Picture a life where you’re saving $500 a month, with no stress from bills or clutter, and more time for the things that light you up. Sounds amazing, doesn’t it? That’s the beauty of frugal living minimalism. By clearing out the excess, keeping only what matters, and focusing on what truly brings you joy, you’ll save money and feel more at peace. It’s not about missing out—it’s about creating space for what you love. Imagine choosing a cozy family hike over a pricey new gadget. That simple choice can strengthen your finances and fill your life with meaning.

Start Simplifying Today! 🌈Table of Contents

- What is Frugal Living Minimalism?

- Why Choose Frugal Living Minimalism?

- How to Start Frugal Living Minimalism: Decluttering

- How to Create a Minimalist Budget

- Mindful Consumption in Frugal Living Minimalism

- Simplify Your Meals for Savings

- Streamline Your Transportation

- Interactive Self-Assessment: How Frugal Minimalist Are You?

- Resources for Frugal Living Minimalism

- Maintaining Your Frugal Minimalist Lifestyle

- Frequently Asked Questions

- Conclusion

What is Frugal Living Minimalism?

Frugal living minimalism brings together two amazing ideas to help you save cash and live a happier life. Here’s the scoop:

- Frugal Living: It’s about being smart with your money, choosing what you need over what you want, and finding creative ways to save without skimping on quality. Picture whipping up a tasty homemade dinner instead of grabbing expensive takeout.

- Minimalism: This means living with less—keeping only the stuff that makes you happy or serves a purpose, and letting go of the rest, both in your home and your head.

Together, frugal living minimalism is about choosing less stuff and more meaning. It’s a path to saving money while building a life you love. Take Sarah, a single mom, who embraced this approach. She cleared out her home, stopped buying things on a whim, and saved $300 a month. That extra cash went straight to her daughter’s college fund, proving this lifestyle can help you reach your biggest goals. Before you buy anything, ask yourself, “Do I really need this?” That one question can kickstart a whole new way of living. For more practical ideas, explore these 18 frugal living tips to boost your savings.

“Minimalism isn’t about giving up—it’s about making room for what matters most.”

Why Choose Frugal Living Minimalism?

Embracing frugal living minimalism can transform your life in ways you might not expect. Here’s why it’s worth trying:

- Save More Money: By decluttering and skipping unnecessary purchases, you’ll naturally spend less.

- Build Wealth: Redirect savings to pay off debt, invest, or create an emergency fund.

- Less Stress: A clutter-free home can calm your mind—studies show organized spaces boost mental health.

- More Time: Less time managing stuff means more for family, friends, or hobbies.

- Help the Planet: Consuming less reduces waste and your environmental footprint.

- Financial Freedom: Needing less to live opens doors to flexible work or passion-driven careers.

- Stay Focused: Clearing distractions helps you prioritize goals, like saving for a dream vacation.

A 2023 survey found that 65% of people practicing frugal living minimalism felt less stressed, proving its mental health perks.

How to Start Frugal Living Minimalism: Decluttering

Decluttering is the heart of frugal living minimalism. By letting go of items you don’t need, use, or love, you make space for a more intentional life. Take John, a teacher, who decluttered his apartment and saved $150 a month on storage and impulse buys. Plus, decluttering can uncover forgotten treasures, like a favorite jacket, curbing the urge to shop.

Decluttering Your Home for Frugal Living Minimalism

Start small to keep it manageable and build momentum:

- One Area at a Time: Tackle a single drawer, shelf, or closet to make progress feel doable.

- KonMari Method: Sort by category (clothes, books) and keep items that “spark joy.” Learn more about Marie Kondo’s method.

- 20/20 Rule: Toss items you could replace for under $20 in 20 minutes, like old cables or kitchen gadgets.

- One In, One Out: For every new item you bring in, remove one to keep things balanced.

- Reverse Hanger Method: Turn hangers backward; donate unworn clothes after six months.

- Box Method: Put items you’re unsure about in a box. If you don’t use them in 90 days, donate or sell them.

Examples: Donate unworn clothes, recycle old electronics, sell duplicate kitchen gadgets on eBay, or give away decor that no longer fits your vibe. Emily sold $200 worth of unused kitchen appliances, funding a weekend getaway.

Decluttering Your Digital Life

Digital clutter can mess with your focus and productivity. Clear it out to support frugal living minimalism:

- Unsubscribe from newsletters you never read to calm your inbox.

- Delete unused apps to free up phone storage and mental space.

- Organize computer files into folders and delete duplicates for a smoother workflow.

- Cut social media time and unfollow accounts that push you to buy stuff.

- Back up photos to a cloud service like Google Drive and delete blurry or duplicate images.

- Clear browser bookmarks, keeping only the essentials to avoid digital overwhelm.

Tom, for example, cut his screen time by 2 hours a day after a social media detox, giving him more time for hobbies like reading.

Decluttering Your Commitments

Simplify your schedule by saying “no” to things that don’t align with your values. For example, if volunteering too much drains you, scale back and focus on what matters most, like family time. Delegate tasks like housecleaning to family or try affordable services, like a $10 car wash, to free up your time for what you love.

How to Create a Minimalist Budget

With your space decluttered, it’s time to streamline your finances with a minimalist budget. This means focusing on what you need and value while cutting out the rest. Lisa, a freelancer, saved $200 a month by tracking her spending and ditching unused subscriptions like streaming services she barely watched.

Track Your Expenses for Frugal Living Minimalism

Start by keeping an eye on your spending for a month to really understand where your money’s going:

- Budgeting Apps: Apps like Mint, YNAB, or Personal Capital make tracking super easy and automatic.

- Spreadsheets: Create a simple tracker for income and expenses to make it your own.

- Notebook: Jot down your spending by hand for a hands-on, mindful approach.

- Bank Statements: Look over your monthly statements to catch those sneaky recurring charges, like a gym membership you forgot about.

Alex, for instance, realized he was spending $80 a month on coffee shops by tracking his expenses, so he started brewing at home to save.

Identify Areas to Cut Back

Look for ways to trim expenses while staying true to frugal living minimalism:

- Housing: Consider downsizing to a smaller apartment or refinancing your mortgage for lower rates.

- Transportation: Walk, bike, or take public transit to save on fuel.

- Food: Cook at home, plan meals, and cut food waste.

- Entertainment: Choose free activities like hiking or library events.

- Subscriptions: Cancel unused services, like magazines or apps you don’t need.

- Utilities: Use energy-efficient bulbs and unplug devices to lower bills.

Prioritize Spending by Values

Spend on what matters most to you, like family, travel, or education. If health is a priority, keep that gym membership but skip dining out to balance your budget.

Minimalist Budgeting Tools

These tools can help you stay on track with frugal living minimalism. For a deeper dive, check out our guide on the best minimalist budgeting tools for beginners:

- YNAB: Gives every dollar a job, perfect for goal-driven budgeting.

- Mint: Tracks spending and sends alerts if you’re overspending.

- Personal Capital: Monitors net worth and investments for big-picture planning.

- Spreadsheets: Fully customizable for hands-on budgeters.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Mindful Consumption in Frugal Living Minimalism

Mindful consumption is key to frugal living minimalism. It’s about making intentional choices with your money. To avoid impulse buys, try these tips:

- Wait 24 hours before buying non-essentials to rethink your choice.

- Unsubscribe from marketing emails to dodge temptation.

- Shop with a list and stick to it, ignoring flashy displays.

- Ask yourself: “Do I need this? Does it add value? Can I borrow or rent it?”

- Use cash for small purchases to feel the impact of spending.

Prioritize experiences over stuff. Instead of a new TV, save for a cooking class with friends. Buying used from thrift stores or eBay saves money and cuts waste. Maria, for example, furnished her apartment with secondhand finds, saving $1,000 while creating a cozy, intentional home.

Simplify Your Meals for Savings

Food costs can add up fast. Simplify your meals to align with frugal living minimalism. For extra tips, see our guide to grocery shopping on a budget:

- Meal Planning: Plan weekly meals to avoid impulse buys. Example: Monday – lentil soup, Tuesday – veggie stir-fry, Wednesday – pasta with homemade sauce.

- Cook at Home: Save by making meals with budget-friendly staples like rice and beans.

- Batch Cooking: Cook big batches on weekends, like a pot of chili, for quick weekday meals.

- Eat Seasonally: Buy in-season produce, like summer tomatoes, for better flavor and lower costs.

- Reduce Waste: Turn leftovers into new meals, like roasted veggies into soup, and compost scraps.

- Shop Smart: Buy non-perishables in bulk and use coupons or loyalty programs for discounts.

Jane saved $50 a week by planning meals and batch-cooking, redirecting those savings to her travel fund. Try a simple meal plan: Monday’s lentil soup costs ~$5 for four servings, compared to $20 for takeout.

Streamline Your Transportation

Transportation can eat into your budget. Here’s how to streamline it and keep more money in your pocket:

- Walk or Bike: Perfect for short trips, saving gas and keeping you active.

- Public Transit: Hop on buses or trains—monthly passes are often a great deal.

- Carpool: Share rides with coworkers to cut fuel costs in half.

- Downsize Your Car: Choose a fuel-efficient car, like a hybrid, to save on gas.

- Maintain Your Car: Keep up with oil changes and maintenance to avoid pricey repairs.

- Rent Instead of Own: For occasional trips, rent a car or use rideshare apps to skip ownership costs.

Mark saved $100 a month by biking to work, while Emma cut her commute costs by 60% with a bus pass. Mix and match ideas, like biking for errands and carpooling for longer trips, to save even more.

Interactive Self-Assessment: How Frugal Minimalist Are You?

Test Your Frugal Living Minimalism Skills

Resources for Frugal Living Minimalism

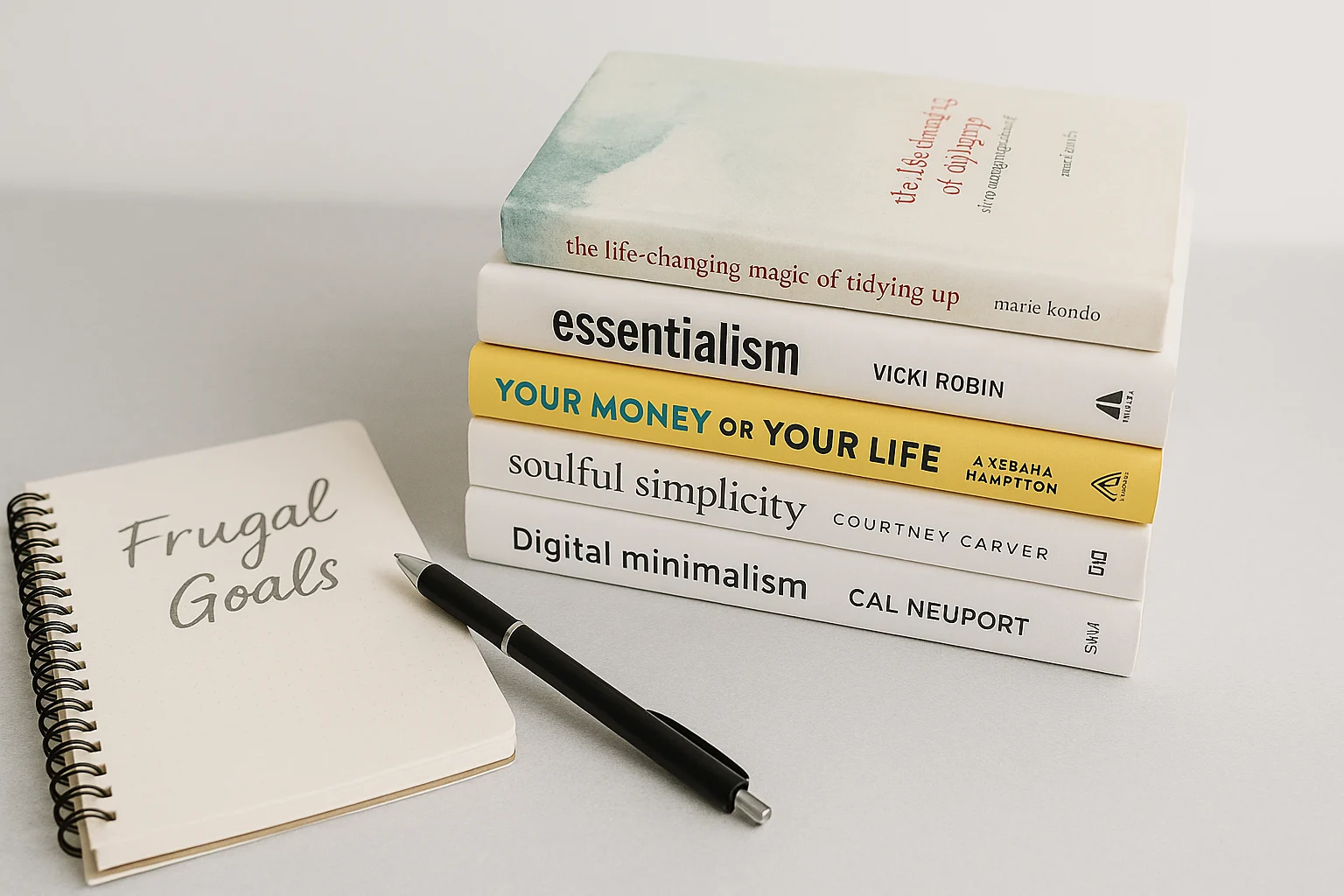

Ready to explore frugal living minimalism? Here are some awesome resources to spark your journey:

- Favorite Reads:

- The Life-Changing Magic of Tidying Up by Marie Kondo: Learn to declutter with the “spark joy” method that’s changed lives.

- Essentialism by Greg McKeown: Discover how to focus on what really matters to you.

- Your Money or Your Life by Vicki Robin: Follow a nine-step plan to gain financial independence.

Want more book recommendations? See our list of the best frugal living books for 2025.

- Websites and Blogs:

- The Minimalists: Packed with practical tips for a simpler, happier life.

- Zen Habits: Offers insights on mindfulness and keeping things simple.

- Becoming Minimalist: Guides you toward living with intention.

- Podcasts:

- The Minimalists Podcast: Fun and inspiring talks about minimalism.

- Optimal Finance Daily: Quick daily tips to manage your money better.

Coming Soon: Decluttering Courses

Check back for online courses to simplify your home and finances!

Maintaining Your Frugal Minimalist Lifestyle

Frugal living minimalism is a way of life, not a quick fix. Keep it going with these simple habits:

- Regular Decluttering: Set aside time each month to tidy up and keep your space intentional.

- Budget Reviews: Peek at your budget every few months to make sure it matches your goals.

- Mindful Spending: Always check if a purchase is something you truly need or value.

- Focus on What Matters: Put family, personal growth, or your core values first in your decisions.

- Connect with Others: Join online minimalist groups to swap ideas and stay motivated.

Clara, for example, kept her momentum by joining a minimalist Facebook group. She saved $500 over six months by sharing tips with others.

Frequently Asked Questions About Frugal Living Minimalism

Conclusion

Frugal living minimalism opens the door to saving money, easing stress, and living with intention. By clearing out your home, budgeting wisely, and choosing moments over things, you can find true financial freedom. So many people have used these ideas to pay off debt, chase dream vacations, or just live more fully. It’s a journey—take it one small step at a time and enjoy the lightness of owning less while living more.