Debt consolidation loans 600 credit score — if you’re weighing consolidation with a ~600 score, you’re not alone. A fair score (580–669) can still qualify for a loan that rolls multiple balances into one payment, sometimes at a lower rate. That means fewer bills to track, a clearer payoff date, and less stress. For step-by-step payoff support, see our Debt Management Plan guide.

This guide explains fair credit, how consolidation works, and how to compare lenders so you can see if you qualify and what to do next.

Debt Consolidation Calculator

Move the sliders or type values to estimate payments and potential savings.

Est. Payment (Current)

$—

Est. Payment (New Loan)

$—

Estimated Savings

$— / mo · $— / yr

Estimates use standard amortization and may differ from actual offers. Compare multiple prequalified quotes.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- How Debt Consolidation Works (and Why It Helps)

- How to Choose a Loan with Fair Credit

- Top Lenders to Compare

- Frequently Asked Questions

Debt Consolidation Loans 600 Credit Score: How They Work & Why They Help

Before exploring options, let’s break down what a 600 credit score means and how consolidation can shift your financial path. If you’re unsure where your score stands for this type of loan, check what credit score for a consolidation loan lenders typically look for.

What Is a 600 Credit Score?

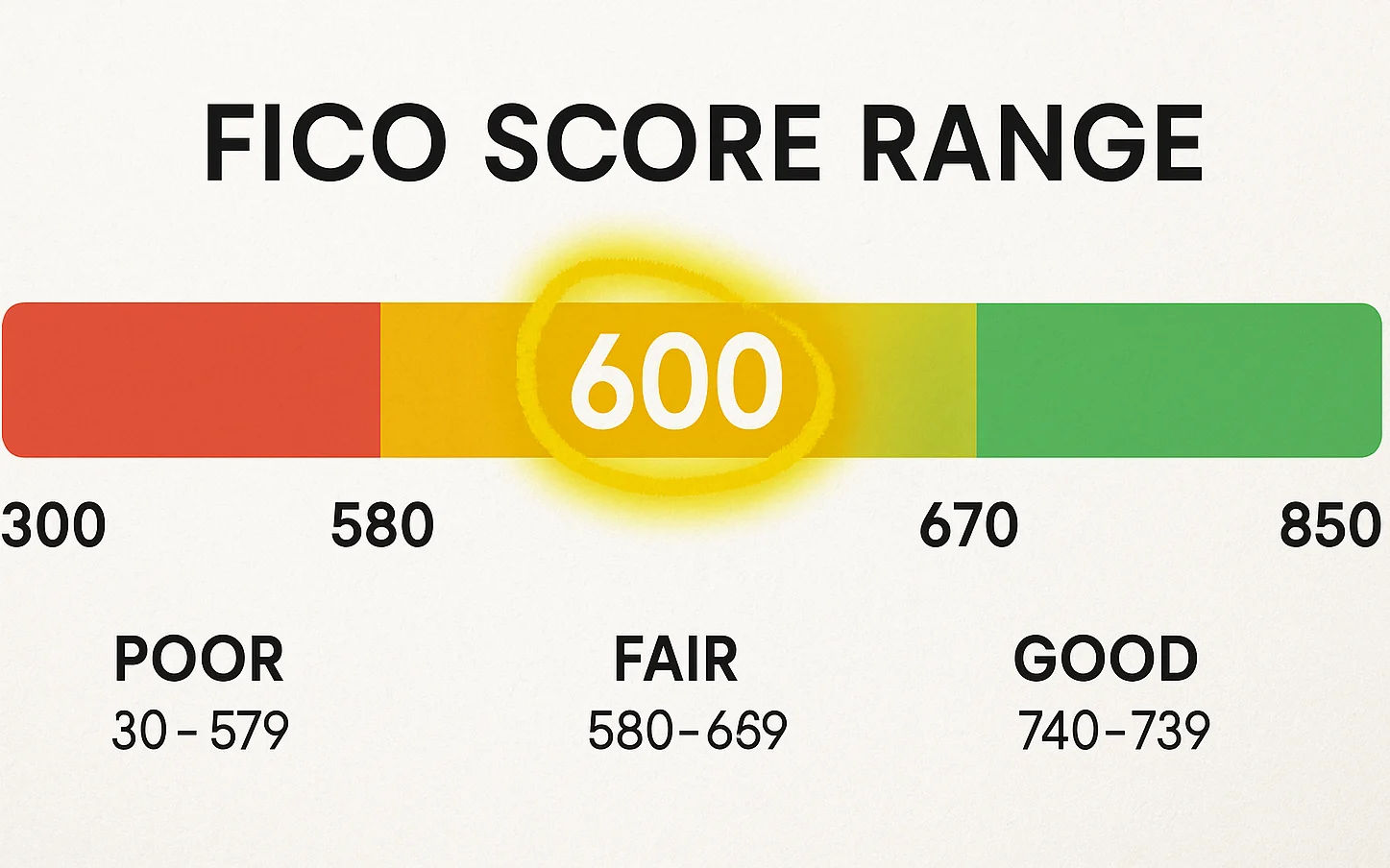

A credit score is a snapshot of borrowing habits. FICO ranges from 300 to 850:

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

A 600 score is “fair,” often tied to factors like late payments or high utilization. Many lenders still consider these applications, though rates may be higher. Improving on-time payments and keeping balances under ~30% of limits can help over time.

How Debt Consolidation Works

Use one new loan to pay off several higher-interest debts (credit cards, medical bills, etc.). You’ll swap many payments for one predictable monthly bill.

Quick steps:

- Apply: Request a loan that covers your combined balances.

- Approval & Funding: If approved, funds are sent to you or directly to creditors.

- Pay Off Debts: Zero out old balances.

- One Payment: Make a single payment to the new lender.

Want a simple way to track progress month by month? Grab our free debt payoff tracker to stay on schedule.

“Consolidation isn’t just bundling bills; it can simplify repayment and make costs more predictable.”

Benefits of a Consolidation Loan at 600 Credit

- Simplify payments: One bill instead of many.

- Lower costs: Many cards charge over 20% APR; some consolidation loans may offer lower rates depending on your profile and market conditions.

- Give a payoff date: Fixed terms show when you’ll be debt-free.

- Reduce stress: Fewer due dates to juggle.

- Support score growth: On-time payments and lower utilization can help.

Choosing Debt Consolidation Loans for a 600 Credit Score (Debt Relief Loans vs. Consolidation)

Compare offers before accepting. Focus on the items below to see if a loan beats your current debts. If you’re unsure whether consolidation or debt relief loans fit better, note the differences in cost, credit impact, and timeline.

1. Interest Rates (APRs)

The Annual Percentage Rate (APR) reflects total borrowing cost. With a ~600 score, expect roughly low- to mid-teens into the 20s. A soft-pull rate check helps you compare without a hard inquiry. If you want to sanity-check payments over different terms, our loan amortization calculator can help.

2. Fees

Here’s what to look for in the fine print:

- Origination: A one-time setup fee (often 1–8%) that’s taken out of your loan before you get the money.

- Late fees: Charged if a payment arrives after the due date—autopay can help you avoid these.

- Prepayment penalties: Some lenders charge if you pay off early; aim for loans with no penalty.

3. Loan Terms

Most loans run 24–60 months (sometimes longer). Shorter terms mean a higher monthly payment but less interest overall; longer terms lower the payment but increase total interest.

4. Loan Amount

Pick an amount that actually covers all the balances you want to roll in. Many lenders offer roughly $1,000–$50,000.

5. Prequalification for Fair Credit Debt Consolidation

Use a soft-pull prequalification first. You’ll see estimated rates and terms without a hard inquiry, so you can compare safely before applying.

6. Approval Speed

Once approved, some lenders can send funds in about 1–3 business days.

7. Reputation

Scan reviews and ratings (e.g., BBB) and read the fee disclosures so there are no surprises.

Common Mistakes to Avoid

Don’t grab the first offer. Compare APRs and fees, avoid prepayment penalties, be careful with very long terms, and make sure the loan is big enough to clear the balances you intend to consolidate. For fair credit debt consolidation, set a realistic budget and timeline—missed payments can erase any savings.

Not sure your current score will get you the rate you want?

When consolidation isn’t a fit

If new APRs aren’t lower than current card rates, balances are very small, or you can repay within a few months, consolidation may not help. In those cases, a simple snowball vs. avalanche plan or no-fee 0% balance transfer cards can be cheaper and quicker if you qualify.

Top Lenders to Compare

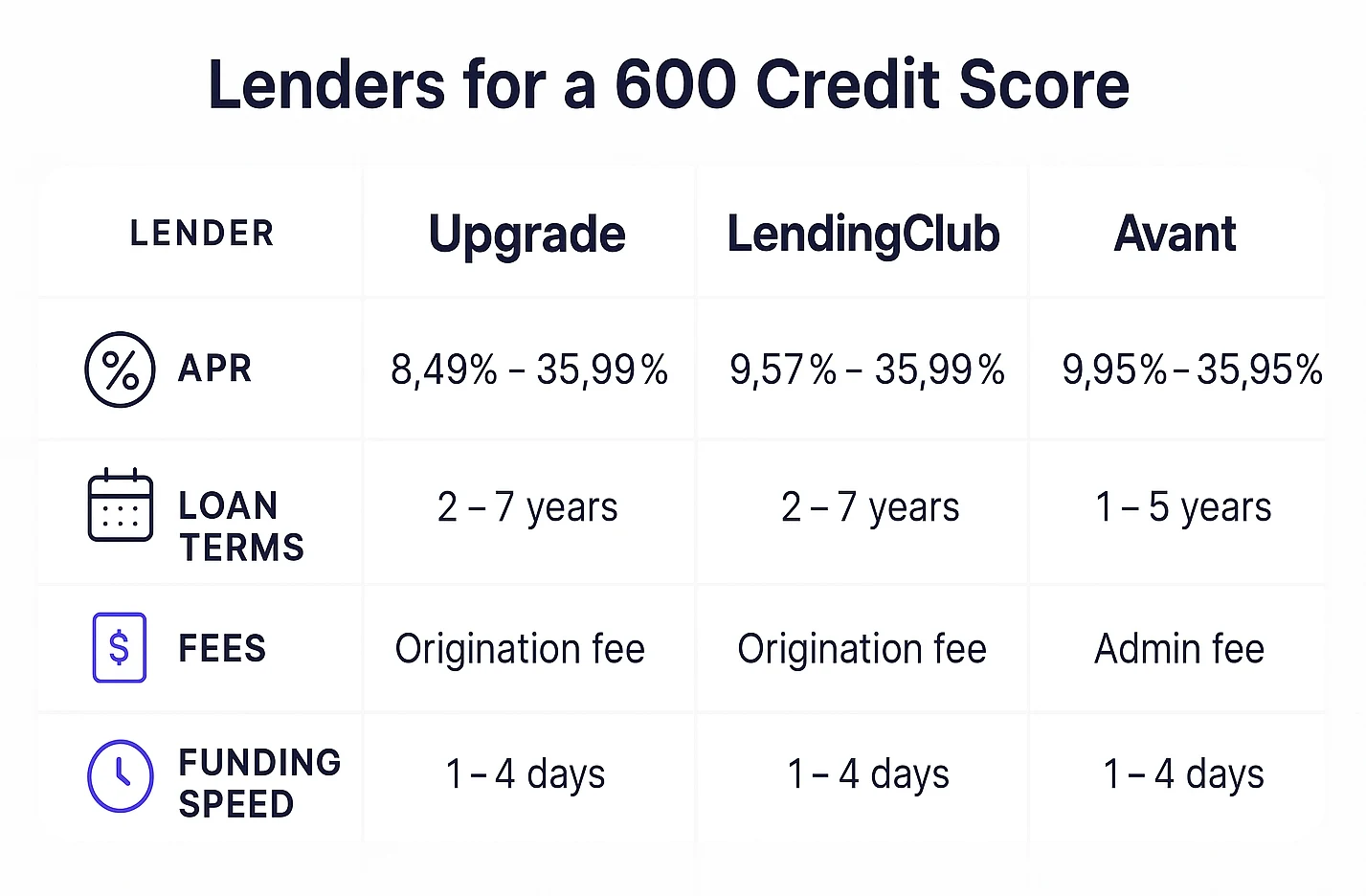

Here are the top debt consolidation loans 600 credit score borrowers often compare, with APRs, terms, and fees:

| Lender | APR Range (600 Credit Score) | Loan Amounts | Loan Terms | Fees | Prequal? | Speed | Pros |

|---|---|---|---|---|---|---|---|

| Upgrade | 8.49%–25.99% | $1,000–$50,000 | 24–84 months | Origination: 1.85%–9.99% | Yes | 1–4 days | Flexible terms, fast funding |

| LendingClub | 9.77%–24.99% | $1,000–$40,000 | 24–60 months | Origination: 3%–8% | Yes | 2–7 days | Prequalification, no prepayment penalties |

| Avant | 9.95%–25.99% | $2,000–$35,000 | 12–60 months | Origination: Up to 4.75% | Yes | 1–2 days | Quick approval, fair-credit focus |

Rates, fees, and eligibility change. Always confirm details on each lender’s official site before you apply.

Frequently Asked Questions

The hard inquiry from a full application can cause a small, temporary dip. Paying down high-interest cards and making on-time payments may help scores recover and improve. Use soft-pull prequalification to compare offers first.

It can. A lower utilization ratio and consistent on-time payments are positive signals. Results vary by profile and payment behavior—set reminders or autopay to stay on track and avoid late fees.

Many lenders consider fair-credit applicants. Expect higher APRs than prime borrowers, and compare multiple prequalified offers to find the best rate and fees.

Some lenders consider scores down to the high-500s, but eligibility, APRs, and terms vary. Check each lender’s criteria and fee disclosures.

It’s possible if income, debts, and lender criteria align. Prequalification can show estimated amounts, rates, and terms without a hard pull.

Conclusion

If balances feel like a game of Tetris, consolidation can help clear the board. Compare offers, use the calculator to gauge savings, and avoid common mistakes (fees, penalties, overly long terms). Taking a few minutes to prequalify can reveal real savings and a simpler path forward.

This content is for informational purposes only and does not constitute financial advice. Consult a qualified professional for guidance tailored to your situation.