Imagine being able to stop saving for retirement and still know you’ll retire with financial freedom. That’s the promise of this approach—this coast fire number calculator shows if you already qualify or what to tweak next. After your first run, skim our pillar on early financial independence to plan your next step.

Coast FIRE Number Calculator

Use the sliders for quick adjustments or type exact values.

Enter your details above to see your Coast FIRE status.

Educational only. Projections are simplified—not guarantees; markets, inflation, taxes, and fees can change outcomes. Consider discussing your plan with a fiduciary financial advisor.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for Your Coast FIRE Journey

- What is Coast FIRE and How Does it Work?

- How Coast FIRE Stacks Up Against Lean FIRE and Fat FIRE

- Why This Calculator Matters

- Coast FIRE Math (How It Works)

- How to Use the Calculator

- Example Scenarios Using the Calculator

- After Reaching Your Coast FIRE Number: Next Steps

- Common Coast FIRE Questions (FAQs)

- Your Path to Financial Freedom

Key Takeaways for Your Coast FIRE Journey

- Coast FIRE in a nutshell: Save enough early, then let growth carry you to retirement by your target age.

- Flex your lifestyle: After you hit your number, choose part-time, a career change, or a break—without stressing about retirement saving.

- Balance vs. extremes: Coast FIRE sits between Lean (frugal) and Fat (luxury) FIRE.

- Compounding wins: Start earlier, save less overall.

- Find your number: Use the calculator to check if you already qualify and what to adjust next.

What is Coast FIRE and How Does it Work?

Coast FIRE means you’ve saved enough that, from here, compound growth can finish the job by your target age—freeing you to stop retirement contributions. For a clear definition and context, see this overview from Investopedia.

Here’s the idea: build a solid base in accounts like a 401(k) or IRA. Once you reach your Coast FIRE number, you can stop contributing and let time do the work so your balance reaches your retirement target by around age 60–65 (earlier if you start sooner).

- Pick lower-stress work, if you want.

- Shift to part-time for balance.

- Start a project or business with less money stress.

How Coast FIRE Stacks Up Against Lean FIRE and Fat FIRE

The FIRE movement has a few flavors. Here’s a quick comparison to help you choose. For a deeper breakdown of the minimalist and more luxurious paths, see our guide to Fat FIRE vs. Lean FIRE.

Coast FIRE: At a Glance

- Goal: Save enough early so growth funds retirement by your target age.

- Saving period: ~5–15 years of focused saving.

- Work after goal: Flexible or part-time to cover current expenses.

- Lifestyle: Your call—modest to comfortable.

Lean FIRE: Minimalist Early Retirement

- Goal: Retire early with a smaller nest egg and simple budget.

- Saving period: ~10–20 years.

- Work after goal: None or passion work.

- Lifestyle: Frugal, often under $40,000–$50,000 a year.

Fat FIRE: Luxurious Early Retirement

- Goal: Retire early with a larger nest egg for a higher-spend lifestyle.

- Saving period: 15–25+ years or high income.

- Work after goal: None.

- Lifestyle: $100,000+ a year.

| Feature | Coast FIRE | Lean FIRE | Fat FIRE |

|---|---|---|---|

| Retirement Age | Traditional (60–65) or earlier | Early (30s–50s) | Early (30s–50s) |

| Savings Goal | Enough for investments to grow | Minimalist budget | Higher-spend lifestyle |

| Active Saving | Stop once number is hit | Stop once number is hit | Stop once number is hit |

| Work After Goal | Optional, flexible | None or minimal | None |

| Lifestyle | Flexible | Frugal | Luxurious |

| Benefit | Choice and lower stress | Early retirement | High comfort |

Why This Coast FIRE Calculator Matters

The tool quickly shows whether you qualify now—or exactly what gap to close.

- Less worry: Confidence that retirement is on track.

- Work your way: Pick roles that fit your life.

- More life: Focus on family, hobbies, and health.

- Start young, save less: Compounding does more.

- Built-in buffer: More flexibility for life changes.

Coast FIRE Math: How the Calculator Works

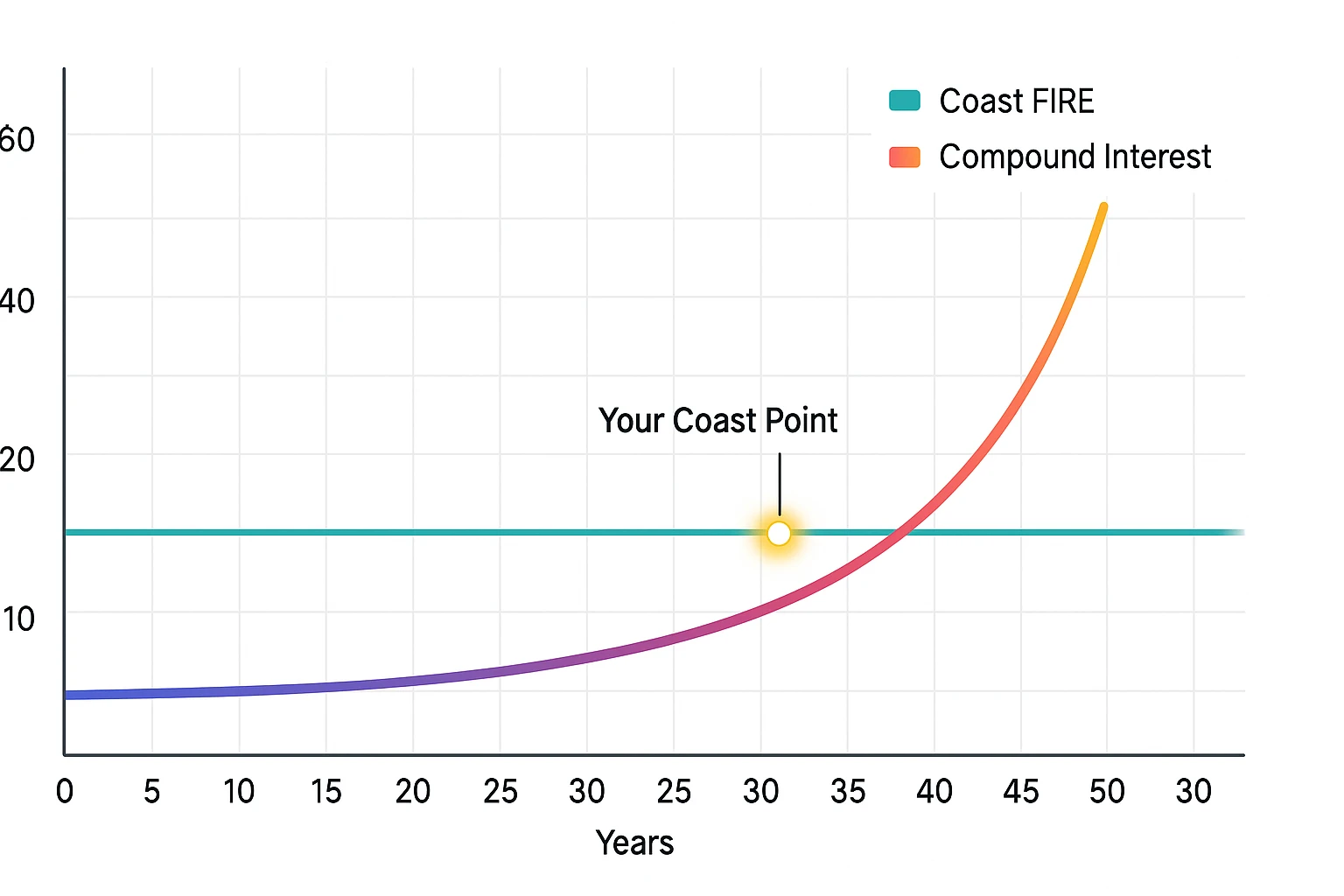

Coast FIRE runs on compound interest—growth on your contributions and on prior gains.

How the Formula Works

- Save a base amount.

- Invest broadly—for many people, a simple approach like index fund investing 101 in low-cost index funds or ETFs works well.

- Assume ~3–5% real returns (roughly ~6–8% nominal) over decades.

- Let time do the heavy lifting.

Example: invest $100,000 at age 30 at 7% annual returns (nominal):

- Age 40: ~$196,715

- Age 50: ~$386,968

- Age 60: ~$761,225

Reality check: returns & inflation

Markets don’t move in straight lines. Use these estimates as a starting point, then revisit your plan yearly—especially after big life or market changes.

What the calculator needs:

- Current age

- Target retirement age

- Current investment balance

- Desired retirement amount (often 25× expenses)

- Rate of return (assumed in the tool)

How to Use Our Coast FIRE Number Calculator

Pop in your numbers and the tool shows whether you can coast now—or exactly how much to close the gap.

Step-by-Step

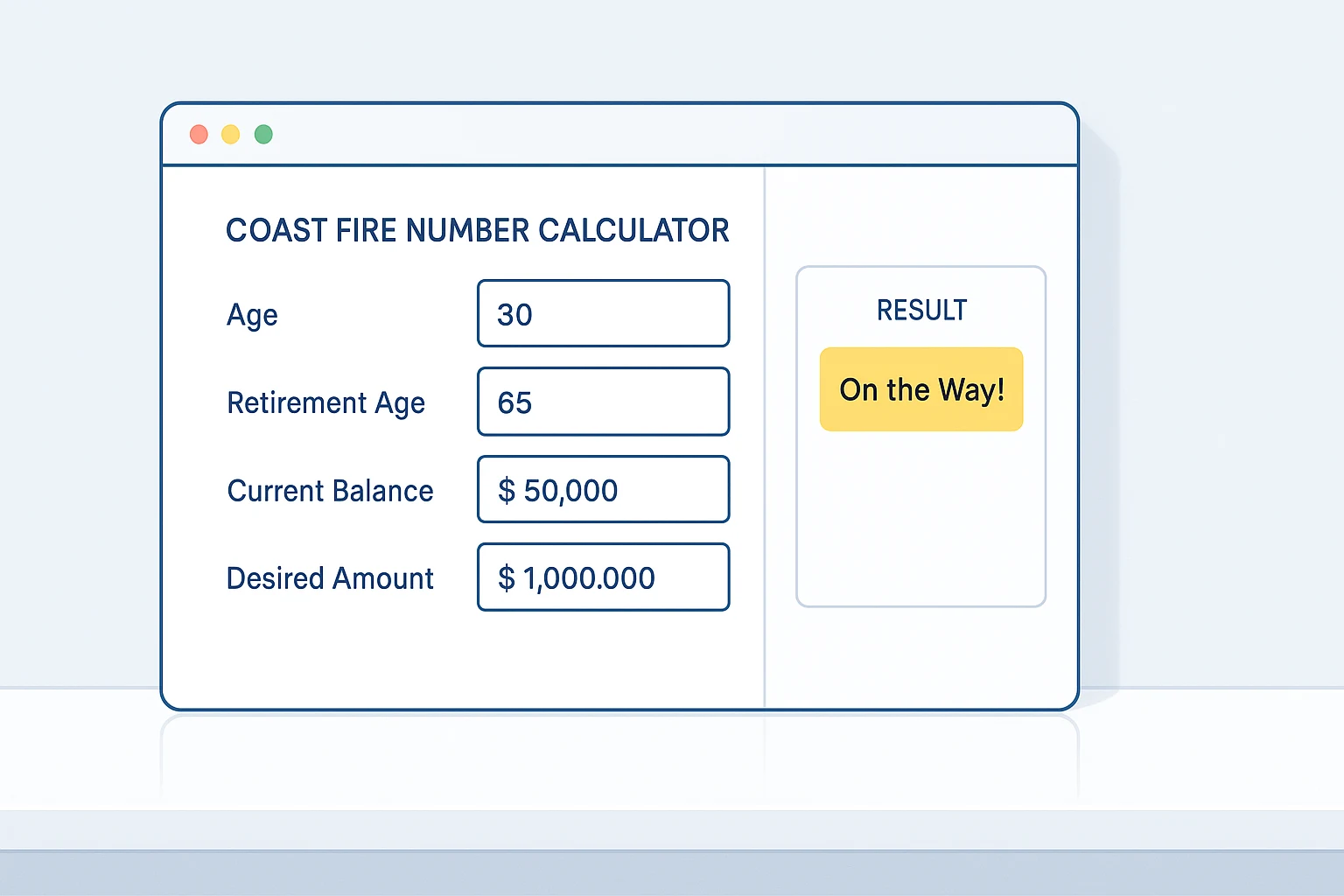

- Your Current Age: 18–80.

- Target Retirement Age: 40–100.

- Current Investment Balance ($): Total in accounts like 401(k)/IRA.

- Desired Retirement Amount ($): Often annual expenses × 25.

You’ll get color-coded feedback and a clear estimate of today’s gap—if you’re not there yet.

Understanding Your Coast FIRE Calculator Results

- Green: Coast FIRE reached. Growth should meet your goal.

- Yellow: On the way—shows how much to add today.

- Red: Off-target—adjust savings or timeline.

- Gray: Add valid inputs.

Prefer to ask a professional before you change your timeline?

Example Scenarios Using the Calculator

These examples show how different ages and balances play out in practice. If you’re aiming to stop full-time work around 60, our step-by-step guide to retiring at 60 with $1 million can help you turn the numbers into a concrete plan.

| Scenario | Age | Retire | Balance | Desired | Result |

|---|---|---|---|---|---|

| Early Bird | 25 | 60 | $75,000 | $1,500,000 | Yellow — Projected ~$801,900; add ~\$45,400 today to coast. |

| Mid-Career Achiever | 40 | 65 | $300,000 | $1,200,000 | Green — Projected ~$1,630,000; set to coast. |

| Late Starter | 50 | 65 | $100,000 | $2,000,000 | Red — Need about ~$724,900 today; increase savings or extend timeline. |

After Reaching Your Coast FIRE Number: Next Steps

Once you hit your number, consider:

Reassess Your Career

- Downshift: Move to a less stressful role.

- Part-time: Trade hours for balance.

- Passion project: Take work you enjoy.

Optimize Investments

Rebalance yearly, keep fees low, and review progress.

Focus on Lifestyle

Use income for experiences, debt payoff, or wellness—retirement is on track. To keep your spending aligned with your goals while you coast, check out our frugal living guide for practical ways to cut costs without feeling deprived.

Common Coast FIRE Questions (FAQs)

Your Path to Financial Freedom

Coast FIRE, paired with this calculator, can shrink money stress. Run your numbers, adjust your plan, and map the next step toward financial independence.

This content is for informational purposes only and not financial advice. Consult a professional before making financial decisions.