Will medical bills drain your retirement savings? Our health sharing ministries reviews show how to save thousands before Medicare. For early retirees, the gap between leaving work and Medicare at 65 is tough. ACA marketplace plans often come with steep premiums that threaten your nest egg. Health sharing ministries can be a cheaper bridge. These faith-based groups pool member contributions to help pay medical costs, skipping traditional insurance overhead.

This guide pulls from independent reviews and member stories to compare Medi-Share, Christian Healthcare Ministries (CHM), and Liberty HealthShare. We cover costs, coverage, and real experiences so you can see if these programs fit your budget and risk comfort.

Interactive Health Sharing Plan Finder

Pick a budget and household size, then review notes for prescriptions, preventative care, maternity, and mental health.

| Plan Name | Est. Monthly Cost (Individual) | Pre-existing Conditions | Specific Needs Notes | Key Features |

|---|

Table of Contents

- Key Takeaways

- What Are Health Sharing Ministries?

- Why Consider Health Sharing for Early Retirement?

- Health Sharing Ministries Reviews: Top Plans

- Comparison Table: Health Sharing Plans

- Pros of Health Sharing for Retirees

- Cons and Risks to Watch For

- Health Sharing vs. Other Pre-Medicare Options

- Key Considerations Before Joining

- Frequently Asked Questions

- Conclusion: Affordable Retirement Healthcare

Health Sharing Ministries Reviews: Key Takeaways

- Not Insurance: Sharing is voluntary and not a legal guarantee.

- Cost Savings: Many unsubsidized retirees pay less than ACA plans.

- Faith Rules: Christian lifestyle guidelines affect shareable services.

- Pre-existing Conditions: Waiting periods and limits are common.

- Do Your Homework: Compare plans and read multiple sources.

What Are Health Sharing Ministries?

Health sharing ministries collect monthly “shares” and use them to help pay members’ medical bills. They are non-profit and faith-based. Unlike insurance, they rely on community guidelines rather than a contract.

How They Operate

- Join: Apply and agree to faith-based guidelines.

- Contribute: Pay a monthly share to the community.

- Cover Initial Costs: Pay an Annual Unshared Amount (AUA), similar to a deductible.

- Submit Bills: Send eligible expenses to the ministry.

- Share Costs: Approved bills are paid with member funds.

- Payment: Some pay providers directly, others reimburse you.

Differences from Insurance

There’s no guarantee your bill will be paid. Ministries aren’t bound by ACA rules or state insurance regulators. Expect limits on pre-existing conditions and lifestyle expectations such as no tobacco or drug use.

Why Consider Health Sharing? (Health Sharing Ministries Reviews)

The “retirement healthcare gap” before Medicare is expensive. Reviews often cite strong PPO access with Medi-Share in some states, and lower monthly shares than ACA plans.

Jane’s Story: A Retiree’s Experience

Jane, 62, switched to Medi-Share and saved about $500 per month compared with her ACA plan. A knee surgery claim took months, so she kept a $10,000 buffer. Her story shows both savings and risk.

High ACA Costs

Before Medicare, COBRA can be pricey and ACA plans often run $800–$1,200 per month without subsidies. Health sharing can lower the monthly outlay, but reliability differs by ministry.

Health Sharing Ministries Reviews: Top Plans

Use the finder above, then scan these notes from member reports and public materials.

Medi-Share (Christian Care Ministry)

Eligibility: Christian faith, no tobacco or drugs, abstinence outside marriage.

Costs: $220–$380/month at age 60 (2025 estimates), AHP $3,000–$12,000.

Pre-existing: Not shareable for 36 months, then limited to $100,000/year.

Process: Providers bill via PHCS MultiPlan; delays can happen.

Feedback: Liked for discounts and community; preventative care gaps noted.

Christian Healthcare Ministries (CHM)

See official site.

Eligibility: Christian principles, no tobacco or drugs.

Costs: Bronze $78, Silver $110, Gold $172 (age 60, 2025 est.).

Pre-existing: Not shareable year 1; limited years 2–3; full if symptom-free after year 3.

Process: Pay first, then reimbursement.

Feedback: Very affordable, but cash-flow stress is common.

Liberty HealthShare

Eligibility: Values-based, less faith-focused.

Costs: ~$230–$270/month at age 60; AUA varies.

Pre-existing: Historically 24–36 months waiting; policies vary.

Process: Reports of long delays or denials.

Feedback: High complaint volume—proceed with caution.

Other Plans to Explore

- Samaritan Ministries: Member-to-member sharing with strong community.

- Sedera: Modern approach for some employers and groups.

- Zion HealthShare: Flexible options, some immediate pre-existing sharing.

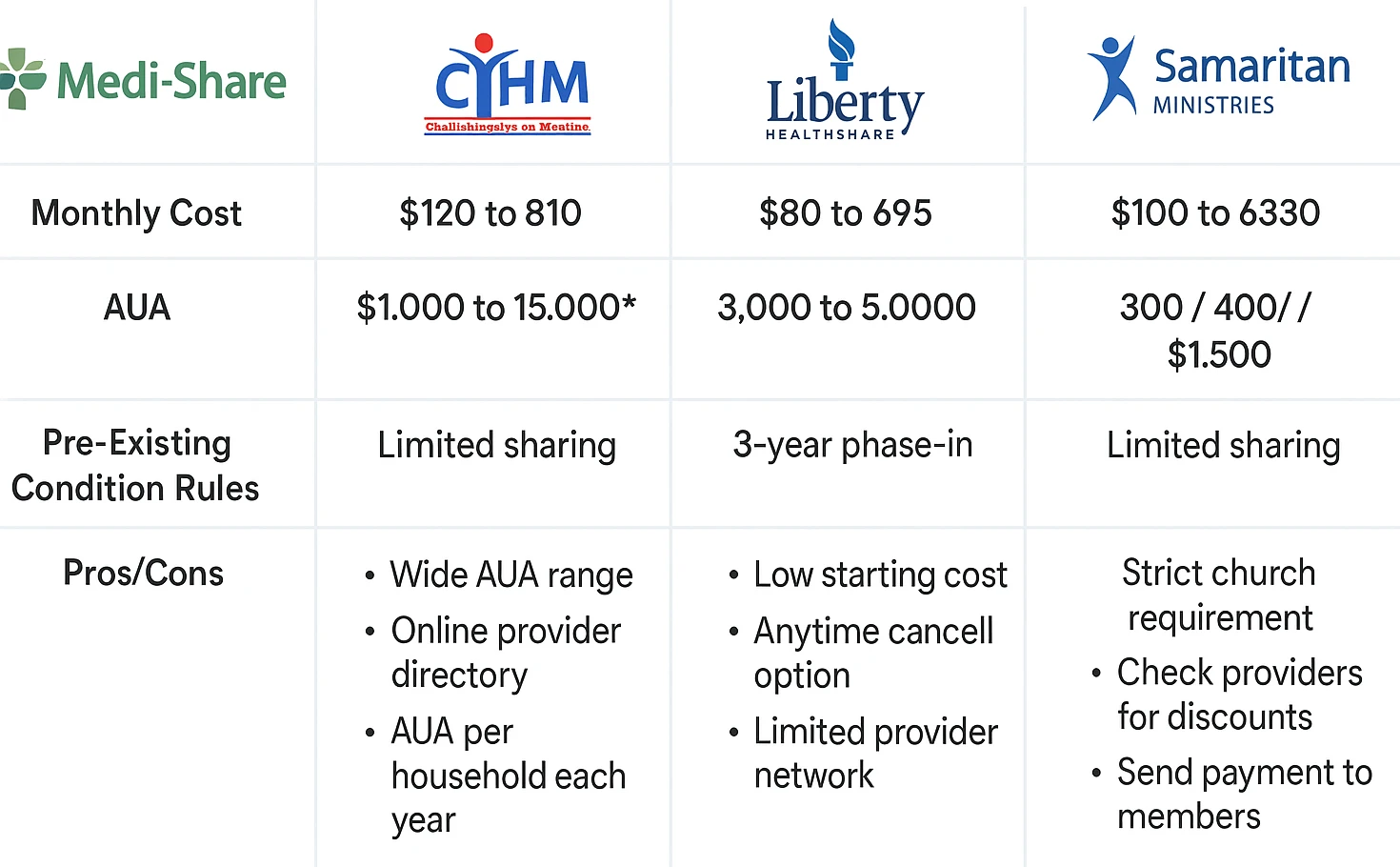

Comparison Table: Health Sharing Plans

| Plan | Est. Monthly Cost (Age 60) | AUA/Responsibility | Pre-existing Conditions | Notes |

|---|---|---|---|---|

| Medi-Share | $220–$380 | $3,000–$12,000/year | Not shareable for 36 mos | PPO network, fast processing |

| CHM Bronze | $78 | $5,000/incident | Limited for 3 years | Pay upfront, affordable |

| CHM Gold | $172 | $500/incident | Limited for 3 years | Unlimited sharing |

| Liberty HealthShare | $230–$270 | Varies | 24–36 mos waiting | High complaints, delays |

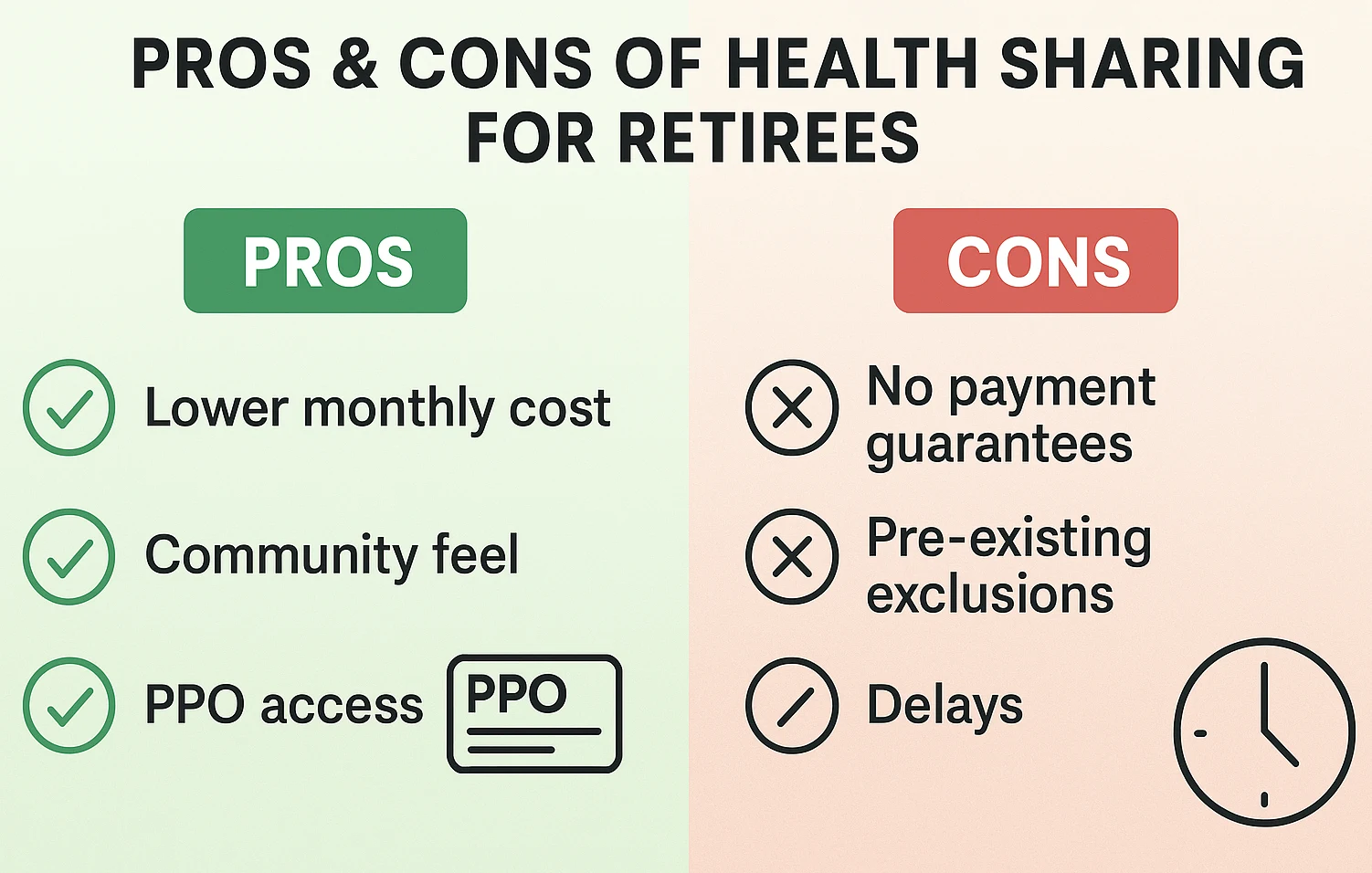

Pros of Health Sharing for Retirees

- Lower Shares: Often $200–$400 less per month than ACA plans.

- Community Support: Faith-based encouragement matters to many.

- Provider Choice: Some PPO discounts.

- Fewer Age Spikes: Costs can be steadier by age band.

- Good fit for healthy retirees who value community.

- Budget for out-of-pocket costs and waiting periods.

Cons and Risks to Watch For

- No Guarantee: Sharing is not a contract.

- Pre-existing Limits: Waiting periods and caps.

- Exclusions: Preventative care, prescriptions, mental health often limited.

- Lifestyle Rules: Strict requirements may exclude some.

- Delays or Denials: Be ready for slow processing.

- If you have chronic conditions, weigh the risk carefully.

- Keep a cash buffer in case of delays.

Health Sharing vs. Other Pre-Medicare Options

Short-term plans can be cheap but exclude pre-existing conditions. Catastrophic insurance uses high deductibles for major events. ACA plans are comprehensive but expensive without subsidies. Health sharing often wins on price, not on reliability.

Key Considerations Before Joining

Before you enroll, read the faith statement and bylaws, know your AUA, check pre-existing limits and exclusions, scan member feedback, and assess your health needs. Keep $5,000–$10,000 set aside for delays or denials. Healthy retirees tend to benefit most.

Enrollment Process

Most ministries use a 10–15 minute online application with a faith statement and health history. Approval usually takes one to two weeks, sometimes with a pastor reference.

Cost-Saving Tips

- Negotiate Bills: Ask for cash discounts.

- Appeal Denials: Resubmit with documentation.

- Use Networks: Choose PPO providers when available.

Frequently Asked Questions

Conclusion: Affordable Retirement Healthcare

If you plan to retire before Medicare, weigh price against certainty. Health sharing can cut monthly costs, but limits and delays are real. Use the plan finder, read guidelines closely, and keep a cash buffer. Choose the option that matches your health needs and risk tolerance.

This content is for informational purposes only and not financial advice. Consult a qualified professional before making financial decisions.