Trying to juggle payments with a 620 score? Getting a debt consolidation loan 620 credit score is doable—here’s how to compare options without guesswork. If your score dips closer to 500, options shrink, yet there are still paths forward. A credit score reflects payment history, amounts owed, credit history length, new credit, and credit mix. A 620 score sits in the “Fair” range, which can qualify for consolidation, typically at higher rates than top-tier borrowers. If consolidation isn’t the best fit, consider a Debt Management Plan (our in-depth guide), or try the snowball/avalanche to speed up payoff.

Debt Consolidation Loan 620 Credit Score Estimator

Set your score, amount, and state. We’ll preview potential lender fits with estimated APR bands. Results are illustrative—always review fees and terms.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Understanding Your Credit Score

- Why Choose a Debt Consolidation Loan?

- Top Lenders for a 620 Score

- Loan Estimator (620 Score)

- Lender Selection Notes

- Alternatives if You’re at a 620 Credit Score

- How to Apply for a Debt Consolidation Loan

- Avoiding Scams and Predatory Lenders

- Improving Your Credit Score

- FAQs on Consolidation at 620

- Conclusion

Understanding Your Credit Score

Your credit score influences lender decisions. Common bands:

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

At 620, you’re “Fair.” A consolidation loan may be available, usually at higher APRs than prime credit. Scores near 500 (“Poor”) face fewer options and may need collateral. Knowing where you stand helps set expectations.

Why Choose a Debt Consolidation Loan?

A consolidation loan combines multiple debts—such as credit cards and medical bills—into one payment. This can simplify your budget and may reduce interest when the new APR is lower than your current rates. If most of your debt is on cards, compare a no-fee balance transfer card as an alternative path.

- Simplify Payments: One due date instead of many.

- Lower Costs: A lower APR can save money.

- Clear Timeline: Fixed terms provide an end date.

- Build Credit: On-time payments may help your score.

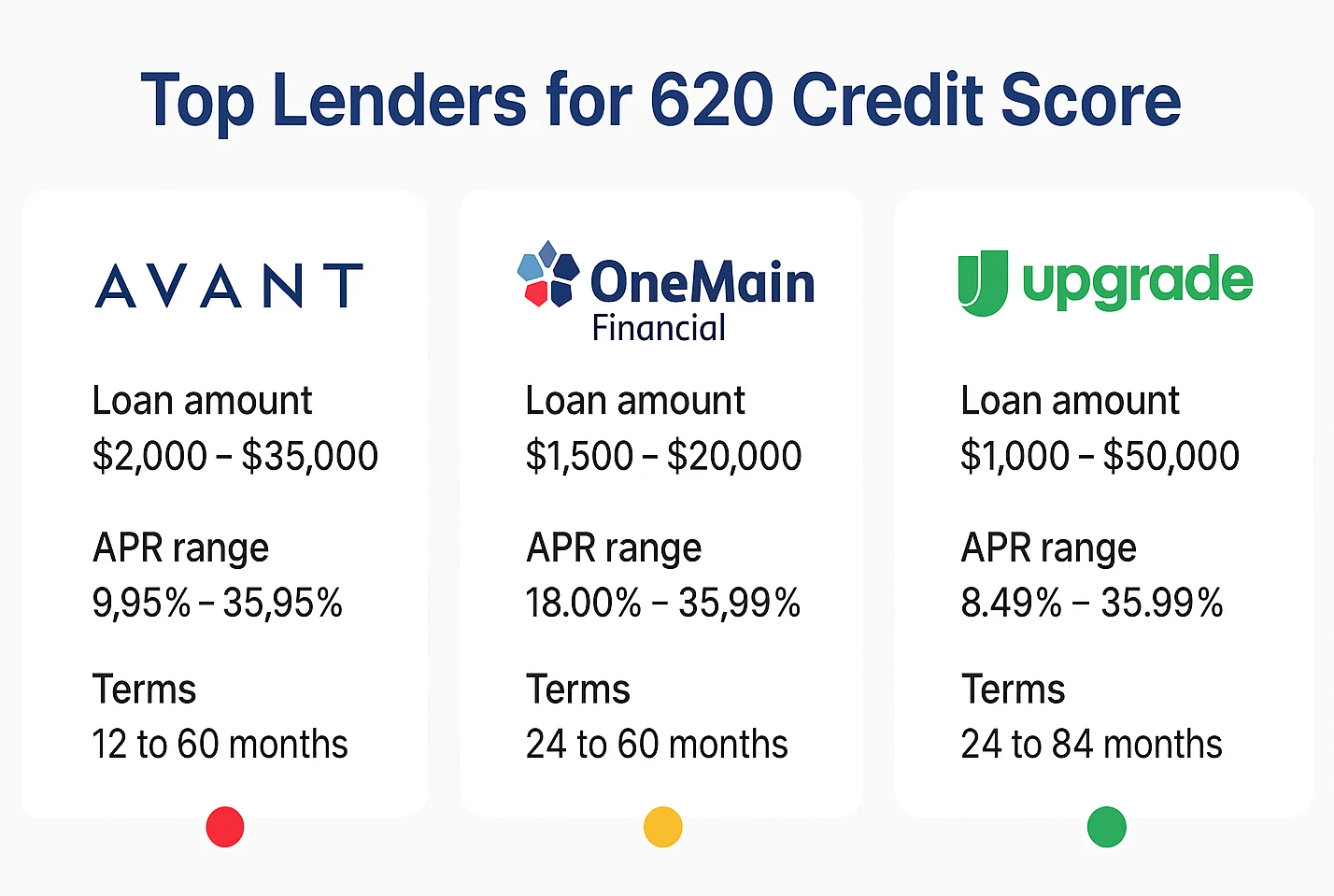

Top Lenders and Bad Credit Loans for a 620 Credit Score

Several lenders serve fair-credit borrowers (around 620) and, in some cases, those closer to 500. Curious about approval thresholds? See what credit score you need for consolidation to set realistic expectations.

Avant: Best for Fair Credit

- Loan Amounts: $2,000–$35,000

- APR: 9.95%–35.99%

- Terms: 24–60 months

- Pros: Money can arrive quickly, and you won’t be charged for paying the loan off early.

- Cons: Rates can run high, and there may be an origination fee (up to 4.75%).

- Notes: Approval looks at your income and debt-to-income, not just your score.

OneMain Financial: Ideal for Bad Credit Loans

- Loan Amounts: $1,500–$20,000

- APR: 18.00%–35.99%

- Terms: 24–60 months

- Pros: More flexible with lower scores, plus you can get in-person help at branches.

- Cons: Expect higher rates, and an origination fee may apply.

- Notes: You might need collateral or a branch visit to finalize.

Upgrade: Great for Direct Payments

- Loan Amounts: $1,000–$50,000

- APR: 8.49%–35.99%

- Terms: 24–84 months

- Pros: Can pay creditors directly, and there’s no penalty for early payoff.

- Cons: Charges an origination fee (up to 8%), and rates may trend higher depending on profile.

- Notes: Co-borrowers are allowed, and cash-flow is part of the review.

LendingPoint: Flexible for Fair Credit

- Loan Amounts: $2,000–$36,500

- APR: 7.99%–35.99%

- Terms: 24–72 months

- Pros: Funds often arrive fast, and early payoff doesn’t trigger a fee.

- Cons: May charge an origination fee (up to 8%).

- Notes: Takes a broader look at your profile, not just the number.

Local Credit Unions: Community Options

- Loan Amounts: $1,000–$40,000

- APR: ~6%–20%

- Terms: 12–60 months

- Pros: Rates are often lower, with more personalized service.

- Cons: You’ll need membership, and offerings vary by location.

- Notes: Check local eligibility rules and any member perks.

Lender Selection Notes

Prequalification uses a soft inquiry to show estimates. Your final APR, amount, and term depend on verified income, existing obligations, and each lender’s model. When comparing offers, review origination fees, repayment term, and whether the lender will pay creditors directly. Match the term to cash flow—shorter terms usually reduce total interest but raise monthly payments; if your budget is tight, a slightly longer term can work as long as the APR is competitive and there’s no prepayment penalty. For official free credit reports to check for errors before applying, use AnnualCreditReport.com. For nonprofit counseling and debt-management plan evaluations, see the National Foundation for Credit Counseling at nfcc.org.

Before you apply, pull your free reports and fix any errors. AnnualCreditReport.com is the only government-authorized site for this purpose. Review each loan’s fees, term length, and total cost.

Alternatives if You’re at a 620 Credit Score

If a consolidation loan doesn’t fit—especially if your score is closer to 500—consider these options. To prioritize payoff order, compare the debt snowball vs. avalanche methods.

Debt Management Plan (DMP)

Nonprofit agencies negotiate lower rates or payments with creditors. You make one payment to the agency, which distributes funds. Learn more at nfcc.org.

- Pros: Often lowers rates; simplifies payments

- Cons: Enrolled accounts are typically closed

Secured Personal Loans

Using collateral (e.g., a vehicle or savings) can improve approval odds at lower scores, but collateral is at risk if you miss payments.

- Pros: Easier to qualify and sometimes at better rates

- Cons: Collateral can be taken if you miss payments

Credit Counseling

Nonprofits help with budgeting and debt guidance—no new loan required.

- Pros: You get an expert plan and ongoing resources

- Cons: Works best if you stick with the plan

Borrowing from Friends or Family

Spelling out terms up front can keep costs low and avoid fees.

- Pros: Often low or no interest

- Cons: Relationship risk if payments lapse

Debt Settlement (Last Resort)

Negotiates balances down but can significantly harm credit and may involve fees.

- Pros: May reduce total owed

- Cons: Severe credit impact; fees apply

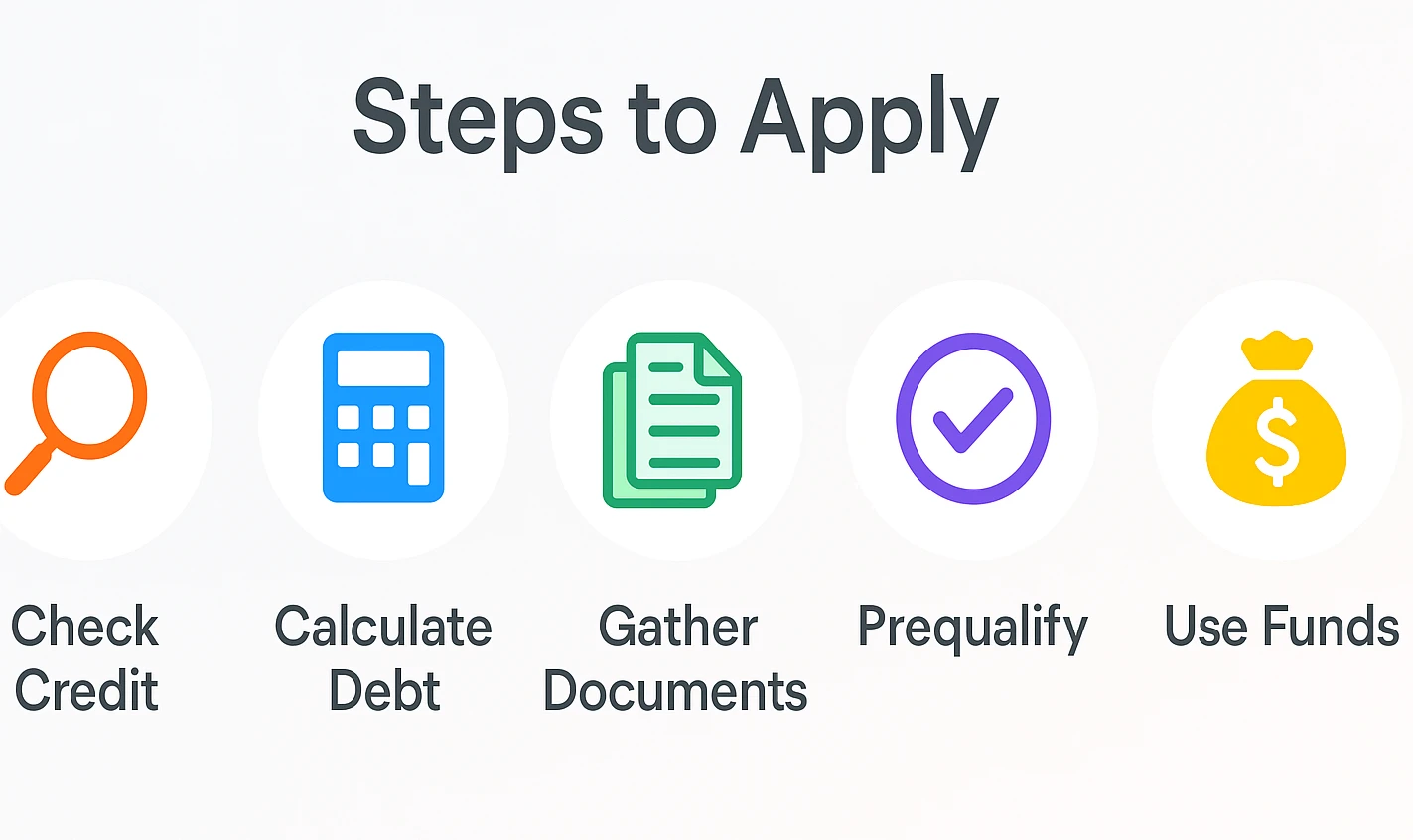

How to Apply for a Debt Consolidation Loan

Ready to apply with a 620 score? Use this simple checklist:

- Check Credit: Get free reports and fix errors at AnnualCreditReport.com.

- Calculate Debt: Add up balances and fees to consolidate.

- Gather Documents: Pay stubs, ID, and bank statements.

- Prequalify: Compare estimated rates with soft checks.

- Compare Offers: Look at APR, fees, and monthly payment. Line up offers side by side before authorizing any hard inquiry. You can also model costs with our loan amortization calculator.

- Apply: Submit a full application (hard inquiry).

- Use Funds: Pay creditors directly or through the lender.

Ready to compare real offers after prequal?

Improving Your Credit Score

While shopping for a consolidation loan, work on credit habits that can improve future offers. For helpful tools, browse our free financial tools and build budgeting habits that stick.

- Pay On Time: Use reminders or autopay.

- Lower Utilization: Keep credit card balances under 30%.

- Limit Applications: Too many inquiries can drag scores down.

- Maintain Mix: Keep a reasonable balance of loans and cards.

- Review Reports: Check and dispute errors regularly.

Debt Consolidation at 620: Key Points

Conclusion

You can qualify for a consolidation loan with a 620 credit score. Compare multiple offers, check fees, and run the numbers. If a loan isn’t the right fit, explore a debt management plan or nonprofit credit counseling for structured relief without new borrowing. Stick with trusted lenders and clear terms to move toward financial stability.

This content is for informational and educational purposes only and is not financial advice. Loan offers, APRs, and eligibility vary by lender and your profile. Review terms carefully and consider speaking with a qualified professional before borrowing.