Retire by 40, but a $10,000 IRS bill from misapplying mortgage interest tax deduction rules could derail your FIRE dream. For those chasing Financial Independence, Retire Early (FIRE), tax complexities like audits or back taxes can turn freedom into stress. Luckily, top tax relief services can sort out these messes, saving you time and cash.

This guide breaks down mortgage interest tax deduction rules for FIRE, dives into tax traps for early retirees, and spotlights trusted tax relief companies. Try our interactive tool to find the perfect provider for your needs.

Table of Contents

- Key Takeaways for FIRE Tax Planning

- Why FIRE Individuals Face Tax Challenges

- What Are Tax Relief Services?

- When Should FIRE Individuals Seek Tax Relief?

- How Tax Relief Services Help FIRE Individuals

- Top Tax Relief Companies for FIRE

- Choosing a Tax Relief Company

- Interactive Tax Relief Matching Tool

- Before Hiring a Tax Relief Company

- Frequently Asked Questions About Mortgage Interest Tax Deduction Rules

- Protect Your FIRE Dream

Key Takeaways for FIRE Tax Planning

- FIRE tax headaches: Early retirees deal with tricky income streams like capital gains or early withdrawals, often tripping over mortgage interest tax deduction rules.

- Tax relief perks: Pros handle IRS issues like audits, back taxes, or liens, fighting for you.

- Pick wisely: Go for companies with clear fees, solid credentials (EAs, CPAs, tax attorneys), and great reviews.

- Top picks: Optima Tax Relief, Anthem Tax Services, Community Tax, and Tax Defense Network shine for FIRE tax woes.

- Act fast: Ignoring tax issues snowballs into bigger problems. Quick action saves stress and money.

Why FIRE Individuals Face Tax Challenges

The FIRE lifestyle is awesome, but tax complexities like mortgage interest tax deduction rules for FIRE can hit you with surprise penalties. Here’s why early retirees face unique tax hurdles.

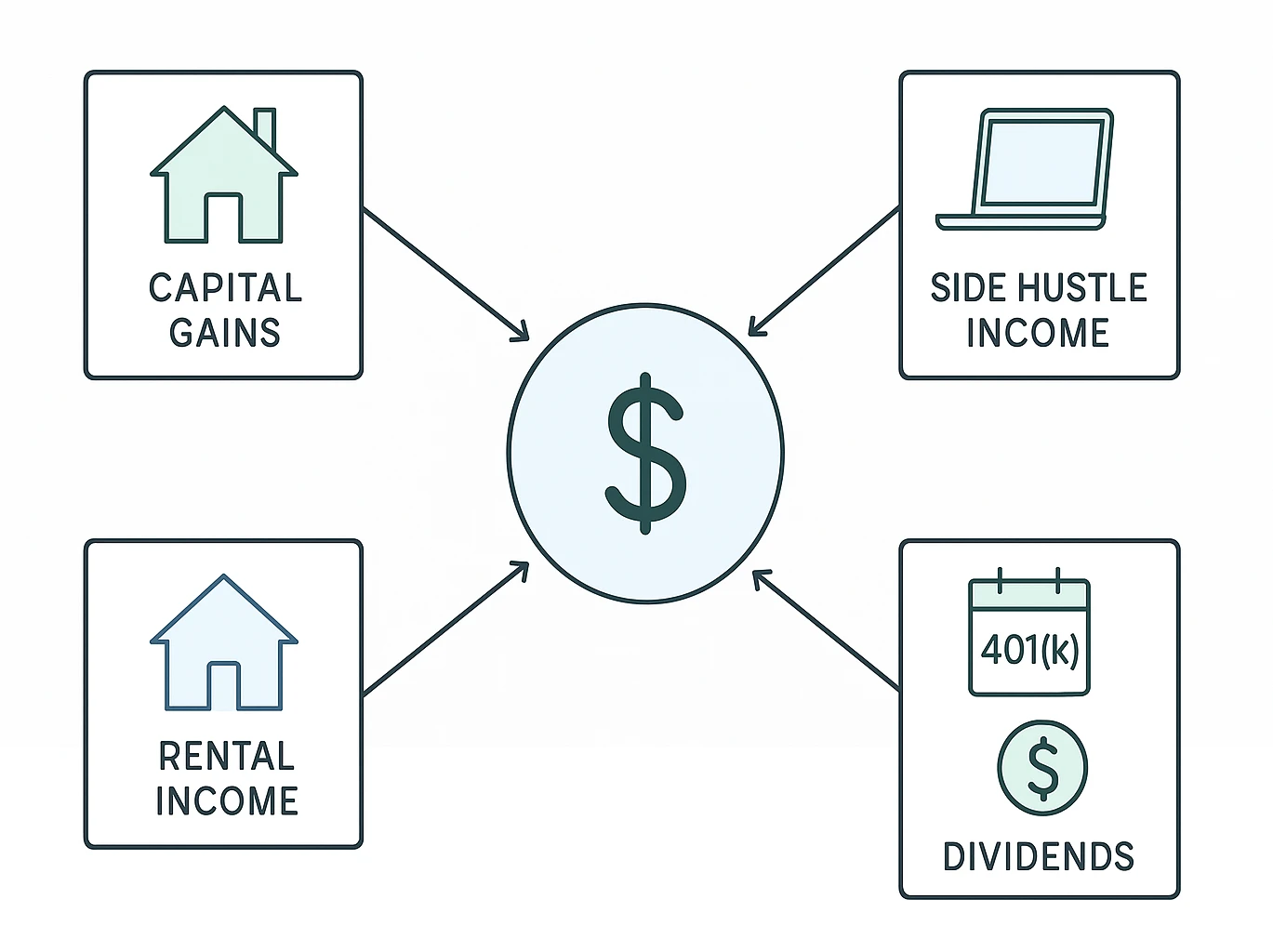

Diverse Income Streams

Unlike traditional retirees with pensions, FIRE folks juggle all sorts of income:

- Capital Gains: Selling stocks or real estate sparks taxes. Messing up basis or short-term vs. long-term gains can mean big bills.

- Self-Employment Income: Consulting or side gigs come with self-employment taxes and quarterly payments. Missing these invites penalties.

- Early Withdrawals: Tapping 401(k)s before 59½ can slap you with a 10% penalty unless you nail exceptions like Rule 72(t).

- Rental Income: Rental properties bring depreciation and passive loss rules, making things messy.

Misunderstanding Mortgage Interest Tax Deduction Rules

Getting deductions right is huge for FIRE, but mortgage interest tax deduction rules catch many off guard. I once helped a pal who thought all HELOC interest was deductible, only to get a tax bill. Per IRS Publication 936, the Tax Cuts and Jobs Act (TCJA) shook things up:

- Debt Limit: For mortgages after December 15, 2017, interest is deductible on up to $750,000 of debt ($375,000 for married filing separately). Older mortgages get $1 million.

- Home Equity Loans: Interest is deductible only if funds improve the home securing the loan, not for daily expenses.

- Itemizing Requirement: You gotta itemize to claim the deduction, but higher standard deductions often make it less worthwhile.

- Rental Properties: Rental mortgage interest is a business expense, but the rules are a maze.

To slash mortgage-related tax burdens, check out our guide on mortgage payoff hacks.

Real Story: My friend Sarah, a FIRE retiree, got burned by mortgage interest tax deduction rules. She used a HELOC for living expenses, thinking it was deductible. The IRS nailed her with a $5,000 bill when she learned only home-improvement interest counts.

Lack of Employer Withholding

Without a paycheck withholding taxes, FIRE folks must estimate and pay quarterly. I learned this the hard way when I underestimated my income one year, facing penalties. To stay on track, see our tips for avoiding tax filing fees. Missing payments can lead to costly IRS penalties.

Audit Risks

Complex FIRE returns with big deductions or mixed income raise audit red flags. A buddy’s rental property deductions triggered an audit, which could’ve been dodged with better prep. Learn how to cut risks with our guide on avoiding tax penalties for underpayment. Unfiled returns can also spark serious IRS trouble.

What Are Tax Relief Services?

Tax relief firms are your allies, tackling IRS and state tax headaches on your behalf. They bring in:

- Enrolled Agents (EAs): Federally licensed to represent you.

- CPAs: Accountants who know taxes inside out.

- Tax Attorneys: Lawyers for heavy legal tax fights.

“When the IRS came knocking, my tax relief team took over, letting me enjoy my FIRE life stress-free.”

When Should FIRE Individuals Seek Tax Relief?

Tax troubles can wreck your FIRE plans. Reach out for help if you’re hit with:

- Back Taxes: Unpaid taxes piling up from past years.

- Unfiled Returns: Missing tax filings.

- Audits: IRS poking around your return.

- Liens or Levies: IRS grabbing your property or wages.

- Penalties: Fines for screw-ups or late payments.

- Complex Issues: Overseas income or big capital gains.

How Tax Relief Services Help FIRE Individuals

Tax relief companies dish out solutions tailored to FIRE tax messes:

Audit Representation

Pros handle IRS audits, sorting paperwork and negotiating, perfect for messy FIRE income.

Back Tax Resolution

Options include:

- Offer in Compromise (OIC): Settle your debt for less if you can’t pay it all.

- Installment Agreement (IA): Pay off taxes over time.

- Currently Not Collectible (CNC): Hit pause on collections during tough times.

Penalty Abatement

Firms can beg for penalty cuts, like those from botching mortgage interest tax deduction rules.

Lien and Levy Release

Services fight to stop wage garnishments or bank levies, shielding your FIRE assets.

Unfiled Returns Assistance

Experts whip up overdue returns, keeping penalties low.

Top Tax Relief Companies for FIRE

Picking the right firm is key. Here’s a sleek comparison:

| Company | Services | Best For |

|---|---|---|

| Optima Tax Relief | Audits, OIC, liens, levies | Complex FIRE tax issues |

| Anthem Tax Services | OIC, payment plans, levies | Personalized service |

| Community Tax | Resolution & preparation | Ongoing tax needs |

| Tax Defense Network | Back taxes, state issues | Federal & state taxes |

Optima Tax Relief

- Pros: Wide-ranging services, seasoned team, solid rep.

- Cons: Upfront fees, occasional comms hiccups.

- Best For: Tricky FIRE tax problems.

Anthem Tax Services

- Pros: Happy clients, dedicated case managers.

- Cons: Smaller team, limited reach.

- Best For: Debt resolution with a personal touch.

Community Tax

- Pros: Handles resolution and prep, flexible payments.

- Cons: Mixed reviews, some sales pressure.

- Best For: Ongoing tax prep needs.

Tax Defense Network

- Pros: Broad services, free consult, BBB accredited.

- Cons: Can feel impersonal, pricing varies.

- Best For: Federal and state tax issues.

Choosing a Tax Relief Company

Keep these in mind:

- Credentials: Make sure they’ve got EAs, CPAs, or tax attorneys.

- Transparency: Steer clear of murky fees or wild promises.

- Reputation: Scope out BBB, Google Reviews, Trustpilot.

- Communication: Look for dedicated case managers.

- FIRE Expertise: Check if they know capital gains or early withdrawals.

Interactive Tax Relief Matching Tool

Find the best tax relief provider for your FIRE needs with a few clicks.

Match with Your Tax Relief Hero

Pick your tax issue to get tailored recommendations.

Before Hiring a Tax Relief Company

Take these steps to make a smart pick:

Avoid Scams

Watch out for guaranteed results, pushy tactics, or sketchy upfront fees.

Review Contracts

Read the fine print—check services, fees, and how to cancel.

IRS Fresh Start Program

This program offers OIC, penalty relief, and payment plans. Reputable firms tap into it for you.

Consult for Big Settlements

For debts over $100,000, a tax attorney brings legal muscle.

Frequently Asked Questions About Mortgage Interest Tax Deduction Rules

Protect Your FIRE Dream

FIRE means financial freedom, but taxes like mortgage interest tax deduction rules for FIRE can throw a wrench in your plans. From audits to back taxes, IRS issues can mess things up. Tax relief companies bring the expertise to fix these problems, so you can chill and enjoy your FIRE life. To map out your financial independence, check out our Coast FIRE calculator. Pick a trustworthy firm, double-check credentials, and jump on issues early to keep your financial freedom safe.