The financial independence 4 rule gives you a simple way to estimate your FIRE number and plan with confidence if you want to quit the 9-to-5 sooner. Below, we explain the 4% rule, compare ETFs and mutual funds, and include a quick calculator to run your numbers. If you’re just getting started, read our financial independence early guide.

FIRE Number Calculator

Set inputs on the left and see results on the right.

Your Estimated FIRE Number:

$0Projected Years Until Target Retirement Age: N/A

Estimate your annual expenses, current savings, and withdrawal rate. Annualize rent and include taxes, insurance, HOA, and utilities to see your target FIRE number.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Key Takeaways for FI

- What Is the 4% Rule for FI?

- Mastering the 4% Rule for FI

- Calculating Your FIRE Number with the 4% Rule

- Types of FIRE: Choose Your Path

- Building Your FIRE Savings Portfolio

- Adjusting for Reality: Inflation and Unexpected Costs

- Beyond the Numbers: Life After FIRE

- Frequently Asked Questions (FAQs) About the 4% Rule

- Conclusion: Your Journey to Financial Independence

Key Takeaways for FI

- 4% Rule: Withdraw 4% in year one and adjust for inflation to target a 30-year+ retirement.

- Your FIRE Number: Annual spending × 25 is a simple savings target you can tailor to your lifestyle.

- Investing Approach: Low-cost ETFs or mutual funds help diversify and grow your long-term savings toward your goal.

- FIRE Paths: Pick Lean, Coast, Barista, or Fat FIRE to match your spending and vision.

What Is the 4% Rule for FI?

Financial Independence (FI) means your passive income covers your living costs, so paid work is optional. The FIRE movement helps you direct your time toward what matters—passions, projects, and people. With consistent saving and investing under this rule, FI is realistic for many households.

Mastering the Financial Independence 4 Rule

The 4% rule suggests withdrawing 4% of your portfolio each year, adjusted for inflation, to fund a ~30-year retirement with high historical success.

Origin of the 4% Rule (Trinity Study)

The 4% rule stems from the 1998 Trinity Study by Trinity University professors, which analyzed historical market data and found a 4% withdrawal rate sustained portfolios in most 30-year periods. Read the original Trinity Study paper (AAII Journal). See a modern analysis from Stanford.

The 4% rule is a research-based guideline drawn from historical data—helpful for planning, though not a guarantee of future results.

How the 4% Rule Works for Financial Independence

How it works:

- Initial Withdrawal: Withdraw 4% of your portfolio in year one.

- Inflation Adjustment: Increase withdrawals each year for inflation (e.g., $40,000 becomes $41,200 at 3%).

- Portfolio Growth: The remaining funds stay invested to outpace inflation and withdrawals over time.

Past returns don’t guarantee future results. Fees, taxes, and when returns arrive can change outcomes. Consider flexible spending rules and revisit your plan yearly.

The 25x Rule: Your Financial Independence Target

The 4% rule implies your portfolio should be 25× your annual expenses (e.g., $40,000 × 25 = $1,000,000). This “25× rule” is your FIRE number.

Calculating Your FIRE Number with the 4% Rule

Turning big goals into a number makes them actionable.

Step 1: Estimate Your Annual Expenses

Your FIRE number depends on what you spend. Track 3–12 months with a budgeting app or bank tools. Group by housing, food, healthcare, travel, and more. Separate must-haves from nice-to-haves. Forecast changes (paid-off mortgage, more travel) and consider taxes on withdrawals. Example: if current expenses are $60,000, subtract $18,000 for a paid-off mortgage and add $5,000 for travel to land near $47,000.

Step 2: Choose Your Withdrawal Rate

4% is the common baseline. Planning for a very long retirement? Consider 3.5% or 3% for more cushion—lower rates need bigger savings.

| Withdrawal Rate | Multiplier | FIRE Number Impact |

|---|---|---|

| 4% | 25× | Standard for ~30+ years. |

| 3.5% | 28.57× | Higher safety margin. |

| 3% | 33.33× | Maximum security. |

Step 3: Apply the 25x Rule

Formula: FIRE Number = Annual Expenses × Multiplier. For $47,000 at 4%, that’s $47,000 × 25 = $1,175,000. At 3.5%, it’s ~$1,342,857.

Types of FIRE: Choose Your Path

Pick the path that fits your lifestyle and goals.

Lean FIRE

Overview: Modest spending with a straightforward 4% withdrawal. Ideal for: Minimalists. Mindset: Value freedom over things. Example: $30,000 × 25 = $750,000. For a deeper comparison, explore how Lean FIRE vs. Fat FIRE can shape your lifestyle trade-offs.

Coast FIRE

Overview: Save early, then let investments grow to your target by traditional retirement. Ideal for: Flexibility later. Mindset: Front-load effort for future freedom. Example: $300,000 at 35 compounding to ~$1.5M by 60. You can use a dedicated Coast FIRE calculator to see whether you’re already on track.

Barista FIRE

Overview: Part-time work covers some costs so the portfolio does less. Ideal for: A gradual step into retirement. Mindset: Blend light work with more leisure. Example: $50,000 expenses; $20,000 from work; portfolio covers $30,000 ($750,000). For a full walkthrough of how this works in practice, read this Barista FIRE guide.

Fat FIRE

Overview: Higher budget for a more luxurious lifestyle. Ideal for: Comfort without worry. Mindset: Enjoy upgrades and experiences. Example: $150,000 × 25 = $3,750,000.

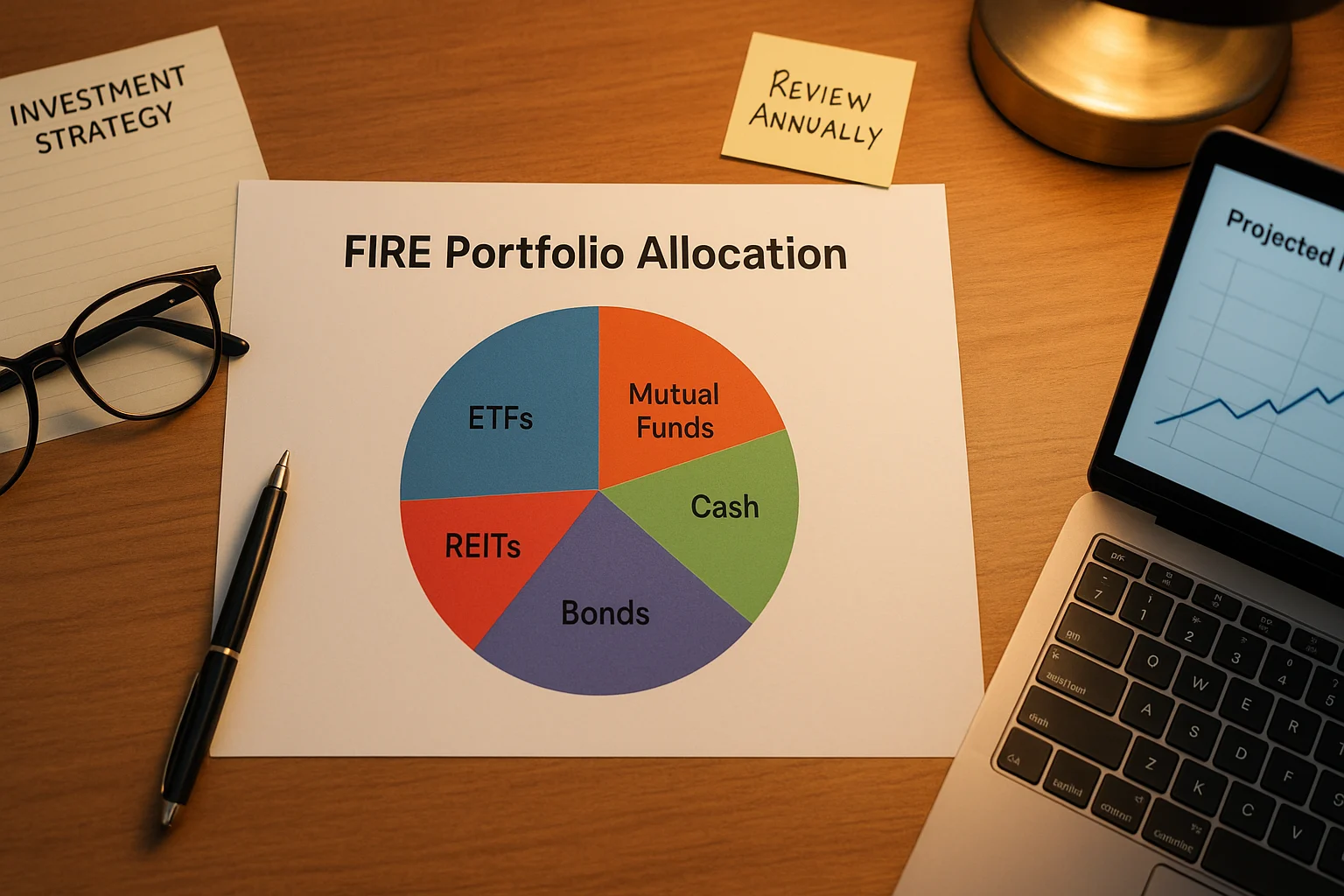

Building Your FIRE Savings Portfolio

Investing—guided by the 4% rule—powers your plan. If you’re new to investing, start with a simple index fund investing 101 guide so the basics feel less intimidating.

Compound Interest Power

Returns build on returns. For example, $10,000 at 7% becomes ~$11,449 in two years. Start early to let time work harder than you do. For a plain-language explainer, see the SEC’s compound interest basics.

ETF vs. Mutual Fund for FIRE Savings

Both spread risk across many holdings. Low-cost index funds are a FIRE staple.

Mutual Funds

Pros: Professional management, diversification, easy automation, common in 401(k)s. Cons: Often higher fees, limited trading windows, possible sales charges.

Exchange-Traded Funds (ETFs)

Pros: Low fees, intraday trading, tax-efficient, transparent. Cons: Trading costs may apply; typically less hands-on management.

Best Choice

Many FIRE investors prefer broad, low-fee index ETFs (e.g., S&P 500-tracking options near 0.03% expense ratios). If your 401(k) offers cheap index mutual funds, those work too.

Diversification and Rebalancing

Mix assets—example: 70% stocks, 20% bonds, 10% real estate—to manage portfolio risk.

Adjusting for Reality: Inflation and Unexpected Costs

This guideline anticipates inflation and bumps withdrawals accordingly. Your personal costs—especially healthcare—may rise faster, so plan a buffer.

Inflation

As prices climb, a $40,000 withdrawal becomes $41,200 at 3% inflation. Equities aim to outpace this over time.

Sequence-of-Returns Risk

Big market drops early in retirement can be harder to recover from when you’re withdrawing. Build flexibility: keep a cash buffer, consider dynamic spending rules, and revisit withdrawals after down years to protect your plan.

Questions about adjusting withdrawals after a down year?

Contingency Funds

Keep 3–6 months for emergencies and consider 5–10% extra for surprises or fun. In down markets, trim discretionary spend to protect your plan.

Beyond the Numbers: Life After FIRE

FI lets you design your days.

- Your Time: Travel, build a project, volunteer, or focus on relationships.

- Staying Engaged: Explore hobbies and new skills to stay energized.

- Identity Shift: Expect a transition as work matters less—plan for purpose.

Frequently Asked Questions (FAQs) About the 4% Rule

Conclusion: Your Journey to Financial Independence

This simple guideline makes retirement feel achievable. Save consistently, keep costs low, and spend with intent. Revisit your plan yearly so it evolves with your life.

Educational content only — not financial advice. Investing involves risk, including loss of principal. Past performance doesn’t guarantee future results. Consider taxes, fees, and your risk tolerance; consult a qualified fiduciary advisor before acting.