Thinking about leaving work a few years early? The early retirement Rule of 55 is an IRS exception that can allow penalty-free access to certain employer plans at 55. For many in the FIRE movement, the big hurdle is the 10% early-withdrawal penalty before 59½. This rule can remove that penalty if you separate from your employer in the right year—see our guide to financial independence and early retirement for the broader roadmap.

This guide covers eligibility, withdrawal steps, and common mistakes—plus a quick tool to check your status. Key takeaway: time your separation carefully and confirm plan rules.

Educational only—tax rules can change and plans vary. Confirm details with your plan administrator and a qualified tax professional.

Rule of 55 Eligibility Checker

Help: Separate in or after the year you turn 55 (50 for certain public-safety roles). Applies to the plan of the employer you’re leaving—old 401(k)s and IRAs don’t qualify.

*Disclaimer: This tool provides general information and is not financial or tax advice.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways of the Rule of 55

- What Is the Early Retirement Rule of 55?

- How to Use the Rule of 55: Step-by-Step

- Key Nuances of the 55-and-over 401(k) exception

- Tax and Investment Considerations

- Real-Life Examples: How the Rule Works

- Avoid These Rule of 55 Mistakes

- How This Rule Fits Into Your FIRE Strategy

- Frequently Asked Questions About the Rule of 55

- Conclusion: Unlock Your Early Retirement Dreams

Key Takeaways of the 401k Rule of 55

- Penalty-free access: If you leave your job in the year you turn 55 (50 for certain public-safety employees), you may take withdrawals from that employer’s plan without the 10% penalty.

- Timing is critical: Separating before the qualifying year generally disqualifies that plan.

- Current plan only: The exception applies to the plan of the employer you’re leaving—not old 401(k)s or IRAs. Rolling to an IRA too soon ends eligibility.

- Taxes still apply: Distributions are ordinary income even when the penalty is waived.

- Confirm details: Check your plan’s distribution rules and talk to a tax professional.

What Is the Early Retirement Rule of 55?

The Rule of 55 is an IRS exception (see Section 72(t)) that waives the 10% early-withdrawal penalty for certain workplace retirement plans if you separate from service in or after the year you turn 55. Normally, withdrawals before 59½ trigger income tax plus a 10% penalty. This age-55 exception removes the penalty but not the tax, making it useful for those retiring a bit early.

For other paths to avoid the 10% additional tax, see 401(k) withdrawals without penalty.

Who Qualifies for the Rule of 55?

To use the exception, you must meet both:

- Age: Separate from service in the calendar year you turn 55 or later (50 for certain public-safety employees). If you turn 55 in December 2025, leaving any time in 2025 qualifies; leaving in December 2024 does not.

- Separation from service: You no longer work for the employer sponsoring the plan you’re accessing.

Understanding Separation from Service for Early Retirement

Ending employment with the plan sponsor is what matters—retiring, quitting, or being laid off all count. For example:

- Scenario A: Sarah, 54, quits on December 31, 2024, and turns 55 on January 15, 2025. She doesn’t qualify for her employer’s 401(k) because she left before the year she turned 55.

- Scenario B: Mark turns 55 on July 1, 2025, and quits on August 1, 2025. He does qualify because he left in the year he turned 55.

Plan your exit so your separation date clearly falls in the qualifying year.

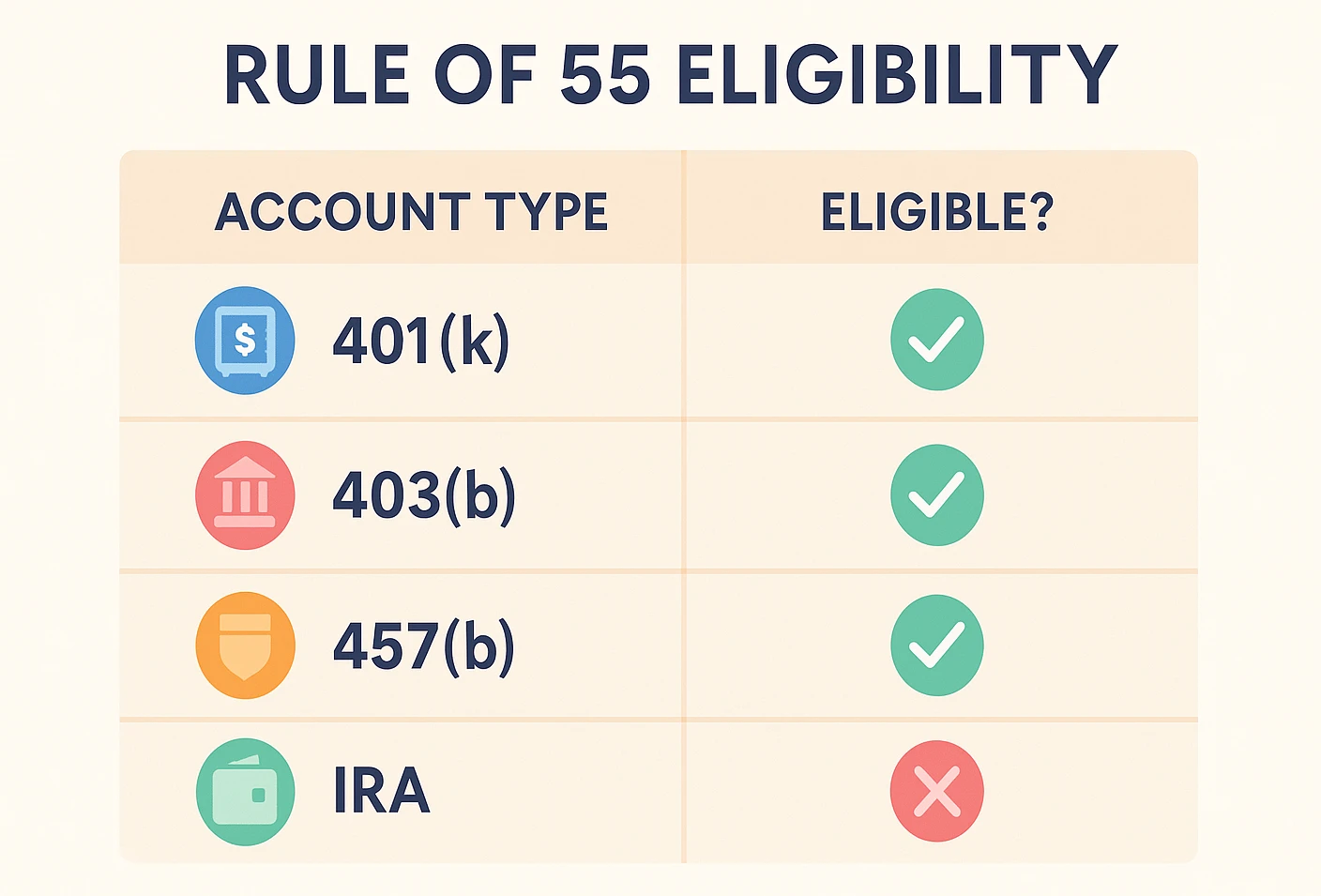

Which Accounts Qualify Under the Rule of 55?

Here’s where the early retirement rule of 55 applies (and where it doesn’t).

The exception applies to these plan types from the employer you’re leaving:

- 401(k) plans

- 403(b) plans

Important: Old 401(k)s and IRAs (Traditional, Roth, SEP, SIMPLE) don’t qualify under this rule.

Note on governmental 457(b): penalty rules are different—governmental 457(b) distributions aren’t subject to the 10% additional tax after separation from service, and there’s no age-55 requirement. (Rollovers from non-457 plans into a 457(b) can change the penalty treatment; check your plan.)

| Account Type | Penalty Rule at Separation |

|---|---|

| Current Employer 401(k) | ✅ Penalty waived if you separate in or after the year you turn 55 (50 for some public-safety roles). |

| Current Employer 403(b) | ✅ Penalty waived if you separate in or after the year you turn 55 (50 for some public-safety roles). |

| Current Employer 457(b) — Governmental | ✅ Different rule: No 10% additional tax after separation; no age-55 requirement. See note above. |

| Old 401(k) from previous job | ❌ Not covered by the Rule of 55; generally wait until 59½ or consider other exceptions. |

| Traditional IRA | ❌ Rule of 55 doesn’t apply; IRA exceptions differ (e.g., SEPP/72(t), certain special distributions). |

| Roth IRA | ❌ Rule of 55 doesn’t apply; Roth IRA ordering rules and five-year/59½ tests govern taxation/penalty. |

| SEP IRA / SIMPLE IRA | ❌ Rule of 55 doesn’t apply; SIMPLE IRAs may have a 25% early-distribution penalty in first two years. |

How to Use the Rule of 55: Step-by-Step

Here’s how to apply the rule when you qualify. To use the early retirement rule of 55, start by confirming your separation year and plan rules.

Step 1: Leave Your Job at or After Age 55

Leave in the year you turn 55 or later. If your 55th birthday is October 20, 2025, quitting any time in 2025 works; leaving in 2024 doesn’t.

What to do: Confirm your dates before giving notice.

Step 2: Look Into Your Plan’s Details

The IRS allows the exception, but your plan’s rules (timing, frequency, forms) decide how you can take money out.

What to do:

- Ask your plan: “What withdrawal options do I have at 55?”

- Confirm: “Does our plan allow Rule of 55 withdrawals?”

- Clarify: “What paperwork and timelines apply?”

Tip: Ask before you resign.

Step 3: Plan Your Strategy

Estimate how much to withdraw and when. For example, withdrawing $50,000 at a 22% tax rate means about $11,000 in federal tax and $39,000 net.

- Needs: Cover living costs and near-term goals.

- Taxes: Smaller, steady withdrawals may help manage your bracket.

- Investments: Keep the remaining allocation aligned with your horizon.

What to do: Coordinate with a financial planner and tax pro. See IRS early-distribution guidance for details.

Step 4: Request Your Withdrawals

Submit the forms, choose a payment method (e.g., direct deposit), and expect default withholding (often 20%). Keep your Form 1099-R for taxes. If your 1099-R doesn’t show the exception code, you may need to file Form 5329 to claim the exception.

Key Nuances of the 55-and-over 401(k) exception

These details trip people up—here’s how to stay penalty-free.

Current Employer Plan Limitation

The exception applies only to the plan of the employer you’re leaving at 55 or older. Old 401(k)s or IRAs don’t qualify. Some plans allow partial withdrawals (e.g., taking a set amount yearly while keeping the rest invested)—confirm with your administrator.

Avoid Rolling Over to an IRA Too Soon

Rolling a 401(k) into an IRA before taking Rule of 55 distributions makes those funds ineligible under this rule.

Special Rule for Public Safety Employees

Qualified public-safety employees (e.g., police, firefighters, EMTs) may use a similar exception at age 50 (or with 25 years of service under certain plans) when separating from a governmental employer’s plan.

Tax and Investment Considerations

Penalty-free doesn’t mean tax-free.

Taxes Still Apply

Withdrawals are ordinary income. For example, a $20,000 withdrawal at a 24% rate incurs $4,800 of federal tax. For a deeper overview of the additional tax on early distributions, see IRS Topic No. 558.

Roth 401k specifics under the 401k rule of 55

Under the Rule of 55, the 10% penalty is waived for eligible Roth 401(k) distributions. Designated Roth 401(k) withdrawals are treated as a mix of contributions and earnings, and the earnings can be taxable unless the 5-year and qualifying-event rules are met. Plans don’t apply the same “contributions first” ordering rules as Roth IRAs.

Long-Term Impact on Early Retirement Savings

Early withdrawals reduce future growth. For instance, $50,000 withdrawn at 55 could grow to about $80,000 by 65 at a 5% annual return. Make sure your plan sustains your time horizon.

Need coverage before Medicare? Try this:

Real-Life Examples: How the Rule Works

A few quick snapshots to show how this plays out.

Example 1: The Early Retiree (Eligible)

David, 55, left work in July 2025 after turning 55 in June. He takes about $40,000 a year from his current employer’s 401(k). He owes income tax (assume 22%) but avoids the 10% penalty.

Example 2: The Job Hopper (Ineligible)

Maria, 57, left Company B in 2025. She can tap Company B’s 401(k) without the penalty, but her older Company A 401(k) still falls under the 59½ rule.

Example 3: The Firefighter (Eligible)

Captain Jones, a 50-year-old firefighter, left a governmental employer in 2025 and can draw from his 457(b) with no 10% penalty—regular income tax still applies. This access comes from 457(b) rules after separation, not the Rule of 55.

Avoid These Rule of 55 Mistakes

Avoid these mistakes with the early retirement rule of 55 so you don’t accidentally trigger penalties.

- Wrong timing: Leaving at 54—even a month before turning 55—disqualifies you.

- Premature IRA rollover: Moving funds to an IRA before withdrawals ends eligibility.

- Assuming all accounts qualify: Only the current employer plan is eligible.

- Ignoring taxes: Plan for withholding and total tax.

- Skipping plan rules: Confirm distribution options with your administrator.

Frequently Asked Questions About the Rule of 55

How This Rule Fits Into Your FIRE Strategy

The Rule of 55 can bridge the gap between leaving work and age 59½. Unlike a Roth conversion ladder (which takes years) or 72(t) SEPP (which fixes payments), this exception allows flexible withdrawals from your current employer plan starting at 55 (or 50 for qualifying public-safety roles). Many FIRE planners pair it with taxable accounts or part-time income to manage taxes and cash flow.

Conclusion: Unlock Your Early Retirement Dreams

The early retirement Rule of 55 can open penalty-free access to your current employer’s 401(k) or 403(b) once you separate in the qualifying year. With sound timing and plan knowledge, you can fund the early years of retirement without the 10% penalty.

Remember: income tax still applies, and rolling to an IRA too soon can end eligibility. To succeed:

- Confirm your plan’s distribution rules.

- Align withdrawals with your goals and risk tolerance.

- Coordinate with a tax professional.

This content is educational and not financial, tax, or legal advice. Confirm details with your plan administrator and a qualified professional before making decisions.