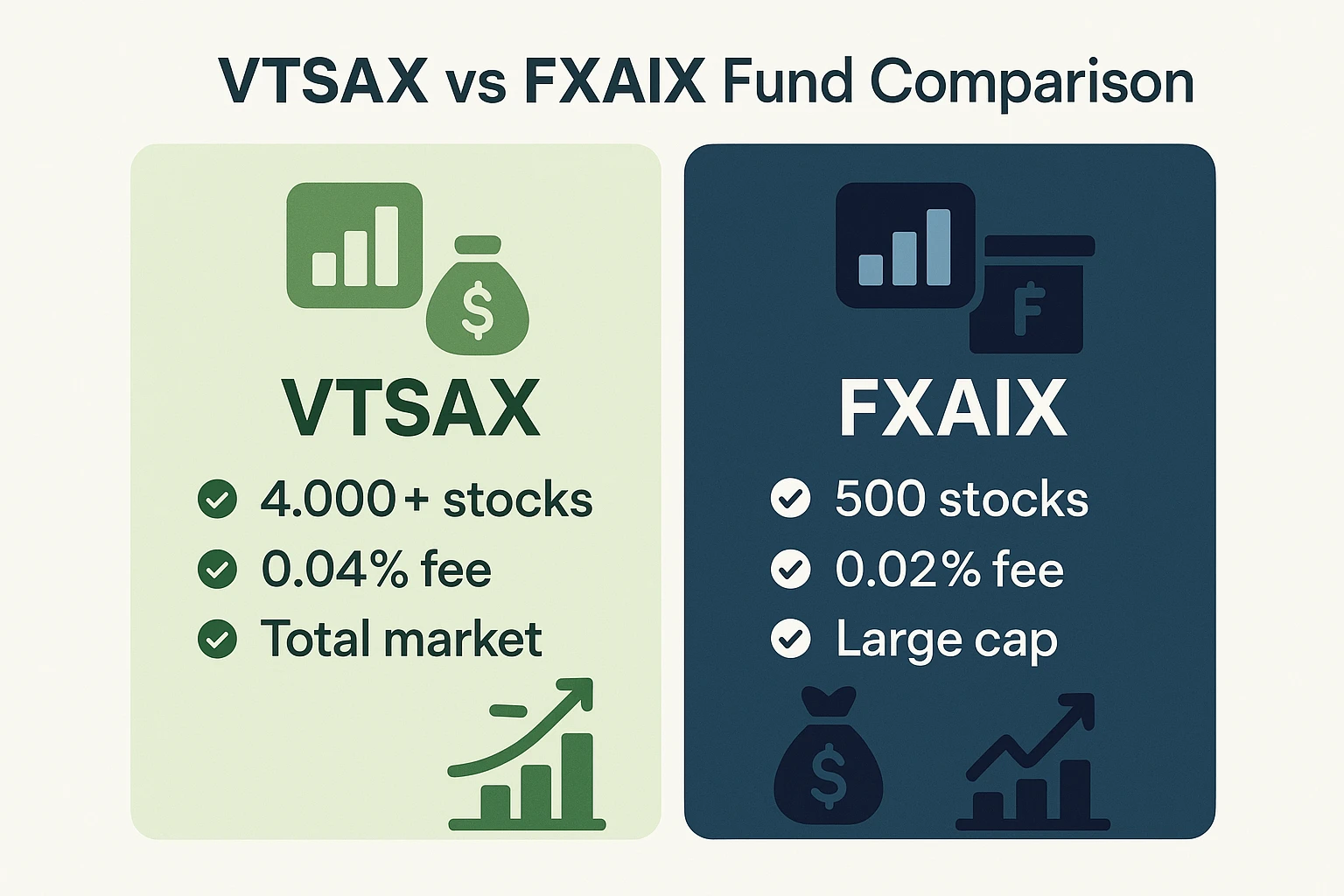

- VTSAX casts a wider net: It holds thousands of U.S. stocks across sizes. FXAIX sticks to the 500 largest in the S&P 500.

- Both are very low cost: Expense ratios: VTSAX 0.04%; FXAIX 0.015%.

- Performance depends on the market: Large-cap strength favors FXAIX; small-/mid-cap rallies can benefit VTSAX.

- Tax efficiency: In taxable accounts, using VTSAX’s ETF share class (VTI) can reduce capital gains. If you’re deciding which account should hold which fund, this simple asset location strategy guide walks through examples.

- Pick by style and account: Choose VTSAX for total-market breadth, FXAIX for large-cap focus—both are solid choices.

Why Index Funds Matter: A Quick Primer

Index funds track a market benchmark (like the S&P 500) instead of trying to beat it, keeping costs low and diversification high. FXAIX gives you a slice of America’s 500 biggest companies. Pairing investing with our favorite free financial tools helps you stay on track.

Here’s why they’re popular:

- Broad diversification spreads risk across many companies.

- Low fees mean less drag on long-term returns.

- Simplicity: buy once, keep contributing, and let compounding work.

- Long-term fit for retirement and other goals.

If you don’t have time or energy to follow the market every day, this kind of “buy regularly and let it ride” approach can feel like a huge relief.

Introducing VTSAX and FXAIX

VTSAX: Vanguard Total Stock Market Index Fund

VTSAX tracks the CRSP US Total Market Index, a total stock market index fund approach that owns nearly the entire U.S. market—large, mid, and small caps.

- Coverage: roughly 99.5% of the U.S. stock market’s value.

- Minimum: $3,000 for Admiral Shares.

- Idea: own the whole haystack.

Vanguard’s focus on keeping costs low makes VTSAX a favorite for broad, long-term exposure. Prefer an ETF? VTI mirrors the same total-market approach. If you’re deciding between structures, this quick primer on ETF vs mutual funds for retirement can help.

FXAIX: Fidelity 500 Index Fund

FXAIX tracks the S&P 500—about 500 of the largest U.S. companies like Apple and Microsoft.

- Coverage: large-cap U.S. stocks.

- Minimum: $0, so it’s easy to start.

- Idea: concentrate on market leaders.

Fidelity’s low costs and user-friendly platform make FXAIX a straightforward choice. If income is your focus, compare these dividend aristocrats funds for steady payouts.

VTSAX vs FXAIX: Head-to-Head Comparison

Expense Ratios: Why Fees Matter

Even tiny fee differences compound over time:

- VTSAX: 0.04%.

- FXAIX: 0.015%.

Both are extremely cheap; other factors often drive the final choice.

Minimum Investments: Accessibility

How to get started:

- VTSAX: $3,000 for Admiral Shares.

- FXAIX: $0 minimum.

If $3,000 is steep, VTI (the ETF version of VTSAX) lets you buy a single share instead.

Diversification: What Each Holds

- VTSAX: total U.S. market (large, mid, small).

- FXAIX: S&P 500 large caps (about 80% of market value).

This index fund comparison boils down to breadth (VTSAX) versus a large-cap core (FXAIX).

Sector Allocations: Under the Hood

As of late 2025, both tilt toward technology. Recent snapshots show VTSAX around 38% tech (ICB methodology) and FXAIX near 34.75% information technology (GICS). Mixes change—always confirm current weights on the fund pages or Morningstar.

Historical Performance: Long-Run Returns

Figures below are as of Sept 30, 2025 (average annual unless noted). Check fund sites for month-end updates.

| Fund | 1-Year Return | 5-Year Return (Avg. Ann.) | 10-Year Return (Avg. Ann.) |

|---|---|---|---|

| VTSAX | 17.33% | 15.65% | 14.66% |

| FXAIX | 17.59% | 16.45% | 15.29% |

Note: 2025’s market remained tech-heavy and choppy at times. Always verify the latest month-end performance before deciding or rebalancing.

Where these numbers come from

All return, fee, and holdings figures in this article come from official Vanguard and Fidelity fund pages, cross-checked against Morningstar. We last reviewed them in November 2025, but you should still glance at the latest fact sheet before you invest or change your plan—markets move and numbers update.

Even with strong long-term averages, both funds can experience short-term drops of 20–30% or more in rough markets. That’s normal stock-market behavior—not a sign the fund is broken.

Market conditions change. If you’re unsure how these funds fit your plan, consider speaking with a qualified financial professional.

A Real Investor’s Story: Choosing Between the Funds

The right pick depends on your account and comfort with breadth vs. focus. Curious if you’re already on track? Try our Coast FIRE calculator.

Platform Comparison: Vanguard vs Fidelity

Usability and Customer Service

In this quick Vanguard vs Fidelity comparison, Fidelity feels modern and responsive. Vanguard is simpler and steadier—great if you like to set things up once and then mostly leave them alone, without constant app notifications and new features to learn.

Investment Philosophy

Vanguard emphasizes low costs and investor ownership. Fidelity offers both active and passive options across account types.

Who Should Choose Which Fund? (Total Stock Market vs S&P 500)

Skim this section and pick the 1–2 bullet points that sound most like your situation—that’s usually enough to decide without overthinking it. This is really the classic total stock market vs S&P 500 decision, just broken down in plain language.

It comes down to coverage vs. concentration and your account type, not finding a single “perfect” fund you can never change.

VTSAX: Best for Total Stock Market Index Fund Coverage

- You want exposure to large, mid, and small caps.

- You value tax efficiency in a taxable account (via VTI).

- You can meet the $3,000 minimum or prefer the ETF.

FXAIX: Ideal if you want an S&P 500 index fund

- You prefer the biggest companies driving the market.

- You’re starting with $0.

- You’re investing inside IRAs or 401(k)s.

Beginners: Where to Start

Starting small? FXAIX’s $0 minimum makes it easy to get your feet wet. As your balance grows, you can add VTSAX or VTI to bring in more mid- and small-cap exposure. Whatever you choose, set a simple schedule for contributions and review just once or twice a year—no constant tinkering needed. For withdrawal planning later, here’s a simple look at the 4% rule for financial independence.

Glossary: Key Terms Explained

- Expense Ratio: The yearly fee, expressed as a percentage of assets.

- Capital Gains Distributions: Taxable payouts when a fund realizes profits.

- Index Fund: A fund that mirrors a market index for low-cost diversification.

Frequently Asked Questions

Still unsure how VTSAX or FXAIX fit into your exact plan? This on-demand chat can help:

Your Bottom Line: VTSAX vs FXAIX

Want broad, one-and-done coverage and better tax handling in a taxable account? Choose VTSAX/VTI. Prefer an ultra-low-fee large-cap index or you’re starting with $0? Choose FXAIX. Either path can work well—pick one that fits your account, automate contributions, reinvest dividends, and let time in the market do most of the heavy lifting.

Author’s note: I invest in low-cost index funds myself and regularly review data from Vanguard, Fidelity, and Morningstar when updating this page.

This article is general education, not personalized financial advice. Everyone’s situation and risk tolerance are different, so talk with a qualified financial professional before making big investing decisions. Past performance never guarantees future results, and you can lose money when you invest. Your results and comfort level may be very different from someone else’s, even if you choose the same funds.