Can an extra $50 a month really move your mortgage payoff date closer? It can, and often by more than you’d expect. Mortgages are long-term debts, but small, consistent extra payments can reduce your total interest and bring your payoff date forward by months or even years. If you’ve ever looked at your mortgage statement and felt like the balance barely moves, this tool gives you a simple way to see how much faster it might actually drop. Use our free mortgage payoff calculator with extra payments to run the numbers on your loan, visualize the impact, and decide what’s realistic for your budget. For a bigger-picture overview from payoff to refinancing, check out our homeowner’s guide to mortgages.

Estimates only: results vary by lender terms, payment timing, and fees. For personalized guidance, talk with your lender or a qualified financial professional.

Mortgage Payoff Calculator with Extra Payments (Interactive Tool)

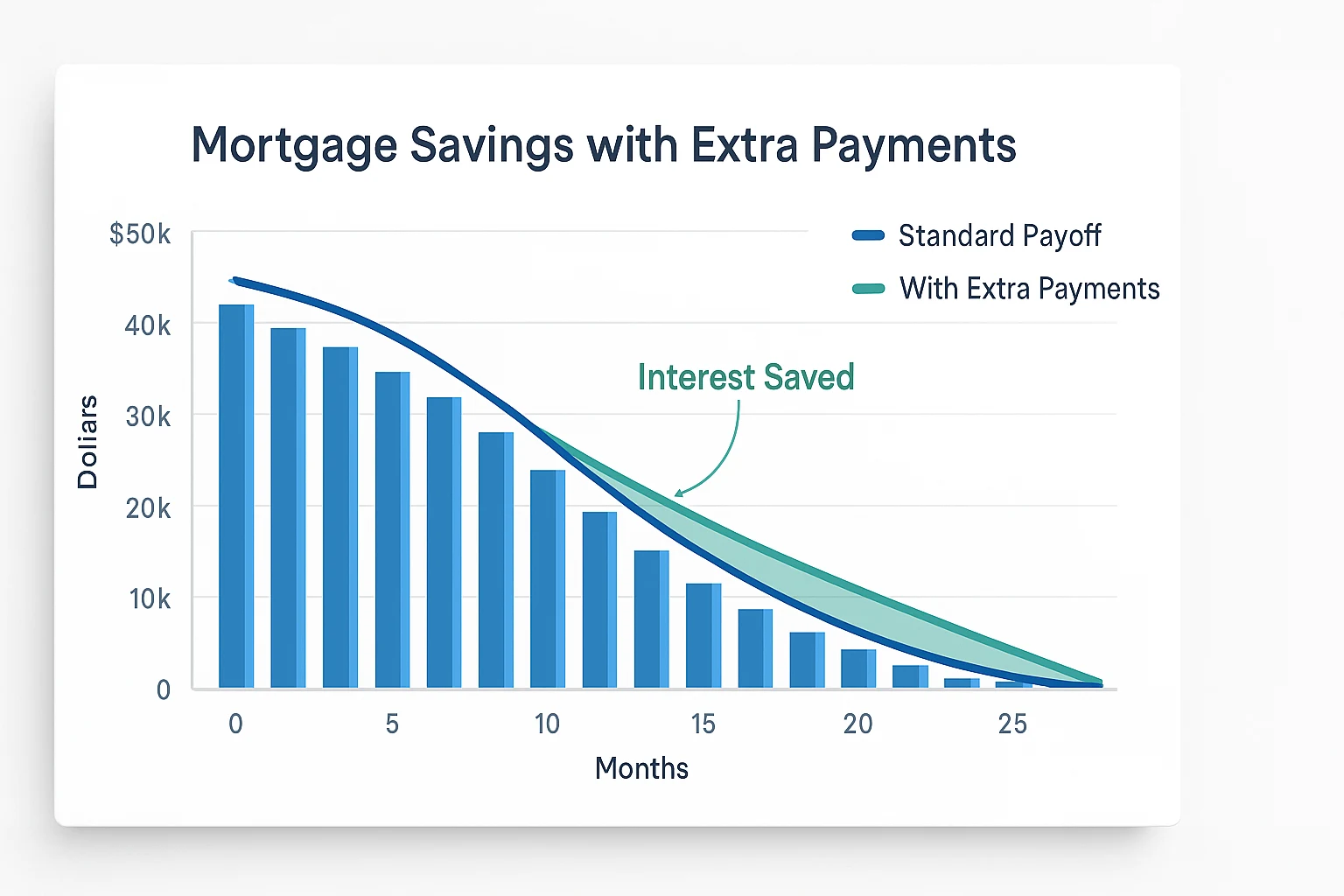

Use this interactive tool to estimate how extra monthly payments could change your mortgage payoff date and the total interest you’ll pay. Enter your current balance, interest rate, remaining term, and an optional extra payment to compare your current schedule with a faster payoff plan.

Your Payoff Snapshot

See how your current schedule compares with a plan that adds extra monthly payments.

Enter your numbers and an optional extra payment to see potential months and interest saved.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Paying Off Your Mortgage Early

- Why Pay Off Your Mortgage Early?

- How Extra Payments Work

- Using the Mortgage Payoff Calculator (Extra Payments)

- Mortgage Payoff Calculator (Extra Payments)

- Strategies for Mortgage Extra Payments

- Other Financial Considerations

- Is Early Payoff Right for You?

- Frequently Asked Questions

- Start Your Mortgage Payoff Journey

Key Takeaways for Paying Off Your Mortgage Early

- Small extras add up: Even modest consistent extras can shorten your term and cut interest.

- Model scenarios: A payoff calculator with extra payments shows your projected payoff date and total interest savings.

- Practical tactics: Bi-weekly cadence, rounding up, and lump sums accelerate payoff.

- Weigh trade-offs: Consider emergency funds, higher-rate debts, and retirement matches first.

- Next step: Test your numbers in the calculator to build a plan.

- Check your lender’s rules: Confirm any prepayment penalties and how to label extra payments (for example, “principal only”).

Why Pay Off Your Mortgage Early?

Early payoff can reduce lifetime interest, build equity faster, and free cash flow for other goals. It can also lower your sensitivity to market changes or income disruptions, and for many homeowners, knowing the house is on track to be paid off sooner simply feels less stressful.

Market Fluctuations

Higher equity cushions you against housing-price swings and can improve flexibility if you need to sell.

Borrowing Power

Lower balances and higher equity may qualify you for better terms on home equity products when needed.

Profit on Sale

More equity at sale generally means more proceeds after transaction costs. Extra principal payments build that equity sooner.

Free Up Your Budget

Eliminating a mortgage payment can redirect cash to retirement, education, investing, or other priorities.

Reduce Stress

Lower debt obligations can increase financial resilience and peace of mind. Knowing your mortgage is shrinking faster can make surprise expenses or job changes feel a little less scary. If this resonates, write down one or two reasons an earlier payoff matters to you—those reasons will help you stick with your extra-payment plan on harder months.

How Extra Payments Work

Extra payments reduce your principal sooner. Your mortgage amortization schedule updates each month as the balance shrinks, so future interest charges get a little smaller and payoff speeds up. If you want to see the same pattern on other loans, try our simple loan amortization calculator with extra payments.

Understanding Amortization

Early scheduled payments are interest-heavy. Directing extras to principal only shrinks the balance and interest charged in later months.

| Month | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | $1,200 | $750 | $450 | $199,550 |

| 2 | $1,200 | $748 | $452 | $199,098 |

| 3 (with $100 extra) | $1,300 | $747 | $553 | $198,545 |

Illustrative example for a $200,000 loan at 4.5%. Actual results vary by balance, rate, and term.

Compounding Savings

Each extra payment lowers future interest, so the effect compounds over time—especially earlier in the schedule. Think of it like taking a small shortcut on your route every single month; over a few years, you’ve skipped a lot of distance on the way to being mortgage-free. For a quick reality check, compare the sample table above with your latest statement and notice how much of each payment is going to interest versus principal.

Using the Mortgage Payoff Calculator (Extra Payments)

This mortgage prepayment calculator lets you test “what if” scenarios before you commit real money. Enter your balance, interest rate, remaining term, and a monthly extra payment, then watch how your payoff date and total interest shift in real time.

What the Calculator Does

- Accepts balance, interest rate, and remaining term.

- Lets you test extras (monthly, bi-weekly equivalent, or occasional lump sums).

- Shows new payoff date, interest saved, and months saved.

Example: Imagine you owe $260,000 at 5.5% with about 24 years left. The calculator might show a regular payment around $1,600/month. If you add a $100 monthly extra, that could trim a few years off your term and help you avoid paying many thousands of dollars in interest over time, depending on your lender and exact loan details. Run the same test with your own numbers to see a realistic range for your payoff date.

Try a 10-Minute Payoff Check-In

Feeling unsure where to start? Use this quick 10-minute check-in to see what an extra payment could do for your mortgage.

- Grab your latest statement (or log in to your lender) to confirm your balance, interest rate, and remaining term.

- Enter those numbers into the calculator and test 2–3 extra amounts (for example, $50, $100, $150) to see how the payoff date and interest change.

- Pick the smallest extra that still feels motivating and fits your budget, then set it up as an automatic extra payment in your bank or mortgage portal.

Strategies for Mortgage Extra Payments

Pick one approach you can sustain. Consistency generally beats one-off large payments, and you can always adjust your plan as your income or expenses change.

Bi-Weekly Payments

Pay half the monthly amount every two weeks. That’s 26 half-payments (13 full payments) per year, effectively adding one extra monthly payment annually, which can work especially well if your paycheck already lands every other week. If you want a deeper walkthrough of how bi-weekly structures can affect your interest costs, see our bi-weekly mortgage payments guide.

Round Up Payments

Round to a clean figure (e.g., $1,175 → $1,200). Small habitual extras accumulate into meaningful principal reduction.

Lump-Sum Payments

Direct windfalls (bonuses, refunds) to principal early for a larger interest impact. Specify “principal only.”

Debt Snowball or Avalanche

Clear smaller or higher-rate debts first, then redirect freed-up cash to the mortgage. If you’re choosing between methods, our debt snowball vs. avalanche guide walks through the pros and cons before you roll that freed-up payment into your home loan.

Use Windfalls

Side-income or occasional cash can be applied to principal. Confirm the lender posts it to principal, not escrow or future interest. If you’re also working on student loans, you can run similar scenarios with our student loan payoff calculator with extra payments. To keep things simple, choose just one strategy from this list to try for the next two or three months, then adjust once you see how it feels in your budget.

Other Financial Considerations

Before you send extra money to your mortgage, make sure the rest of your financial basics feel solid.

Emergency Fund

Maintain 3–6 months of essential expenses to handle surprises without pausing payments. An unexpected car repair or medical bill is easier to manage when you’re not also worried about keeping up with a big extra mortgage payment.

High-Interest Debt

Prioritize debts with rates higher than your mortgage. See the CFPB’s resources for practical guidance. For a step-by-step plan, read our complete guide to debt management.

Prepayment Rules and Penalties

Not every mortgage treats extra payments the same way. Read your loan documents or call your lender to ask about prepayment penalties, how to label extra amounts (such as “principal only”), and whether there are limits on how much extra you can send in each year.

Retirement Savings

Capture any employer match before allocating significant extras to the mortgage.

Investment Opportunities

If your expected investment return meaningfully exceeds your mortgage rate, investing may be preferable. Consider risk tolerance.

Inflation and Taxes

Fixed payments may feel lighter in high-inflation periods. Mortgage interest may be deductible depending on your situation—consult a tax professional.

Refinancing Option

When rates fall, refinancing plus moderate extras can outperform extras alone. To compare options, start with our mortgage recast vs refinance guide and, if you’re considering a new loan, use a mortgage refinance break-even calculator to see when the costs pay off. Before you change your payments, quickly scan this section and note which area—emergency fund, high-interest debt, retirement, or lender rules—needs attention first.

While you’re revisiting your mortgage and building equity faster, it also makes sense to review your home insurance so you’re not overpaying for coverage.

Is Early Payoff Right for You?

Deciding on an early mortgage payoff really depends on your situation and comfort with risk. Use this quick guide to decide where each extra dollar does the most good.

When to Pay Off Early

- High-interest debts are cleared.

- Adequate emergency fund is in place.

- Retirement contributions (and employer match) are on track.

- Reducing debt aligns with your risk tolerance and goals.

- Your mortgage rate is relatively high versus alternatives.

When to Focus Elsewhere

- High-interest balances remain.

- Emergency fund is thin.

- Employer match is being missed.

- Attractive investment opportunities exceed mortgage rate (for your risk level).

Test scenarios in the calculator to pick a contribution level that fits your budget.

Many readers (and our own family) start by testing a small extra amount for a few months. If it feels comfortable, they slowly increase it instead of jumping straight to a big extra payment on day one.

There’s no one “right” answer—some people sleep better knowing the mortgage is shrinking quickly, while others prefer to keep extra cash invested. The calculator is here to help you see those trade-offs clearly. Try moving the extra payment slider up and down until you land on a combination of monthly payment and payoff date that feels both doable and genuinely encouraging.

Frequently Asked Questions

Start Your Mortgage Payoff Journey

Use the mortgage payoff calculator to explore extra-payment scenarios and plan your early mortgage payoff strategy in a way that fits your real budget and goals.

Bookmark this page and come back whenever your budget changes so you can keep your payoff plan aligned with your real life.

This content is for general information and education only and is not personalized financial, tax, or investment advice. Your interest rate, lender terms, and personal circumstances are unique, so your actual results may differ from the examples on this page. Use this calculator as a starting point only, and consider speaking with your lender or a qualified financial or tax professional before making big changes to your mortgage or payoff plan.