Worried about funding retirement? Picking between etf vs mutual fund for retirement can feel like a small choice, but over 20–30 years it can shift your final nest egg by tens of thousands of dollars. Want lower fees and fewer moving parts? You’ll see which option may fit your goal—especially when you understand how it fits into the beginners guide to investing and building wealth over time. This guide walks through the trade-offs step by step and includes a simple planner below to help you sanity-check your choice.

ETFs vs Mutual Funds: Quick Retirement Planner

Use this mini planner as a quick gut-check: first pick an investment type, then choose your main retirement goal to see a simple suggestion.

Step 1: Select investment typeThis post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What Are ETFs and Mutual Funds? (Retirement Basics)

- Benefits for Retirement Investors

- How to Choose Between ETFs and Mutual Funds for Retirement

- Why It Matters for Retirement Investors

- Pros and Cons to Watch

- The Road Ahead for Retiree Portfolios

What Are ETFs and Mutual Funds? (Retirement Basics)

Choosing between etf vs mutual fund for retirement really comes down to three things you can control: how each one trades, what it costs you every year, and how it’s taxed in your account. If you’re new to ETF investing, think of exchange-traded funds (ETFs) as baskets of securities that trade throughout the day like stocks. Most simply follow an index and give you instant diversification—for example, a total-market ETF; see VTSAX vs. FXAIX for a popular index-fund comparison. Mutual funds pool investor assets and price once per day at net asset value (NAV); many track indexes while some are actively managed. Both structures may diversify across hundreds or thousands of holdings. For a neutral, regulation-focused reference, see the mutual fund guide from the U.S. Securities and Exchange Commission.

Beyond structure, consider how each fits your saving habits. If you prefer scheduled contributions, most providers make it simple to automate into mutual funds. If you value intraday control and transparent pricing, ETFs may fit better. Either can work as a core—as long as costs stay low and the exposure is broad.

To make this concrete, picture two savers: Jamie, who auto-invests $300 every month into a single mutual fund in a workplace plan, and Riley, who prefers building a two-ETF mix inside an IRA. Both are doing “the right thing” by contributing regularly—the difference is simply which wrapper makes it easier for them to stay consistent.

Logistics note: ETFs can often be bought as fractional shares at many brokers; mutual funds sometimes have minimum investments (commonly $1,000–$3,000), though some providers may waive these inside retirement accounts. As a quick next step, log in to your main retirement account and note whether your core holding is an ETF or a mutual fund and what its expense ratio is.

Why It Matters for Retirement Investors

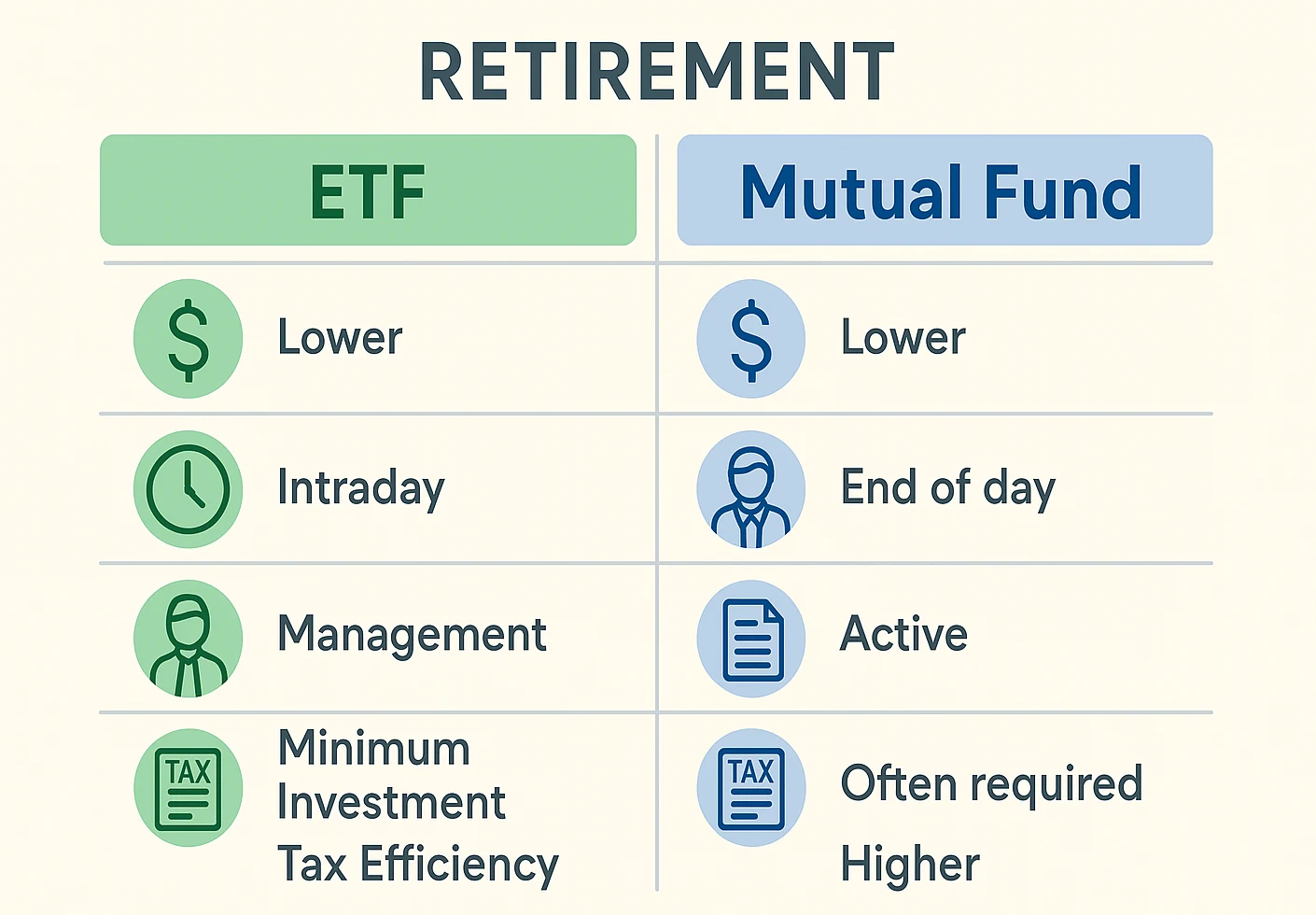

The ETF–mutual fund decision affects costs, flexibility, and taxes. ETFs often may come with very low expense ratios and intraday trading, while mutual funds offer end-of-day pricing and may include automatic rebalancing options. For tax considerations, ETFs are generally structured to reduce capital-gains distributions compared with many actively managed mutual funds, though results vary by fund. If you’re juggling a workplace retirement plan and an IRA, thinking through which account you touch most often can make this choice feel more concrete.

Cost Efficiency

Even a small expense-ratio gap may matter once contributions, company matches, and reinvested dividends compound for years. Many financial planners and investor-education sites point out that this quiet drag from fees is one of the few factors you can actually control. Favor low-cost building blocks for your core holdings, then add tilts only if they serve a clear purpose (for withdrawal planning basics, see the 4% rule).

For example, imagine you invest $300 a month for 30 years and your portfolio earns 7% before fees. A low-cost ETF with a 0.05% expense ratio might grow to roughly $362,000, while a higher-cost fund at 0.80% could end closer to $313,000—about $49,000 lost to fees alone over three decades. Those numbers are simplified illustrations, not guarantees; you can plug your own contributions into a compound interest calculator from a major broker or government financial education site to see your version of the math.

Flexibility and Accessibility

ETFs give intraday control and transparent pricing, while mutual funds may simplify life with end-of-day trades and easy automation. Dividend reinvestment (DRIP) is typically available for both—double-check your broker’s settings so payouts don’t sit in cash. If you prefer to “set it and forget it,” that simplicity can be as important as the underlying investment choice.

Behavior and Process

Results tend to stick when your process stays simple—automate contributions, rebalance on a schedule, and choose risk you can live with. When the market feels noisy, coming back to that short checklist can be more useful than refreshing the news feed. For this week, pick just one lever—fees, automation, or risk level—and make a small, concrete tweak instead of trying to overhaul everything at once.

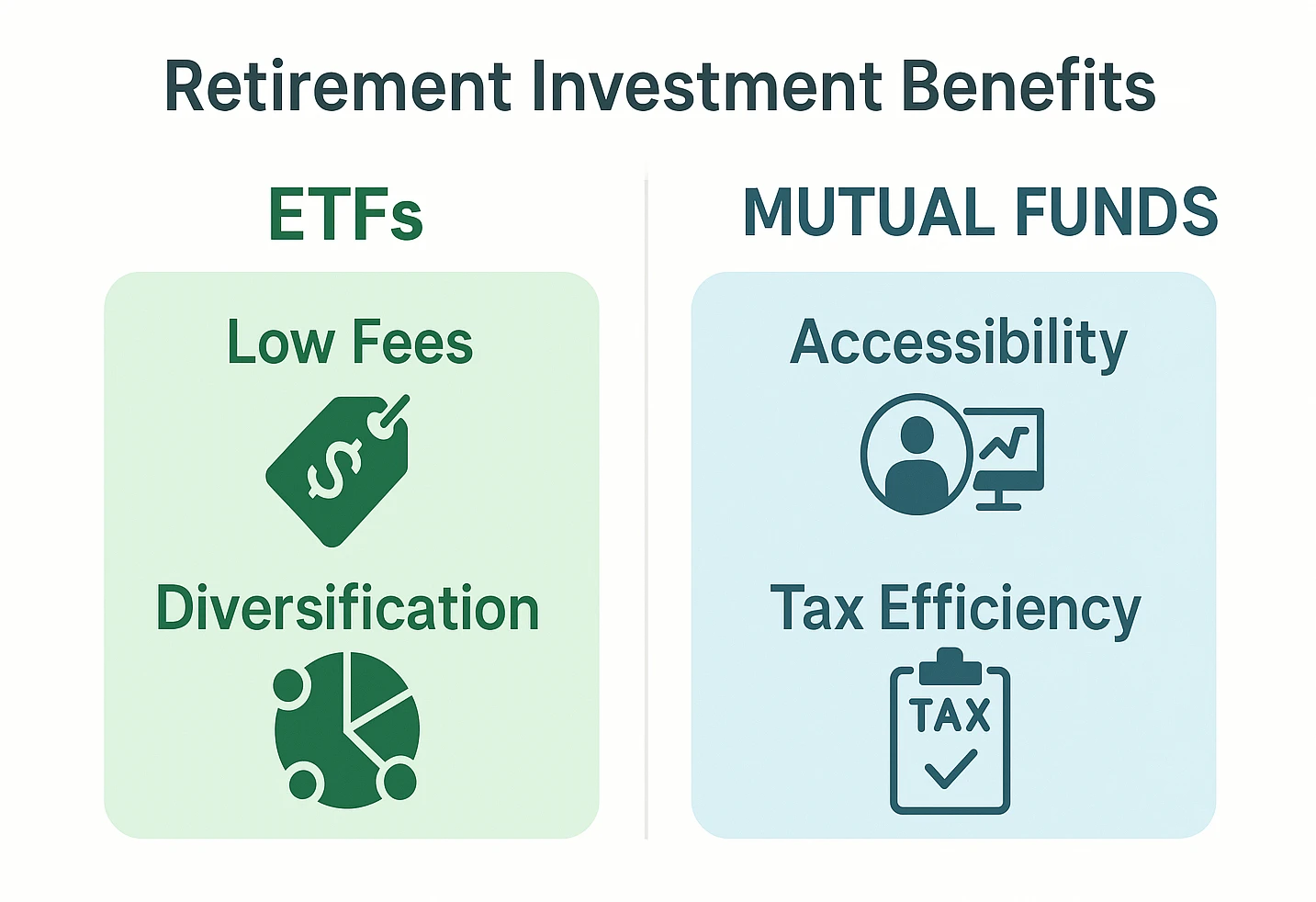

Benefits for Retirement Investors

Each option has strengths. Broad-market ETFs tend to offer very low costs and clear, rules-based exposure. Income-oriented mutual funds may prioritize stability and distribution policies that suit retirees. Both can diversify across many securities and may be used together in a plan, so it’s reasonable to start with one core choice now and adjust the mix as retirement gets closer.

- Low Fees: Many index ETFs have very low expense ratios, which may improve long-term outcomes.

- Diversification: Both ETFs and mutual funds can track broad indexes or specific segments.

- Accessibility: ETFs trade during market hours; mutual funds support scheduled contributions and rebalancing.

- Tax Awareness: ETFs often distribute fewer capital gains than many active funds; tax results depend on the fund and account type.

Example Core Allocations by Goal

The mixes below are illustrative starting points. Tweak weights to match your risk tolerance and timeline. If income is the priority, explore dividend aristocrats funds as a complement to broad-market exposure.

| Goal | Equities | Bonds/Cash | Notes |

|---|---|---|---|

| Growth (long horizon) | 80–90% (US total market + international) | 10–20% (US bond index) | Keep costs low; rebalance annually. |

| Balanced | 60–70% (broad stock exposure) | 30–40% (aggregate bonds) | Pairs well with an automatic rebalancing rule. |

| Income-tilted | 40–60% (diversified equity) | 40–60% (bonds, possibly short-intermediate) | Focus on stability and sequence-of-returns risk. |

Pros and Cons to Watch

ETFs require basic order-type knowledge and can invite overtrading during volatility. Mutual funds often have higher expense ratios and may require minimum investments, but they can reduce decision friction with end-of-day pricing and optional automatic rebalancing. If you’ve ever opened your account during a market drop and felt an urge to “do something” with your ETFs, you’ve already felt this difference in behavior risk.

Learning Curve

Understanding spreads, market/limit orders, and rebalancing disciplines helps ETF users avoid common mistakes. If you rarely place trades, a simple mutual fund lineup may be easier to maintain.

Cost vs. Management

Active management can justify higher fees in some cases, but low-cost index exposure is difficult to beat over long horizons. If you use active funds, clarify the role they play and compare costs to passive alternatives.

Tax Implications

ETFs tend to be tax-efficient due to creation/redemption mechanics. Actively managed mutual funds may distribute capital gains more frequently. Account type matters: tax-advantaged accounts mute distribution differences; in taxable accounts, manage withdrawals and harvesting with care (for conversion planning basics, see the Roth conversion ladder).

Tax rules vary by location and account type. Before you sell or rebalance, consider asking a qualified tax professional to review your plan and estimate the tax impact so there are fewer surprises later.

How to Choose etf vs mutual fund for retirement

Start with goals—growth, income, or balance—and your timeline. Broad-market, low-fee ETFs can be compelling long-term building blocks for growth. Income-oriented mutual funds may support steadier payouts. Consider risk tolerance, automate contributions, and review annually to keep allocation in line with your plan.

Quick Decision Framework for ETF investing vs mutual funds

- Prefer set-and-forget? Lean mutual funds with automatic rebalancing.

- Want intraday control? Lean ETFs and define guardrails (e.g., quarterly changes only).

- Minimize costs? Favor low-expense-ratio index exposure for your core.

- Need income? Blend diversified equities with quality bond exposure; match payout needs.

- Reduce behavior risk? Use simple rules to avoid “accidental” risk creep: set a contribution day, plan one annual rebalance, and avoid off-cycle trades triggered by headlines.

Common Mistakes to Avoid

- Chasing last year’s winners instead of sticking to a set allocation.

- Over-tilting to narrow themes; keep them as small satellites, if at all.

- Ignoring fees and taxes—small drags compound.

Mini example: two different investors

Imagine Alex, 40, with twenty years to go until retirement, choosing a low-cost stock ETF plus a bond ETF and rebalancing once a year. Meanwhile Pat, already retired, prefers a single balanced mutual fund that automatically keeps 60% bonds and 40% stocks. Both approaches can work because each investor matched the structure to their timeline and stress level, not to the latest headline.

| Feature | ETF | Mutual Fund |

|---|---|---|

| Expense Ratio | Often very low (index) | Varies; active funds higher |

| Trading | Intraday | End of day (NAV) |

| Management | Typically passive (index) | Index or active |

| Minimum Investment | Share price (fractional at many brokers) | Commonly $1,000–$3,000 |

| Tax Efficiency | Often high | Varies; active funds moderate |

Frequently Asked Questions

The Road Ahead for Retiree Portfolios

ETF and mutual fund options continue to expand. Expect more targeted exposures, evolving fee structures, and tools that make building and monitoring a retirement allocation easier. Focus on costs, diversification, and process—then stay consistent.

Whichever structure you prefer, a simple policy statement helps: write your target allocation, rebalancing cadence, and a brief list of “when I will make changes.” Keeping decisions rule-based may lower stress and support better long-term behavior. If you’re five to ten years from retirement, having that written plan can make it easier to stay calm when headlines are noisy.

Bottom line

If you value low fees and flexibility, broad-market ETFs often shine. Prefer hands-off simplicity or income targeting? A well-chosen mutual fund may fit the bill. Use the planner above to sanity-check your goal, automate contributions, and review yearly—small cost differences can compound into meaningful gains by retirement.

This content is for general educational and informational purposes only and is not personalized financial or tax advice. Everyone’s situation is different, so consider speaking with a qualified financial or tax professional about your specific plan. Investing always involves risk, including the possible loss of principal, and individual results will vary.